First Time Homebuyer Credit Form

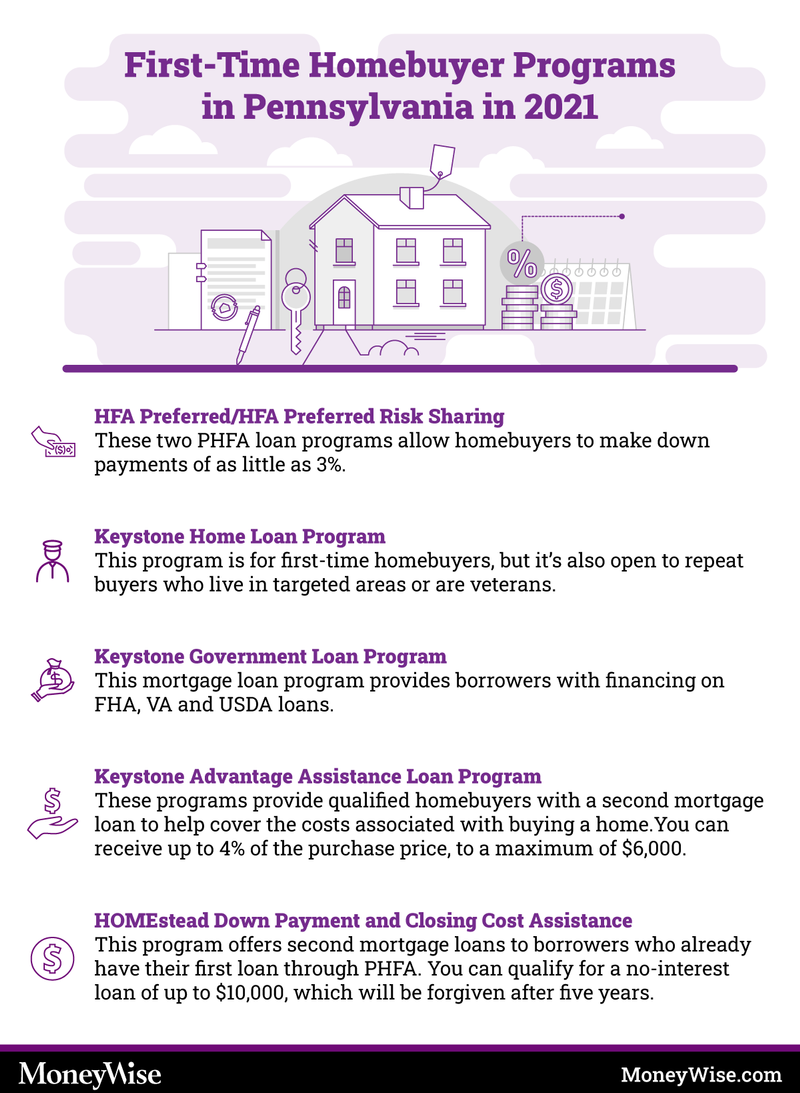

First Time Homebuyer Credit Form - Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your. The year you stopped owning and/or using the home. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to. Web use form 5405 to do the following. The form is used for the credit received if. If you dispose of the home or if you (and your spouse if married) stopped using it as your. Khrc collaborates with a network of. By providing eligible applicants with. Web to qualify, you must meet the program’s income limits, and the home you’re buying must be no more than $349,525 (or $447,542 if in a targeted area). Web the kansas housing resources corporation (khrc) offers potential homebuyers assistance via the first time homebuyer program.

Web the kansas housing resources corporation (khrc) offers potential homebuyers assistance via the first time homebuyer program. Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to. If you dispose of the home or if you (and your spouse if married) stopped using it as your. If you have a low income and want to buy your first home, the housing choice voucher homeownership program could help. Khrc collaborates with a network of. The federal housing administration allows down payments as low as 3.5% for. By providing eligible applicants with. The year you stopped owning and/or using the home. Web to qualify, you must meet the program’s income limits, and the home you’re buying must be no more than $349,525 (or $447,542 if in a targeted area).

The federal housing administration allows down payments as low as 3.5% for. Web before accessing the tool, please read through these questions and answers to determine the requirements for repaying the credit. Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your. The year you stopped owning and/or using the home. Web to qualify, you must meet the program’s income limits, and the home you’re buying must be no more than $349,525 (or $447,542 if in a targeted area). By providing eligible applicants with. If you have a low income and want to buy your first home, the housing choice voucher homeownership program could help. The year the home was acquired. If you dispose of the home or if you (and your spouse if married) stopped using it as your. The form is used for the credit received if.

IRS Form 5405 Repayment Of First Time Homebuyer Credit Stock video

Web the kansas housing resources corporation (khrc) offers potential homebuyers assistance via the first time homebuyer program. Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your. The form is used for the credit received if. You report these payments on form 1040, schedule. Notify the irs that the home.

What is the FirstTime Homebuyer Credit?

Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your. Web to qualify, you must meet the program’s income limits, and the home you’re buying must be no more than $349,525 (or $447,542 if in a targeted area). If you have a low income and want to buy your first.

FirstTime Homebuyer Credit and Repayment of the Credit

Web before accessing the tool, please read through these questions and answers to determine the requirements for repaying the credit. Web the kansas housing resources corporation (khrc) offers potential homebuyers assistance via the first time homebuyer program. By providing eligible applicants with. You report these payments on form 1040, schedule. The federal housing administration allows down payments as low as.

How To Claim First Time Homebuyer Credit Asbakku

Web the kansas housing resources corporation (khrc) offers potential homebuyers assistance via the first time homebuyer program. The federal housing administration allows down payments as low as 3.5% for. You report these payments on form 1040, schedule. Web before accessing the tool, please read through these questions and answers to determine the requirements for repaying the credit. Notify the irs.

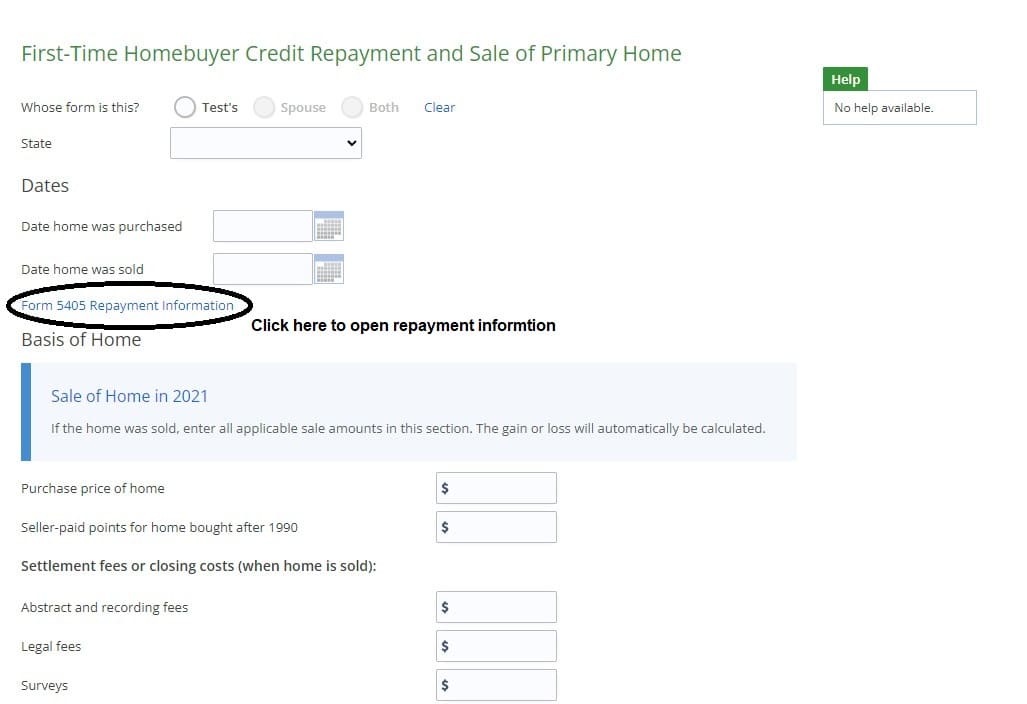

Add IRS Form 5405 to Repay FirstTime Homebuyer Credit

By providing eligible applicants with. If you dispose of the home or if you (and your spouse if married) stopped using it as your. Web before accessing the tool, please read through these questions and answers to determine the requirements for repaying the credit. You report these payments on form 1040, schedule. The federal housing administration allows down payments as.

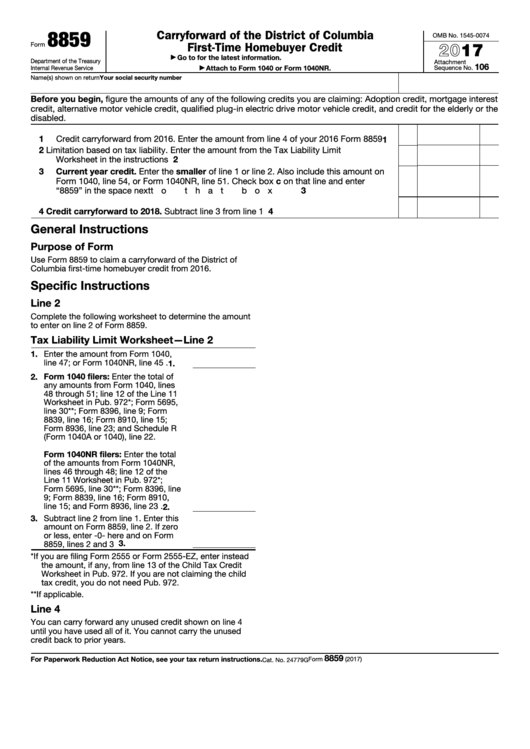

Fillable Form 8859 Carryforward Of The District Of Columbia First

Web use form 5405 to do the following. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to. You report these payments on form 1040, schedule. Web to qualify, you must meet the program’s income limits, and the home you’re buying must be no more than $349,525.

Form 5405 FirstTime Homebuyer Credit

The federal housing administration allows down payments as low as 3.5% for. If you have a low income and want to buy your first home, the housing choice voucher homeownership program could help. Web to qualify, you must meet the program’s income limits, and the home you’re buying must be no more than $349,525 (or $447,542 if in a targeted.

Form 5405 FirstTime Homebuyer Credit

By providing eligible applicants with. Khrc collaborates with a network of. The year you stopped owning and/or using the home. The federal housing administration allows down payments as low as 3.5% for. Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your.

Popular Home Buyer Interest Form, House Plan App

Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to. Web to qualify, you must meet the program’s income limits, and the home you’re buying must be no more than $349,525 (or $447,542 if in a targeted area). Web before accessing the tool, please read through these.

How To Claim First Time Homebuyer Credit Asbakku

Web use form 5405 to do the following. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to. Khrc collaborates with a network of. If you have a low income and want to buy your first home, the housing choice voucher homeownership program could help. If you.

If You Dispose Of The Home Or If You (And Your Spouse If Married) Stopped Using It As Your.

By providing eligible applicants with. Web to qualify, you must meet the program’s income limits, and the home you’re buying must be no more than $349,525 (or $447,542 if in a targeted area). Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to. Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your.

The Year The Home Was Acquired.

If you have a low income and want to buy your first home, the housing choice voucher homeownership program could help. The federal housing administration allows down payments as low as 3.5% for. Web use form 5405 to do the following. Khrc collaborates with a network of.

You Report These Payments On Form 1040, Schedule.

The year you stopped owning and/or using the home. The form is used for the credit received if. Web the kansas housing resources corporation (khrc) offers potential homebuyers assistance via the first time homebuyer program. Web before accessing the tool, please read through these questions and answers to determine the requirements for repaying the credit.

/GettyImages-185121670-be12b2817ff9419497195a93e62632cc.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-23at12.21.54PM-9f1fd40798a54df0b41b2473e3541290.png)