Form 1099 Composite

Form 1099 Composite - Web the primary forms of income you'll need to include in your tax filing are contained in the following three sections of your 1099 composite: To get the transaction information into your return, select from the 6 options described. Web your form 1099 composite may include the following internal revenue service (irs) forms: It is number 13 and prior box numbers 13 through. Web form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income other. The form used to report various types of income, such as royalties, rents, and. See how we can help! Fatca check box and renumbering. Instead, it tells me 'various'. The form on which financial institutions report dividends.

Web charles schwab 1099 composite form just report it as it is reported to you by schwab; It is number 13 and prior box numbers 13 through. Fatca check box and renumbering. To get the transaction information into your return, select from the 6 options described. The document should contain three separate tax documents that you need to report: The form reports the interest income you. Please see this answer from richardg. The form on which financial institutions report dividends. Find out if you will receive 1099 forms from employers or. Web the primary forms of income you'll need to include in your tax filing are contained in the following three sections of your 1099 composite:

Web learn what a 1099 irs tax form is, and the different types of 1099 forms with the experts at h&r block. Most of my other 1099's regarding crypto gave me the date acquired, while robinhood did not. It is number 13 and prior box numbers 13 through. Web your form 1099 composite may include the following internal revenue service (irs) forms: Find out if you will receive 1099 forms from employers or. Substitute payments in lieu of dividends may be reported on a composite. To get the transaction information into your return, select from the 6 options described. The form used to report various types of income, such as royalties, rents, and. Fatca check box and renumbering. The document should contain three separate tax documents that you need to report:

【ベストコレクション】 1099 composite vs 1099 r 1985841099 composite vs 1099 r

Web learn what a 1099 irs tax form is, and the different types of 1099 forms with the experts at h&r block. The form on which financial institutions report dividends. Web a composite has more than one type of 1099. Instead, it tells me 'various'. Find out if you will receive 1099 forms from employers or.

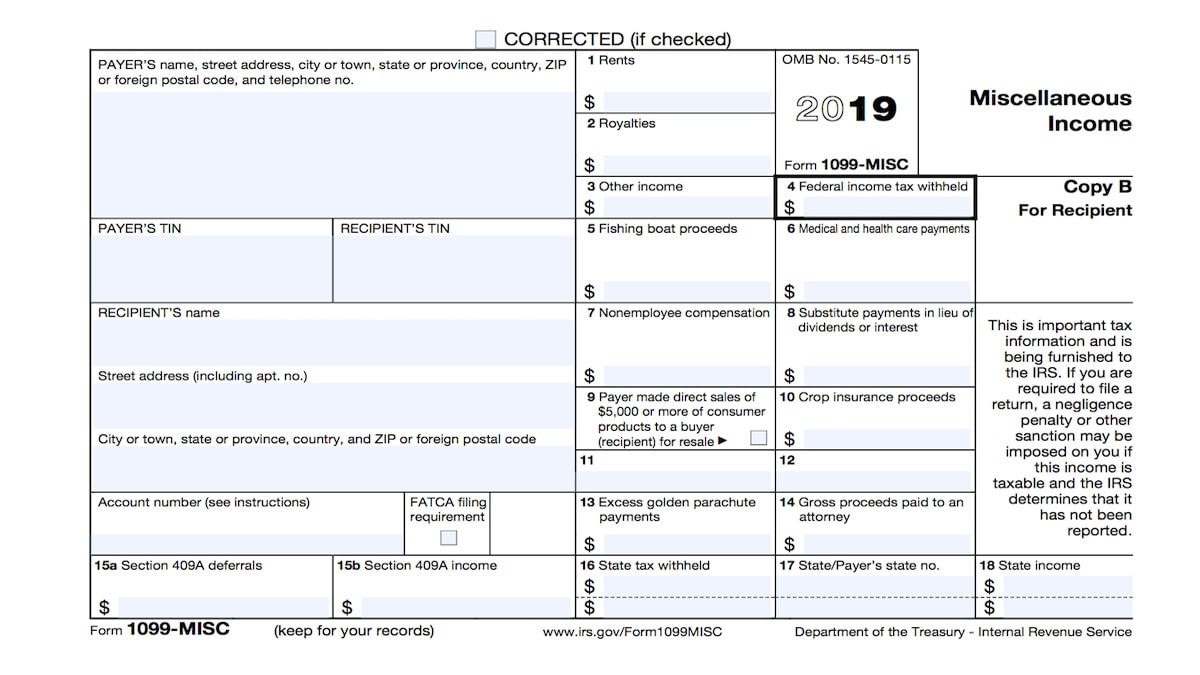

Form 1099MISC for independent consultants (6 step guide)

Most of my other 1099's regarding crypto gave me the date acquired, while robinhood did not. See how we can help! The document should contain three separate tax documents that you need to. Web form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to.

Form 1099

Please see this answer from richardg. Web learn what a 1099 irs tax form is, and the different types of 1099 forms with the experts at h&r block. The form used to report various types of income, such as royalties, rents, and. The document should contain three separate tax documents that you need to. Web your form 1099 composite may.

united states Why no 1099 for short term capital gains from stocks

Most of my other 1099's regarding crypto gave me the date acquired, while robinhood did not. The form on which financial institutions report dividends. There is no need to report each mutual fund separately if schwab is reporting. Substitute payments in lieu of dividends may be reported on a composite. Web form 1099 is one of several irs tax forms.

Information returns What You Should Know About Form1099

Web the primary forms of income you'll need to include in your tax filing are contained in the following three sections of your 1099 composite: The form on which financial institutions report dividends. The document should contain three separate tax documents that you need to. Please see this answer from richardg. Web how do i enter information from a 1099.

united states Why no 1099 for short term capital gains from stocks

Web charles schwab 1099 composite form just report it as it is reported to you by schwab; The form on which financial institutions report dividends. To get the transaction information into your return, select from the 6 options described. Ad for more than 20 years, iofm has reduced your peers’ compliance risk. Please see this answer from richardg.

Form1099NEC

See how we can help! To get the transaction information into your return, select from the 6 options described. Web taxact® will complete form 8949 for you and include it in your tax return submission. Substitute payments in lieu of dividends may be reported on a composite. Web the primary forms of income you'll need to include in your tax.

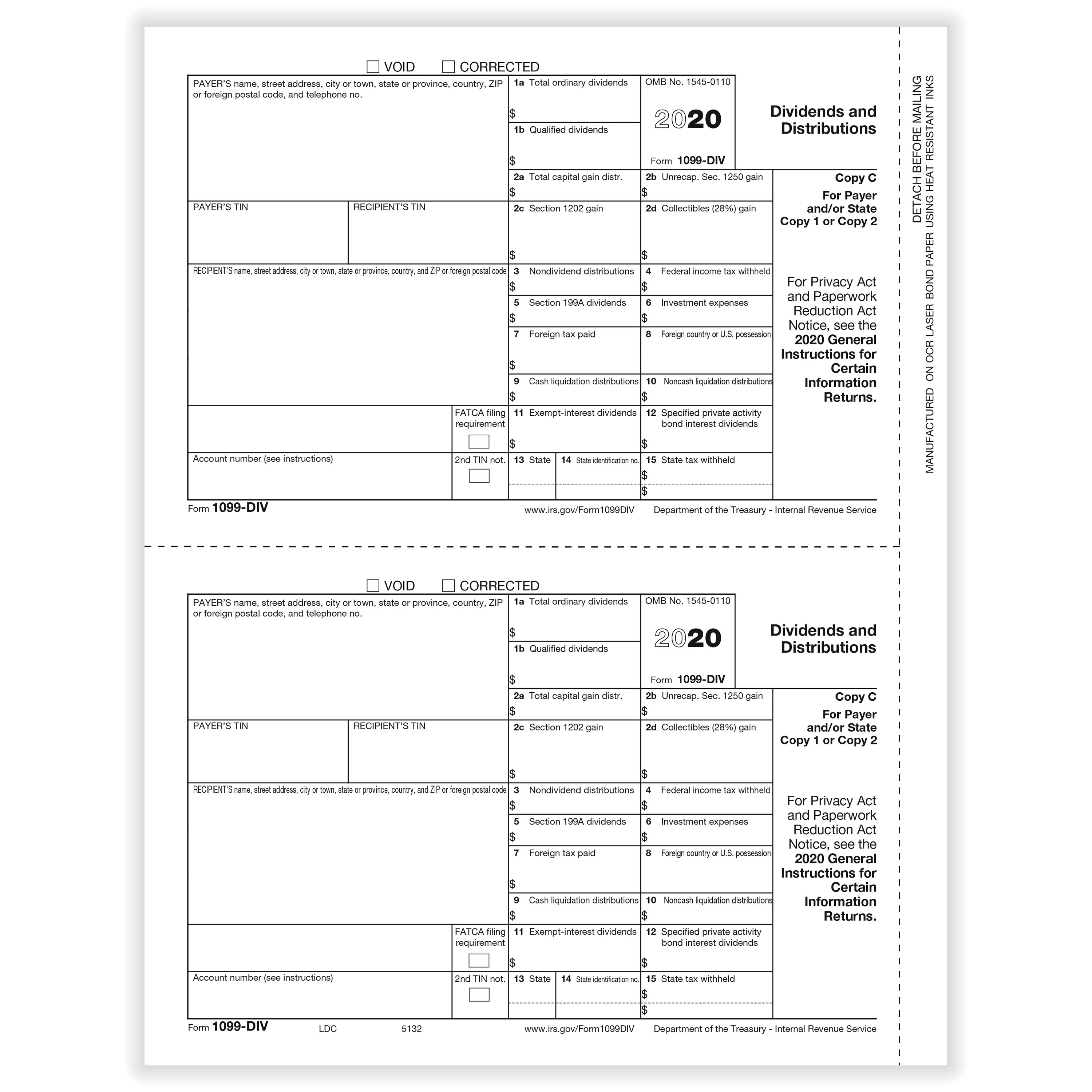

1099DIV Payer and State Copies Formstax

The form on which financial institutions report dividends. Web how do i enter information from a 1099 composite? To get the transaction information into your return, select from the 6 options described. Web taxact® will complete form 8949 for you and include it in your tax return submission. Web your form 1099 composite may include the following internal revenue service.

Form 1099DIV, Dividends and Distributions, State Copy 1

The form on which financial institutions report dividends. Web taxact® will complete form 8949 for you and include it in your tax return submission. Web the primary forms of income you'll need to include in your tax filing are contained in the following three sections of your 1099 composite: Substitute payments in lieu of dividends may be reported on a.

【ベストコレクション】 1099 composite vs 1099 r 1985841099 composite vs 1099 r

Web a composite has more than one type of 1099. Web how do i enter information from a 1099 composite? See how we can help! Web taxact® will complete form 8949 for you and include it in your tax return submission. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations.

The Form Used To Report Various Types Of Income, Such As Royalties, Rents, And.

Web form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income other. Web your form 1099 composite may include the following internal revenue service (irs) forms: Web charles schwab 1099 composite form just report it as it is reported to you by schwab; Web the primary forms of income you'll need to include in your tax filing are contained in the following three sections of your 1099 composite:

Ad For More Than 20 Years, Iofm Has Reduced Your Peers’ Compliance Risk.

Please see this answer from richardg. It is number 13 and prior box numbers 13 through. Substitute payments in lieu of dividends may be reported on a composite. Web how do i enter information from a 1099 composite?

Web Learn What A 1099 Irs Tax Form Is, And The Different Types Of 1099 Forms With The Experts At H&R Block.

Web taxact® will complete form 8949 for you and include it in your tax return submission. See how we can help! Find out if you will receive 1099 forms from employers or. There is no need to report each mutual fund separately if schwab is reporting.

Fatca Check Box And Renumbering.

Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. The form on which financial institutions report dividends. Most of my other 1099's regarding crypto gave me the date acquired, while robinhood did not. To get the transaction information into your return, select from the 6 options described.

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)