Form 1065 Extension Due Date 2023

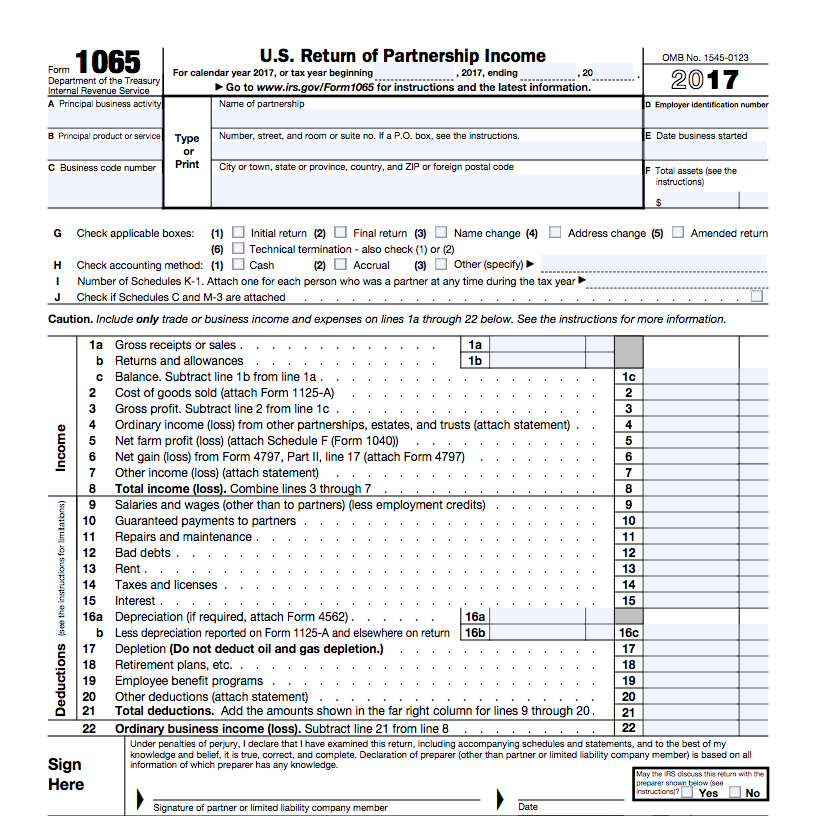

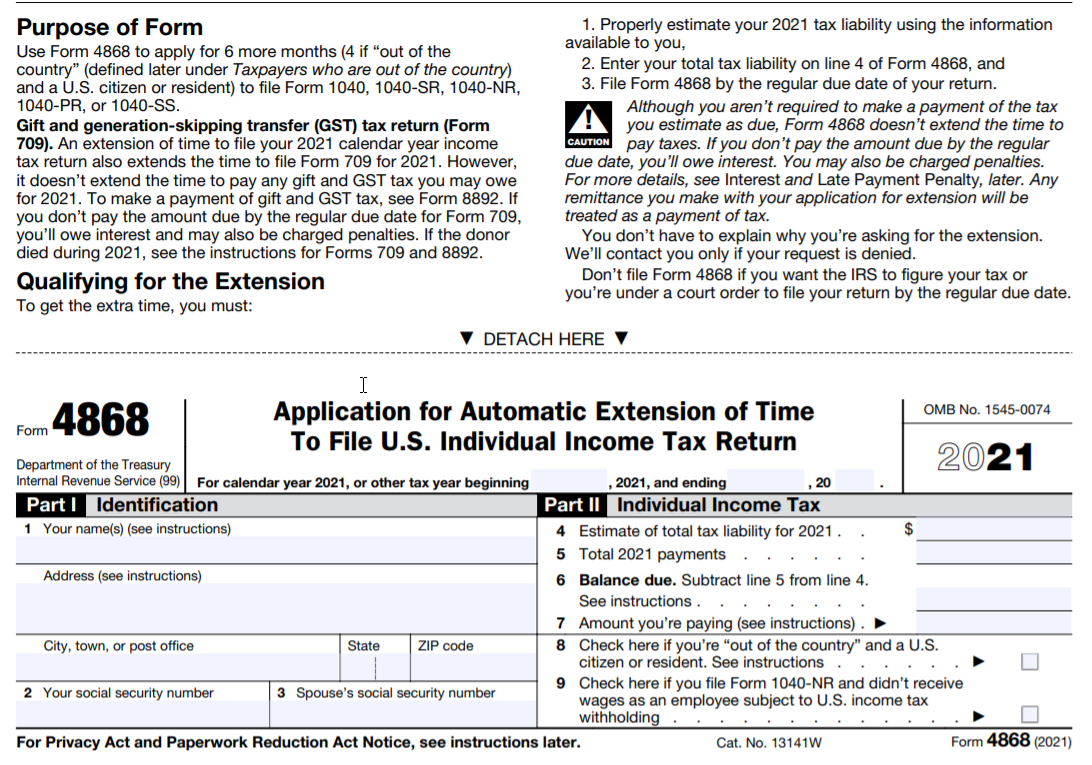

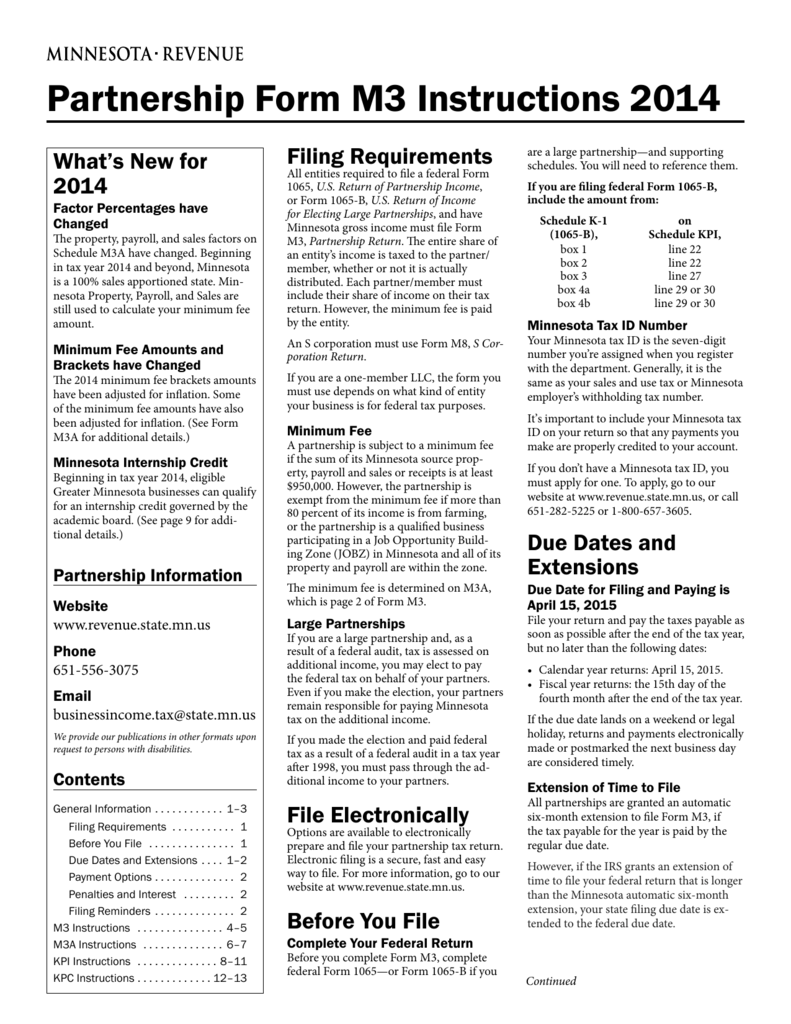

Form 1065 Extension Due Date 2023 - Form 1065 (partnership) september 15, 2023: Return of partnership income, including recent updates, related forms and instructions on how to file. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Payments are due on the 15th day of the 4th, 6th, and 9th months of your tax year and on the 15th day of. Web generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of form 1065. Filing this form gives you until october 15 to file a return. 2023 filing season deadline (calendar year): 15 th day of the 3 rd month following the close of the entity’s year; Deadline for extended personal income tax returns: Since april 15 falls on a saturday, and emancipation day falls on monday, april 17, 2023, the tax deadline is moved to april 18, 2023.

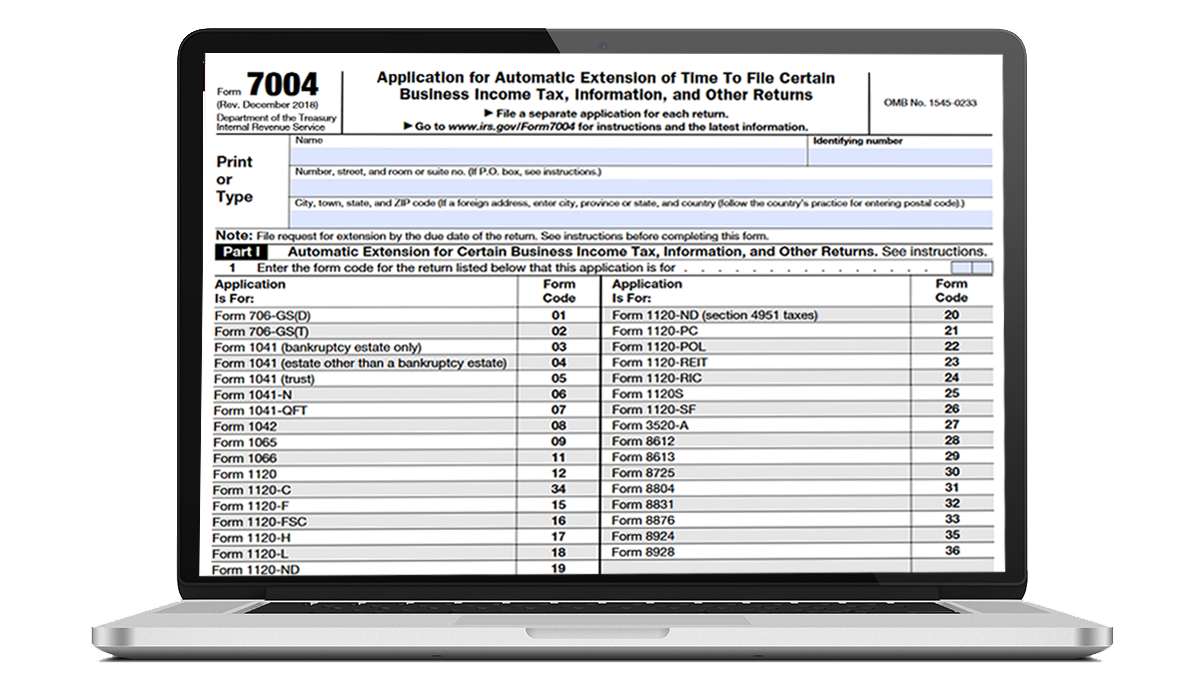

For calendar year partnerships, the due date is march 15. Payments are due on the 15th day of the 4th, 6th, and 9th months of your tax year and on the 15th day of. If october 15 falls on a saturday, sunday, or legal holiday, the due date is delayed until the next business day. Filing this form gives you until october 15 to file a return. Form 1065 (partnership) september 15, 2023: 5 days * 2023 filing season return deadline: Web type of form: Form 1040, the late filing deadline: About form 7004, application for automatic extension of time to file certain business income tax, information, and other returns | internal revenue service 15 th day of the 3 rd month following the close of the entity’s year;

Or getting income from u.s. Web type of form: About form 7004, application for automatic extension of time to file certain business income tax, information, and other returns | internal revenue service 5 days * 2023 filing season return deadline: Web generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of form 1065. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Deadline for extended personal income tax returns: If you need an extension, submit form 4868 by this date. Since april 15 falls on a saturday, and emancipation day falls on monday, april 17, 2023, the tax deadline is moved to april 18, 2023. This is also the deadline for individuals to make ira and hsa contributions for 2022.

Turbotax 1065 Extension Best Reviews

If you need an extension, submit form 4868 by this date. Since april 15 falls on a saturday, and emancipation day falls on monday, april 17, 2023, the tax deadline is moved to april 18, 2023. Web information about form 1065, u.s. Web generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following.

Form 12 Extension Due Date How Will Form 12 Extension Due Date Be In

Web generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of form 1065. Web failing to file your tax return by the due date can result in penalties and extra charges. Form 1040, the late filing deadline: Payments are due on.

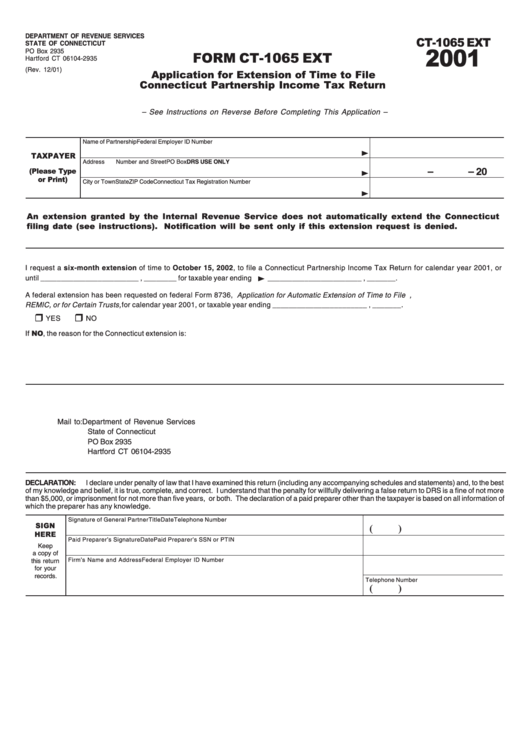

Form Ct1065 Ext Application For Extension Of Time To File

10 days * form 7004 extends filing deadline by: Web type of form: About form 7004, application for automatic extension of time to file certain business income tax, information, and other returns | internal revenue service Filing this form gives you until october 15 to file a return. Return of partnership income, including recent updates, related forms and instructions on.

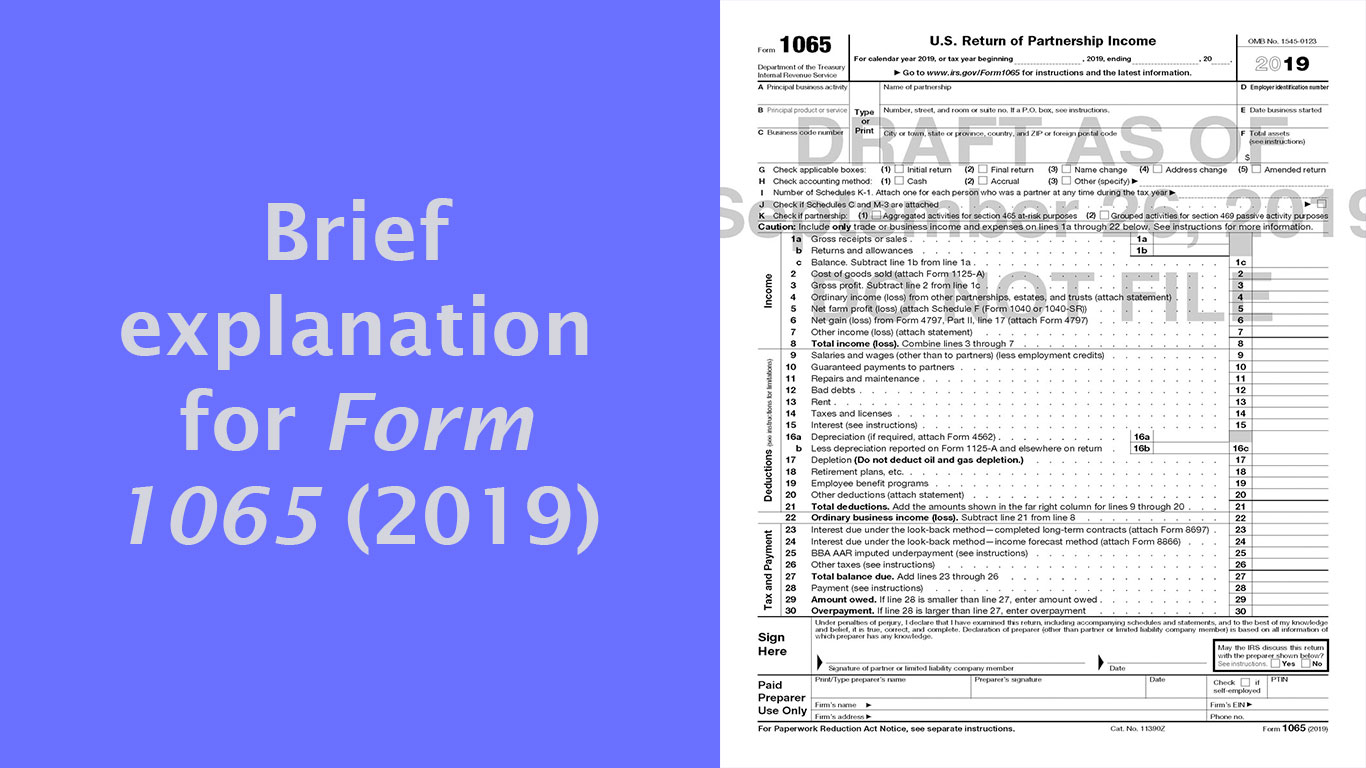

Form 1065 (2019), Partnership Tax Return 1065 Meru Accounting

Web generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of form 1065. About form 7004, application for automatic extension of time to file certain business income tax, information, and other returns | internal revenue service For calendar year partnerships, the.

Form 1065 Instructions 2022 2023 IRS Forms Zrivo

Web information about form 1065, u.s. Web failing to file your tax return by the due date can result in penalties and extra charges. Form 1040 due october 16, 2023. Return of partnership income, including recent updates, related forms and instructions on how to file. Deadline for extended personal income tax returns:

How to Prepare Form 1065 in 8 Steps [+ Free Checklist]

Payments are due on the 15th day of the 4th, 6th, and 9th months of your tax year and on the 15th day of. 5 days * 2023 filing season return deadline: Return of partnership income, including recent updates, related forms and instructions on how to file. Form 1065 (partnership) september 15, 2023: Fin cen 114 (along with form 1040).

How To Fill Out Form 1065 Overview and Instructions Bench Accounting

Web information about form 1065, u.s. This is also the deadline for individuals to make ira and hsa contributions for 2022. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Form 1040, the late filing deadline: Web type of form:

File Form 1065 Extension Online Partnership Tax Extension

If october 15 falls on a saturday, sunday, or legal holiday, the due date is delayed until the next business day. If you need an extension, submit form 4868 by this date. Deadline for extended personal income tax returns: Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Form 1065 is used to report the income of.

IRS Tax Extension Efile Federal Extension

Return of partnership income, including recent updates, related forms and instructions on how to file. If you need an extension, submit form 4868 by this date. Web failing to file your tax return by the due date can result in penalties and extra charges. Web type of form: Or getting income from u.s.

10 Days * Form 7004 Extends Filing Deadline By:

Form 1040 due october 16, 2023. Web information about form 1065, u.s. Filing this form gives you until october 15 to file a return. If you need an extension, submit form 4868 by this date.

Or Getting Income From U.s.

15 th day of the 3 rd month following the close of the entity’s year; About form 7004, application for automatic extension of time to file certain business income tax, information, and other returns | internal revenue service 5 days * 2023 filing season return deadline: Return of partnership income, including recent updates, related forms and instructions on how to file.

Deadline For Extended Personal Income Tax Returns:

Form 1040, the late filing deadline: This is also the deadline for individuals to make ira and hsa contributions for 2022. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. 2023 filing season deadline (calendar year):

For Calendar Year Partnerships, The Due Date Is March 15.

Payments are due on the 15th day of the 4th, 6th, and 9th months of your tax year and on the 15th day of. Web failing to file your tax return by the due date can result in penalties and extra charges. Since april 15 falls on a saturday, and emancipation day falls on monday, april 17, 2023, the tax deadline is moved to april 18, 2023. If october 15 falls on a saturday, sunday, or legal holiday, the due date is delayed until the next business day.

![How to Prepare Form 1065 in 8 Steps [+ Free Checklist]](https://fitsmallbusiness.com/wp-content/uploads/2019/02/word-image-743.png)