Form 2210 Instructions 2022

Form 2210 Instructions 2022 - Web for form 2210, part iii, section b—figure the penalty), later. No you may owe a penalty. Filer’s name shown on tax return 3. No complete line 7 and line 8 of part i. Is line 3 or line 6 less than $100? For calendar year 2022 or taxable year beginning: Does any box in part ii below apply? Is line 5 equal to or greater than line 8? Web 2022 underpayment of estimated. All withholding and estimated tax payments were made equally throughout the year.

12/22) underpayment of estimated income tax by individuals, trusts, and estates 2022 electronic filers: Filer’s name shown on tax return 3. You may need this form if: Web 2022 underpayment of estimated. Round all money items to whole dollars. Web for form 2210, part iii, section b—figure the penalty), later. Complete line 1 through line 6 of part i. No you may owe a penalty. This form allows you to figure penalties you may owe if you did not make timely estimated payments, pay the tax you owe by the original due date, or file a processable return by the extended due date. Dispute a penalty if you don’t qualify for penalty removal or reduction due to retirement or disability, we can't adjust the underpayment of estimated tax by individuals penalty for reasonable cause.

Web for form 2210, part iii, section b—figure the penalty), later. No complete line 7 and line 8 of part i. You are not required to calculate your penalty. Is line 3 or line 6 less than $100? No you may owe a penalty. You may use the short method if: Is line 5 equal to or greater than line 8? Web 2022 underpayment of estimated. For calendar year 2022 or taxable year beginning: This form allows you to figure penalties you may owe if you did not make timely estimated payments, pay the tax you owe by the original due date, or file a processable return by the extended due date.

Instructions for Federal Tax Form 2210 Sapling

Web for form 2210, part iii, section b—figure the penalty), later. You may use the short method if: No complete line 7 and line 8 of part i. 12/22) underpayment of estimated income tax by individuals, trusts, and estates 2022 electronic filers: You may need this form if:

Ssurvivor Irs Form 2210 Ai Instructions

12/22) underpayment of estimated income tax by individuals, trusts, and estates 2022 electronic filers: Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). Does any box in part ii below apply? Filer’s name shown on tax return 3. All withholding and estimated tax payments were made equally throughout the year.

Ssurvivor Irs Form 2210 Instructions 2020

Web for form 2210, part iii, section b—figure the penalty), later. Does any box in part ii below apply? No you may owe a penalty. You may use the short method if: No complete line 7 and line 8 of part i.

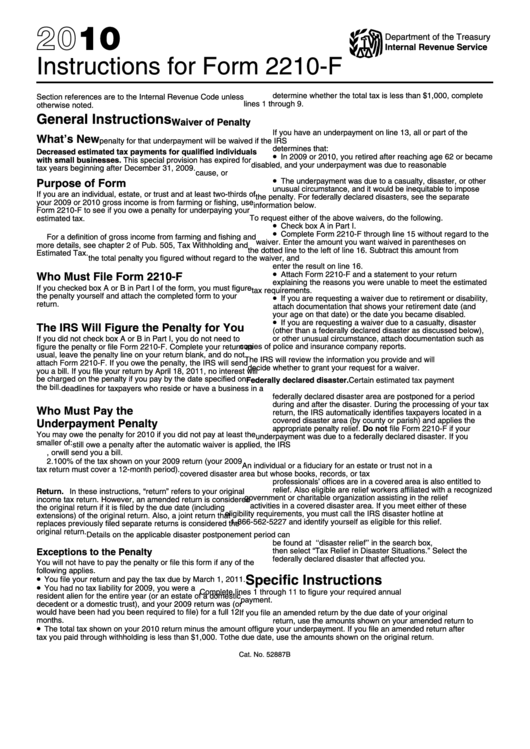

Instructions For Form 2210F Underpayment Of Estimated Tax By Farmers

12/22) underpayment of estimated income tax by individuals, trusts, and estates 2022 electronic filers: No do not file the sc2210. This form allows you to figure penalties you may owe if you did not make timely estimated payments, pay the tax you owe by the original due date, or file a processable return by the extended due date. Web 2022.

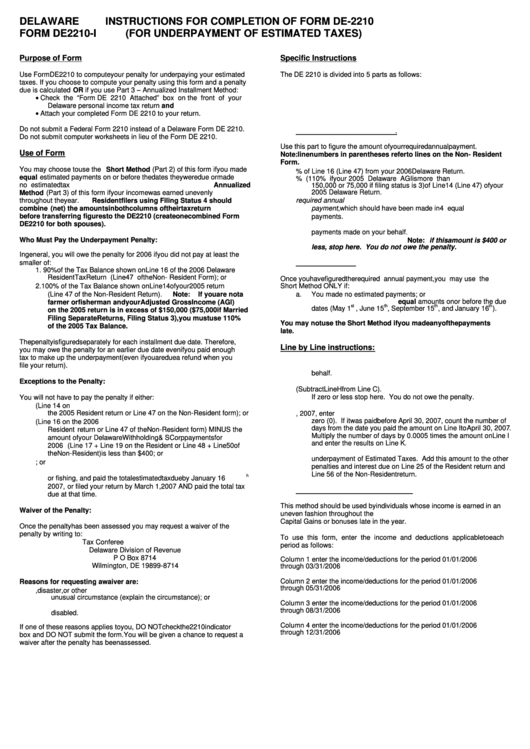

Delaware Form De2210I Instructions For Completion Of Form De2210

Does any box in part ii below apply? Is line 5 equal to or greater than line 8? No you may owe a penalty. Web 2022 underpayment of estimated. Web 2022 ssn do you have to file the sc2210?

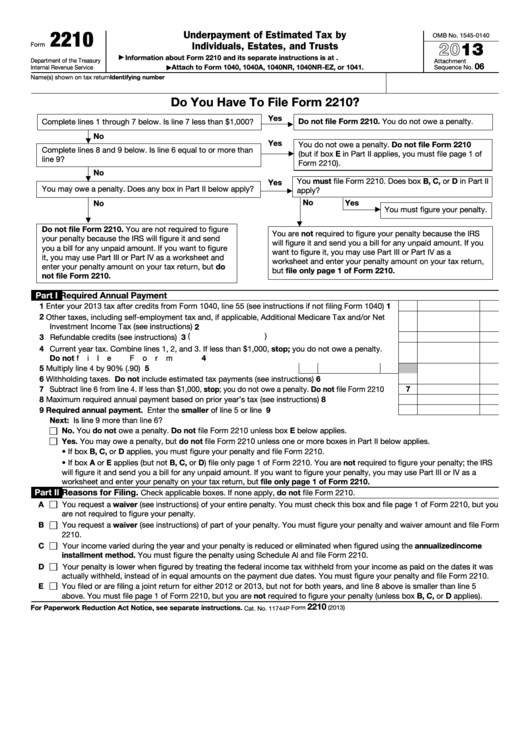

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Complete line 1 through line 6 of part i. Enter the penalty on form 2210,. This form allows you to figure penalties you may owe if you did not make timely estimated payments, pay the tax you owe by the original due date, or file a processable return by the extended due date. Is line 3 or line 6 less.

Fillable Form 2210 Underpayment Of Estimated Tax By Individuals

No you may owe a penalty. Dispute a penalty if you don’t qualify for penalty removal or reduction due to retirement or disability, we can't adjust the underpayment of estimated tax by individuals penalty for reasonable cause. This form allows you to figure penalties you may owe if you did not make timely estimated payments, pay the tax you owe.

Ssurvivor Form 2210 Instructions 2018

Complete line 1 through line 6 of part i. For calendar year 2022 or taxable year beginning: Filer’s name shown on tax return 3. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Web complete form 2210, schedule ai, annualized income installment method pdf (found.

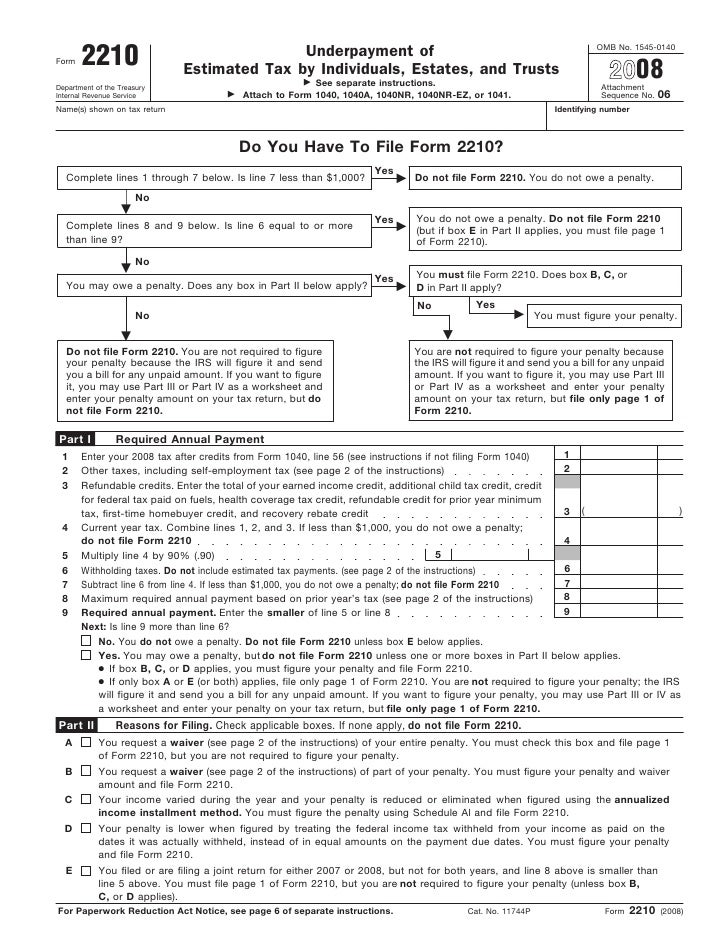

Form 2210Underpayment of Estimated Tax

All withholding and estimated tax payments were made equally throughout the year. Is line 5 equal to or greater than line 8? No do not file the sc2210. Dispute a penalty if you don’t qualify for penalty removal or reduction due to retirement or disability, we can't adjust the underpayment of estimated tax by individuals penalty for reasonable cause. No.

Is Line 5 Equal To Or Greater Than Line 8?

Type or print in blue or black ink. No complete line 7 and line 8 of part i. Does any box in part ii below apply? Complete line 1 through line 6 of part i.

Round All Money Items To Whole Dollars.

Filer’s name shown on tax return 3. No do not file the sc2210. You may qualify for the short method to calculate your penalty. Enter the penalty on form 2210,.

12/22) Underpayment Of Estimated Income Tax By Individuals, Trusts, And Estates 2022 Electronic Filers:

You may need this form if: Is line 3 or line 6 less than $100? Web 2022 ssn do you have to file the sc2210? This form allows you to figure penalties you may owe if you did not make timely estimated payments, pay the tax you owe by the original due date, or file a processable return by the extended due date.

Dispute A Penalty If You Don’t Qualify For Penalty Removal Or Reduction Due To Retirement Or Disability, We Can't Adjust The Underpayment Of Estimated Tax By Individuals Penalty For Reasonable Cause.

All withholding and estimated tax payments were made equally throughout the year. You may use the short method if: For calendar year 2022 or taxable year beginning: Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form).