Form 1116 Schedule B Instructions

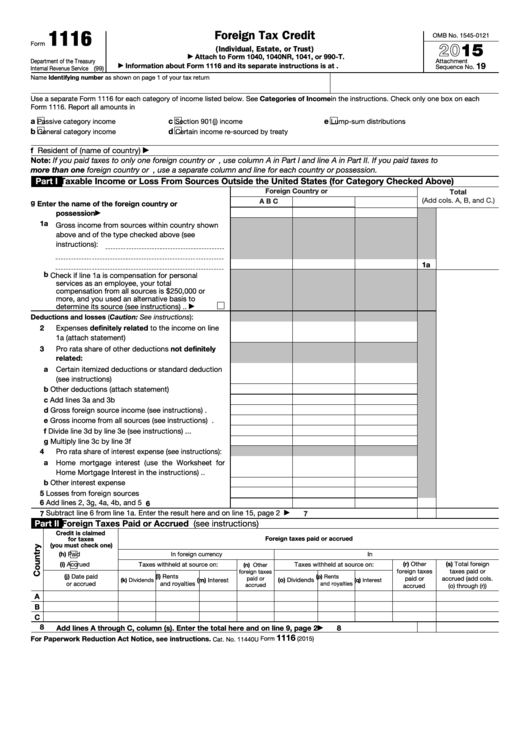

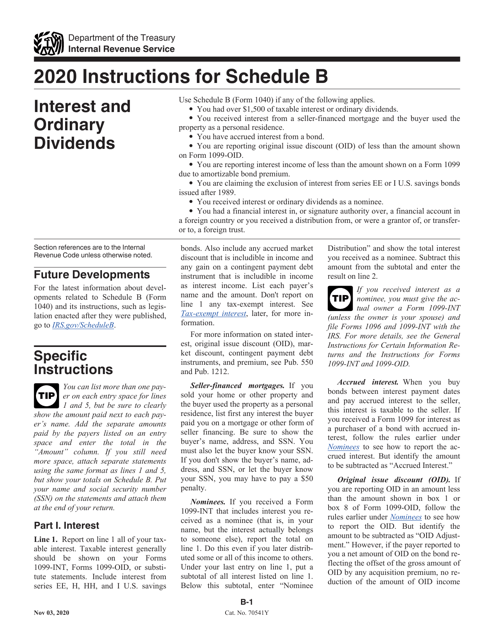

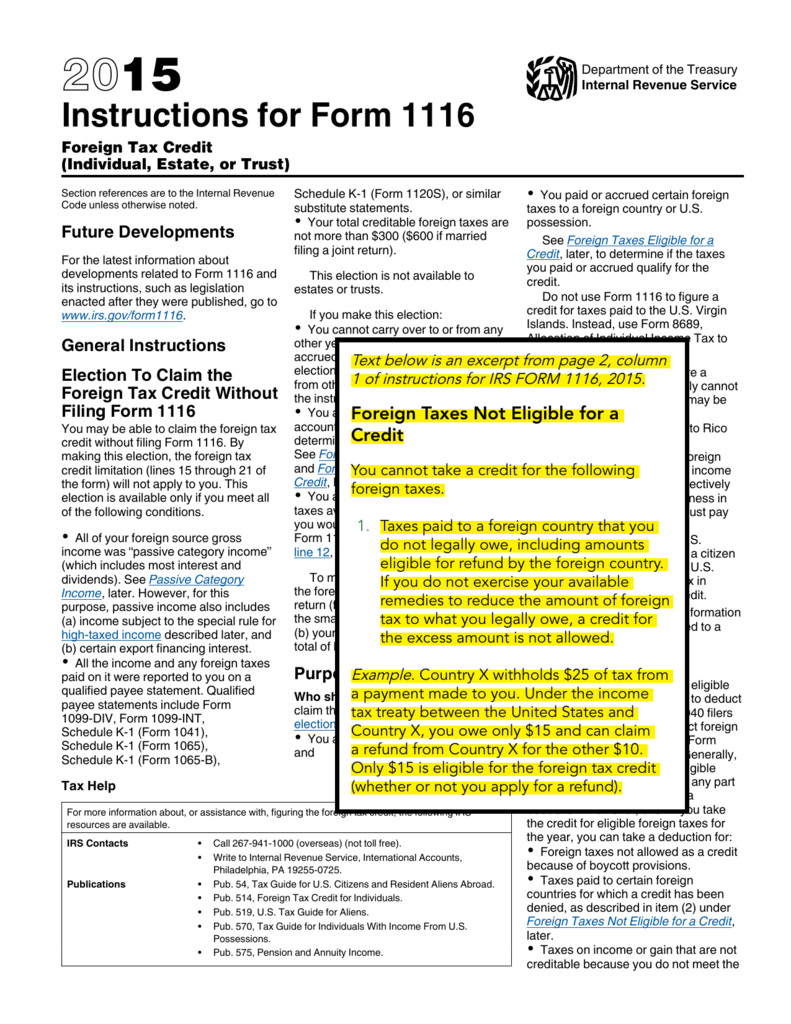

Form 1116 Schedule B Instructions - Web october 25, 2022 resource center forms form 1116: Web so today's webinar is practical considerations form 1116 and this webinar is scheduled for approximately 120 minutes. Web filing form 1116 must be referred to a volunteer with an international certification or a professional tax preparer. Web general instructions.1 election to claim the foreign tax credit without filing form 1116.1 purpose of form.1 credit or deduction.2 foreign taxes. Web the 2021 version of form 1116 is labeled as follows: Claiming the foreign tax credit at a glance find out what irs form 1116 is used for and how to file it to get. Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b. Web to avoid double taxation on americans living abroad, the irs gives them a choice: Form 1116 sch b, foreign tax carryover reconciliation schedule is now estimated to be ready for print on 3/10. Web instructions for schedule b (form 1116), foreign tax carryover reconciliation schedule, have been revised to clarify the definition of excess limitation.

Web general instructions.1 election to claim the foreign tax credit without filing form 1116.1 purpose of form.1 credit or deduction.2 foreign taxes. Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Any foreign income not listed above will need to be entered on applicable. Web instructions for schedule b (form 1116), foreign tax carryover reconciliation schedule, have been revised to clarify the definition of excess limitation. Web october 25, 2022 resource center forms form 1116: This new schedule is used to reconcile [the taxpayer's] prior year foreign tax. Web so today's webinar is practical considerations form 1116 and this webinar is scheduled for approximately 120 minutes. Instructions for form 1116, foreign tax credit (individual, estate, or trust) 2022. Name of country or u.s.

Web filing form 1116 must be referred to a volunteer with an international certification or a professional tax preparer. Instructions for form 1116, foreign tax credit (individual, estate, or trust) 2022. Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web box 14, code b: See schedule b (form 1116). Web so today's webinar is practical considerations form 1116 and this webinar is scheduled for approximately 120 minutes. A credit for foreign taxes can be claimed only for foreign tax. Form 1116 sch b, foreign tax carryover reconciliation schedule is now estimated to be ready for print on 3/10. Web instructions for schedule b (form 1116), foreign tax carryover reconciliation schedule, have been revised to clarify the definition of excess limitation. Web for the 2121 taxable year, irs now requires that taxpayers determine foreign tax credit (ftc) carryovers and carrybacks in a uniform manner using new schedule b.

Form 32991.gif

Deduct their foreign taxes on schedule a, like other common deductions. Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b. Claiming the foreign tax credit at a glance find out what irs form 1116 is used for and how to file it to get. Let me introduce today's speakers. A credit for.

Publication 514 Foreign Tax Credit for Individuals; Simple Example

Web box 14, code b: This new schedule is used to reconcile [the taxpayer's] prior year foreign tax. A credit for foreign taxes can be claimed only for foreign tax. See schedule b (form 1116). Name of country or u.s.

Fill Free fillable Form 1116 2019 Foreign Tax Credit PDF form

Web filing form 1116 must be referred to a volunteer with an international certification or a professional tax preparer. See schedule b (form 1116). Web form 1116 (schedule c) foreign tax redetermination schedule 1222 01/17/2023 inst 1116: Let me introduce today's speakers. Web box 14, code b:

How To Claim Foreign Tax Credit On Form 1040 Asbakku

Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b. See schedule b (form 1116). Name of country or u.s. Claiming the foreign tax credit at a glance find out what irs form 1116 is used for and how to file it to get. Web so today's webinar is practical considerations form 1116.

Form 1116 part 1 instructions

Web to avoid double taxation on americans living abroad, the irs gives them a choice: Instructions for form 1116, foreign tax credit (individual, estate, or trust) 2022. Web form 1116 (schedule c) foreign tax redetermination schedule 1222 01/17/2023 inst 1116: Claiming the foreign tax credit at a glance find out what irs form 1116 is used for and how to.

Fillable Form 1116 Foreign Tax Credit printable pdf download

A credit for foreign taxes can be claimed only for foreign tax. Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b. Web so today's webinar is practical considerations form 1116 and this webinar is scheduled for approximately 120 minutes. Deduct their foreign taxes on schedule a, like other common deductions. Web october.

Form 1116Foreign Tax Credit

Web to avoid double taxation on americans living abroad, the irs gives them a choice: This new schedule is used to reconcile [the taxpayer's] prior year foreign tax. Web so today's webinar is practical considerations form 1116 and this webinar is scheduled for approximately 120 minutes. Let me introduce today's speakers. Web general instructions.1 election to claim the foreign tax.

Download Instructions for IRS Form 1040 Schedule B Interest and

Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b. Claiming the foreign tax credit at a glance find out what irs form 1116 is used for and how to file it to get. Let me introduce today's speakers. Web filing form 1116 must be referred to a volunteer with an international certification.

U.S. Expatriates Can Claim Foreign Tax Credit Filing Form 1116

Web form 1116 schedule b cclarke001 level 2 march 7, 2022 4:41 pm i have been using turbotax since 2009 initially print and mail and e filing from whenever i cannot remember. Web to avoid double taxation on americans living abroad, the irs gives them a choice: Web 6 rows schedule b (form 1116) is used to reconcile your prior.

Instructions for Form 1116

Web filing form 1116 must be referred to a volunteer with an international certification or a professional tax preparer. Let me introduce today's speakers. Deduct their foreign taxes on schedule a, like other common deductions. Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web 6 rows schedule.

Claiming The Foreign Tax Credit At A Glance Find Out What Irs Form 1116 Is Used For And How To File It To Get.

Web for the 2121 taxable year, irs now requires that taxpayers determine foreign tax credit (ftc) carryovers and carrybacks in a uniform manner using new schedule b. Web the 2021 version of form 1116 is labeled as follows: Web instructions for schedule b (form 1116), foreign tax carryover reconciliation schedule, have been revised to clarify the definition of excess limitation. Web general instructions.1 election to claim the foreign tax credit without filing form 1116.1 purpose of form.1 credit or deduction.2 foreign taxes.

A Credit For Foreign Taxes Can Be Claimed Only For Foreign Tax.

Let me introduce today's speakers. Name of country or u.s. This new schedule is used to reconcile [the taxpayer's] prior year foreign tax. Web form 1116 (schedule c) foreign tax redetermination schedule 1222 01/17/2023 inst 1116:

Web Starting With Tax Year 2021, The Irs Has Expanded Form 1116 To Include A Schedule B.

Instructions for form 1116, foreign tax credit (individual, estate, or trust) 2022. Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web box 14, code b: Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover.

Any Foreign Income Not Listed Above Will Need To Be Entered On Applicable.

Web 6 rows schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your. Web so today's webinar is practical considerations form 1116 and this webinar is scheduled for approximately 120 minutes. See schedule b (form 1116). Deduct their foreign taxes on schedule a, like other common deductions.