Form 3115 Dcn 7 Example

Form 3115 Dcn 7 Example - Web use code 7 as the code number of change on page 1 of form 3115 if correcting an error while the asset is still owned by the taxpayer. Web form 3115 application for change in accounting method (rev. The taxpayer must attach all applicable statements. Can you elect to do the 3115 in a higher rate tax year? Web i have the depreciation schedules and have calculated what the depreciation to date should be, and calculated my 481(a) adjustment. The basics of form 3115 automatic change request when to file form 3115 how to address questions posed on the form to avoid. Web department of the treasury internal revenue service application for change in accounting method go to www.irs.gov/form3115 for instructions and the latest information. It’s a common strategy to accelerate tax deductions into years where rates are going to be the highest. In accordance with the procedures of rev. Web these above methods include the following files:

Web a form 3115 is filed to change either an entity’s overall accounting method or the accounting treatment of any item, such as switching to the accrual method,. Web these above methods include the following files: Web the requirement to file form 3115, application for change in accounting method (including the ogden, ut copy), is waived for the first effective year. Web department of the treasury internal revenue service application for change in accounting method go to www.irs.gov/form3115 for instructions and the latest information. Web form 3115 and the instructions use a new acronym—dcn—which is defined as “designated automatic accounting method change.” the draft instructions from september 30, 2015,. Web form 3115 application for change in accounting method (rev. December 2018) department of the treasury internal revenue service. Web for example, a taxpayer with accounts receivables of $2.0mm and accounts payable of $1.0mm would obtain a negative §481(a) adjustment, which is a tax. Can you elect to do the 3115 in a higher rate tax year? It’s a common strategy to accelerate tax deductions into years where rates are going to be the highest.

Web these above methods include the following files: The basics of form 3115 automatic change request when to file form 3115 how to address questions posed on the form to avoid. Web use code 7 as the code number of change on page 1 of form 3115 if correcting an error while the asset is still owned by the taxpayer. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Web up to 30% cash back form 3115 (rev. Web a form 3115 is filed to change either an entity’s overall accounting method or the accounting treatment of any item, such as switching to the accrual method,. Web objectives this webinar will cover the following: Can you elect to do the 3115 in a higher rate tax year? Web the requirement to file form 3115, application for change in accounting method (including the ogden, ut copy), is waived for the first effective year. The taxpayer must attach all applicable statements.

Form 3115 Edit, Fill, Sign Online Handypdf

Web section 6.01, relating to impermissible to permissible depreciation method changes, is modified by removing language in paragraph (1)(c)(viii) and paragraph. Web i have the depreciation schedules and have calculated what the depreciation to date should be, and calculated my 481(a) adjustment. Web a form 3115 is filed to change either an entity’s overall accounting method or the accounting treatment.

Form 3115 Application for Change in Accounting Method(2015) Free Download

Application for change in accounting method. Explanations form 3115 fillable templates form 3115 attachment in word modifiable file customized to the needs of the particular. December 2018) department of the treasury internal revenue service. Can you elect to do the 3115 in a higher rate tax year? Web a form 3115 is filed to change either an entity’s overall accounting.

Fill Free fillable Form 3115 2018 Application for Change in

Can you elect to do the 3115 in a higher rate tax year? Web a form 3115 is filed to change either an entity’s overall accounting method or the accounting treatment of any item, such as switching to the accrual method,. Web department of the treasury internal revenue service application for change in accounting method go to www.irs.gov/form3115 for instructions.

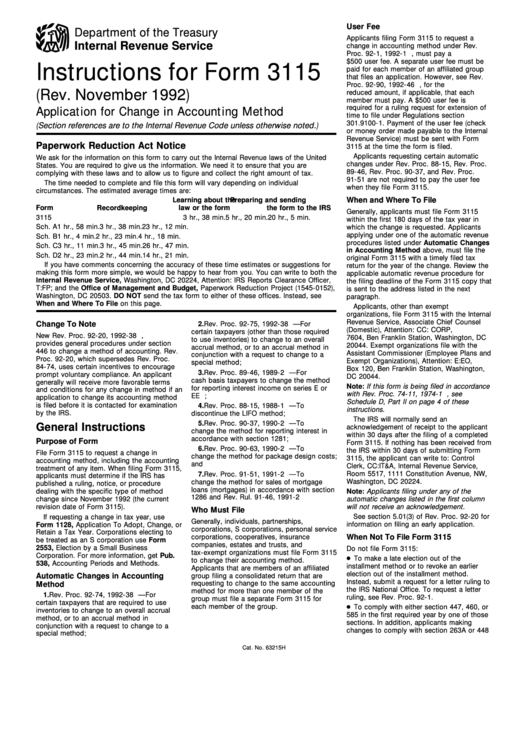

Instructions For Form 3115 printable pdf download

Web objectives this webinar will cover the following: Web section 6.01, relating to impermissible to permissible depreciation method changes, is modified by removing language in paragraph (1)(c)(viii) and paragraph. Can you elect to do the 3115 in a higher rate tax year? Form 3115 will use code 107 as the code. Web a form 3115 is filed to change either.

Form 24 Change To Section We've chosen to wrap it inside a tag in

Web these above methods include the following files: Web section 6.01, relating to impermissible to permissible depreciation method changes, is modified by removing language in paragraph (1)(c)(viii) and paragraph. The taxpayer must attach all applicable statements. Web up to 30% cash back form 3115 (rev. Web a form 3115 is filed to change either an entity’s overall accounting method or.

Form 3115 Application for Change in Accounting Method(2015) Free Download

Web form 3115 and the instructions use a new acronym—dcn—which is defined as “designated automatic accounting method change.” the draft instructions from september 30, 2015,. Web the requirement to file form 3115, application for change in accounting method (including the ogden, ut copy), is waived for the first effective year. Web this form 3115 (including its instructions), and (2) any.

Correcting Depreciation Form 3115 LinebyLine

Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Web section 6.01, relating to impermissible to permissible depreciation method changes, is modified by removing language in paragraph (1)(c)(viii) and paragraph. Web use code 7 as the code number of change on page 1 of form 3115 if.

Form 3115 App for change in acctg method Capstan Tax Strategies

Web form 3115 application for change in accounting method (rev. Web objectives this webinar will cover the following: It’s a common strategy to accelerate tax deductions into years where rates are going to be the highest. Web form 3115 and the instructions use a new acronym—dcn—which is defined as “designated automatic accounting method change.” the draft instructions from september 30,.

Form 3115 Application for Change in Accounting Method(2015) Free Download

Web form 3115 and the instructions use a new acronym—dcn—which is defined as “designated automatic accounting method change.” the draft instructions from september 30, 2015,. And (iii) taxpayer’s method of accounting for intangibles under section 11.05 of rev. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file..

Fill Free fillable Form 3115 2018 Application for Change in

In accordance with the procedures of rev. Web form 3115 application for change in accounting method (rev. Explanations form 3115 fillable templates form 3115 attachment in word modifiable file customized to the needs of the particular. Web up to 30% cash back form 3115 (rev. The basics of form 3115 automatic change request when to file form 3115 how to.

Can You Elect To Do The 3115 In A Higher Rate Tax Year?

Web a form 3115 is filed to change either an entity’s overall accounting method or the accounting treatment of any item, such as switching to the accrual method,. Web for example, a taxpayer with accounts receivables of $2.0mm and accounts payable of $1.0mm would obtain a negative §481(a) adjustment, which is a tax. Web the requirement to file form 3115, application for change in accounting method (including the ogden, ut copy), is waived for the first effective year. Form 3115 will use code 107 as the code.

Web This Form 3115 (Including Its Instructions), And (2) Any Other Relevant Information, Even If Not Specifically Requested On Form 3115.

The taxpayer must attach all applicable statements. Web objectives this webinar will cover the following: Web i have the depreciation schedules and have calculated what the depreciation to date should be, and calculated my 481(a) adjustment. Application for change in accounting method.

Web Use Code 7 As The Code Number Of Change On Page 1 Of Form 3115 If Correcting An Error While The Asset Is Still Owned By The Taxpayer.

Web section 6.01, relating to impermissible to permissible depreciation method changes, is modified by removing language in paragraph (1)(c)(viii) and paragraph. It’s a common strategy to accelerate tax deductions into years where rates are going to be the highest. Web up to 30% cash back form 3115 (rev. Web form 3115 application for change in accounting method (rev.

Explanations Form 3115 Fillable Templates Form 3115 Attachment In Word Modifiable File Customized To The Needs Of The Particular.

Web form 3115 and the instructions use a new acronym—dcn—which is defined as “designated automatic accounting method change.” the draft instructions from september 30, 2015,. Web these above methods include the following files: Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. In accordance with the procedures of rev.