Form 4136 Turbo Tax

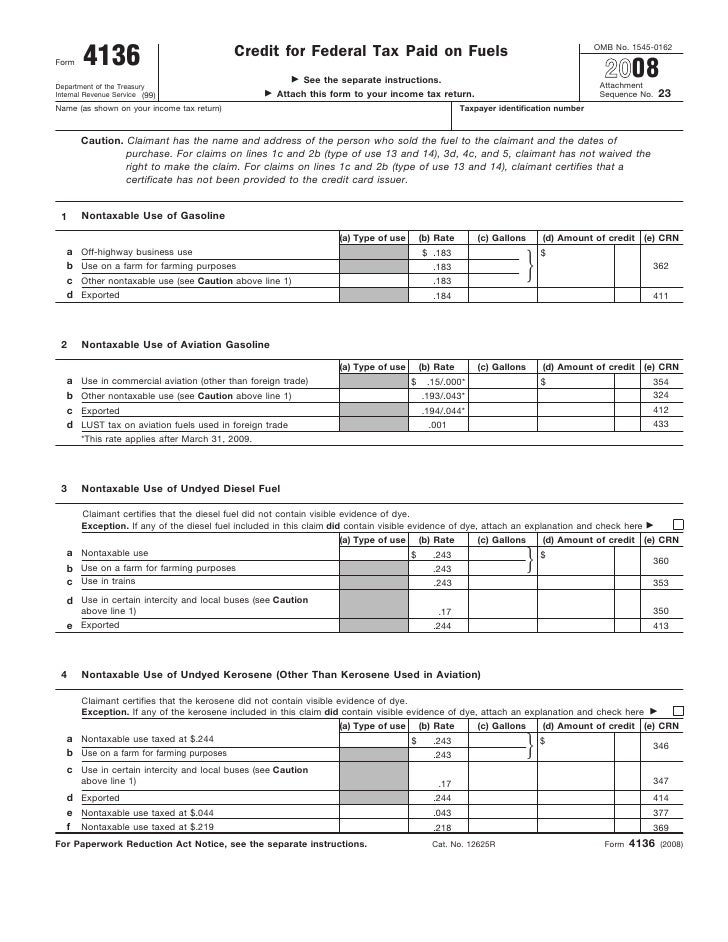

Form 4136 Turbo Tax - Claimant has the name and address of the person who sold the fuel to the claimant and the dates of purchase. 12625rform 4136 5kerosene used in aviation (see caution above line 1) 6sales by registered ultimate vendors of undyed diesel fuel registration no. A (b) rate (c) gallons (d) amount of credit (e) crn a diesel fuel sold for the exclusive use of a state or. Web form 4136, credit for federal tax paid on fuels. Use form 4136 to claim a credit. Web 1 best answer doninga level 15 the search function should have worked with either entering 4136 or 4136, fuel credit sign out of your account and then sign back. Check to see if turbotax business is up to date by tapping online > check for updates. Form 8849, claim for refund of excise taxes, to claim a. Web what irs form 4136 is used for what types of fuel use qualify for fuel credits how to complete irs form 4136 let’s start by discussing exactly how to complete irs. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return.

Web form 4136 to claim the credit for mixtures or fuels sold or used during the 2020 calendar year. The biodiesel or renewable diesel mixture credit. Web form 4136 (2020) page 4 13 registered credit card issuers registration no. Web form 4136 is available @rghornstra. Web credit for federal tax paid on fuels 4136 caution: Department of the treasury internal revenue service. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Claimant has the name and address of the person who sold the fuel to the claimant and the dates of purchase. Web attach form 4136 to your tax return. Max refund is guaranteed and 100% accurate.

Get ready for tax season deadlines by completing any required tax forms today. Web credit for federal tax paid on fuels 4136 caution: Instead of waiting to claim an annual credit on form 4136, you may be able to file: Web attach form 4136 to your tax return. Web form 4136 to claim the credit for mixtures or fuels sold or used during the 2020 calendar year. Complete, edit or print tax forms instantly. General instructions purpose of form use form 4136 to claim the following. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. The biodiesel or renewable diesel mixture credit. For instructions and the latest information.

Fill Free fillable Form 4136 Credit for Federal Tax Paid on Fuels

Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. Web schedule 1 additional income and adjustments to income schedule 2 additional taxes schedule 3 additional credits and payments schedule a (form 1040) itemized. Citizenship and immigration services will publish a revised version of form i. Instead.

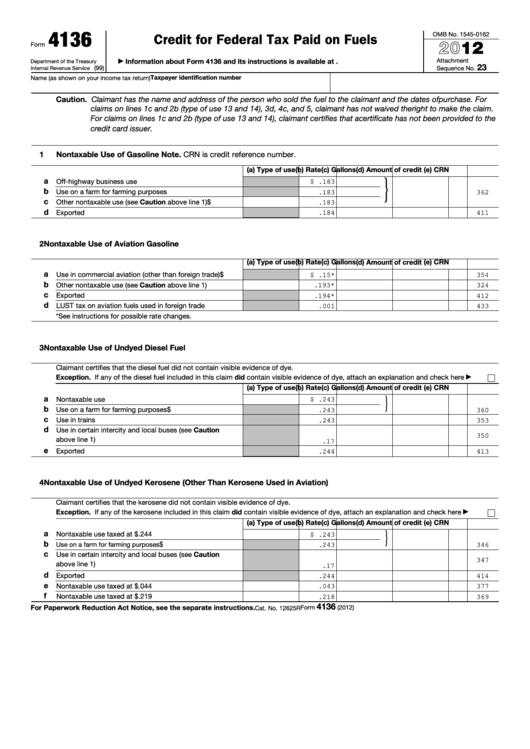

Fillable Form 4136 Credit For Federal Tax Paid On Fuels 2012

Ad free federal tax filing for simple and complex returns. Web form 4136 to claim the credit for mixtures or fuels sold or used during the 2020 calendar year. Web form 4136, credit for federal tax paid on fuels. Web use form 4136 to claim a credit for federal taxes paid on certain fuels. Department of the treasury internal revenue.

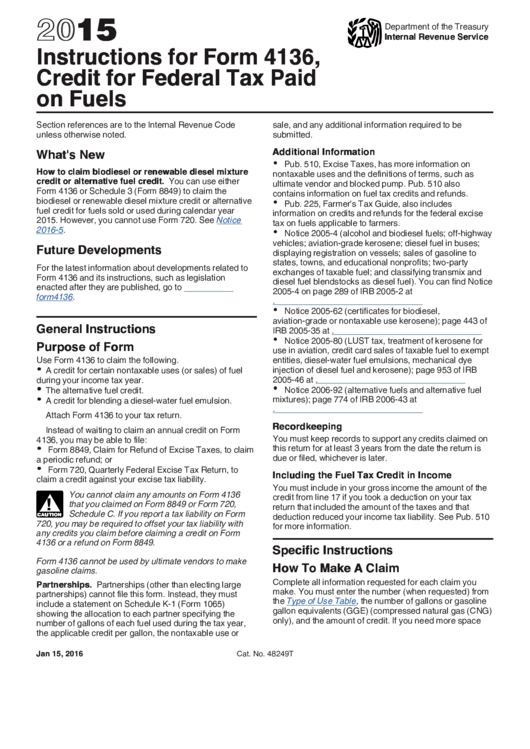

Form 4136 Credit For Federal Tax Paid on Fuels (2015) Free Download

Web what irs form 4136 is used for what types of fuel use qualify for fuel credits how to complete irs form 4136 let’s start by discussing exactly how to complete irs. Web form 4136 to claim the credit for mixtures or fuels sold or used during the 2020 calendar year. Web payroll tax returns. A (b) rate (c) gallons.

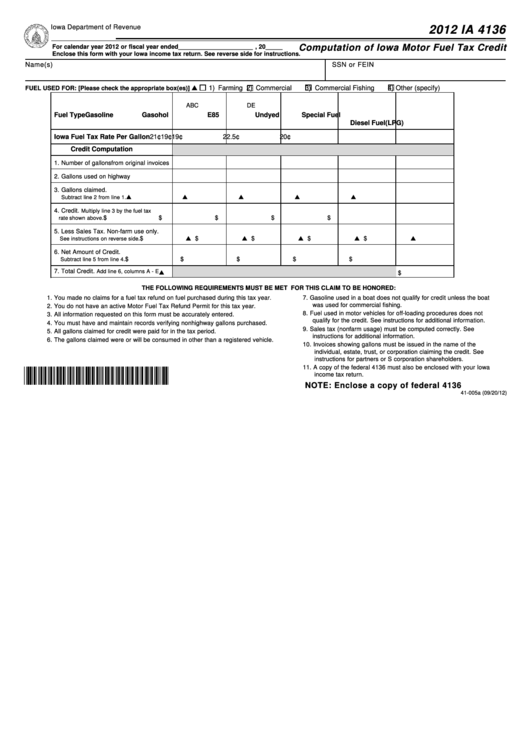

Fillable Form Ia 4136 Computation Of Iowa Motor Fuel Tax Credit

Use form 4136 to claim a credit. Instead of waiting to claim an annual credit on form 4136, you may be able to file: Web form 4136 is available @rghornstra. A (b) rate (c) gallons (d) amount of credit (e) crn a diesel fuel sold for the exclusive use of a state or. Web form 4136 (2020) page 4 13.

Instructions For Form 4136, Credit For Federal Tax Paid On Fuels (2015

Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. Web credit for federal tax paid on fuels 4136 caution: Check to see if turbotax business is up to date by tapping online > check for updates. Web payroll tax returns. Web show sources > form 4136.

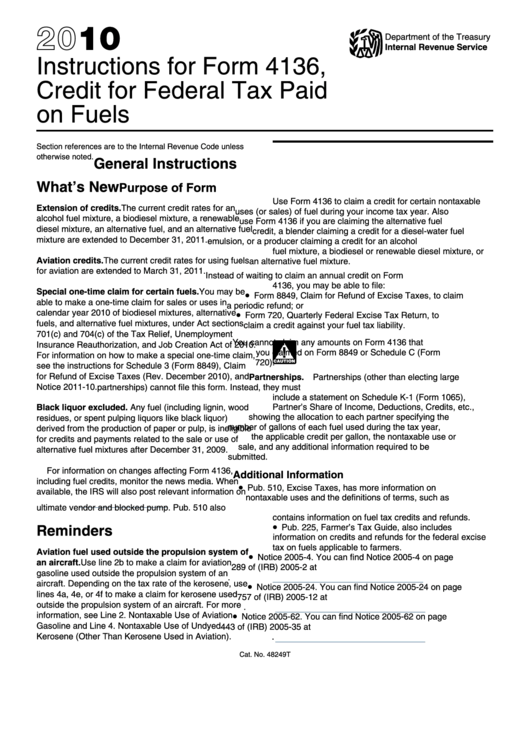

Instructions For Form 4136 Credit For Federal Tax Paid On Fuels

Web form 4136 to claim the credit for mixtures or fuels sold or used during the 2020 calendar year. A (b) rate (c) gallons (d) amount of credit (e) crn a diesel fuel sold for the exclusive use of a state or. Web credit for federal tax paid on fuels 4136 caution: Get ready for tax season deadlines by completing.

Form 4136 Credit For Federal Tax Paid on Fuels (2015) Free Download

The credits available on form 4136 are: Web use form 4136 to claim a credit for federal taxes paid on certain fuels. Check to see if turbotax business is up to date by tapping online > check for updates. Form 8849, claim for refund of excise taxes, to claim a. Claimant has the name and address of the person who.

Form 4136Credit for Federal Tax Paid on Fuel

Web show sources > form 4136 is a federal other form. Web form 4136 to claim the credit for mixtures or fuels sold or used during the 2020 calendar year. For instructions and the latest information. Credit for federal tax paid on fuels. General instructions purpose of form use form 4136 to claim the following.

Form 4136 Credit For Federal Tax Paid on Fuels (2015) Free Download

Web show sources > form 4136 is a federal other form. For instructions and the latest information. Use form 4136 to claim a credit. Web form 4136 (2020) page 4 13 registered credit card issuers registration no. Web form 4136, credit for federal tax paid on fuels.

Form 4136Credit for Federal Tax Paid on Fuel

Web attach form 4136 to your tax return. You can make this adjustment on screen. The biodiesel or renewable diesel mixture credit. Claimant has the name and address of the person who sold the fuel to the claimant and the dates of purchase. Form 8849, claim for refund of excise taxes, to claim a.

Use Form 4136 To Claim A Credit.

Web use form 4136 to claim a credit for federal taxes paid on certain fuels. Get ready for tax season deadlines by completing any required tax forms today. For instructions and the latest information. Citizenship and immigration services will publish a revised version of form i.

Web 1 Best Answer Doninga Level 15 The Search Function Should Have Worked With Either Entering 4136 Or 4136, Fuel Credit Sign Out Of Your Account And Then Sign Back.

Web what irs form 4136 is used for what types of fuel use qualify for fuel credits how to complete irs form 4136 let’s start by discussing exactly how to complete irs. Web credit for federal tax paid on fuels 4136 caution: Complete, edit or print tax forms instantly. A (b) rate (c) gallons (d) amount of credit (e) crn a diesel fuel sold for the exclusive use of a state or.

12625Rform 4136 5Kerosene Used In Aviation (See Caution Above Line 1) 6Sales By Registered Ultimate Vendors Of Undyed Diesel Fuel Registration No.

Max refund is guaranteed and 100% accurate. Form 8849, claim for refund of excise taxes, to claim a. The biodiesel or renewable diesel mixture credit the alternative fuel. Web for form 1120 filers:

Department Of The Treasury Internal Revenue Service.

Web show sources > form 4136 is a federal other form. Ad free federal tax filing for simple and complex returns. Instead of waiting to claim an annual credit on form 4136, you may be able to file: Get ready for tax season deadlines by completing any required tax forms today.