Form 1041 Extension Due Date 2021

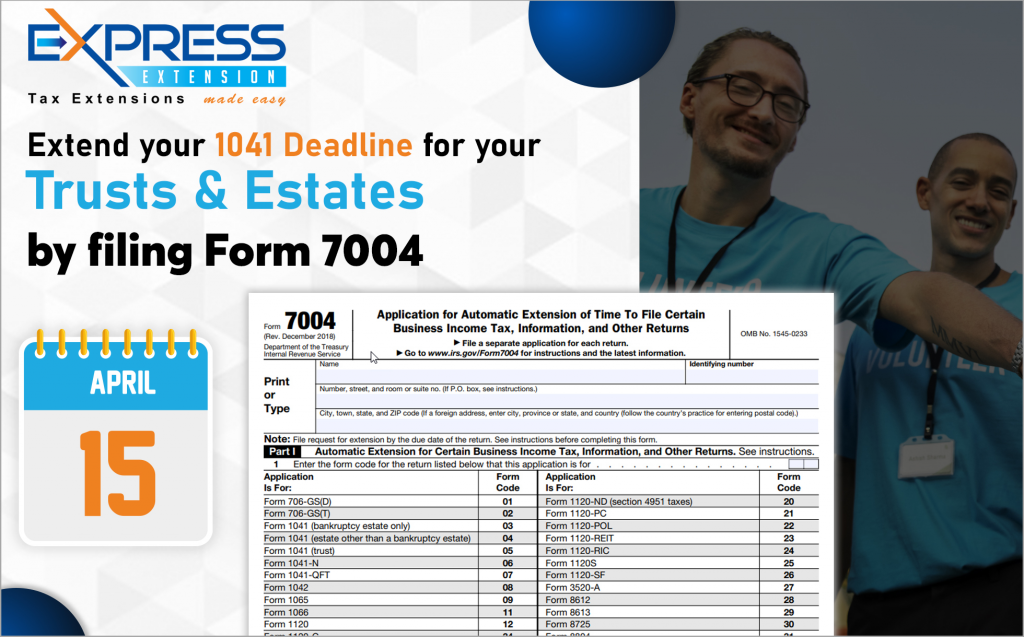

Form 1041 Extension Due Date 2021 - 15 or the next business day. Expresstaxexempt | april 14, 2021. Whenever a regular tax filing date falls on. Web for fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. Web 2021 federal tax filing deadlines | 2022 irs tax deadlines | 1041 due date free download: Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s. Web december 22, 2020 mark your calendars! Web even though the original federal tax return filing deadline for most people was on april 18 this year, the due date for filing an extended return for the 2021 tax year is. Web beneficiaries, including charitable organizations, can extend their irs form 1041 deadline by filing form 7004 by april 15, 2021. Web tax deadlines at a glance.

As a general rule by the irs, the deadline for filing form 1041 falls on the 15th day of the fourth month following the close. Web how to file for a tax extension in 2022. The 15th day of the 4th month after the end of the tax year. Web 7 rows 1041 irs filing deadlines & electronic filing information this topic provides. Web tax deadlines at a glance. Web if the decedent passed away june 1, the fy would run until may 31 of the following year, with form 1041 due sept. Whenever a regular tax filing date falls on. Federal tax filing deadlines for tax year 2021 april 21, 2020 |. Web even though the original federal tax return filing deadline for most people was on april 18 this year, the due date for filing an extended return for the 2021 tax year is. A 1041 extension must be filed no later than midnight on the normal due date of the return:

Complete, edit or print tax forms instantly. Web beneficiaries, including charitable organizations, can extend their irs form 1041 deadline by filing form 7004 by april 15, 2021. For example, an estate that has a tax year that. Web 7 rows 1041 irs filing deadlines & electronic filing information this topic provides. Web when is form 1041 due to the irs? You can file for a tax extension in 2022 by submitting form 4868 to the irs on or before the april 18, 2022 tax deadline. Web general instructions section references are to the internal revenue code unless otherwise noted. 15 or the next business day. A 1041 extension must be filed no later than midnight on the normal due date of the return: Web 2021 federal tax filing deadlines | 2022 irs tax deadlines | 1041 due date free download:

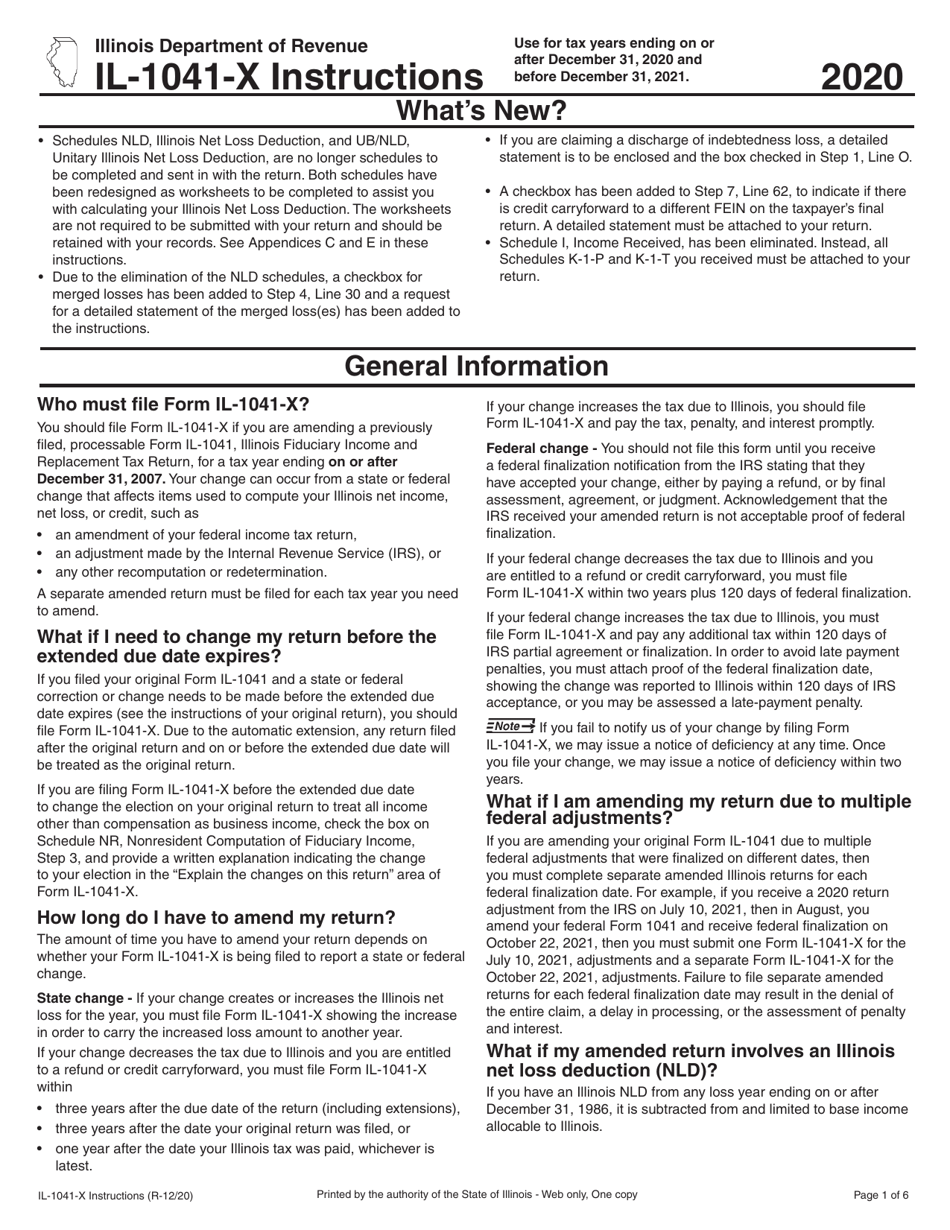

Download Instructions for Form IL1041X Amended Fiduciary and

Web beneficiaries, including charitable organizations, can extend their irs form 1041 deadline by filing form 7004 by april 15, 2021. Web tax deadlines at a glance. A 1041 extension must be filed no later than midnight on the normal due date of the return: Web the original due date of april 15, 2021 was only extended for individuals, not estates.

form1041extension

Web if the decedent passed away june 1, the fy would run until may 31 of the following year, with form 1041 due sept. Web how to file for a tax extension in 2022. A 1041 extension must be filed no later than midnight on the normal due date of the return: Web even though the original federal tax return.

Form 1041 and Other Tax Forms Still Due April 15, 2021 YouTube

A 1041 extension must be filed no later than midnight on the normal due date of the return: Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s. The 15th day of the 4th month after the end of the tax year. Get ready for tax season.

filing form 1041 Blog ExpressExtension Extensions Made Easy

The extension request will allow a 5 1/2 month. Web for fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. Web general instructions section references are to the internal revenue code unless otherwise noted. Web what is the due date for irs form 1041? You can.

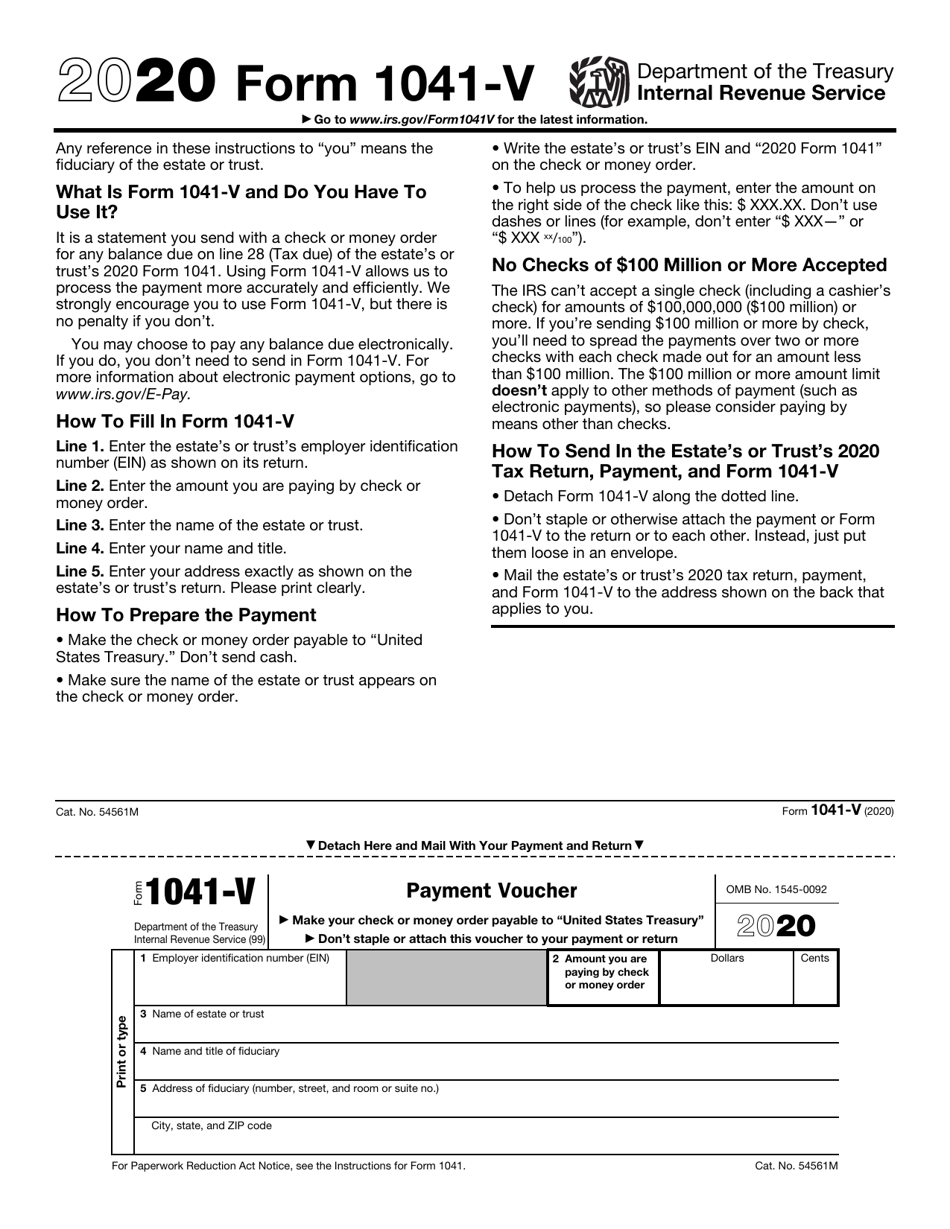

IRS Form 1041V Download Fillable PDF or Fill Online Payment Voucher

Expresstaxexempt | april 14, 2021. Get ready for tax season deadlines by completing any required tax forms today. 15 or the next business day. Supports irs and state extensions. Web general instructions section references are to the internal revenue code unless otherwise noted.

Tax Extension Due Date for Corporations and Partnerships is September

Expresstaxexempt | april 14, 2021. Web the original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. Web december 22, 2020 mark your calendars! You can file for a tax extension in 2022 by submitting form 4868 to the irs on or before the april 18, 2022 tax deadline. Web when.

form 1041t extension Fill Online, Printable, Fillable Blank form

Whenever a regular tax filing date falls on. For example, an estate that has a tax year that. Web december 22, 2020 mark your calendars! Supports irs and state extensions. You can file for a tax extension in 2022 by submitting form 4868 to the irs on or before the april 18, 2022 tax deadline.

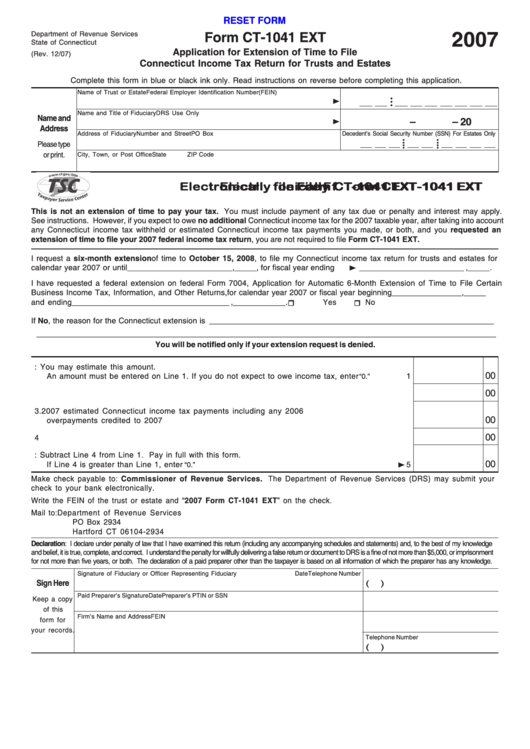

Fillable Form Ct1041 Ext Application For Extension Of Time To File

Web even though the original federal tax return filing deadline for most people was on april 18 this year, the due date for filing an extended return for the 2021 tax year is. Web the original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. Web general instructions section references are.

form 1041 Blog ExpressExtension Extensions Made Easy

You can file for a tax extension in 2022 by submitting form 4868 to the irs on or before the april 18, 2022 tax deadline. Web general instructions section references are to the internal revenue code unless otherwise noted. For example, an estate that has a tax year that. As a general rule by the irs, the deadline for filing.

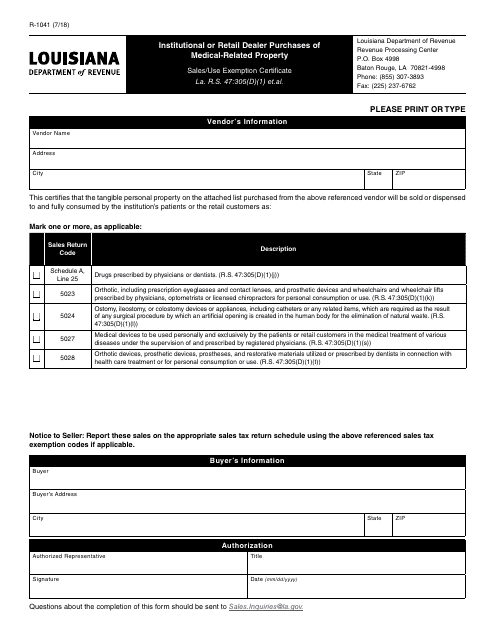

Form R1041 Download Fillable PDF or Fill Online Institutional or

The calendar year 2021 due dates for tax year 2020 tax returns is now available. A 1041 extension must be filed no later than midnight on the normal due date of the return: Whenever a regular tax filing date falls on. You can file for a tax extension in 2022 by submitting form 4868 to the irs on or before.

You Can File For A Tax Extension In 2022 By Submitting Form 4868 To The Irs On Or Before The April 18, 2022 Tax Deadline.

Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s. Complete, edit or print tax forms instantly. Web december 22, 2020 mark your calendars! Web even though the original federal tax return filing deadline for most people was on april 18 this year, the due date for filing an extended return for the 2021 tax year is.

Web What Is The Due Date For Irs Form 1041?

Web how to file for a tax extension in 2022. The calendar year 2021 due dates for tax year 2020 tax returns is now available. Web when must the 7004 be filed? Federal tax filing deadlines for tax year 2021 april 21, 2020 |.

Web If The Decedent Passed Away June 1, The Fy Would Run Until May 31 Of The Following Year, With Form 1041 Due Sept.

Web when is form 1041 due to the irs? Expresstaxexempt | april 14, 2021. 15 or the next business day. Whenever a regular tax filing date falls on.

Ad Access Irs Tax Forms.

Web the original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. The extension request will allow a 5 1/2 month. Web beneficiaries, including charitable organizations, can extend their irs form 1041 deadline by filing form 7004 by april 15, 2021. Get ready for tax season deadlines by completing any required tax forms today.