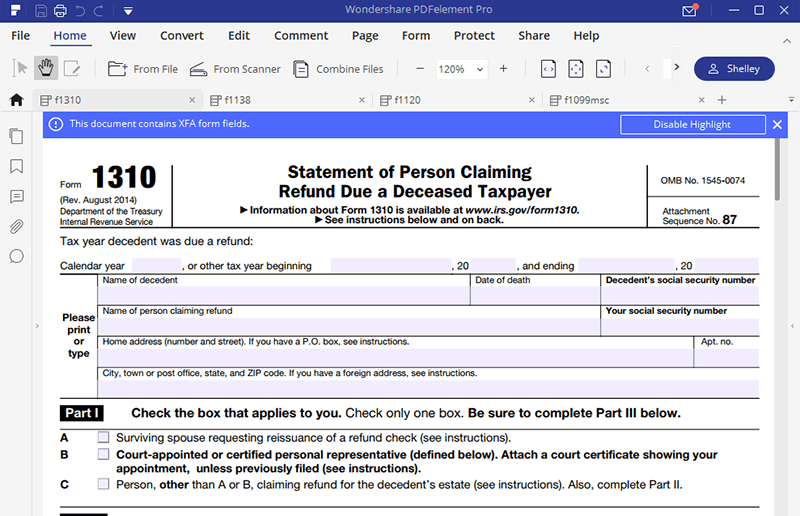

Form 1310 2022

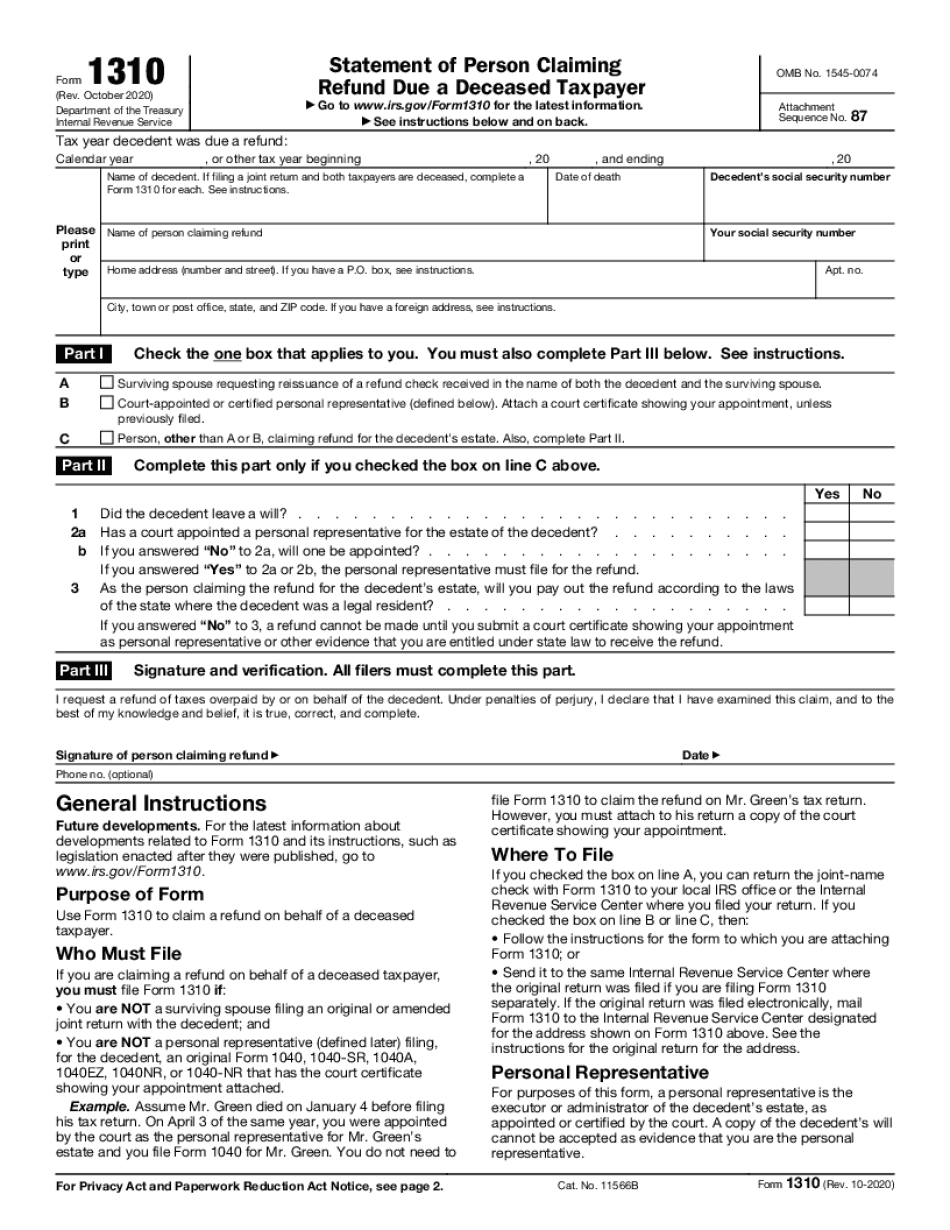

Form 1310 2022 - Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual. Web turbotax will automatically fill out irs form 1310 when you file a return on behalf of a deceased person (also called a decedent return). Waiver (see instructions) of your entire. Web in addition to completing this screen, the return must have the following in order to calculate form 1310: Choose the web sample in the library. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Get ready for tax season deadlines by completing any required tax forms today. Web we last updated federal form 1310 in january 2023 from the federal internal revenue service. If a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax return.

Web statement of person claiming refund due a deceased taxpayer (irs form 1310) legal representatives. You must file page 1 of form 2210, but you. If a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming. Ad access irs tax forms. Web you should also complete and file with the final return a copy of form 1310, statement of person claiming refund due a deceased taxpayer. If you are claiming a refund on behalf of a deceased taxpayer, you must file. Choose the web sample in the library. For a death that occurred. Web file only page 1 of form 2210. Applies, you must figure your penalty and file form 2210.

A date of death on the 1040 screen in the general folder. You must file page 1 of form 2210, but you. Ad access irs tax forms. Web file only page 1 of form 2210. Web for form 2210, part iii, section b—figure the penalty), later. Complete all necessary information in the necessary fillable. Ad fill, sign, email irs 1310 & more fillable forms, try for free now! Get ready for tax season deadlines by completing any required tax forms today. For a death that occurred. Web comply with our simple actions to have your irs 1310 well prepared rapidly:

Form 3911 Printable

Enter a 1, 2, or 3 in 1=surviving spouse (married filing joint), 2=personal. Go to screen 63, deceased taxpayer (1310). Web file only page 1 of form 2210. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your screen,. Web you filed or are filing a joint return.

Edit Document IRS Form 1310 According To Your Needs

Enter a 1, 2, or 3 in 1=surviving spouse (married filing joint), 2=personal. Web file only page 1 of form 2210. Ad access irs tax forms. If a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming. Go to screen 63, deceased taxpayer (1310).

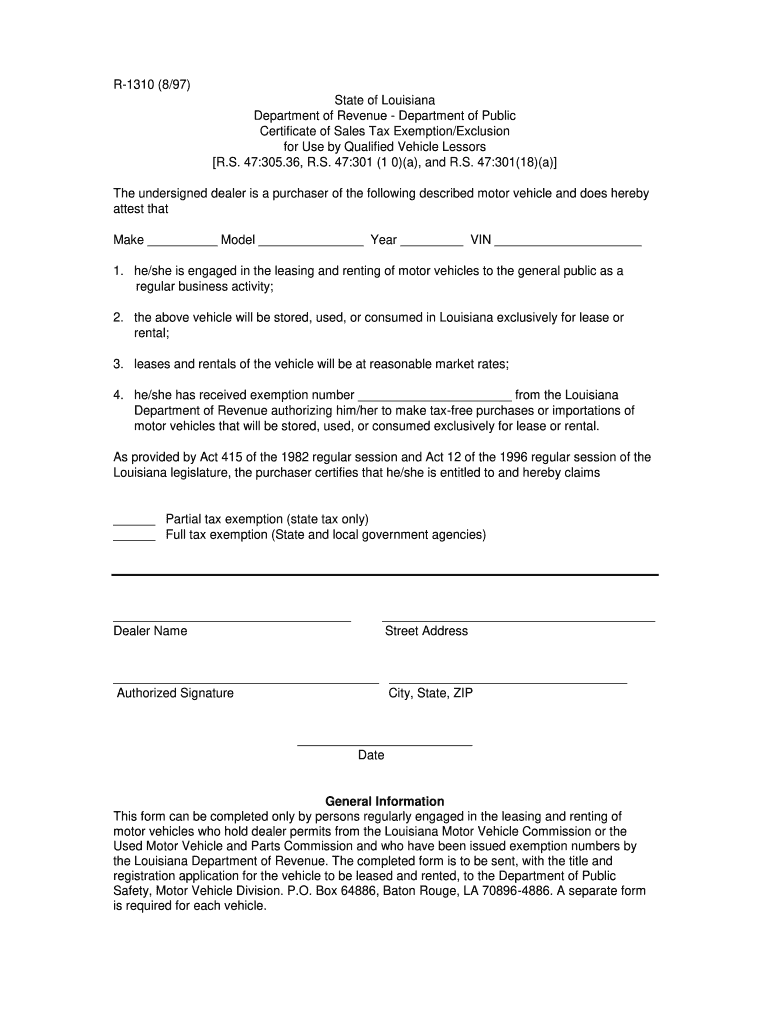

Louisiana She Revenue Fill Out and Sign Printable PDF Template signNow

Part ii reasons for filing. Web comply with our simple actions to have your irs 1310 well prepared rapidly: Waiver (see instructions) of your entire. Web you filed or are filing a joint return for either 2021 2022, but not both years, and line 8 above is smaller than 5 above. From within your taxact return ( online or desktop),.

Form 1310 Instructions Claiming a Refund on Behalf of a Deceased

Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual. Part ii reasons for filing. If you are claiming a refund on behalf of a deceased taxpayer, you must file. Waiver (see instructions) of your entire. Web file form 2210 unless.

Form 1065 Instructions 2020 2021 IRS Forms Zrivo

Part ii reasons for filing. Choose the web sample in the library. Enter a 1, 2, or 3 in 1=surviving spouse (married filing joint), 2=personal. Go to screen 63, deceased taxpayer (1310). Web to access form 1310 in the taxact program:

Form 1310 Instructions 2022 2023 IRS Forms Zrivo

Get ready for tax season deadlines by completing any required tax forms today. Applies, you must figure your penalty and file form 2210. Enter a 1, 2, or 3 in 1=surviving spouse (married filing joint), 2=personal. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax return. Complete, edit or print tax.

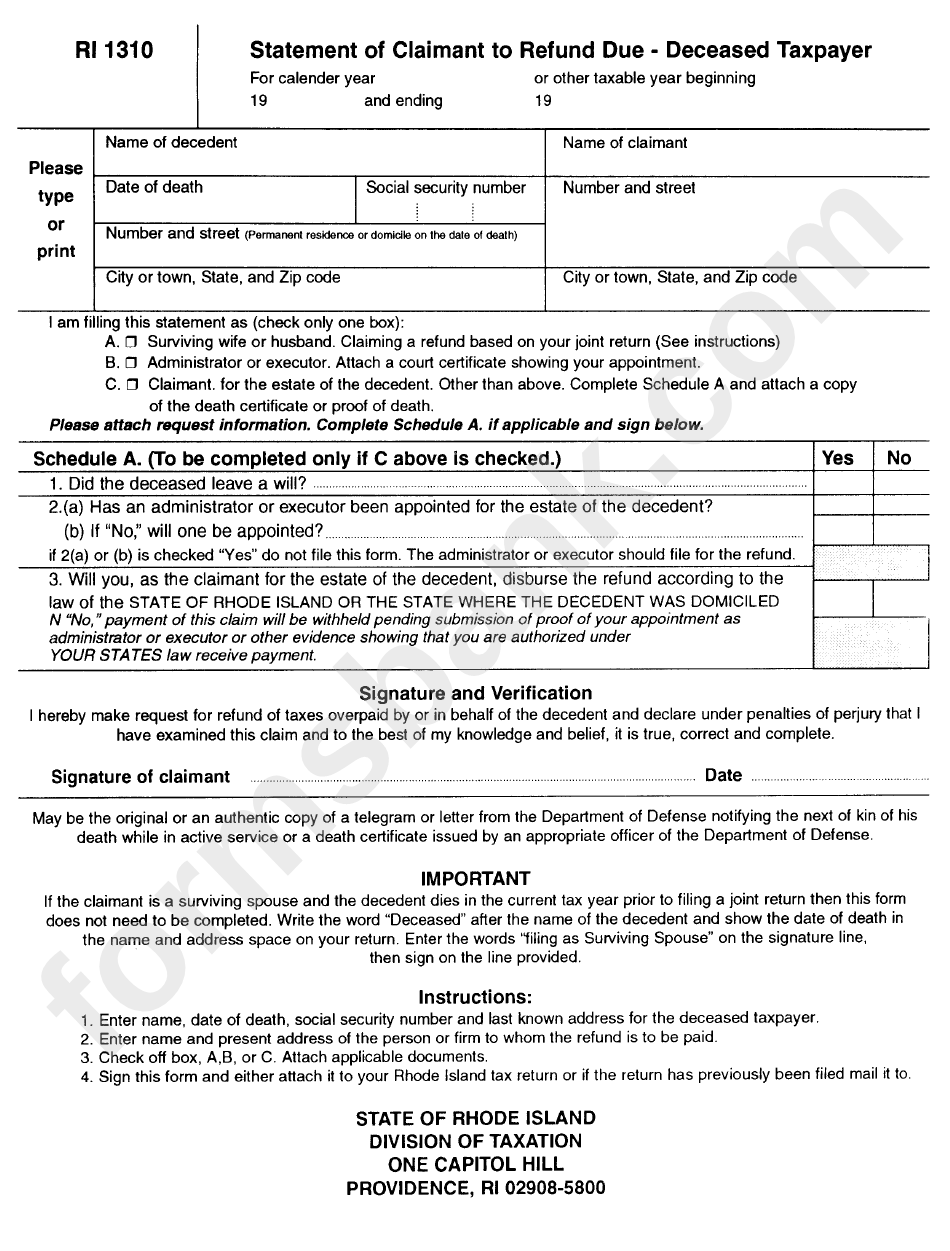

Fillable Form Ri 1310 Statement Of Claimant To Refund Due Deceased

Web you should also complete and file with the final return a copy of form 1310, statement of person claiming refund due a deceased taxpayer. Web comply with our simple actions to have your irs 1310 well prepared rapidly: Ad access irs tax forms. Choose the web sample in the library. Web file only page 1 of form 2210.

1019 Fill Out and Sign Printable PDF Template signNow

A date of death on the 1040 screen in the general folder. This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated federal form 1310 in january 2023 from the federal internal revenue service. Enter a 1, 2, or 3 in 1=surviving spouse (married filing joint), 2=personal. Web if a.

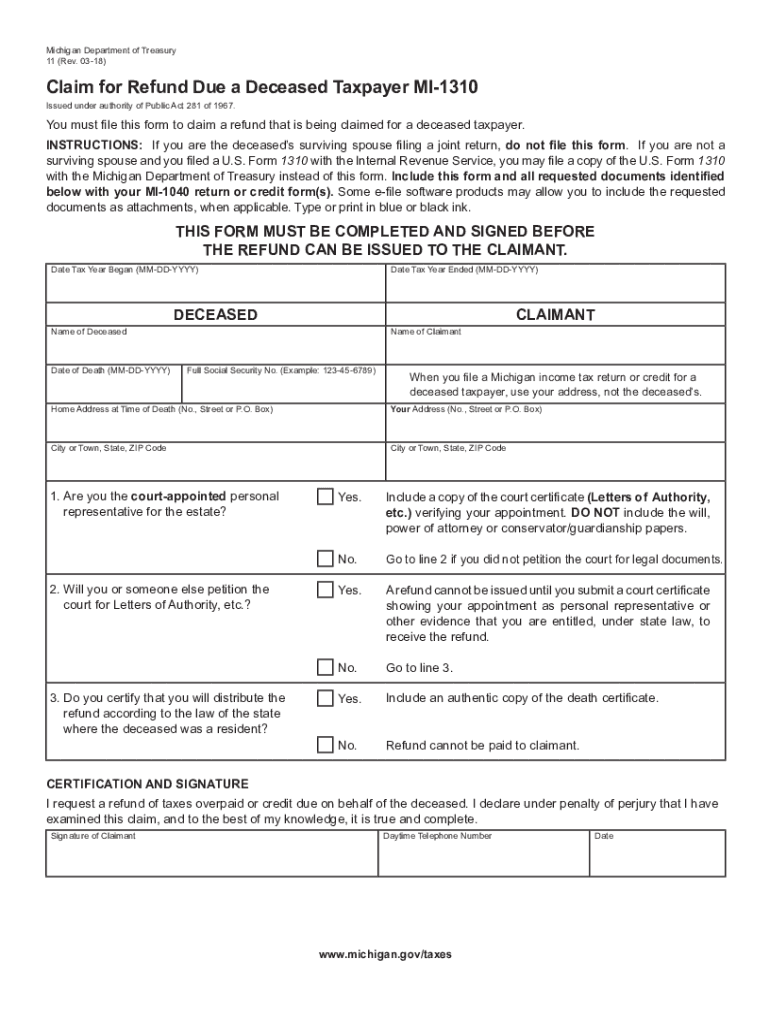

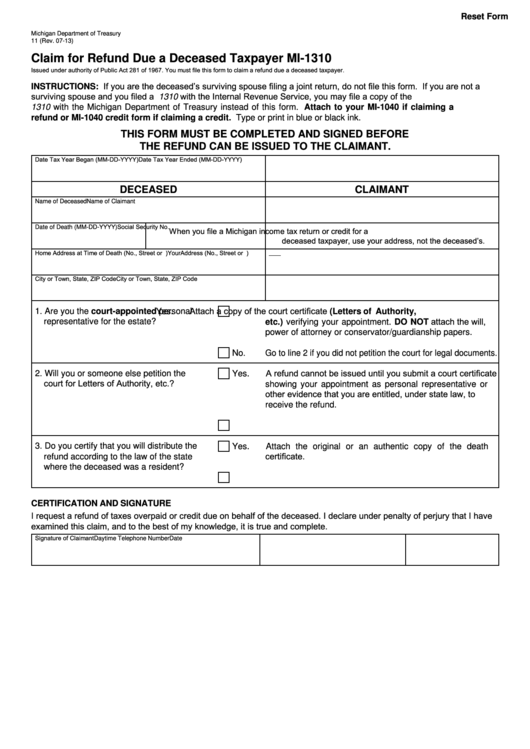

Fillable Form Mi1310 Claim For Refund Due A Deceased Taxpayer

This form is for income earned in tax year 2022, with tax returns due in april. Web turbotax will automatically fill out irs form 1310 when you file a return on behalf of a deceased person (also called a decedent return). If you are claiming a refund on behalf of a deceased taxpayer, you must file. Web in order to.

Form 1310 Major Errors Intuit Accountants Community

Web turbotax will automatically fill out irs form 1310 when you file a return on behalf of a deceased person (also called a decedent return). Complete all necessary information in the necessary fillable. Go to screen 63, deceased taxpayer (1310). Web claim a refund. From within your taxact return ( online or desktop), click federal (on smaller devices, click in.

Web For Form 2210, Part Iii, Section B—Figure The Penalty), Later.

Get ready for tax season deadlines by completing any required tax forms today. Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. Web claim a refund. Ad download or email irs 1310 & more fillable forms, register and subscribe now!

For A Death That Occurred.

Web you filed or are filing a joint return for either 2021 2022, but not both years, and line 8 above is smaller than 5 above. Attach to the tax return certified copies of the: Enter a 1, 2, or 3 in 1=surviving spouse (married filing joint), 2=personal. Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax year 2022.

Ad Fill, Sign, Email Irs 1310 & More Fillable Forms, Try For Free Now!

Ad access irs tax forms. I’ll answer some common questions about requesting a tax refund due to a deceased. A date of death on the 1040 screen in the general folder. Web follow these steps to generate form 1310:

Web In Addition To Completing This Screen, The Return Must Have The Following In Order To Calculate Form 1310:

Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual. Web comply with our simple actions to have your irs 1310 well prepared rapidly: Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Use form 1310 to claim a refund on behalf of a deceased taxpayer.