Form 56 Instructions 2021

Form 56 Instructions 2021 - Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. Web the fiduciary (usually a trustee or an executor) of an estate or trust or a guardian should use this form to notify the irs of the creation or termination of a fiduciary relationship. If you are appointed to act in a fiduciary capacity for another, you must file a written notice with the irs stating this. You can download or print. Download past year versions of this tax form as pdfs. An executor must file form 56 for the individual decedent, if the executor will be filing a final. Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. Web per irs instructions for form 56: Form 56 can only be filed from the current year software. Any documents required to be mailed will be included in the filing.

Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship. (a) whether the collection of information is necessary for the proper performance of the functions of the agency, including whether. Web solved•by intuit•48•updated february 09, 2023. Web per irs instructions for form 56: Web per the form 56 instructions: August 1997) notice concerning fiduciary relationship department of the treasury internal revenue service (internal revenue code sections. Form 56 can only be filed from the current year software. Download past year versions of this tax form as pdfs. Web form 56 omb no. An executor must file form 56 for the individual decedent, if the executor will be filing a final.

Form 56 can only be filed from the current year software. Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for the fiduciary relationship under. That means we will be booking your ots class assignment just as soon as. Web form 56 when you file your tax return part of the documents is the filing instructions. Web per the form 56 instructions: Web form 56 omb no. An executor must file form 56 for the individual decedent, if the executor will be filing a final. Form 56, notice concerning fiduciary. (a) whether the collection of information is necessary for the proper performance of the functions of the agency, including whether. Web use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift).

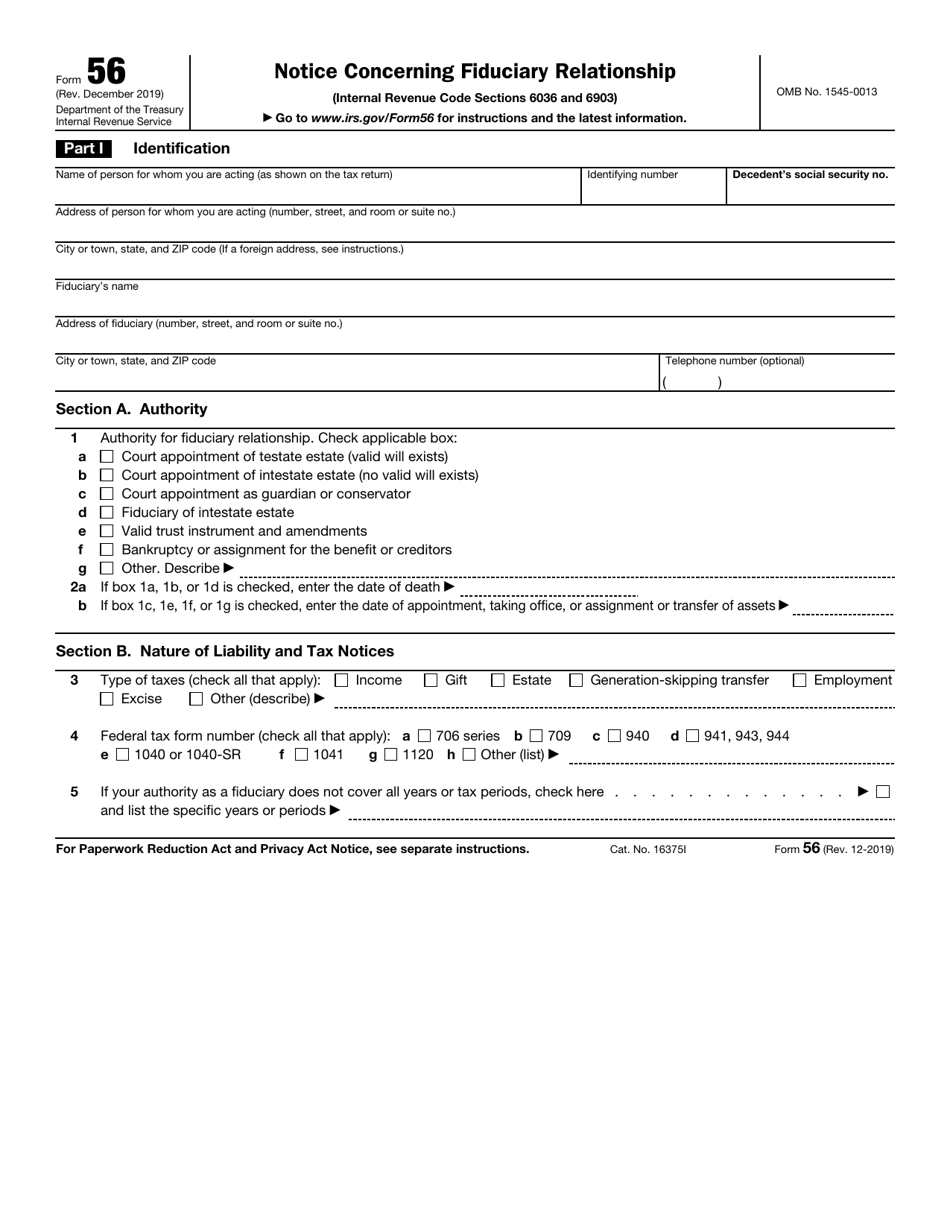

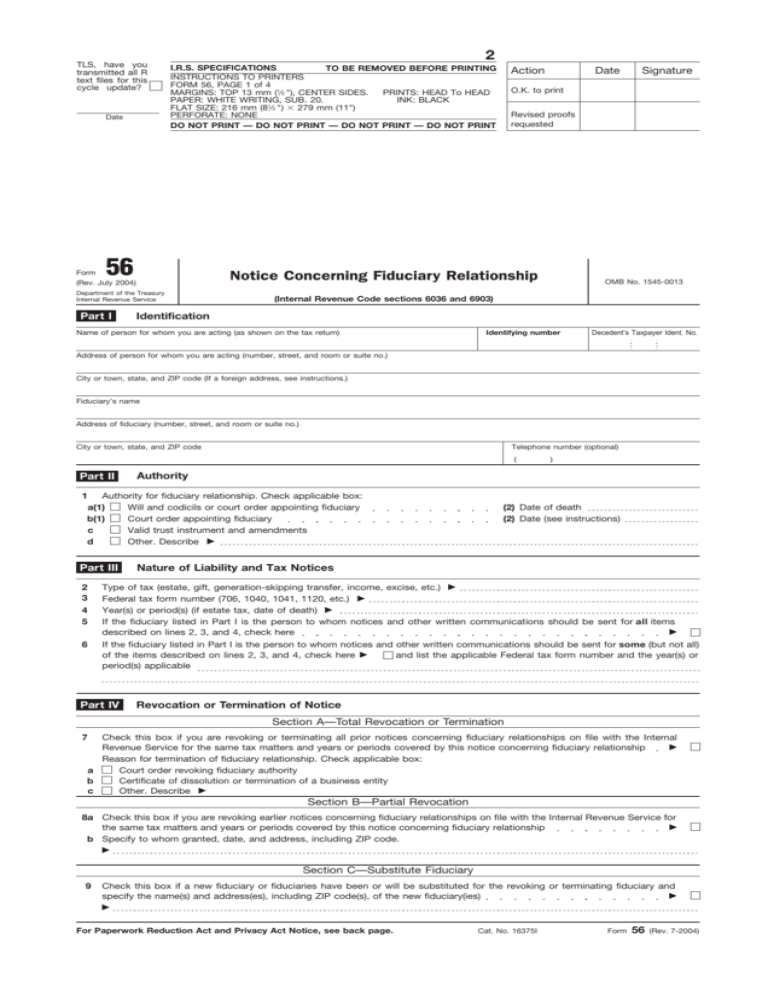

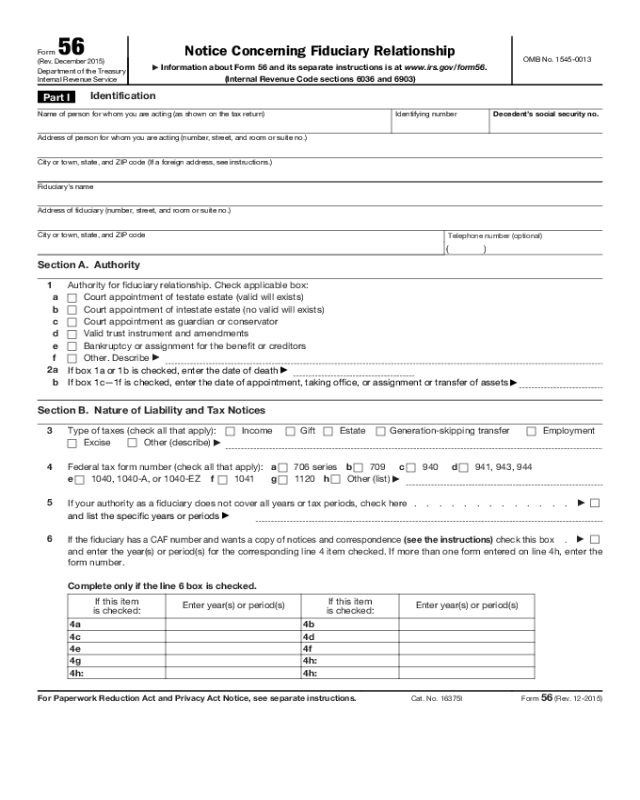

Form 56 IRS Template PDF

Download past year versions of this tax form as pdfs. Form 56, notice concerning fiduciary. Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship. Web per the form 56 instructions: Web per irs instructions for form 56:

IRS Form 56 Download Fillable PDF or Fill Online Notice Concerning

You can download or print. Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for the fiduciary relationship under. Web form 56 when you file your tax return part of the documents is the filing instructions. (a) whether the collection of information is necessary.

IRS form 56Notice Concerning Fiduciary Relationship

Web solved•by intuit•48•updated february 09, 2023. Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for the fiduciary relationship under. If you are appointed to act in a fiduciary capacity for another, you must file a written notice with the irs stating this. Any.

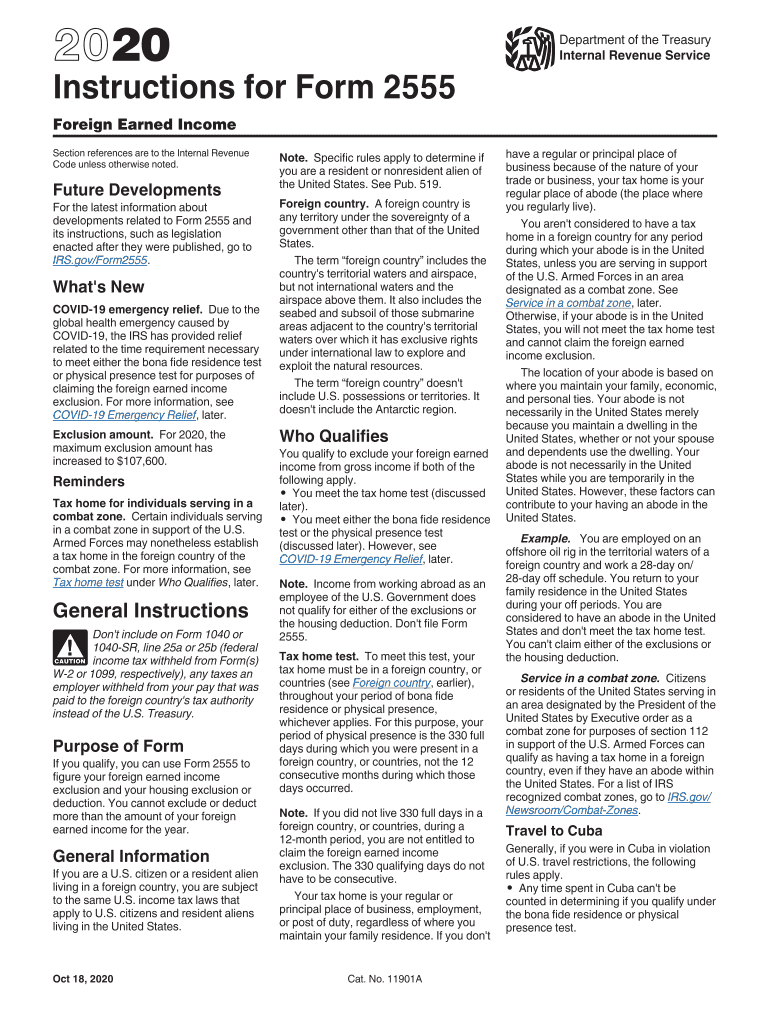

Instructions For Form 2555 Instructions For Form 2555, Foreign Earned

It must be transmitted separately. An executor must file form 56 for the individual decedent, if the executor will be filing a final. If you are appointed to act in a fiduciary capacity for another, you must file a written notice with the irs stating this. Web we last updated the notice concerning fiduciary relationship in december 2022, so this.

Annual Registration Statements (Form 561) SEEDUCATION PUBLIC

Any documents required to be mailed will be included in the filing. August 1997) notice concerning fiduciary relationship department of the treasury internal revenue service (internal revenue code sections. An executor must file form 56 for the individual decedent, if the executor will be filing a final. Web form 56 when you file your tax return part of the documents.

2023 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Web form 56 when you file your tax return part of the documents is the filing instructions. August 1997) notice concerning fiduciary relationship department of the treasury internal revenue service (internal revenue code sections. (a) whether the collection of information is necessary for the proper performance of the functions of the agency, including whether. Web comments are invited on: An.

Form 56 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship. Download past year versions of this tax form as pdfs. Web form 56 omb no. Web per the form 56 instructions: August 1997) notice concerning fiduciary relationship department of the treasury internal revenue service (internal revenue code sections.

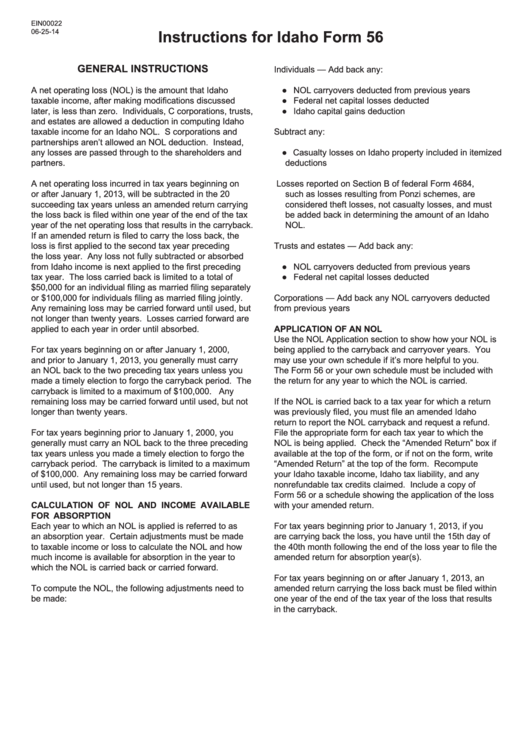

Instructions For Idaho Form 56 printable pdf download

Web solved•by intuit•48•updated february 09, 2023. Form 56 can only be filed from the current year software. Web form 56 omb no. Web per irs instructions for form 56: (a) whether the collection of information is necessary for the proper performance of the functions of the agency, including whether.

form 56 Internal Revenue Service Fiduciary

Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for the fiduciary relationship under. Web per the form 56 instructions: Web.

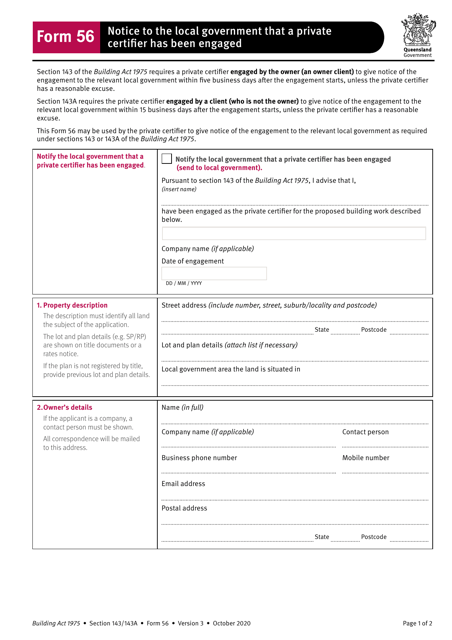

Form 56 Download Fillable PDF or Fill Online Notice to the Local

If you are appointed to act in a fiduciary capacity for another, you must file a written notice with the irs stating this. Web the fiduciary (usually a trustee or an executor) of an estate or trust or a guardian should use this form to notify the irs of the creation or termination of a fiduciary relationship. Any documents required.

Web The Fiduciary (Usually A Trustee Or An Executor) Of An Estate Or Trust Or A Guardian Should Use This Form To Notify The Irs Of The Creation Or Termination Of A Fiduciary Relationship.

Web solved•by intuit•48•updated february 09, 2023. August 1997) notice concerning fiduciary relationship department of the treasury internal revenue service (internal revenue code sections. Web form 56 omb no. An executor must file form 56 for the individual decedent, if the executor will be filing a final.

That Means We Will Be Booking Your Ots Class Assignment Just As Soon As.

Web per irs instructions for form 56: If you are appointed to act in a fiduciary capacity for another, you must file a written notice with the irs stating this. It must be transmitted separately. Web comments are invited on:

Web Per The Form 56 Instructions:

(a) whether the collection of information is necessary for the proper performance of the functions of the agency, including whether. Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship. Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. Web use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift).

Form 56, Notice Concerning Fiduciary.

Download past year versions of this tax form as pdfs. Form 56 can only be filed from the current year software. Any documents required to be mailed will be included in the filing. Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for the fiduciary relationship under.