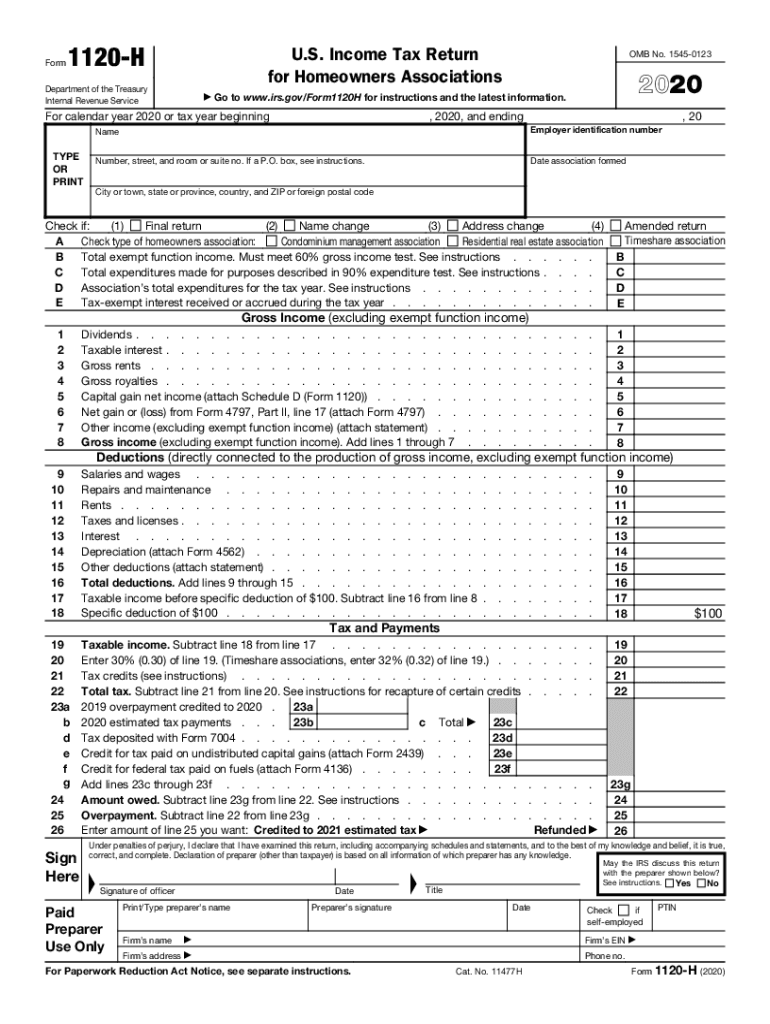

Form 1120 H 2021

Form 1120 H 2021 - The tax rate for timeshare associations is 32%. Use fill to complete blank online irs pdf forms for free. It also allows hoas to enjoy certain tax benefits that are outlined in section 528 of the internal revenue code. Web condominium association homeowners association timeshare association there are five requirements to qualify as an hoa: Income tax return for homeowners associations. Web credited to 2021 estimated tax. Download this form print this form 03 export or print immediately. Compared to form 1120, this form allows for a more simplified hoa tax filing process. The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax return.

These rates apply to both ordinary income and capital gains. Complete, edit or print tax forms instantly. Income tax return for homeowners associations. Ad upload, modify or create forms. This form is for income earned in tax year 2022, with tax returns due in april 2023. Try it for free now! These benefits, in effect, allow the association to exclude exempt function income from its. It also allows hoas to enjoy certain tax benefits that are outlined in section 528 of the internal revenue code. Once completed you can sign your fillable form or send for signing. Complete, edit or print tax forms instantly.

Ad complete irs tax forms online or print government tax documents. Download this form print this form 01 fill and edit template. Download past year versions of this tax form as pdfs here: It also allows hoas to enjoy certain tax benefits that are outlined in section 528 of the internal revenue code. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. Once completed you can sign your fillable form or send for signing. Try it for free now! Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. Income tax return for homeowners associations keywords:

Form 1120H Tips & Tricks to Keep You Out of Trouble [Template]

This extension does not extend the Compared to form 1120, this form allows for a more simplified hoa tax filing process. All forms are printable and downloadable. Income tax return for homeowners associations keywords: Download past year versions of this tax form as pdfs here:

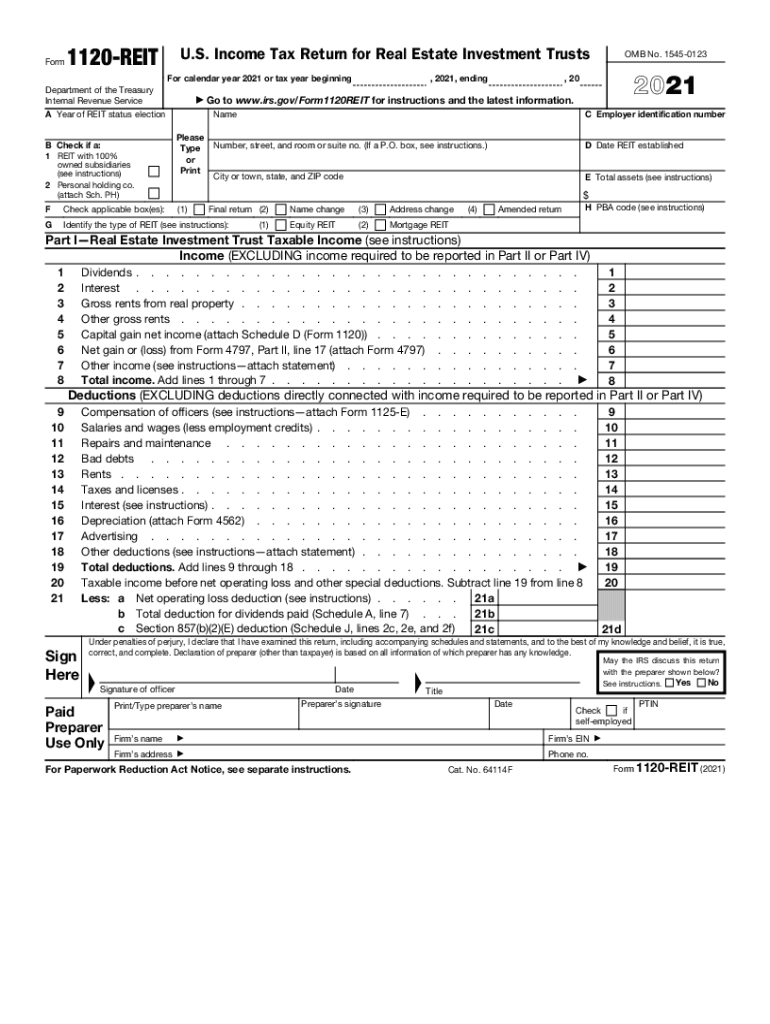

2021 Form IRS 1120REIT Fill Online, Printable, Fillable, Blank pdfFiller

Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. Income tax return for homeowners associations as its income tax return, in order to take advantage of certain tax benefits..

Form 1120 Fill out & sign online DocHub

The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax return. Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. Ad upload, modify or create forms. This form is specifically designated for “qualifying” homeowners’ associations. Complete, edit or.

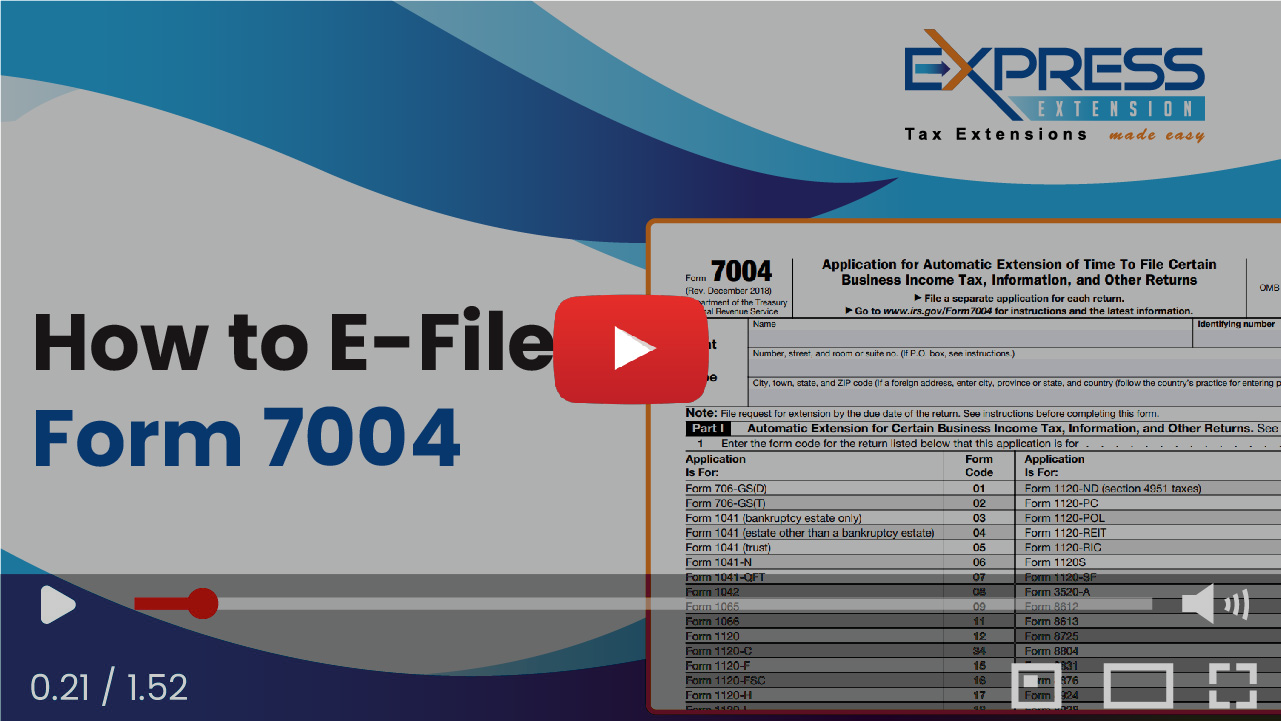

File 1120 Extension Online Corporate Tax Extension Form for 2020

Complete, edit or print tax forms instantly. These benefits, in effect, allow the association to exclude exempt function income from its. Ad complete irs tax forms online or print government tax documents. The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax return. All forms are.

Irs Instructions Form 1120s Fillable and Editable PDF Template

Income tax return for homeowners associations. Use the following irs center address. It will often provide a lower audit risk than the alternative form 1120. This form is specifically designated for “qualifying” homeowners’ associations. A homeowners association files this form as its income tax return to take advantage of certain tax benefits.

1120s schedule d instructions

Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Use fill to complete blank online irs pdf forms for free. Try it for free now!

Irs Filing Tax Irs Filing

Compared to form 1120, this form allows for a more simplified hoa tax filing process. This form is for income earned in tax year 2022, with tax returns due in april 2023. A homeowners association files this form as its income tax return to take advantage of certain tax benefits. Ad complete irs tax forms online or print government tax.

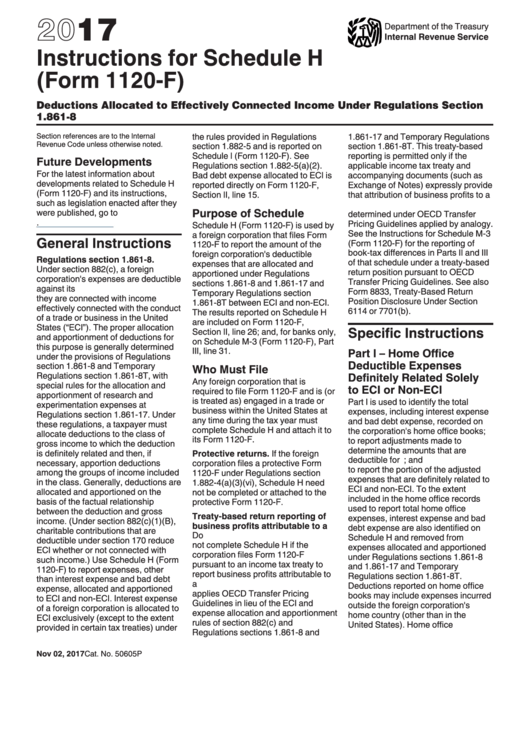

Instructions For Schedule H (Form 1120F) 2017 printable pdf download

Complete, edit or print tax forms instantly. Once completed you can sign your fillable form or send for signing. If the association's principal business or office is located in. Web condominium association homeowners association timeshare association there are five requirements to qualify as an hoa: This form is specifically designated for “qualifying” homeowners’ associations.

Learn How to Fill the Form 1120 U.S. Corporation Tax Return

We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Income tax return for homeowners associations keywords: Compared to form 1120, this form allows for a more simplified hoa tax filing process. This form is for income earned in tax year 2022, with tax returns.

3.11.217 Form 1120S Corporation Tax Returns Internal Revenue

A homeowners association files this form as its income tax return to take advantage of certain tax benefits. These rates apply to both ordinary income and capital gains. Web condominium association homeowners association timeshare association there are five requirements to qualify as an hoa: Download this form print this form Income tax return for homeowners associations, including recent updates, related.

Complete, Edit Or Print Tax Forms Instantly.

Ad complete irs tax forms online or print government tax documents. It will often provide a lower audit risk than the alternative form 1120. This extension does not extend the Use the following irs center address.

Download This Form Print This Form

Web credited to 2021 estimated tax. Complete, edit or print tax forms instantly. At least 60% of gross income should be exempt function income at least 90% of annual expenses should be for the association’s business no private shareholder or individual should benefit from the association’s earnings If the association's principal business or office is located in.

All Forms Are Printable And Downloadable.

Try it for free now! Ad upload, modify or create forms. This form is specifically designated for “qualifying” homeowners’ associations. It also allows hoas to enjoy certain tax benefits that are outlined in section 528 of the internal revenue code.

We Will Update This Page With A New Version Of The Form For 2024 As Soon As It Is Made Available By The Federal Government.

Income tax return for homeowners associations 1120 (schedule h) pdf form content report error it appears you don't have a pdf plugin for this browser. A homeowners association files this form as its income tax return to take advantage of certain tax benefits. Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. Income tax return for homeowners associations keywords:

![Form 1120H Tips & Tricks to Keep You Out of Trouble [Template]](https://hoatax.com/wp-content/uploads/2017/07/05-1024x712.jpg)