Form 15G Sample Filled

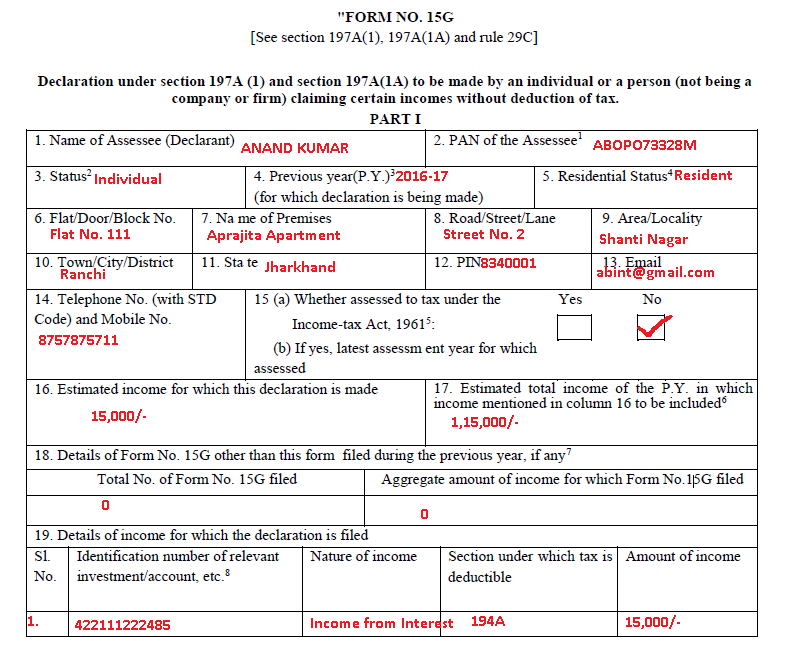

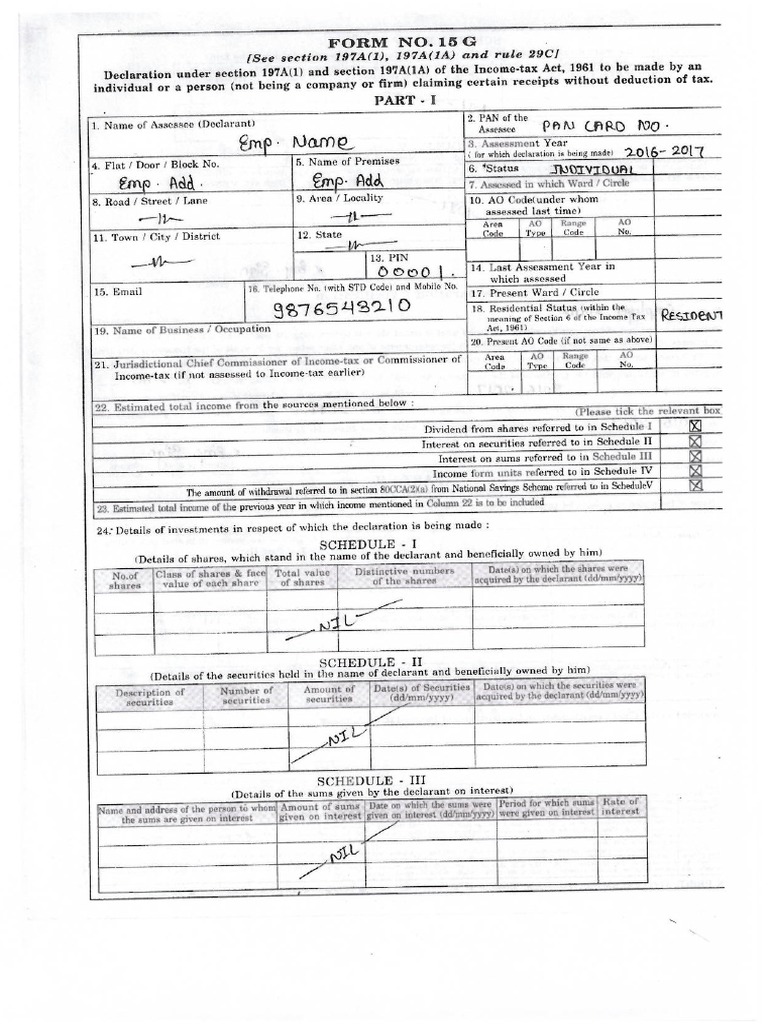

Form 15G Sample Filled - Now login with the help of your uan number & uan password. Web form15g is used for individuals whose age is below 60 years and form 15h is required for senior citizens i.e the individual who is over 60 years of age. Part i signature of the declarant9 declaration/verification10 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a (1) and section 197a(1a) to be made by an individual or a person (not being a company or firm) claiming certain incomes without deduction of tax. Web here’s a sample form 15g. Web how to fill form 15g and 15h ★ filled form 15g sample ★ form 15h sample. Then, select ‘online services’ and click on ‘claim’ Web complete in form no. You can file the form 15g or form 15h by logging into your internet banking account. Web form 15g is a declaration that can be filled out by fixed deposit holders (individuals less than 60 years of age and hufs) to ensure that no tds (tax deduction at source) is deducted from their interest income in a year.

Can we submit form 15g online for pf withdrawal? Fill out the required fields that are colored in yellow. Get your online template and fill it in using progressive features. Have a look at the image below to find a sample of form 15g. Save or instantly send your ready documents. Web part i form no. Easily fill out pdf blank, edit, and sign them. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save form 15g sample download pdf for pf rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 59 votes how to fill out and sign form 15h filled sample online? If you are wondering how to fill out form 15g for pf withdrawal, follow the steps given below:

Form 15g is a declaration to ensure that no tds has deducted from the income and it can be submitted by individuals of india whose age is below 60 yrs. In this article you will know about form 15g download link, form 15g for pf download from income tax website, sample form 15g filled for year 2023, etc. Web epf form 15g is basically a declaration that ensures that tds (tax deducted at source) is not deducted from the employee's interest income in a year. Web the steps to download 15g form online for pf withdrawal are listed below: Visit the official website of uan member website: Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web sample of form 15g. Firstly, log in to the epfo uan portal; Web download in pdf format form 15g filled sample for pf withdrawal in 2022 form 15g consists two parts, we need to fill only part 1 of form 15g there is no need to fill part 2 of form 15g, just leave that page blank. Save or instantly send your ready documents.

How to Fill Form 15G for PF Withdrawal in 2021 YouTube

Web here’s a sample form 15g. If you are wondering how to fill out form 15g for pf withdrawal, follow the steps given below: Tax on epf withdrawal rules. Web how to fill form 15g for pf withdrawal in 2022 raj tech india 21.8k subscribers subscribe 4.8k share 461k views 1 year ago employee provident fund ( epf ) know.

EVERYTHING BANKING NEWS 15G 15H Form Fill Up Step wise Guideline with

These epf withdrawal rules are stated under section 192a, finance act of 2015. Web form15g is used for individuals whose age is below 60 years and form 15h is required for senior citizens i.e the individual who is over 60 years of age. Web sample of form 15g. Can we submit form 15g online for pf withdrawal? Web how it.

Sample Filled Form 15G for PF Withdrawal in 2022

It is important to know about the tds in relation to the epf withdrawal before you start filling out the form 15g for pf. Fill out the required fields that are colored in yellow. Epf form 15g must be filled in by the fixed deposit holders (individuals who are less than 60 years of age and hufs \u2013 hindu undivided.

15G Sample Form

15g online with us legal forms. Now login with the help of your uan number & uan password. Web the steps to download 15g form online for pf withdrawal are listed below: Web epf form 15g is basically a declaration that ensures that tds (tax deducted at source) is not deducted from the employee's interest income in a year. Share.

EPF Form 15G Download Sample Filled Form 15G For PF Withdrawal GST

Or simply click on the template preview to open it in the editor. Fill out the required fields that are colored in yellow. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web how to fill form 15g for pf withdrawal in 2022 raj tech india.

Sample Filled Form 15G for PF Withdrawal in 2022

Press the green arrow with the inscription next to jump from box to box. Web the steps to download 15g form online for pf withdrawal are listed below: Have a look at the image below to find a sample of form 15g. 15g online with us legal forms. Then, select ‘online services’ and click on ‘claim’

Sample Filled Form 15G & 15H for PF Withdrawal in 2021 Invoice Format

Web 15g sample form uploaded by ank description: Firstly, log in to the epfo uan portal; Web download in pdf format form 15g filled sample for pf withdrawal in 2022 form 15g consists two parts, we need to fill only part 1 of form 15g there is no need to fill part 2 of form 15g, just leave that page.

Sample Filled Form 15G PDF

Then, select ‘online services’ and click on ‘claim’ These epf withdrawal rules are stated under section 192a, finance act of 2015. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a (1) and section 197a(1a) to be made by an individual or a person (not being a company or firm) claiming certain incomes without deduction of tax. Easily.

How To Fill Form 15G And 15H ★ Filled Form 15G Sample ★ Form 15H Sample

Epf form 15g must be filled in by the fixed deposit holders (individuals who are less than 60 years of age and hufs \u2013 hindu undivided families). Visit the official website of uan member website: Web form 15g is a declaration that can be filled out by fixed deposit holders (individuals less than 60 years of age and hufs) to.

Sample Filled Form 15G & 15H for PF Withdrawal in 2020

Edit your form 15g for pf withdrawal sample online type text, add images, blackout confidential details, add comments, highlights and more. Form 15g is a declaration to ensure that no tds has deducted from the income and it can be submitted by individuals of india whose age is below 60 yrs. Web the following tips can help you fill out.

Share Your Form With Others

15g online with us legal forms. Web form15g is used for individuals whose age is below 60 years and form 15h is required for senior citizens i.e the individual who is over 60 years of age. Or simply click on the template preview to open it in the editor. Now login with the help of your uan number & uan password.

It Is Important To Know About The Tds In Relation To The Epf Withdrawal Before You Start Filling Out The Form 15G For Pf.

Here is an example of a sample filled form 15g part 1 and part 2, which will guide you on how to fill form 15g correctly for pf. Get your online template and fill it in using progressive features. You can file the form 15g or form 15h by logging into your internet banking account. If you are wondering how to fill out form 15g for pf withdrawal, follow the steps given below:

Web The Following Tips Can Help You Fill Out Form 15G Sample Pdf Download Easily And Quickly:

Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save form 15g sample download pdf for pf rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 59 votes how to fill out and sign form 15h filled sample online? Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Edit your form 15g for pf withdrawal sample online type text, add images, blackout confidential details, add comments, highlights and more.

Part I Signature Of The Declarant9 Declaration/Verification10

Web complete form 15g sample online with us legal forms. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a (1) and section 197a(1a) to be made by an individual or a person (not being a company or firm) claiming certain incomes without deduction of tax. Web form 15g is an official and legally authentic form that is laid down under section 197a of the income tax act, 1971. The post covers the following: