Fiscal Year Vs Calendar

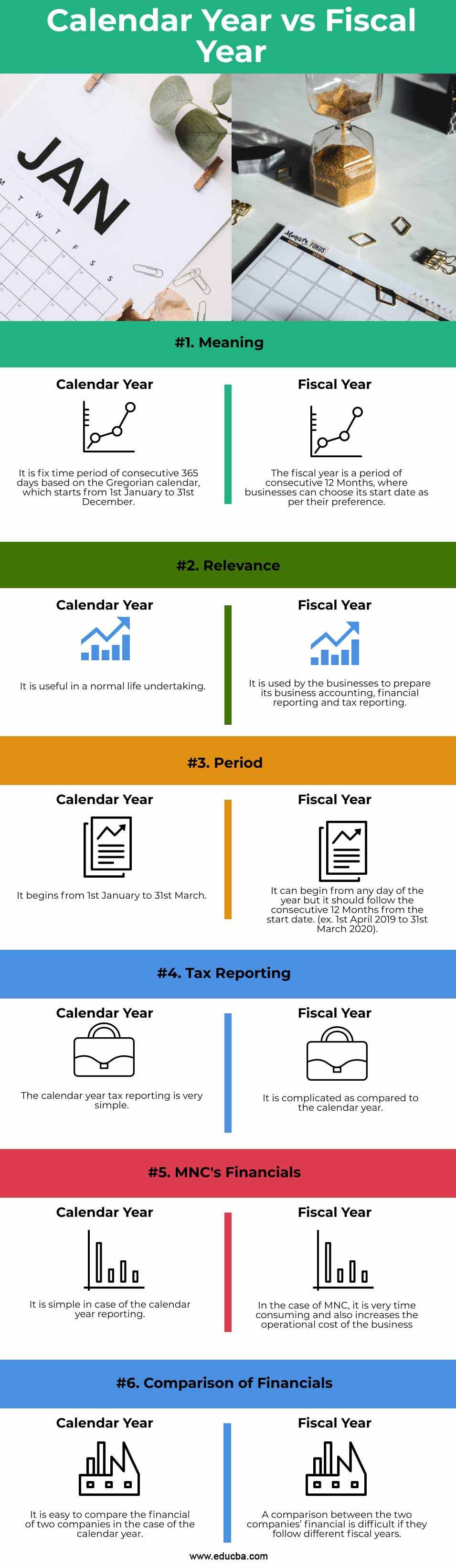

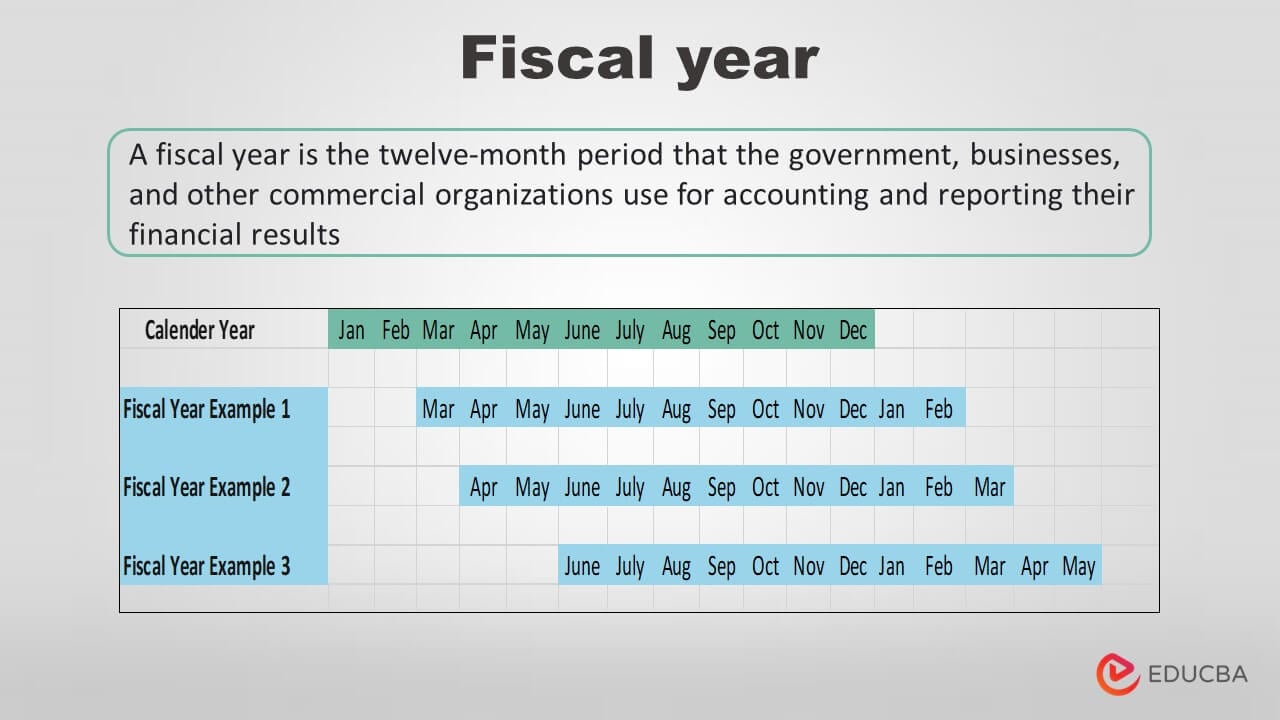

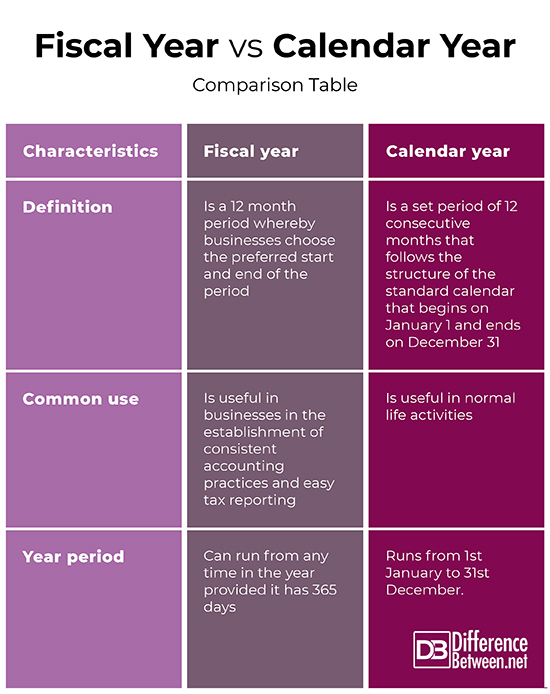

Fiscal Year Vs Calendar - Web fiscal year vs calendar year: Returns the last day of the fiscal year, which. Web understanding what each involves can help you determine which to use for accounting or tax purposes. Learn when you should use each. Web a fiscal year is different from a calendar year because it does not begin on january 1 and end on december 31. Which one is better for my business? Web fiscal years can differ from a calendar year and are an important concern for accounting purposes because they are involved in federal tax filings, budgeting, and. In this article, we define a fiscal and calendar year, list the. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Instead, a fiscal year ends 12 months after it.

Web what is the difference between a fiscal year and calendar year? Web is the fiscal year the same as a calendar year? Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. Web a fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. Learn when you should use each. In this article, we define a fiscal and calendar year, list the. Web understanding what each involves can help you determine which to use for accounting or tax purposes. Instead, a fiscal year ends 12 months after it. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. What is a fiscal year?

Web fiscal years can differ from a calendar year and are an important concern for accounting purposes because they are involved in federal tax filings, budgeting, and. Web is the fiscal year the same as a calendar year? Web different countries and companies use different fiscal years (often referred to in financial records with the acronym fy), and the fiscal year need not align with the. Returns the last day of the fiscal year, which. Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on. Returns the first day of the fiscal year, which is always in the previous calendar year. A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes. Web a fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes.

Calendar Year Vs Fiscal Top 6 Differences You Should vrogue.co

Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Web understanding what each involves can help you determine which to use for accounting or tax purposes. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers.

Fiscal Year Meaning Difference With Assessment Year B vrogue.co

Web a fiscal year is different from a calendar year because it does not begin on january 1 and end on december 31. Web fiscal years can differ from a calendar year and are an important concern for accounting purposes because they are involved in federal tax filings, budgeting, and. Web the fiscal year, a period of 12 months ending.

Fiscal Year Vs Calendar Andy Maegan

Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. If the end of your natural business year isn’t obvious, a fiscal.

Calendar Year vs Fiscal Year Top 6 Differences You Should Know

A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes. Which one is better for my business? Web understanding what each involves can help you determine which to use for accounting or tax purposes. The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on. Web.

What is a Fiscal Year? Your GoTo Guide

Learn when you should use each. Web a fiscal year is different from a calendar year because it does not begin on january 1 and end on december 31. Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. Web a fiscal year is 12.

How to Convert a Date into Fiscal Year ExcelNotes

Returns the last day of the fiscal year, which. Learn when you should use each. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on. Web a fiscal year (also known as a.

Fiscal Year vs Calendar Year What’s Right for Your Business?

Web a fiscal year is different from a calendar year because it does not begin on january 1 and end on december 31. In this article, we define a fiscal and calendar year, list the. Web different countries and companies use different fiscal years (often referred to in financial records with the acronym fy), and the fiscal year need not.

What is the Difference Between Fiscal Year and Calendar Year

Web fiscal years can differ from a calendar year and are an important concern for accounting purposes because they are involved in federal tax filings, budgeting, and. Web is the fiscal year the same as a calendar year? Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with.

What is a Fiscal year? Benefits, IRS Guidelines, & Examples

Returns the last day of the fiscal year, which. Which one is better for my business? Learn when you should use each. A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes. Web fiscal years can differ from a calendar year and are an important concern for accounting purposes because.

Fiscal Year vs Calendar Year Difference and Comparison

Web understanding what each involves can help you determine which to use for accounting or tax purposes. In this article, we define a fiscal and calendar year, list the. Web a fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. Web a fiscal year.

Web Understanding What Each Involves Can Help You Determine Which To Use For Accounting Or Tax Purposes.

Web a fiscal year is different from a calendar year because it does not begin on january 1 and end on december 31. Learn when you should use each. Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes.

If The End Of Your Natural Business Year Isn’t Obvious, A Fiscal Year Might Still Be Better Than The Standard Calendar.

The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on. Instead, a fiscal year ends 12 months after it. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Web a fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes.

Web Is The Fiscal Year The Same As A Calendar Year?

In this article, we define a fiscal and calendar year, list the. Which one is better for my business? Returns the last day of the fiscal year, which. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period.

Web The Fiscal Year, A Period Of 12 Months Ending On The Last Day Of The Month, Does Not Line Up With The Traditional Calendar Year.

What is a fiscal year? Web fiscal years can differ from a calendar year and are an important concern for accounting purposes because they are involved in federal tax filings, budgeting, and. Web fiscal year vs calendar year: Web what is the difference between a fiscal year and calendar year?

:max_bytes(150000):strip_icc()/fiscal-year-definition-federal-budget-examples-3305794_final-c54e01b8314f424a8aefacb8c126d192.png)