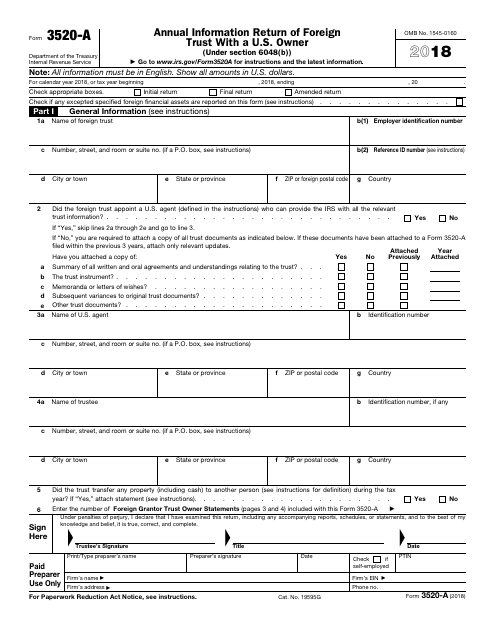

Form 3520-A

Form 3520-A - Show all amounts in u.s. All information must be in english. Certain transactions with foreign trusts, ownership of foreign trusts under the rules of sections 671 through 679, and. The form provides information about the foreign trust, its u.s. This information includes its u.s. Decedents) file form 3520 with the irs to report: Person who is treated as an owner of any portion of the foreign trust under the grantor trust rules (sections 671 through 679). Certain transactions with foreign trusts. A foreign trust with at least one u.s. Persons (and executors of estates of u.s.

Decedents) file form 3520 with the irs to report: Ownership of foreign trusts under the rules of sections internal revenue code 671 through 679. Owner, is an example of a tax document that must be filed every year by taxpayers who are the trustees, beneficiaries, or owners of a foreign trust. Certain transactions with foreign trusts, ownership of foreign trusts under the rules of sections 671 through 679, and. Persons (and executors of estates of u.s. Show all amounts in u.s. All information must be in english. Person who is treated as an owner of any portion of the foreign trust under the grantor trust rules (sections 671 through 679). Person who has any ownership the foreign trust, and also income of the trust. Owner files this form annually to provide information about:

The form is one of the more complicated reporting vehicles for overseas assets. The form provides information about the foreign trust, its u.s. Receipt of certain large gifts or bequests from certain foreign persons. Ownership of foreign trusts under the rules of sections internal revenue code 671 through 679. The form provides information about the foreign trust, its u.s. Person who is treated as an owner of any portion of the foreign trust. Person who is treated as an owner of any portion of the foreign trust under the grantor trust rules (sections 671 through 679). Persons (and executors of estates of u.s. Owner, is an example of a tax document that must be filed every year by taxpayers who are the trustees, beneficiaries, or owners of a foreign trust. Receipt of certain large gifts or.

IRS Form 3520A Download Fillable PDF or Fill Online Annual Information

This information includes its u.s. Person who is treated as an owner of any portion of the foreign trust under the grantor trust rules (sections 671 through 679). Owner (under section 6048 (b)). Person who is treated as an owner of any portion of the foreign trust. Certain transactions with foreign trusts, ownership of foreign trusts under the rules of.

Form 3520A Annual Information Return of Foreign Trust with a U.S

Receipt of certain large gifts or bequests from certain foreign persons. Person who is treated as an owner of any portion of the foreign trust. Owner, is an example of a tax document that must be filed every year by taxpayers who are the trustees, beneficiaries, or owners of a foreign trust. Person who is treated as an owner of.

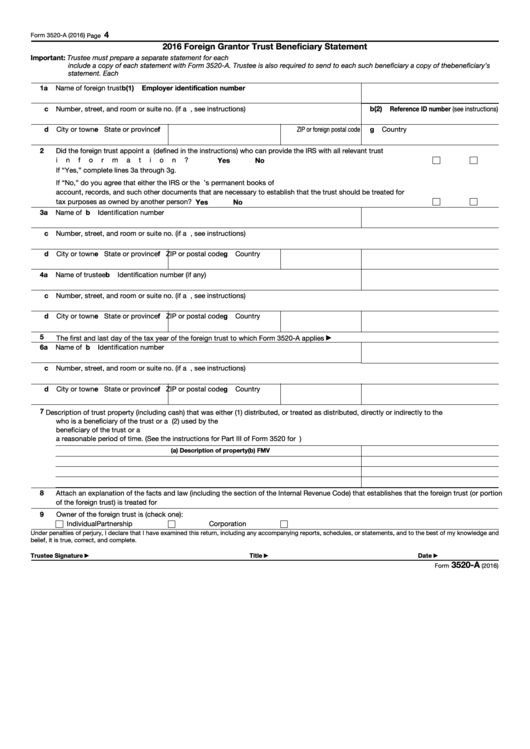

Fillable Form 3520A Foreign Grantor Trust Beneficiary Statement

All information must be in english. Decedents) file form 3520 with the irs to report: Owner files this form annually to provide information about: The form provides information about the foreign trust, its u.s. Person who is treated as an owner of any portion of the foreign trust under the grantor trust rules (sections 671 through 679).

The Tax Times IRS Sending SemiAutomated Penalties For Late Filed Form

Owner (under section 6048 (b)). Person who is treated as an owner of any portion of the foreign trust. Certain transactions with foreign trusts. Person who is treated as an owner of any portion of the foreign trust under the grantor trust rules (sections 671 through 679). Persons (and executors of estates of u.s.

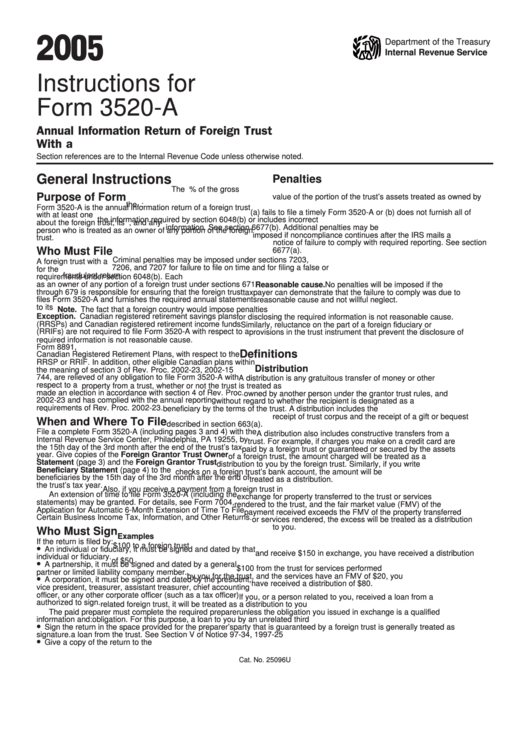

Instructions For Form 3520A Annual Information Return Of Foreign

All information must be in english. Owner files this form annually to provide information about: Decedents) file form 3520 with the irs to report: Person who is treated as an owner of any portion of the foreign trust under the grantor trust rules (sections 671 through 679). Certain transactions with foreign trusts.

IRS Form 3520A 2018 2019 Fill out and Edit Online PDF Template

Owner, is an example of a tax document that must be filed every year by taxpayers who are the trustees, beneficiaries, or owners of a foreign trust. Person who has any ownership the foreign trust, and also income of the trust. Decedents) file form 3520 to report: The form provides information about the foreign trust, its u.s. Person who is.

Tax Audits « TaxExpatriation

Certain transactions with foreign trusts. Person who is treated as an owner of any portion of the foreign trust. Owner files this form annually to provide information about: Persons (and executors of estates of u.s. Owner (under section 6048 (b)).

Form 3520a Annual Information Return of Foreign Trust with a U.S

The form provides information about the foreign trust, its u.s. A foreign trust with at least one u.s. Ownership of foreign trusts under the rules of sections internal revenue code 671 through 679. Person who is treated as an owner of any portion of the foreign trust under the grantor trust rules (sections 671 through 679). Certain transactions with foreign.

Form 3520A Annual Information Return of Foreign Trust with a U.S

The form provides information about the foreign trust, its u.s. Certain transactions with foreign trusts, ownership of foreign trusts under the rules of sections 671 through 679, and. Owner (under section 6048(b)) department of the treasury internal revenue service go to www.irs.gov/form3520a for instructions and the latest information omb no. Owner (under section 6048 (b)). Receipt of certain large gifts.

Forms 3520 and 3520A What You Need to Know

Persons (and executors of estates of u.s. The form is one of the more complicated reporting vehicles for overseas assets. A foreign trust with at least one u.s. Person who is treated as an owner of any portion of the foreign trust under the grantor trust rules (sections 671 through 679). Certain transactions with foreign trusts.

The Form Provides Information About The Foreign Trust, Its U.s.

Certain transactions with foreign trusts, ownership of foreign trusts under the rules of sections 671 through 679, and. Certain transactions with foreign trusts. A foreign trust with at least one u.s. Owner (under section 6048(b)) department of the treasury internal revenue service go to www.irs.gov/form3520a for instructions and the latest information omb no.

All Information Must Be In English.

This information includes its u.s. Persons (and executors of estates of u.s. Person who has any ownership the foreign trust, and also income of the trust. Ownership of foreign trusts under the rules of sections internal revenue code 671 through 679.

The Form Is One Of The More Complicated Reporting Vehicles For Overseas Assets.

Decedents) file form 3520 with the irs to report: Owner, is an example of a tax document that must be filed every year by taxpayers who are the trustees, beneficiaries, or owners of a foreign trust. Person who is treated as an owner of any portion of the foreign trust under the grantor trust rules (sections 671 through 679). Persons (and executors of estates of u.s.

Decedents) File Form 3520 To Report:

Owner (under section 6048 (b)). The form provides information about the foreign trust, its u.s. Receipt of certain large gifts or. Receipt of certain large gifts or bequests from certain foreign persons.