Financial Year Vs Calendar Year

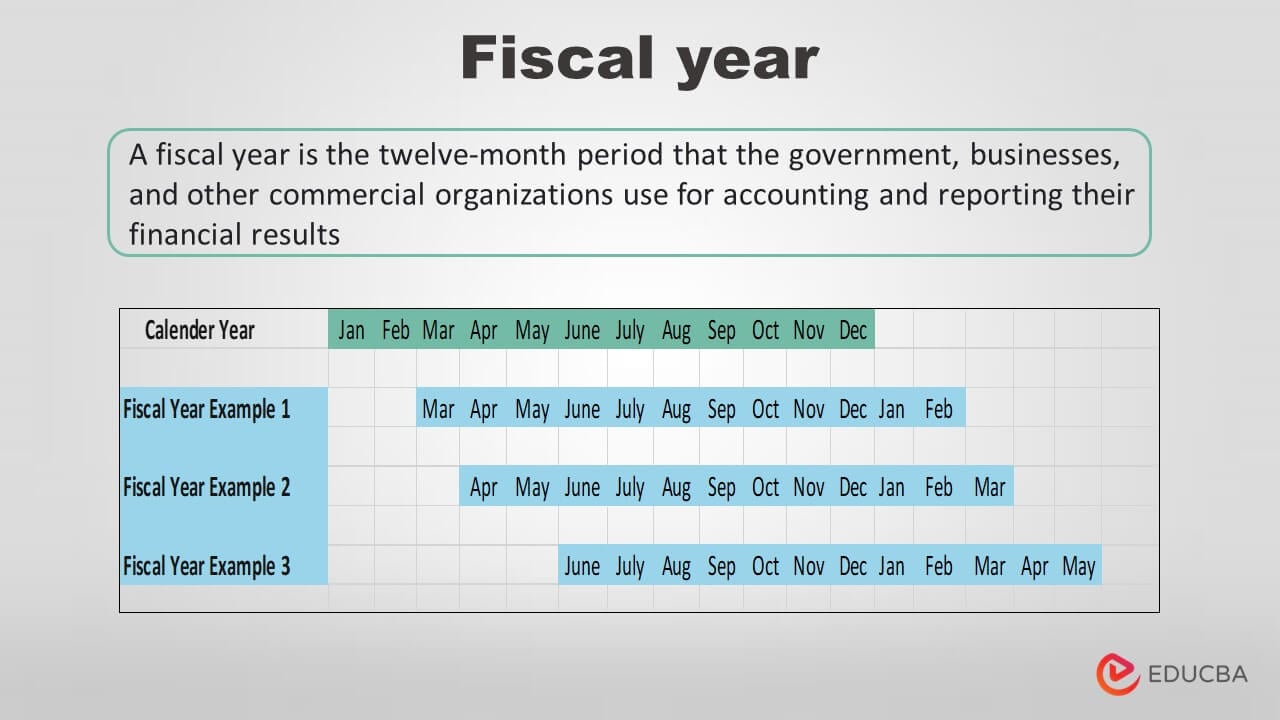

Financial Year Vs Calendar Year - A fiscal year, by contrast, can start and end at any point during the year, as long as it comprises a full 12 months. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Web understanding what each involves can help you determine which to use for accounting or tax purposes. It's used differently by the government and businesses, and does need to. Web a fiscal year spans 12 months and corresponds with a company’s budgeting process and financial reporting periods. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Web a fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. Web a geschäftsjahr (financial year) that differs from the normal calendar year allows entrepreneurs to prepare their annual accounts at a time of their choosing, rather. On the other hand, a.

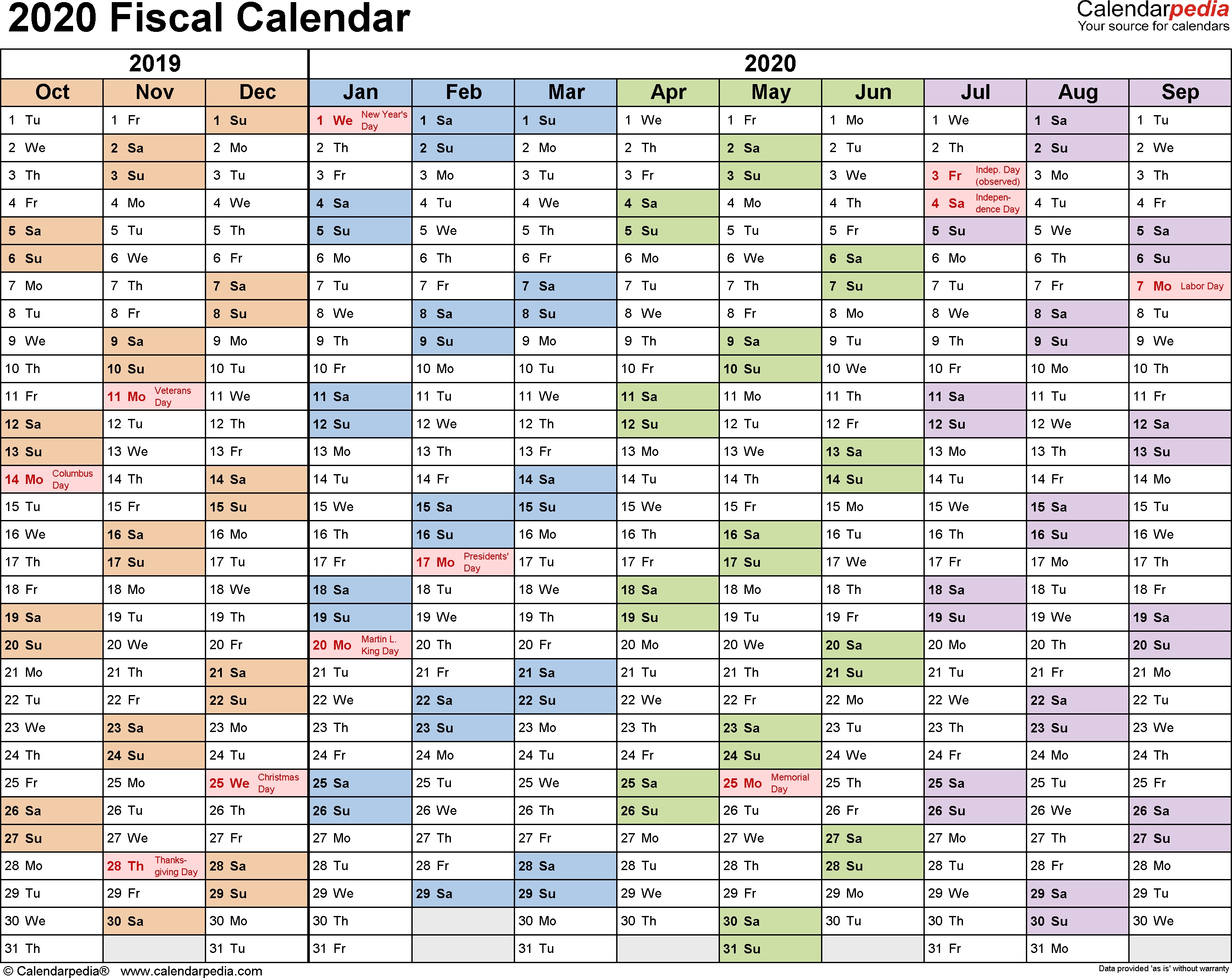

A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. Web in summary, the fiscal year focuses on financial matters, while the calendar year is a broader measure of time used in everyday life. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. A calendar year always runs from january 1 to december 31. On the other hand, a. The terms fiscal year and financial year are synonymous, i.e. Web a fiscal year spans 12 months and corresponds with a company’s budgeting process and financial reporting periods. Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month. Most other countries begin their year at a different calendar. Web a fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes.

Web in summary, the fiscal year focuses on financial matters, while the calendar year is a broader measure of time used in everyday life. A calendar year always runs from january 1 to december 31. Web a fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. It's used differently by the government and businesses, and does need to. The terms fiscal year and financial year are synonymous, i.e. They are a period that governments use for accounting and budget. Web a geschäftsjahr (financial year) that differs from the normal calendar year allows entrepreneurs to prepare their annual accounts at a time of their choosing, rather. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Most other countries begin their year at a different calendar.

What is a Fiscal Year? Your GoTo Guide

Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. The terms fiscal year and financial year are synonymous, i.e..

Financial Year Calendar With Week Numbers Lyndy Nanine

They are a period that governments use for accounting and budget. A fiscal year, by contrast, can start and end at any point during the year, as long as it comprises a full 12 months. Web a fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for.

Fiscal Year Vs Financial Year What Is The Difference?

It's used differently by the government and businesses, and does need to. Fiscal years can differ from a calendar year and. Web understanding what each involves can help you determine which to use for accounting or tax purposes. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to.

Service Year Vs Calendar Year Ruth Wright

A fiscal year, by contrast, can start and end at any point during the year, as long as it comprises a full 12 months. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Web a geschäftsjahr (financial year) that.

Fiscal Year Vs Calendar Andy Maegan

They are a period that governments use for accounting and budget. A fiscal year, by contrast, can start and end at any point during the year, as long as it comprises a full 12 months. The terms fiscal year and financial year are synonymous, i.e. On the other hand, a. Web a fiscal year is 12 months chosen by a.

What is a Fiscal year? Benefits, IRS Guidelines, & Examples

On the other hand, a. Learn when you should use each. Web a fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on.

How to Convert a Date into Fiscal Year ExcelNotes

Most other countries begin their year at a different calendar. A fiscal year, by contrast, can start and end at any point during the year, as long as it comprises a full 12 months. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1.

Fiscal Year Vs. Calendar Maximizing Financial Planning Training for

Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month. Web a geschäftsjahr (financial year) that differs from the normal calendar year allows entrepreneurs to prepare their annual accounts at a time of their choosing, rather. A company that starts its fiscal.

Fiscal Year Definition for Business Bookkeeping

A fiscal year, by contrast, can start and end at any point during the year, as long as it comprises a full 12 months. On the other hand, a. A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. Web a fiscal year spans 12 months and corresponds.

Financial Year Vs Assessment Year for Tax TDS Vs Advance Tax

A fiscal year, by contrast, can start and end at any point during the year, as long as it comprises a full 12 months. Web understanding what each involves can help you determine which to use for accounting or tax purposes. Learn when you should use each. Web a geschäftsjahr (financial year) that differs from the normal calendar year allows.

It's Used Differently By The Government And Businesses, And Does Need To.

Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. They are a period that governments use for accounting and budget. Web a fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes.

Web Understanding What Each Involves Can Help You Determine Which To Use For Accounting Or Tax Purposes.

Web a geschäftsjahr (financial year) that differs from the normal calendar year allows entrepreneurs to prepare their annual accounts at a time of their choosing, rather. A fiscal year, by contrast, can start and end at any point during the year, as long as it comprises a full 12 months. Web in summary, the fiscal year focuses on financial matters, while the calendar year is a broader measure of time used in everyday life. On the other hand, a.

Most Other Countries Begin Their Year At A Different Calendar.

Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Web a fiscal year spans 12 months and corresponds with a company’s budgeting process and financial reporting periods. The terms fiscal year and financial year are synonymous, i.e. Learn when you should use each.

A Company That Starts Its Fiscal Year On January 1 And Ends It On December 31 Operates On A Calendar Year Basis.

Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. A calendar year always runs from january 1 to december 31. Fiscal years can differ from a calendar year and. In this article, we define a fiscal and calendar year, list the.

:max_bytes(150000):strip_icc()/fiscal-year-definition-federal-budget-examples-3305794_final-c54e01b8314f424a8aefacb8c126d192.png)