Form 1045 2020

Form 1045 2020 - Web your work as an employee (unreimbursed employee business expenses, although not deductible for most taxpayers in 2020) casualty or theft losses resulting from a federally. Corporations use form 1139, corporation application for. Web form 1045 computation of decrease in tax (continued) preceding tax year ended: An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Upload, modify or create forms. Web application for tentative refund omb no. ' do not attach to your income tax return—mail in a separate envelope. Web address as shown on form 945. Web the irs announced on april 13, 2020, that taxpayers can temporarily file by fax form 1139 (refunds for corporations) and form 1045 (refunds for individuals, estates, and trusts) to. Too late to file form 1045 for 2020 nol?

Complete, edit or print tax forms instantly. ' do not attach to your income tax return—mail in a separate envelope. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Department of the treasury internal revenue service. Web address as shown on form 945. Web about form 1045, application for tentative refund. Complete, edit or print tax forms instantly. Web form 1045 computation of decrease in tax (continued) preceding tax year ended: Web if you filed your 2019 federal income tax return before april 9, 2020, and did not make the election, you may be able to file form 1045 both to make the election and apply for a. Web application for tentative refund omb no.

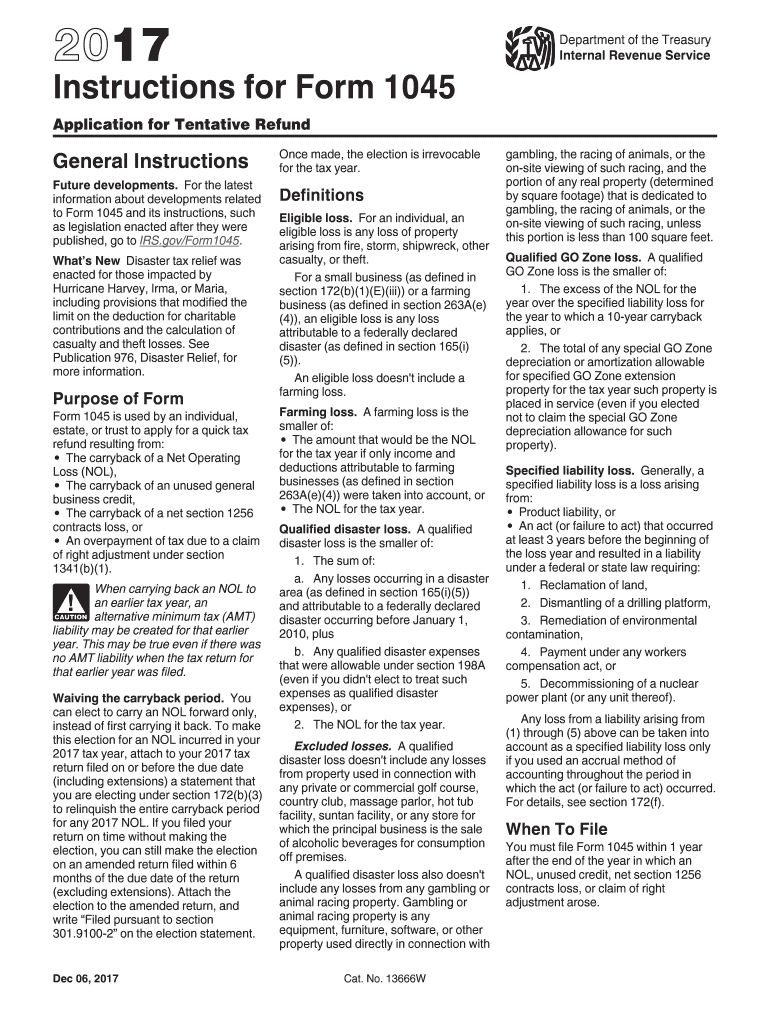

Web form 1045 computation of decrease in tax (continued) preceding tax year ended: The carryback of an nol. Upload, modify or create forms. Web about form 1045, application for tentative refund. Web application for tentative refund omb no. ' do not attach to your income tax return—mail in a separate envelope. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Go to www.irs.gov/form1045 for the latest information. To take advantage of this. I understand that form 1045, application for tentative refund must generally be filed within one year of.

2020 Form 1045 2020 Blank Sample to Fill out Online in PDF

Form 1045, net operating loss worksheet an individual, estate, or trust files form 1045 to apply for a. Department of the treasury internal revenue service. Try it for free now! An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: • enclose your check or money order made payable to “united states treasury.”.

Fill Free fillable Form 1045 2019 Application for Tentative Refund

Web address as shown on form 945. Web we last updated the application for tentative refund in december 2022, so this is the latest version of form 1045, fully updated for tax year 2022. ' do not attach to your income tax return—mail in a separate envelope. Try it for free now! The carryback of an nol.

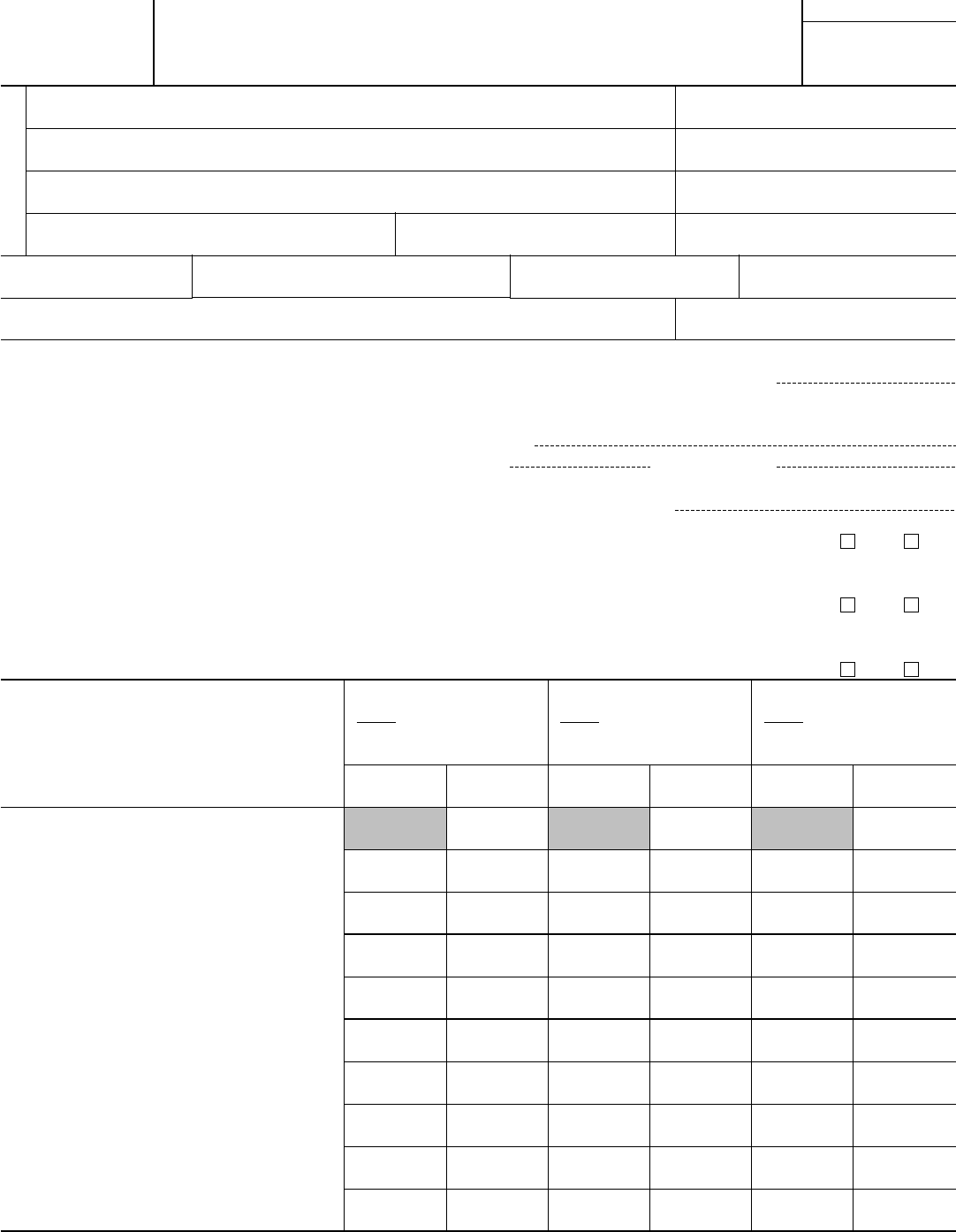

2013 Form IRS Instruction 1045 Fill Online, Printable, Fillable, Blank

Web we last updated the application for tentative refund in december 2022, so this is the latest version of form 1045, fully updated for tax year 2022. Try it for free now! Web up to 10% cash back individuals file a tentative refund claim on form 1045, application for tentative refund. Upload, modify or create forms. You can download or.

Form 1045 Application for Tentative Refund (2014) Free Download

Upload, modify or create forms. Web up to 10% cash back individuals file a tentative refund claim on form 1045, application for tentative refund. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 945,” and “2020” on your. Web form 1045 computation of decrease in tax (continued) preceding tax.

Form 1045 Edit, Fill, Sign Online Handypdf

Web the irs announced on april 13, 2020, that taxpayers can temporarily file by fax form 1139 (refunds for corporations) and form 1045 (refunds for individuals, estates, and trusts) to. Try it for free now! You can download or print current. ' do not attach to your income tax return—mail in a separate envelope. Go to www.irs.gov/form1045 for the latest.

Form 1045 Application for Tentative Refund (2014) Free Download

I understand that form 1045, application for tentative refund must generally be filed within one year of. Web up to 10% cash back individuals file a tentative refund claim on form 1045, application for tentative refund. Web form for individuals, estates, or trusts. Web if you filed your 2019 federal income tax return before april 9, 2020, and did not.

form 1045 instructions 20202022 Fill Online, Printable, Fillable

The carryback of an nol. Form 1045, net operating loss worksheet an individual, estate, or trust files form 1045 to apply for a. Department of the treasury internal revenue service. Complete, edit or print tax forms instantly. I understand that form 1045, application for tentative refund must generally be filed within one year of.

2017 Form IRS Instruction 1045 Fill Online, Printable, Fillable, Blank

Web form 1045 computation of decrease in tax (continued) preceding tax year ended: Try it for free now! Too late to file form 1045 for 2020 nol? To take advantage of this. I understand that form 1045, application for tentative refund must generally be filed within one year of.

Form 1045 Fill Out and Sign Printable PDF Template signNow

Web form 1045 computation of decrease in tax (continued) preceding tax year ended: I understand that form 1045, application for tentative refund must generally be filed within one year of. Web the irs announced on april 13, 2020, that taxpayers can temporarily file by fax form 1139 (refunds for corporations) and form 1045 (refunds for individuals, estates, and trusts) to..

Form 1045 Application for Tentative Refund (2014) Free Download

• enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 945,” and “2020” on your. Web about form 1045, application for tentative refund. Web the irs announced on april 13, 2020, that taxpayers can temporarily file by fax form 1139 (refunds for corporations) and form 1045 (refunds for individuals, estates,.

Complete, Edit Or Print Tax Forms Instantly.

Web taxslayer pro desktop miscellaneous forms menu desktop: Complete, edit or print tax forms instantly. Web address as shown on form 945. Web the irs announced on april 13, 2020, that taxpayers can temporarily file by fax form 1139 (refunds for corporations) and form 1045 (refunds for individuals, estates, and trusts) to.

Upload, Modify Or Create Forms.

Upload, modify or create forms. You can download or print current. To take advantage of this. Go to www.irs.gov/form1045 for the latest information.

Try It For Free Now!

Try it for free now! Web about form 1045, application for tentative refund. Try it for free now! Web application for tentative refund omb no.

Web Form 1045 Computation Of Decrease In Tax (Continued) Preceding Tax Year Ended:

Complete, edit or print tax forms instantly. Department of the treasury internal revenue service. Form 1045, net operating loss worksheet an individual, estate, or trust files form 1045 to apply for a. Generally, you must file form 1045 on or after the date you file your tax return for the nol year, but not later than one year after the end of the nol year.