Form 5695 2022

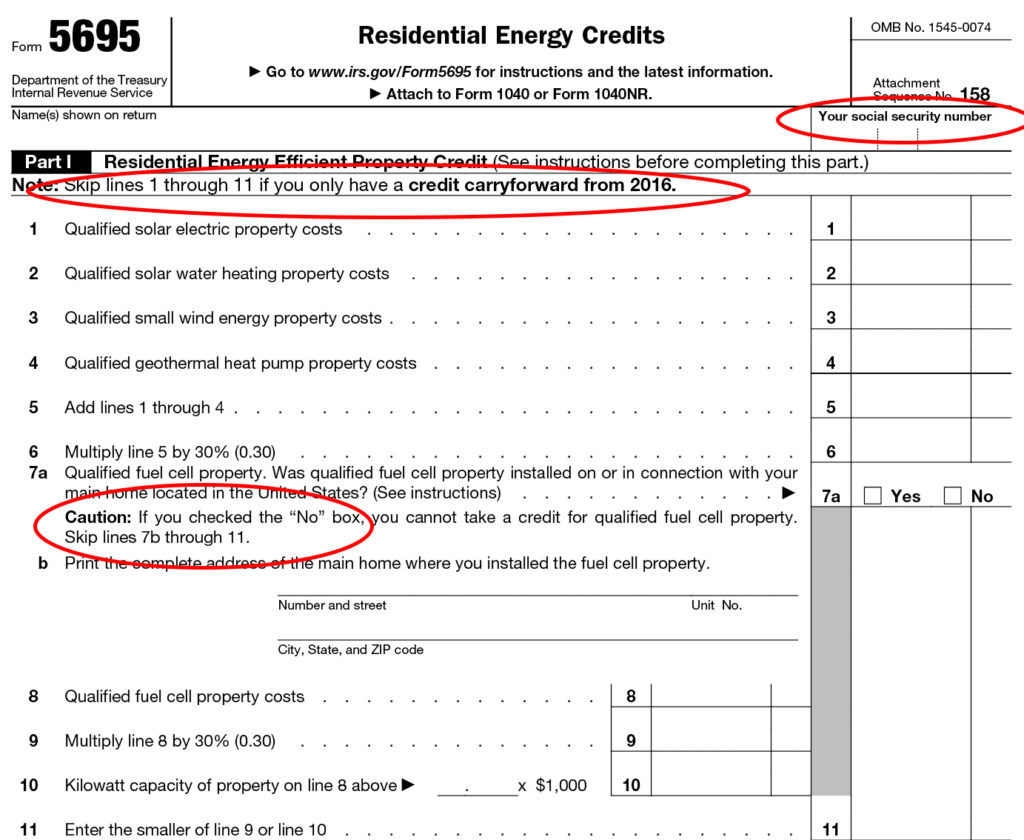

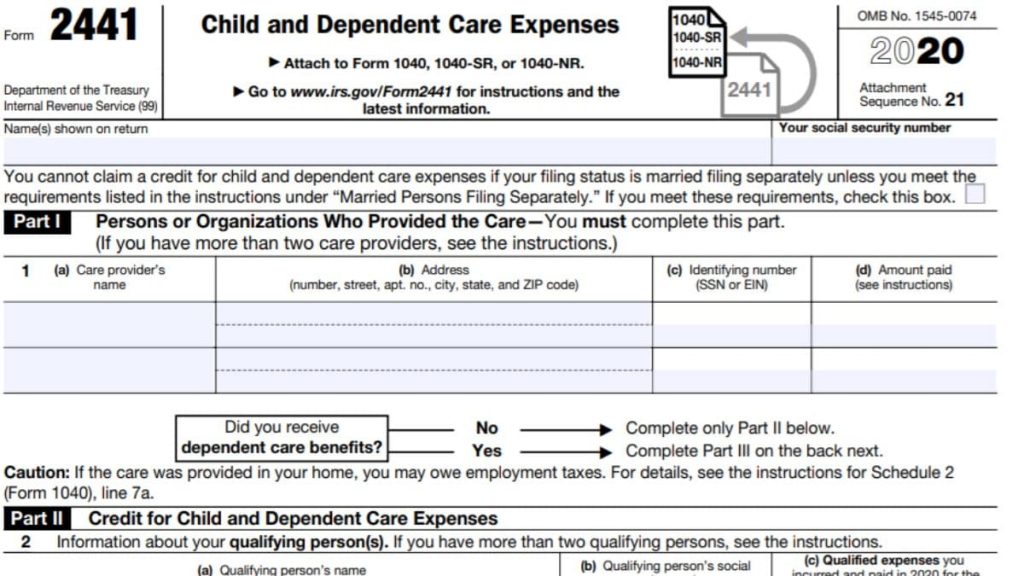

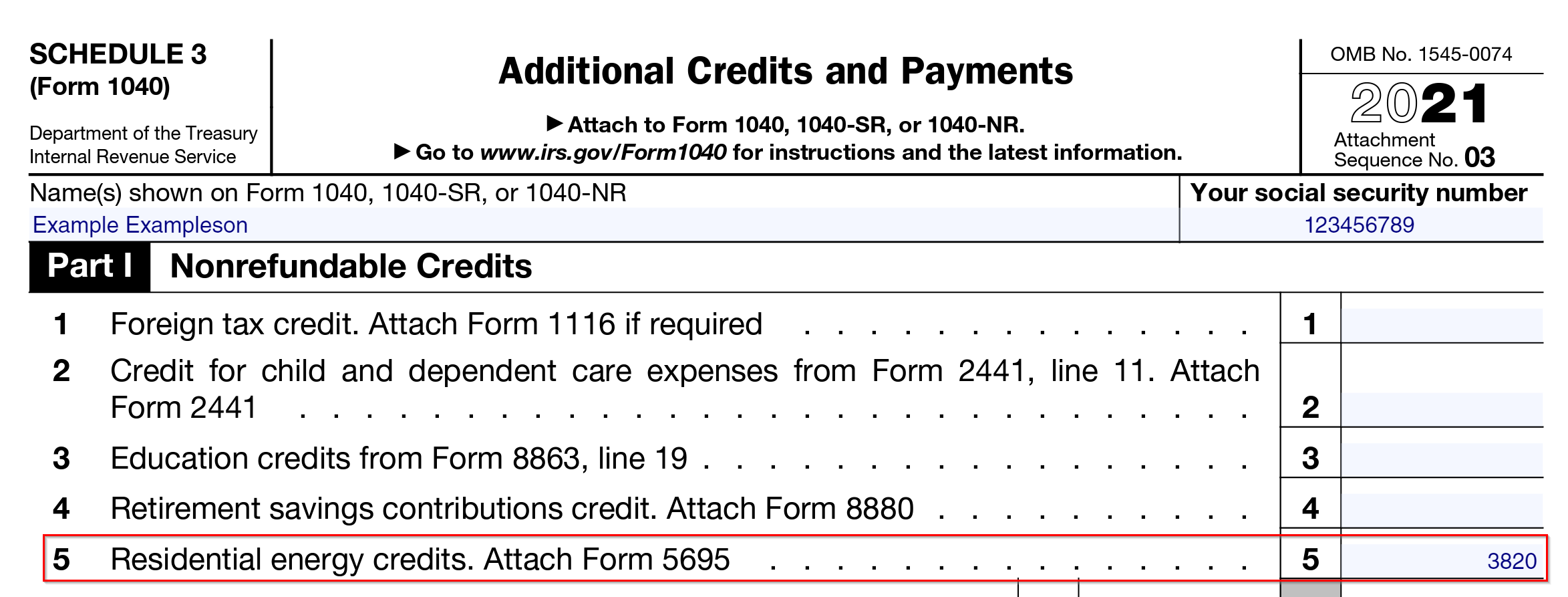

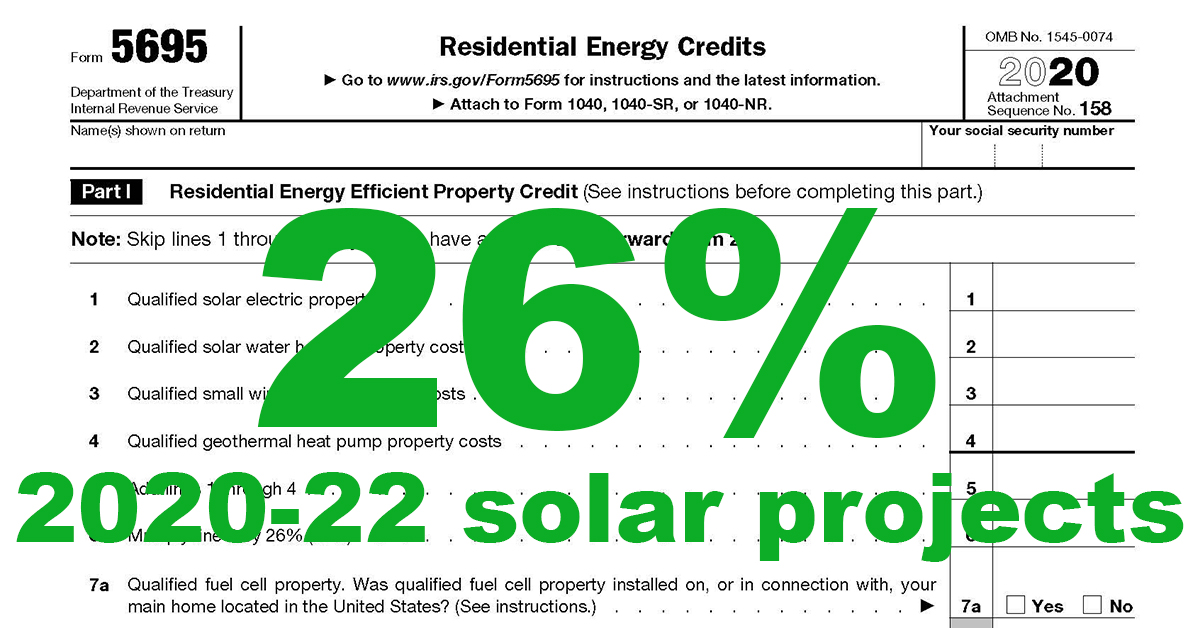

Form 5695 2022 - 1, 2023, the credit equals 30% of certain qualified expenses, including: Qualified energy efficiency improvements installed during the year residential energy property expenses home energy audits Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. 158 name(s) shown on return your social security number part i residential clean energy credit We’ll use $25,000 gross cost. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small wind turbines, and fuel cells. Web the residential clean energy credit, and. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. The residential energy credits are: The residential clean energy credit, and the energy efficient home improvement credit.

Web the residential clean energy credit, and. Web federal tax form 5695 is used to calculate your residential energy credit, and must be submitted alongside form 1040 with your income tax return. 1, 2023, the credit equals 30% of certain qualified expenses, including: Purpose of form use form 5695 to figure and take your residential energy credits. Web for improvements installed in 2022 or earlier: Web what is the irs form 5695? Also use form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023. We’ll use $25,000 gross cost. Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Use previous versions of form 5695.

Web for improvements installed in 2022 or earlier: Two parts cover the two primary tax credits for residential green upgrades. You need to submit it alongside form 1040. Web form 5695 is what you need to fill out to calculate your residential energy tax credits. Use previous versions of form 5695. Web the residential clean energy credit, and. 1, 2023, the credit equals 30% of certain qualified expenses, including: Web what is the irs form 5695? Also use form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023. The energy efficient home improvement credit.

Residential Energy Efficient Property Credit Limit Worksheet

The residential energy credits are: Purpose of form use form 5695 to figure and take your residential energy credits. Two parts cover the two primary tax credits for residential green upgrades. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small wind turbines, and fuel cells..

Form 5695 2021 2022 IRS Forms TaxUni

Use previous versions of form 5695. Also use form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023. Web what is the irs form 5695? Qualified energy efficiency improvements installed during the year residential energy property expenses home energy audits It’s divided into.

Ev Federal Tax Credit Form

Web for improvements installed in 2022 or earlier: Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small wind turbines, and fuel cells. The residential energy credits are: You need to submit it alongside form 1040. Two parts cover the two primary tax credits for residential.

Business Line Of Credit Stated 2022 Cuanmologi

It’s divided into two parts based on the two different tax incentive programs, but you only need to complete whichever portion (s) are relevant to your home improvement project. You need to submit it alongside form 1040. Purpose of form use form 5695 to figure and take your residential energy credits. Web what is the irs form 5695? Qualified energy.

Form 5695 2021 2022 IRS Forms TaxUni

We’ll use $25,000 gross cost. Two parts cover the two primary tax credits for residential green upgrades. 158 name(s) shown on return your social security number part i residential clean energy credit Web the residential clean energy credit, and. Qualified energy efficiency improvements installed during the year residential energy property expenses home energy audits

2021 IRS Form 5695 Fill Online, Printable, Fillable, Blank pdfFiller

The energy efficient home improvement credit. Web for improvements installed in 2022 or earlier: Web department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. We’ll use $25,000 gross cost.

BENNINGTON POOL & HEARTH IRS FORM 5695 RESIDENTIAL ENERGY CREDITS

The residential energy credits are: Qualified energy efficiency improvements installed during the year residential energy property expenses home energy audits Two parts cover the two primary tax credits for residential green upgrades. Purpose of form use form 5695 to figure and take your residential energy credits. The residential clean energy credit, and the energy efficient home improvement credit.

How to file for the solar tax credit IRS Form 5695 instructions (2023)

Also use form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. Purpose of form use form 5695 to figure and take your residential energy.

How to file for the solar tax credit IRS Form 5695 instructions (2023)

The energy efficient home improvement credit. Two parts cover the two primary tax credits for residential green upgrades. Web what is the irs form 5695? Use previous versions of form 5695. Web department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information.

Puget Sound Solar LLC

The residential clean energy credit, and the energy efficient home improvement credit. 158 name(s) shown on return your social security number part i residential clean energy credit Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small wind turbines, and fuel cells. Web department of the.

Web Form 5695 Calculates Tax Credits For A Variety Of Qualified Residential Energy Improvements, Including Geothermal Heat Pumps, Solar Panels, Solar Water Heating, Small Wind Turbines, And Fuel Cells.

158 name(s) shown on return your social security number part i residential clean energy credit Use previous versions of form 5695. Web the residential clean energy credit, and. Web form 5695 is what you need to fill out to calculate your residential energy tax credits.

Web For Improvements Installed In 2022 Or Earlier:

Two parts cover the two primary tax credits for residential green upgrades. Purpose of form use form 5695 to figure and take your residential energy credits. The residential energy credits are: We’ll use $25,000 gross cost.

Web Federal Tax Form 5695 Is Used To Calculate Your Residential Energy Credit, And Must Be Submitted Alongside Form 1040 With Your Income Tax Return.

Also use form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023. Web what is the irs form 5695? Web department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

Web Information About Form 5695, Residential Energy Credits, Including Recent Updates, Related Forms And Instructions On How To File.

The energy efficient home improvement credit. It’s divided into two parts based on the two different tax incentive programs, but you only need to complete whichever portion (s) are relevant to your home improvement project. You need to submit it alongside form 1040. Qualified energy efficiency improvements installed during the year residential energy property expenses home energy audits