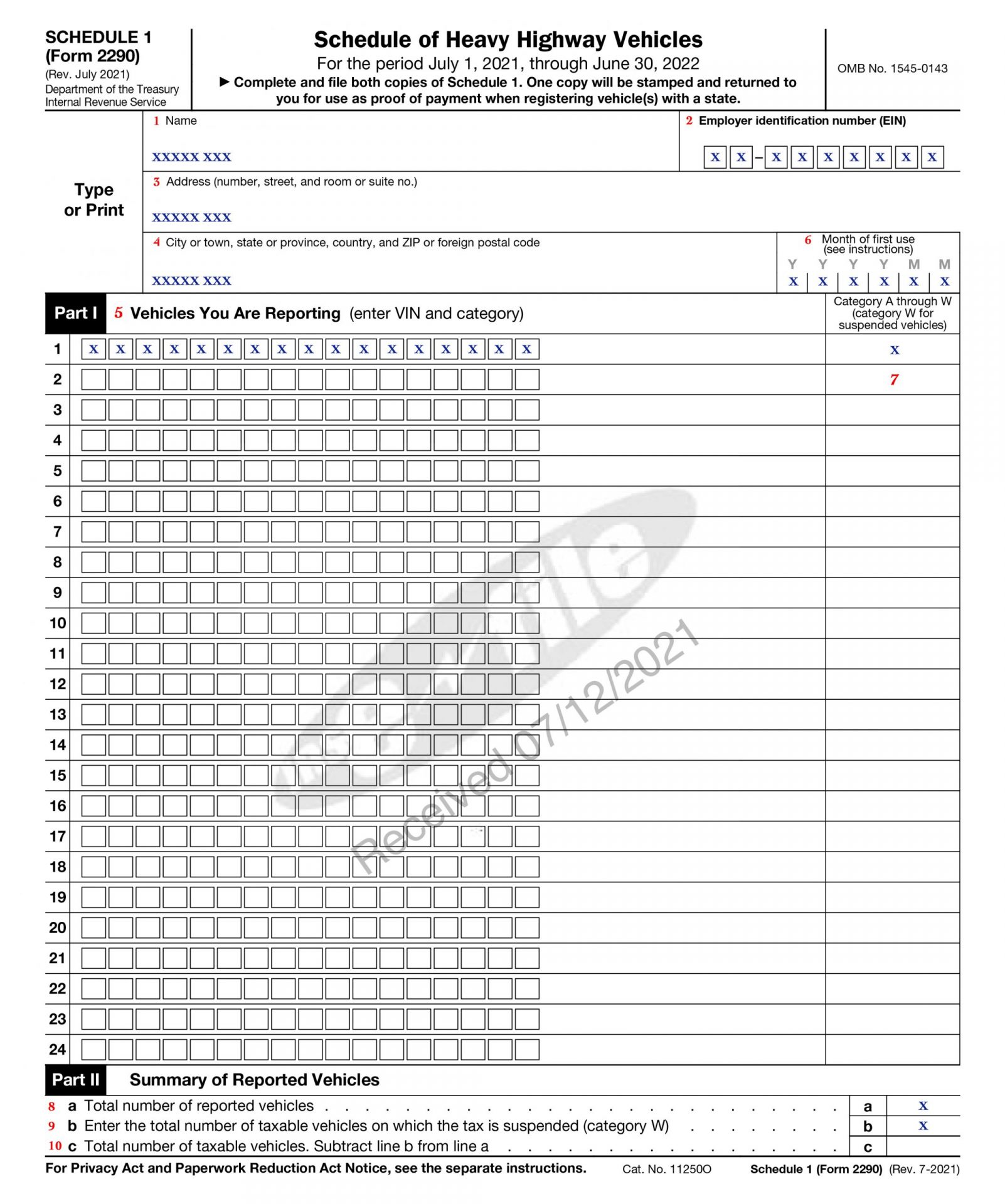

Form 2290 Schedule 1

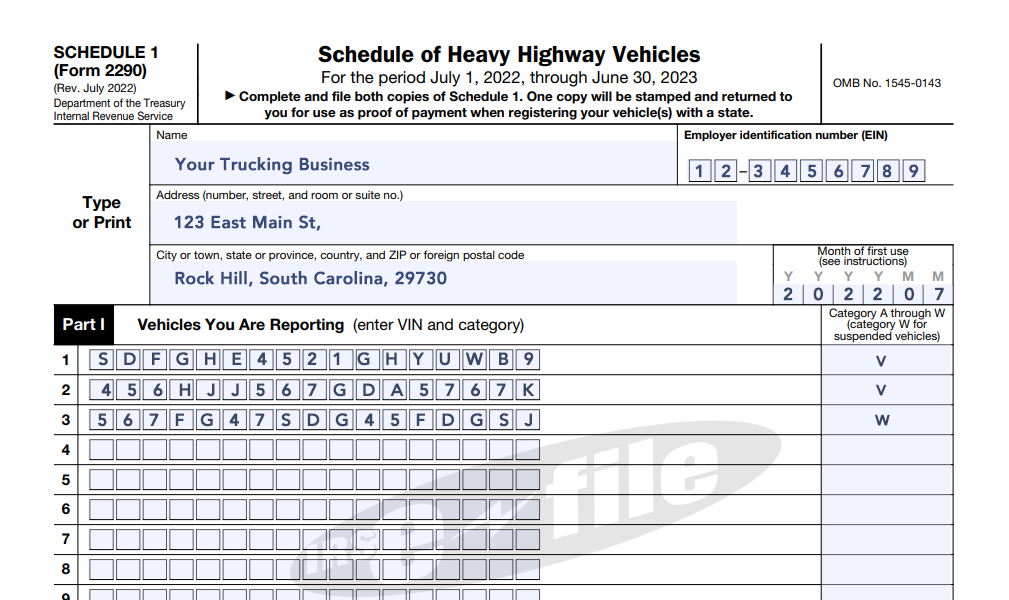

Form 2290 Schedule 1 - Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. For vehicles you first use on a public highway in july, file form 2290 between july 1 and august 31. Instantly file 2290 tax form in less than 5 minutes with the help of profession tax experts. See month of first use under. During the period july 1, 2022, through june 30, 2023, and are suspended from the tax. Get schedule 1 in minutes. Web schedule 1 (form 2290) (rev. The vehicle identification number of the vehicle being registered must appear on the schedule 1 (or an attached page) in order for the schedule 1 to be a valid proof of payment for such vehicle. Web pay the 2290 taxes and get 2290 schedule 1 proof. Easily access and download irs authorized form 2290 schedule 1 proof.

Web schedule 1 (form 2290)—month of first use. See month of first use under. During the period july 1, 2022, through june 30, 2023, and are suspended from the tax. Web the filing season for form 2290 filers is july 1 through june 30. Get schedule 1 in minutes. Web the schedule 1 designated for vehicles for which tax has been suspended. Web pay the 2290 taxes and get 2290 schedule 1 proof. For vehicles you first use on a public highway in july, file form 2290 between july 1 and august 31. Instantly file 2290 tax form in less than 5 minutes with the help of profession tax experts. The vehicle identification number of the vehicle being registered must appear on the schedule 1 (or an attached page) in order for the schedule 1 to be a valid proof of payment for such vehicle.

Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. See month of first use under. No fee for vin correction. Web schedule 1 form 2290 is a proof of payment provided to you by the irs (internal revenue service) upon payment of your heavy highway vehicle use tax. Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. Instantly file 2290 tax form in less than 5 minutes with the help of profession tax experts. The filing deadline for form 2290 is based on the month you first use the taxable vehicle on public highways during the reporting period. Web the schedule 1 designated for vehicles for which tax has been suspended. Web schedule 1 (form 2290) (rev. For vehicles you first use on a public highway in july, file form 2290 between july 1 and august 31.

Schedule 1 2290 IRS Form 2290 Schedule 1 eForm 2290

Get schedule 1 in minutes. Web schedule 1 (form 2290) (rev. Web the schedule 1 designated for vehicles for which tax has been suspended. Web the filing season for form 2290 filers is july 1 through june 30. See month of first use under.

How to Efile Form 2290 for 202223 Tax Period

During the period july 1, 2022, through june 30, 2023, and are suspended from the tax. Quick and secured way to prepare your truck tax return. Web pay the 2290 taxes and get 2290 schedule 1 proof. Instantly file 2290 tax form in less than 5 minutes with the help of profession tax experts. Web schedule 1 (form 2290) (rev.

Federal Form 2290 Schedule 1 Universal Network

Quick and secured way to prepare your truck tax return. See month of first use under. Web schedule 1 (form 2290) (rev. No fee for vin correction. Web schedule 1 form 2290 is a proof of payment provided to you by the irs (internal revenue service) upon payment of your heavy highway vehicle use tax.

Instructions For Form 2290 Schedule 1 Form Resume Examples QJ9eP5g2my

Quick and secured way to prepare your truck tax return. Web i declare that the vehicles reported on schedule 1 as suspended (category w) are expected to be used on public highways (check the boxes that apply): The filing deadline for form 2290 is based on the month you first use the taxable vehicle on public highways during the reporting.

Fillable Form 2290 20232024 Create, Fill & Download 2290

Instantly file 2290 tax form in less than 5 minutes with the help of profession tax experts. Web schedule 1 form 2290 is a proof of payment provided to you by the irs (internal revenue service) upon payment of your heavy highway vehicle use tax. No fee for vin correction. Web i declare that the vehicles reported on schedule 1.

File IRS Form 2290 Online Heavy Vehicle Use Tax (HVUT) Return

Instantly file 2290 tax form in less than 5 minutes with the help of profession tax experts. No fee for vin correction. Quick and secured way to prepare your truck tax return. Web pay the 2290 taxes and get 2290 schedule 1 proof. For vehicles you first use on a public highway in july, file form 2290 between july 1.

A Guide to Form 2290 Schedule 1

No fee for vin correction. During the period july 1, 2022, through june 30, 2023, and are suspended from the tax. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Get schedule 1 in minutes. Web i declare that the vehicles reported on schedule 1 as suspended (category w) are expected to.

Get your Form 2290 Schedule 1 in Minutes Efile Form 2290 Now

One copy will be stamped and returned to you for use as proof of payment when registering vehicle(s) with a state. Quick and secured way to prepare your truck tax return. Get schedule 1 in minutes. See month of first use under. Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles.

Get Form 2290 Schedule 1 in Minutes HVUT Proof of Payment

Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. See month of first use under. Instantly file 2290 tax form in less than 5 minutes with the help of profession tax experts. Quick and secured way to prepare your truck.

Understanding Form 2290 StepbyStep Instructions for 20222023

See month of first use under. Get schedule 1 in minutes. Once your hvut return is processed by the irs, they will create two stamped copies of your schedule of heavy highway vehicles. During the period july 1, 2022, through june 30, 2023, and are suspended from the tax. Web information about form 2290, heavy highway vehicle use tax return,.

Web Schedule 1 (Form 2290) (Rev.

Web schedule 1 form 2290 is a proof of payment provided to you by the irs (internal revenue service) upon payment of your heavy highway vehicle use tax. 5,000 miles or less 7,500 miles or less for agricultural vehicles. The vehicle identification number of the vehicle being registered must appear on the schedule 1 (or an attached page) in order for the schedule 1 to be a valid proof of payment for such vehicle. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles.

Web Information About Form 2290, Heavy Highway Vehicle Use Tax Return, Including Recent Updates, Related Forms, And Instructions On How To File.

Once your hvut return is processed by the irs, they will create two stamped copies of your schedule of heavy highway vehicles. Web the schedule 1 designated for vehicles for which tax has been suspended. During the period july 1, 2022, through june 30, 2023, and are suspended from the tax. Easily access and download irs authorized form 2290 schedule 1 proof.

Web Pay The 2290 Taxes And Get 2290 Schedule 1 Proof.

One copy will be stamped and returned to you for use as proof of payment when registering vehicle(s) with a state. For vehicles you first use on a public highway in july, file form 2290 between july 1 and august 31. July 2020) departrnent of the treasury internal revenue service name schedule of heavy highway vehicles for the period july 1, 2020, through june 30, 2021 complete and file both copies of schedule 1. No fee for vin correction.

Get Schedule 1 In Minutes.

Instantly file 2290 tax form in less than 5 minutes with the help of profession tax experts. Web schedule 1 (form 2290)—month of first use. Web the filing season for form 2290 filers is july 1 through june 30. Quick and secured way to prepare your truck tax return.