Form 5498 Due Date

Form 5498 Due Date - Web up to 10% cash back as mentioned earlier, the 2022 form 5498 filing deadline is may 31, 2023. But, for 2020 tax year, the deadline has been extended to june 30, 2021. Web • transmission reporting option: Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. The trustee or custodian of your ira reports. Web filing form 5498 with the irs. Complete, edit or print tax forms instantly. But, for 2020 tax year, the deadline. The irs form 5498 exists so that financial institutions can report ira information. It is by this date form 5498 must be sent to the irs and to ira owners and.

Complete, edit or print tax forms instantly. When is the deadline for filing form 5498? Web up to 10% cash back as mentioned earlier, the 2022 form 5498 filing deadline is may 31, 2023. The form will be mailed to you in late may after all contributions have been made for that year. Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement (ira), including. It is by this date form 5498 must be sent to the irs and to ira owners and. Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. What is irs form 5498? Web as a result form 5498 reports all contributions made up until the tax filing date. Web filing form 5498 with the irs.

Contributions to similar accounts, such as. Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. The irs form 5498 exists so that financial institutions can report ira information. Complete, edit or print tax forms instantly. What is irs form 5498? Web generally, the deadline to file form 5498 is may 31. Web for participants who made a postponed contribution due to an extension of the contribution due date because of a federally designated disaster, shows the code fd. But, for 2020 tax year, the deadline. Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement (ira), including. Web as a result form 5498 reports all contributions made up until the tax filing date.

5498 Software to Create, Print & EFile IRS Form 5498

Web • transmission reporting option: What is irs form 5498? Web as a result form 5498 reports all contributions made up until the tax filing date. Web filing form 5498 with the irs. If the due date falls on a weekend or.

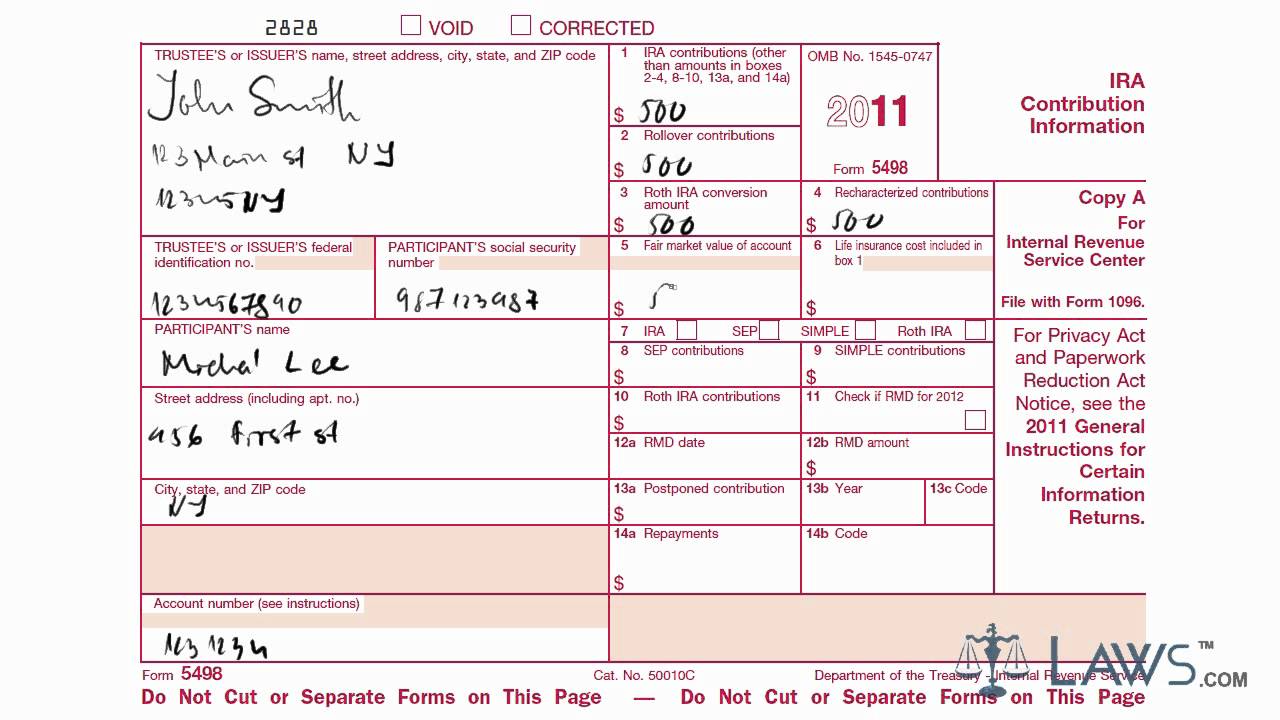

What is Form 5498? New Direction Trust Company

Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. Web the deadline for taxpayers to receive their form 5498 from their ira custodian is may 31 of the following tax year. What is irs form 5498? Contributions to similar accounts, such as. It is by this date form.

How To Prepare and File Form 5498 Blog TaxBandits

Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement (ira), including. If the due date falls on a weekend or. Web • transmission reporting option: The irs form 5498 exists so that financial institutions can report ira information. Web the deadline for.

File Form 5498 Online in Few Minutes Efile Form 5498 for 2020 Tax Year

What is irs form 5498? Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. But, for 2020 tax year, the deadline. Complete, edit or print tax forms instantly. Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions.

What is IRS Form 5498SA? BRI Benefit Resource

Web up to 10% cash back as mentioned earlier, the 2022 form 5498 filing deadline is may 31, 2023. What is irs form 5498? It is by this date form 5498 must be sent to the irs and to ira owners and. Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for.

The Purpose of IRS Form 5498

Web • transmission reporting option: But, for 2020 tax year, the deadline has been extended to june 30, 2021. Web as a result form 5498 reports all contributions made up until the tax filing date. The irs form 5498 exists so that financial institutions can report ira information. If the due date falls on a weekend or.

File Form 5498 Online in Few Minutes Efile Form 5498 for 2020 Tax Year

If the due date falls on a weekend or. What is irs form 5498? Web up to 10% cash back as mentioned earlier, the 2022 form 5498 filing deadline is may 31, 2023. It is by this date form 5498 must be sent to the irs and to ira owners and. Web as a result form 5498 reports all contributions.

Form 5498 IRA Contribution Information Definition

Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. Web • transmission reporting option: Web filing form 5498 with the irs. But, for 2020 tax year, the deadline has been extended to june 30, 2021. If the due date falls on a weekend or.

Form 5498 YouTube

Complete, edit or print tax forms instantly. Web generally, the deadline to file form 5498 is may 31. When is the deadline for filing form 5498? Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement (ira), including. But, for 2020 tax year,.

All About IRS Tax Form 5498 for 2020 IRA for individuals

Web the deadline for taxpayers to receive their form 5498 from their ira custodian is may 31 of the following tax year. If the due date falls on a weekend or. Web for participants who made a postponed contribution due to an extension of the contribution due date because of a federally designated disaster, shows the code fd. Web file.

Complete, Edit Or Print Tax Forms Instantly.

Web as a result form 5498 reports all contributions made up until the tax filing date. Web • transmission reporting option: Web filing form 5498 with the irs. Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions.

But, For 2020 Tax Year, The Deadline Has Been Extended To June 30, 2021.

Contributions to similar accounts, such as. Web for participants who made a postponed contribution due to an extension of the contribution due date because of a federally designated disaster, shows the code fd. The trustee or custodian of your ira reports. Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement (ira), including.

But, For 2020 Tax Year, The Deadline.

Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. The irs form 5498 exists so that financial institutions can report ira information. What is irs form 5498? Web the deadline for taxpayers to receive their form 5498 from their ira custodian is may 31 of the following tax year.

The Form Will Be Mailed To You In Late May After All Contributions Have Been Made For That Year.

It is by this date form 5498 must be sent to the irs and to ira owners and. Web generally, the deadline to file form 5498 is may 31. If the due date falls on a weekend or. When is the deadline for filing form 5498?

:max_bytes(150000):strip_icc()/ScreenShot2020-01-28at4.05.10PM-aaa74c7b441b4609ad379a16d4d624bf.png)

:max_bytes(150000):strip_icc()/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)