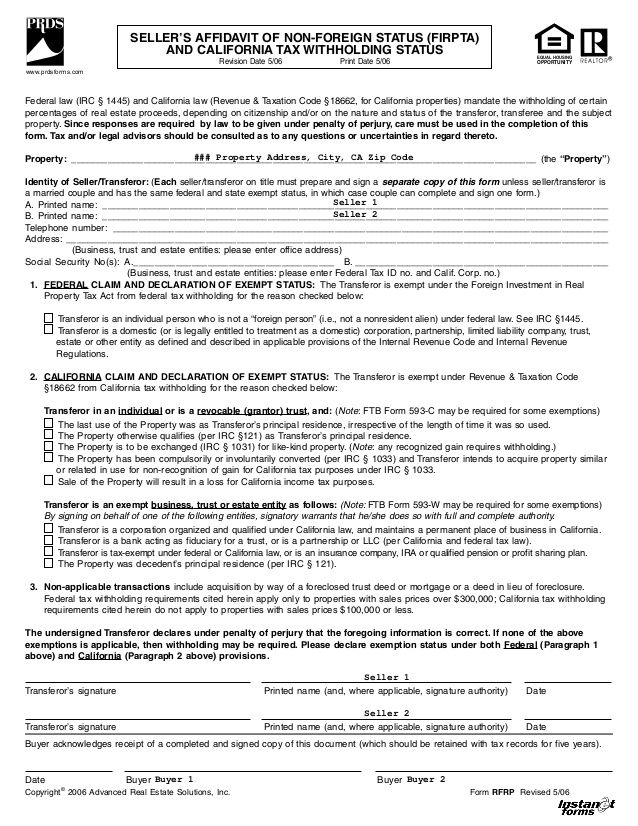

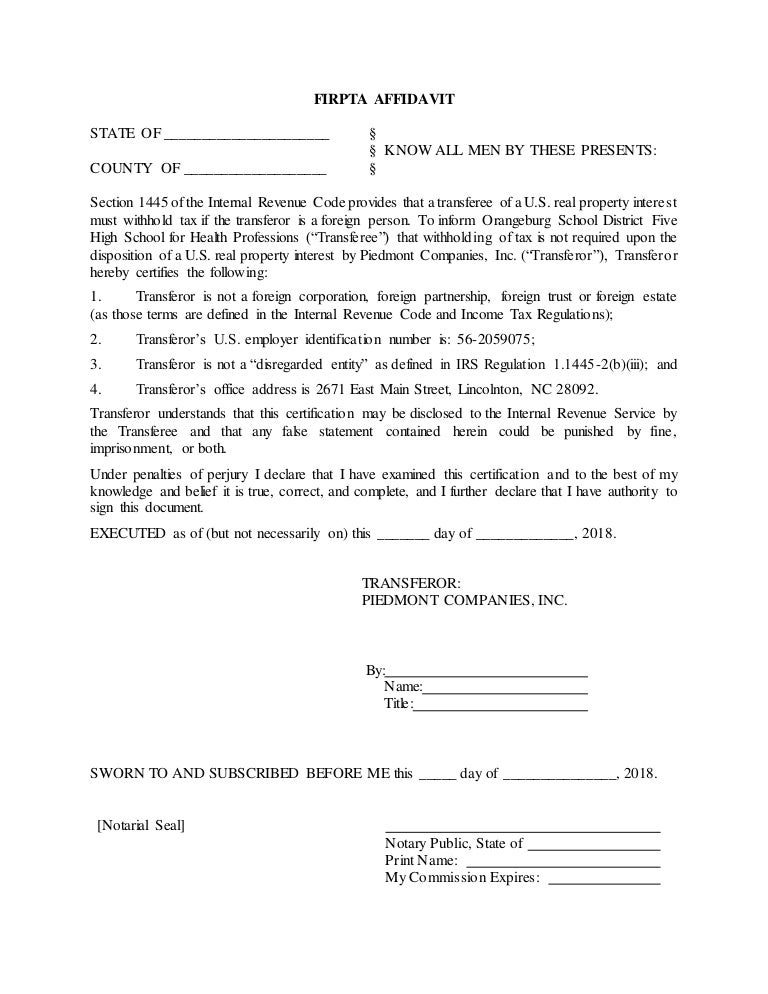

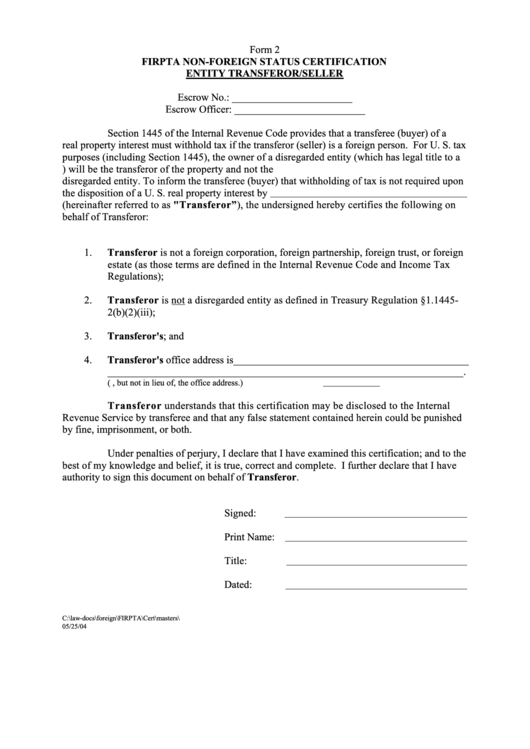

Firpta Affidavit Form

Firpta Affidavit Form - The form includes the seller’s name, u.s. This simple form, containing a certification under oath that the seller is not a “foreign person” and disclosing the transferor’s name, u.s. This nonforeign affidavit is given by seller pursuant to section 1445(b)(2) of the internal revenue code of 1954, Real property interests, with the entire package forwarded to the irs at the. Internal revenue code (“irc”) §1445 provides that a transferee (buyer) of a u.s. Web nonforeign affidavit county of _____ (firpta affidavit) t he undersigned, being first duly sworn, deposes and says that: Web generally, firpta withholding is not required in the following situations; The form includes the seller's name, u.s. Property uses to certify under oath that they aren't a foreign citizen. And there are many details, exceptions, and complicating factors.

The form includes the seller's name, u.s. Property uses to certify under oath that they aren't a foreign citizen. Web generally, firpta withholding is not required in the following situations; However, notification requirements must be met: Web certificate of non foreign status certificate of non foreign status (firpta affidavit) section 1445 of the internal revenue code provides that a transferee (buyer) of a u.s. Real property interests, with the entire package forwarded to the irs at the. Internal revenue code (“irc”) §1445 provides that a transferee (buyer) of a u.s. And there are many details, exceptions, and complicating factors. Property uses to certify under oath that they aren’t a foreign citizen. Real property interest must withhold tax if the transferor (seller) is a “foreign person.” in order to avoid withholding, irc §1445 (b) requires that the seller (a.

Internal revenue code (“irc”) §1445 provides that a transferee (buyer) of a u.s. Taxpayer identification number [4] and. Property uses to certify under oath that they aren't a foreign citizen. The form includes the seller’s name, u.s. And there are many details, exceptions, and complicating factors. Foreign persons must pay a 10% or 15% tax when they sell a piece of u.s. The buyer (transferee) acquires the property for use as a residence and the amount realized (sales price) is not more than $300,000. Taxpayer identification number and home address. Web certificate of non foreign status certificate of non foreign status (firpta affidavit) section 1445 of the internal revenue code provides that a transferee (buyer) of a u.s. As always, though, the devil is in the details.

What is FIRPTA and How to Avoid It

The form includes the seller's name, u.s. And there are many details, exceptions, and complicating factors. Property uses to certify under oath that they aren’t a foreign citizen. Taxpayer identification number and home address. Taxpayer identification number and home address.

Firpta Affidavit Florida Withholding US Legal Forms

Internal revenue code (“irc”) §1445 provides that a transferee (buyer) of a u.s. Taxpayer identification number [4] and. However, notification requirements must be met: Real property interest must withhold tax if the transferor (seller) is a “foreign person.” in order to avoid withholding, irc §1445 (b) requires that the seller (a. Real property interests, with the entire package forwarded to.

When is FIRPTA Affidavit Required? Freedomtax Accounting & Tax Services

Real property interest must withhold tax if the transferor (seller) is a “foreign person.” in order to avoid withholding, irc §1445 (b) requires that the seller (a. Taxpayer identification number [4] and. Property uses to certify under oath that they aren't a foreign citizen. This nonforeign affidavit is given by seller pursuant to section 1445(b)(2) of the internal revenue code.

Firpta affidavit for 5.25.18

Web certificate of non foreign status certificate of non foreign status (firpta affidavit) section 1445 of the internal revenue code provides that a transferee (buyer) of a u.s. This simple form, containing a certification under oath that the seller is not a “foreign person” and disclosing the transferor’s name, u.s. However, notification requirements must be met: Taxpayer identification number [4].

FREE Model FIRPTA Provisions FORM Printable Real Estate Forms Real

Taxpayer identification number [4] and. Web on the surface, the foreign investment in real property tax act of 1980 (firpta), p.l. Taxpayer identification number and home address. This nonforeign affidavit is given by seller pursuant to section 1445(b)(2) of the internal revenue code of 1954, Internal revenue code (“irc”) §1445 provides that a transferee (buyer) of a u.s.

FIRPTA , Sarasota, FL

The form includes the seller’s name, u.s. However, notification requirements must be met: This simple form, containing a certification under oath that the seller is not a “foreign person” and disclosing the transferor’s name, u.s. Real property interest must withhold tax if the transferor (seller) is a. Taxpayer identification number and home address.

firpta affidavit form Fill out & sign online DocHub

And there are many details, exceptions, and complicating factors. Real property interests, with the entire package forwarded to the irs at the. Property uses to certify under oath that they aren’t a foreign citizen. Taxpayer identification number and home address. As always, though, the devil is in the details.

What is FIRPTA and how do I avoid it? Sarasota/Manatee Area Real

Real property interest must withhold tax if the transferor (seller) is a “foreign person.” in order to avoid withholding, irc §1445 (b) requires that the seller (a. Web generally, firpta withholding is not required in the following situations; Web on the surface, the foreign investment in real property tax act of 1980 (firpta), p.l. Web nonforeign affidavit county of _____.

Fillable Firpta NonForeign Status Certification Form Entity

And there are many details, exceptions, and complicating factors. Web certificate of non foreign status certificate of non foreign status (firpta affidavit) section 1445 of the internal revenue code provides that a transferee (buyer) of a u.s. Real property interest must withhold tax if the transferor (seller) is a. This simple form, containing a certification under oath that the seller.

Buyer's Affidavit FIRPTA Withholding Exemption PRINTABLES

Foreign persons must pay a 10% or 15% tax when they sell a piece of u.s. This nonforeign affidavit is given by seller pursuant to section 1445(b)(2) of the internal revenue code of 1954, However, notification requirements must be met: Real property interests, with the entire package forwarded to the irs at the. Real property interest must withhold tax if.

The Buyer (Transferee) Acquires The Property For Use As A Residence And The Amount Realized (Sales Price) Is Not More Than $300,000.

The form includes the seller’s name, u.s. However, notification requirements must be met: Property uses to certify under oath that they aren't a foreign citizen. Taxpayer identification number [4] and.

As Always, Though, The Devil Is In The Details.

And there are many details, exceptions, and complicating factors. Real property interest must withhold tax if the transferor (seller) is a. Real property interests, with the entire package forwarded to the irs at the. This nonforeign affidavit is given by seller pursuant to section 1445(b)(2) of the internal revenue code of 1954,

Web Generally, Firpta Withholding Is Not Required In The Following Situations;

Web nonforeign affidavit county of _____ (firpta affidavit) t he undersigned, being first duly sworn, deposes and says that: The form includes the seller's name, u.s. Real property interest must withhold tax if the transferor (seller) is a “foreign person.” in order to avoid withholding, irc §1445 (b) requires that the seller (a. Taxpayer identification number and home address.

Property Uses To Certify Under Oath That They Aren’t A Foreign Citizen.

This simple form, containing a certification under oath that the seller is not a “foreign person” and disclosing the transferor’s name, u.s. Web on the surface, the foreign investment in real property tax act of 1980 (firpta), p.l. Taxpayer identification number and home address. Foreign persons must pay a 10% or 15% tax when they sell a piece of u.s.