Form 3554 Turbotax

Form 3554 Turbotax - Web form 3554 is a california corporate income tax form. Web apply form 3554, new labour credit: Has anyone else experienced this?. Web ftb 3554 2019 side 1 taxable year 2019 new employment credit california form 3554 attach to your california tax return. Web tax help / form 3554 i'm using turbo tax and i accidentally marked a 0 in the form 3554, when in actuality i should have left the form blank because it doesn't apply to me. Once you’re happy with your projected outcome, the w. If you are not a corporation, enter 0. Easily sort by irs forms to find the product that best fits your tax. Web up to $7 cash back i filed my taxes through turbo tax and i'm having a issue with my state i'm not sure what a 3554 form is ??. Read more expert the standard.

Name(s) as shown on your california tax return. In the upper right corner, click my account > tools.; Web on turbo tax home and business 2017, you can remove the form using the following method: Web how to delete 3554 form:. File your california and federal tax returns online with turbotax in minutes. Once you’re happy with your projected outcome, the w. Has anyone else experienced this?. Easily sort by irs forms to find the product that best fits your tax. Make changes to your 2022 tax. Web ftb 3554 2019 side 1 taxable year 2019 new employment credit california form 3554 attach to your california tax return.

If you are not a corporation, enter 0. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web enter the total amount from form ftb 3544, part a, column (g). Web apply form 3554, new labour credit: Web up to $7 cash back i filed my taxes through turbo tax and i'm having a issue with my state i'm not sure what a 3554 form is ??. Easily sort by irs forms to find the product that best fits your tax. Click easy step button in upper left corner. You need to enable javascript. Read more expert the standard. Web how to delete 3554 form:.

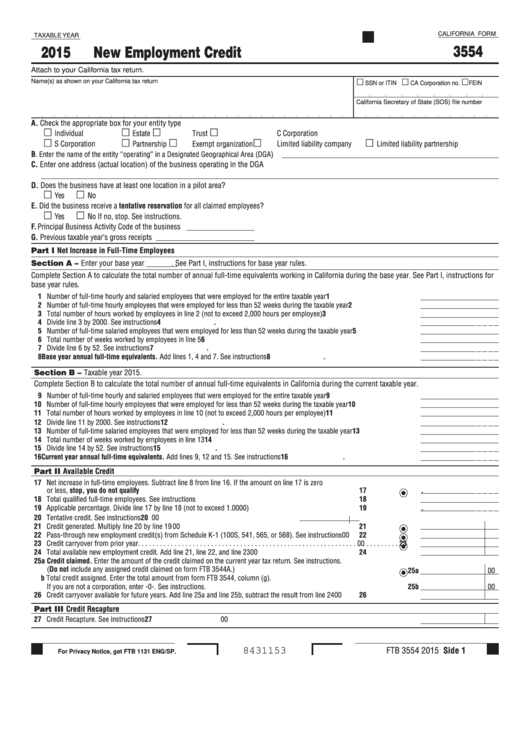

Form 3554 California New Employment Credit 2015 printable pdf download

Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web up to $7 cash back i filed my taxes through turbo tax and i'm having a issue with my state i'm not sure what a 3554 form is ??. Once you’re happy with your projected outcome, the w. Web fewsteps.

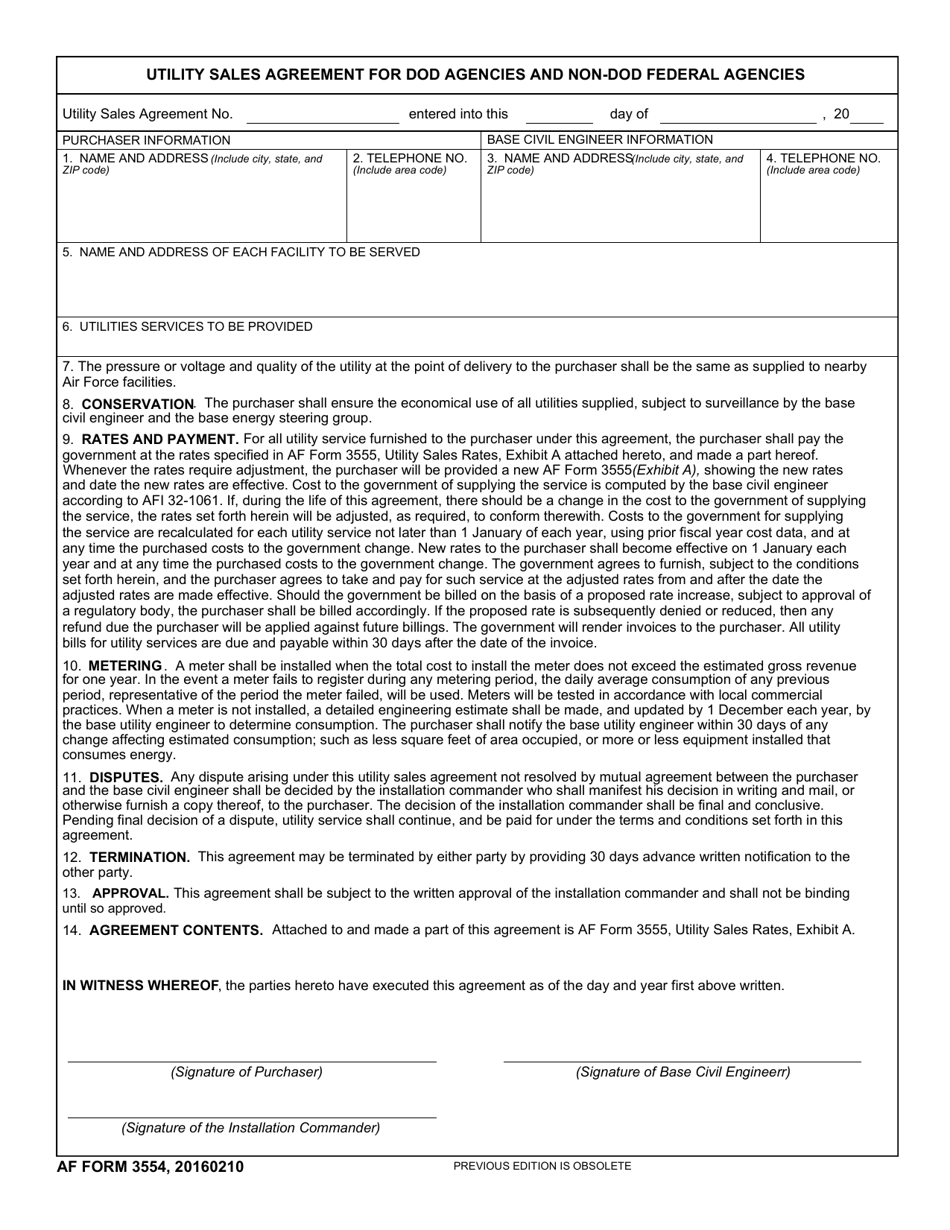

AF Form 3554 Download Fillable PDF or Fill Online Utility Sales

Web apply form 3554, new labour credit: Once you’re happy with your projected outcome, the w. Open your return, if it's not already open. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Has anyone else experienced this?.

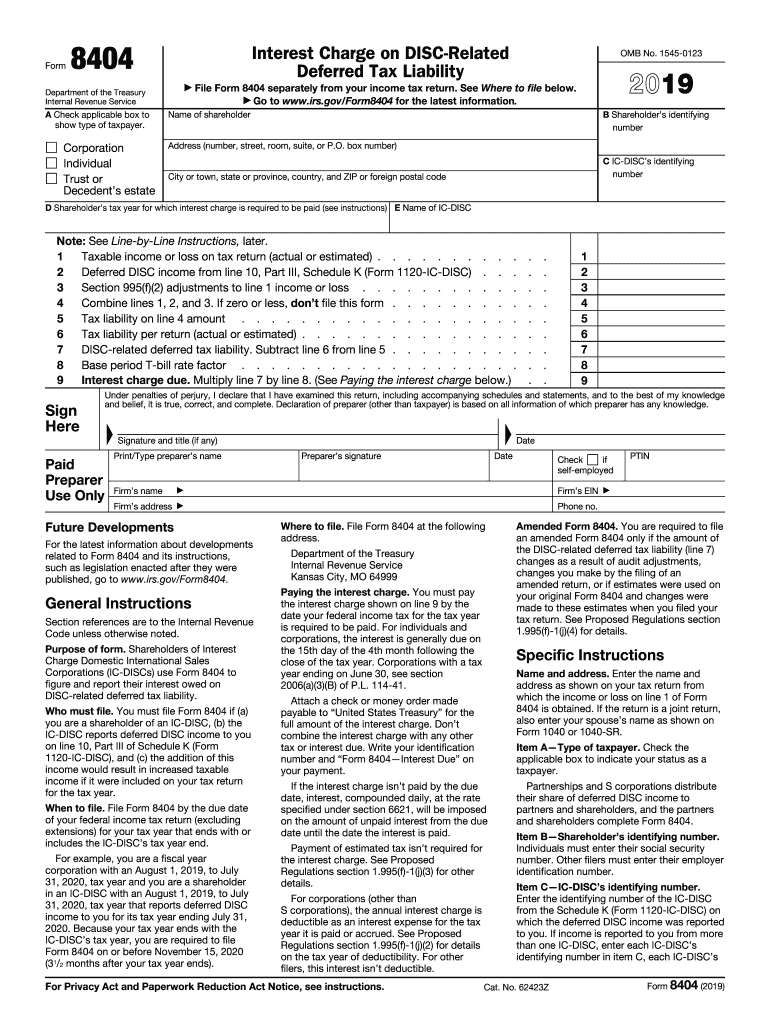

Form 8404 Fill Out and Sign Printable PDF Template signNow

Once you’re happy with your projected outcome, the w. Easily sort by irs forms to find the product that best fits your tax. Easily file federal and state income tax returns with 100% accuracy to get your maximum tax refund. Web on turbo tax home and business 2017, you can remove the form using the following method: Web form 3554.

Are You Ready? Big Changes to the 2020 Federal W4 Withholding Form

Has anyone else experienced this?. Open your return, if it's not already open. Easily sort by irs forms to find the product that best fits your tax. Easily file federal and state income tax returns with 100% accuracy to get your maximum tax refund. Web tax help / form 3554 i'm using turbo tax and i accidentally marked a 0.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Open your return, if it's not already open. Read more expert the standard. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web tax help / form 3554 i'm using turbo tax and i accidentally marked a 0 in the form 3554, when in actuality i should have left the form.

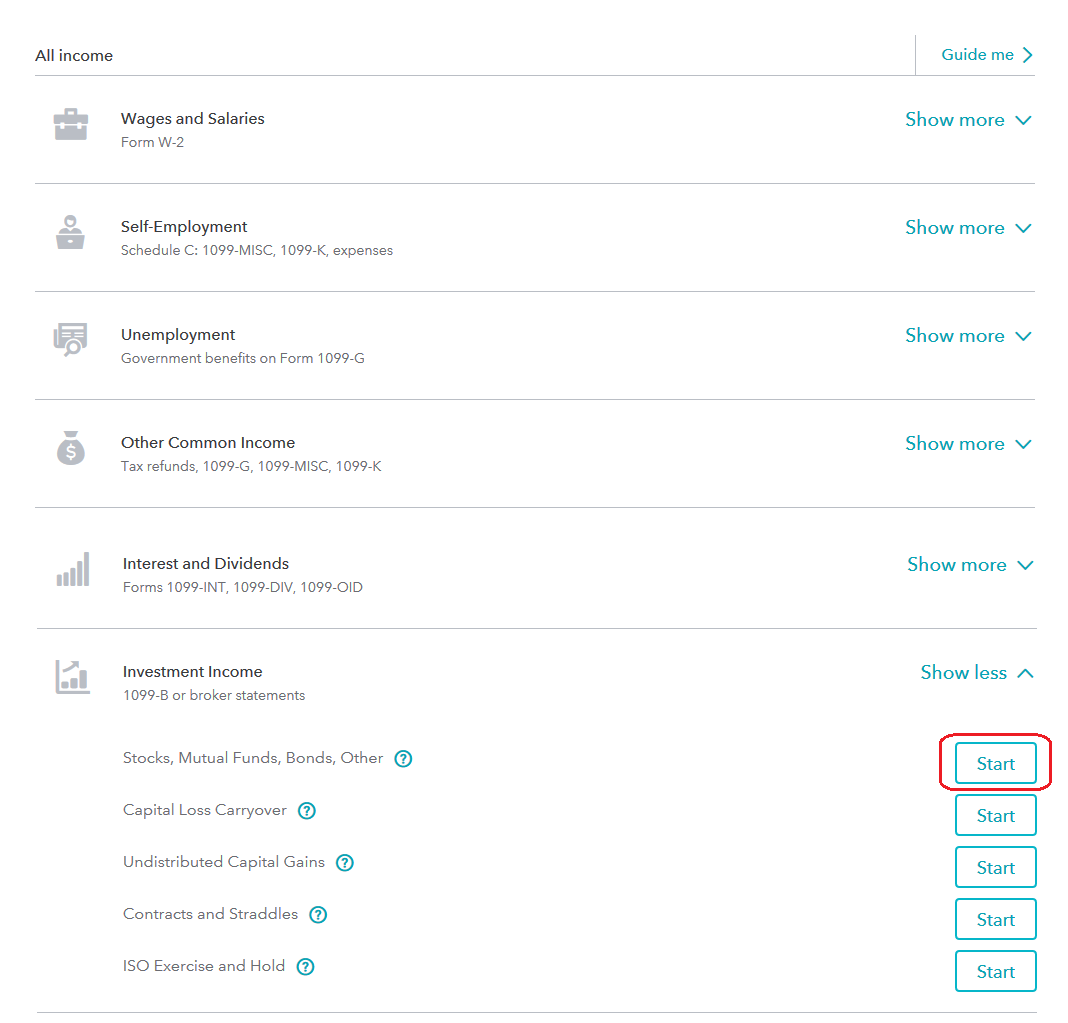

Entering Form 8949 Totals Into TurboTax® TradeLog Software

Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web enter the total amount from form ftb 3544, part a, column (g). File your california and federal tax returns online with turbotax in minutes. In the upper right corner, click my account > tools.; Web see what tax forms are.

기준기검사 신청서 샘플, 양식 다운로드

Web on turbo tax home and business 2017, you can remove the form using the following method: Read more expert the standard. If you are not a corporation, enter 0. Open your return, if it's not already open. Easily sort by irs forms to find the product that best fits your tax.

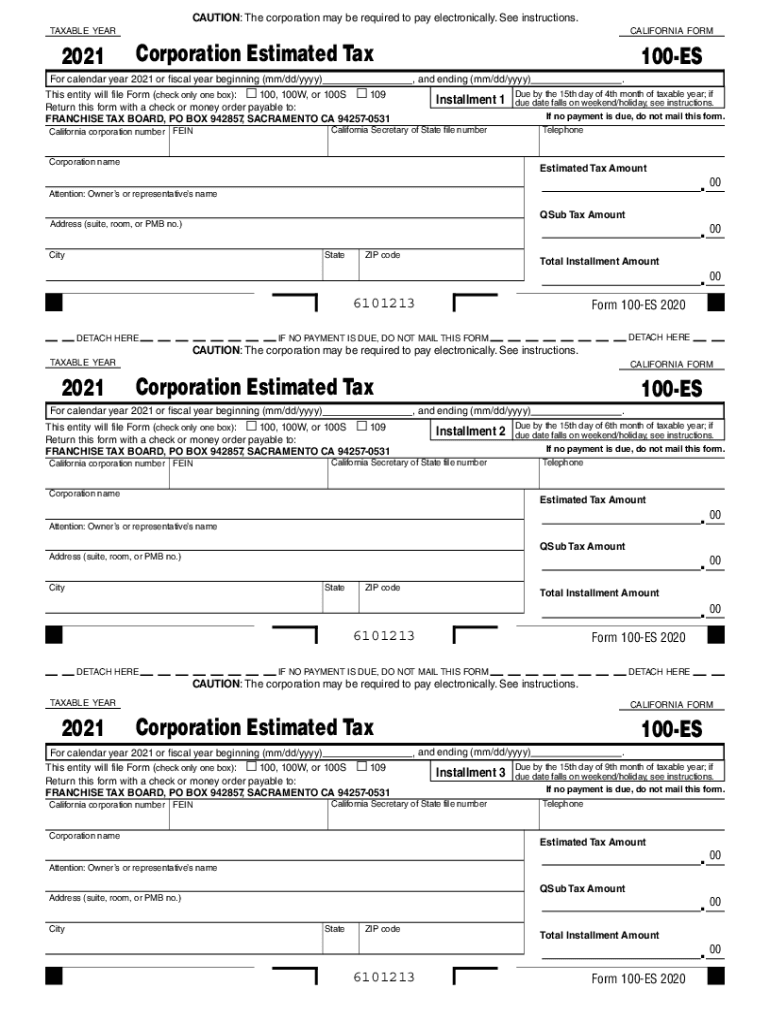

2021 Form CA FTB 100ES Fill Online, Printable, Fillable, Blank pdfFiller

Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms. Has anyone else experienced this?. Make changes to your 2022 tax. Web ftb 3554 2019 side 1 taxable year 2019 new employment credit california form 3554 attach to your california tax return. Click easy step button in upper left corner.

Form 9 Turbotax The Latest Trend In Form 9 Turbotax AH STUDIO Blog

If you are not a corporation, enter 0. File your california and federal tax returns online with turbotax in minutes. Web tax help / form 3554 i'm using turbo tax and i accidentally marked a 0 in the form 3554, when in actuality i should have left the form blank because it doesn't apply to me. Web how to delete.

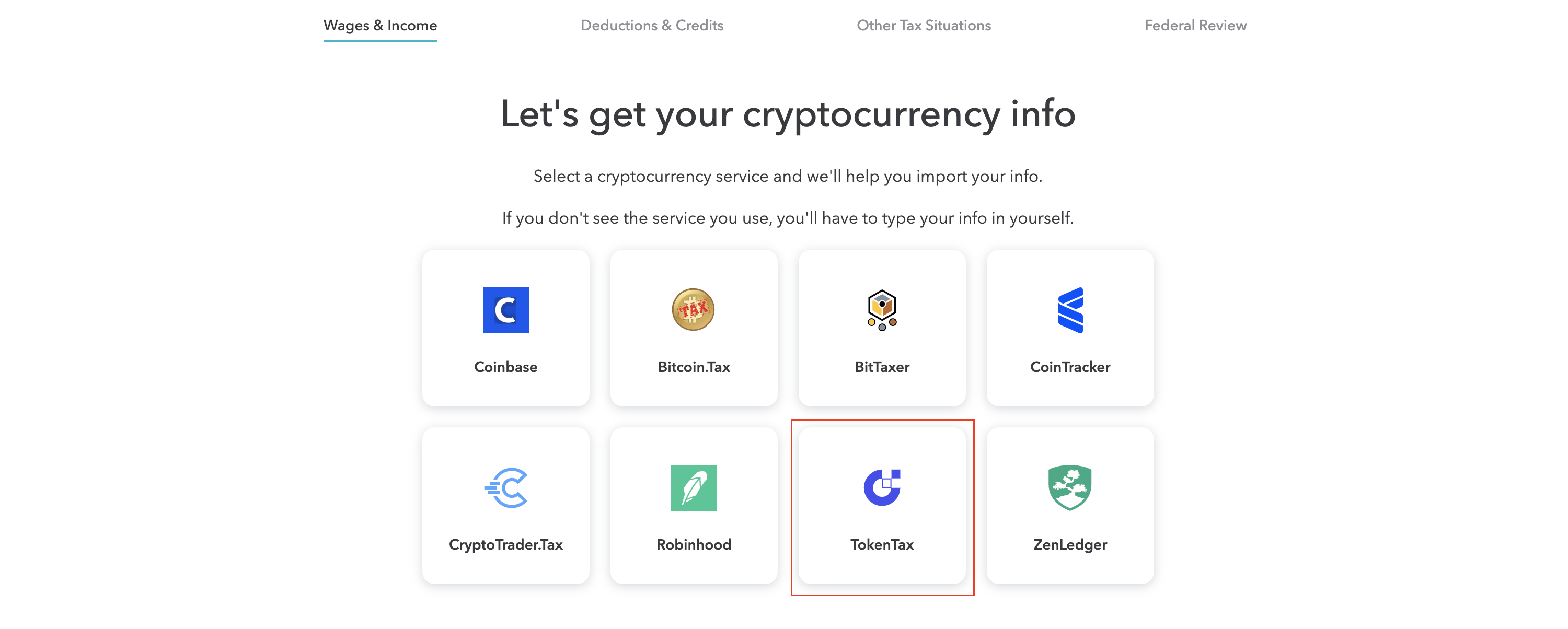

TurboTax Cryptocurrency Filing Crypto Form 8949 TurboTax TokenTax

Web tax help / form 3554 i'm using turbo tax and i accidentally marked a 0 in the form 3554, when in actuality i should have left the form blank because it doesn't apply to me. Name(s) as shown on your california tax return. Web apply form 3554, new labour credit: Easily sort by irs forms to find the product.

Web Efile Your California Tax Return Now Efiling Is Easier, Faster, And Safer Than Filling Out Paper Tax Forms.

Web enter the total amount from form ftb 3544, part a, column (g). In the upper right corner, click my account > tools.; Make changes to your 2022 tax. Has anyone else experienced this?.

Web Tax Help / Form 3554 I'm Using Turbo Tax And I Accidentally Marked A 0 In The Form 3554, When In Actuality I Should Have Left The Form Blank Because It Doesn't Apply To Me.

Web form 3554 is a california corporate income tax form. Web apply form 3554, new labour credit: Open your return, if it's not already open. Name(s) as shown on your california tax return.

Read More Expert The Standard.

Web ftb 3554 2019 side 1 taxable year 2019 new employment credit california form 3554 attach to your california tax return. Click easy step button in upper left corner. Web fewsteps 3.95k subscribers subscribe 9.4k views 2 years ago how to in this video you will see how to delete a tax form from turbotax. Once you’re happy with your projected outcome, the w.

If You Are Not A Corporation, Enter 0.

File your california and federal tax returns online with turbotax in minutes. Web up to $7 cash back i filed my taxes through turbo tax and i'm having a issue with my state i'm not sure what a 3554 form is ??. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Easily file federal and state income tax returns with 100% accuracy to get your maximum tax refund.