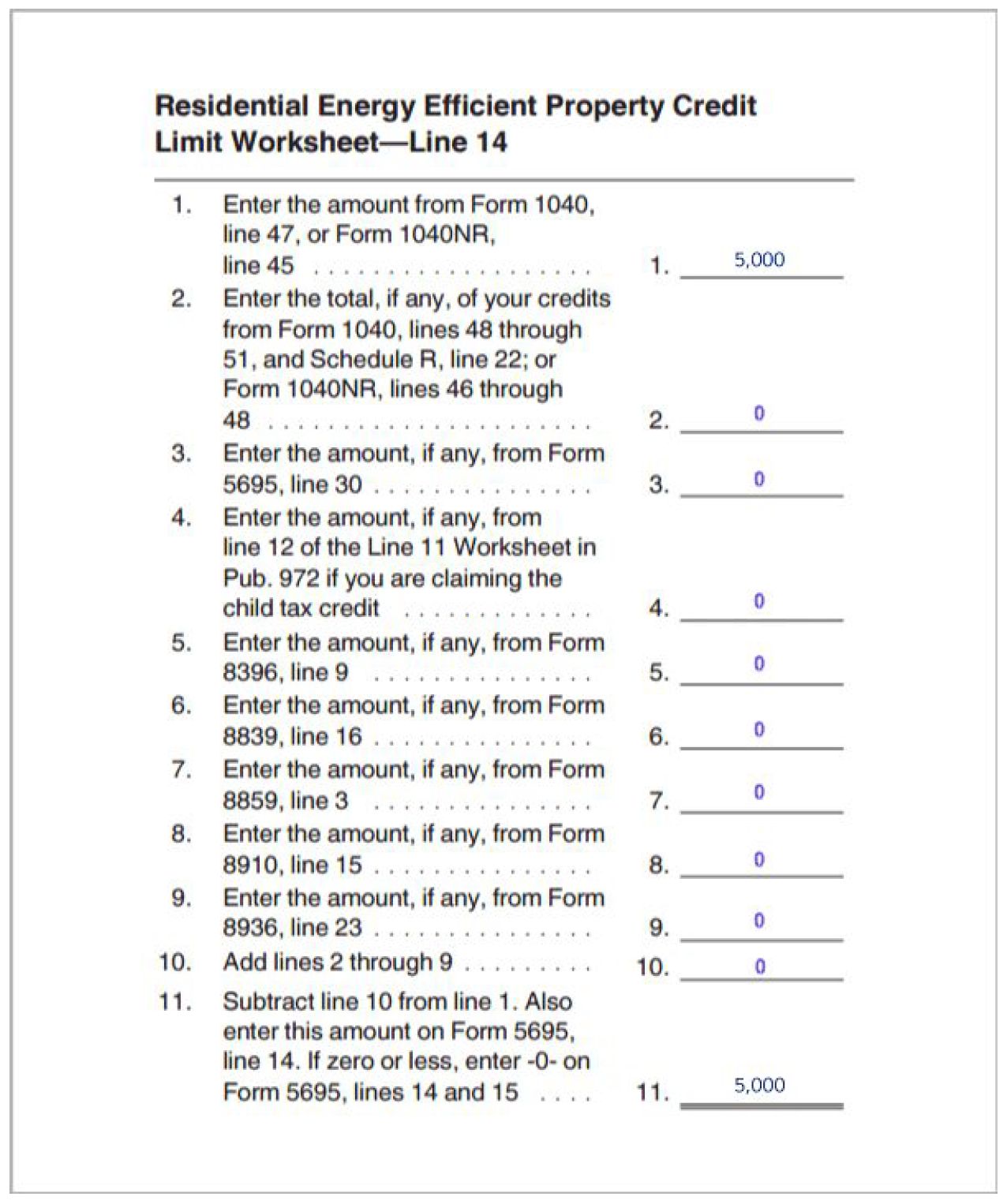

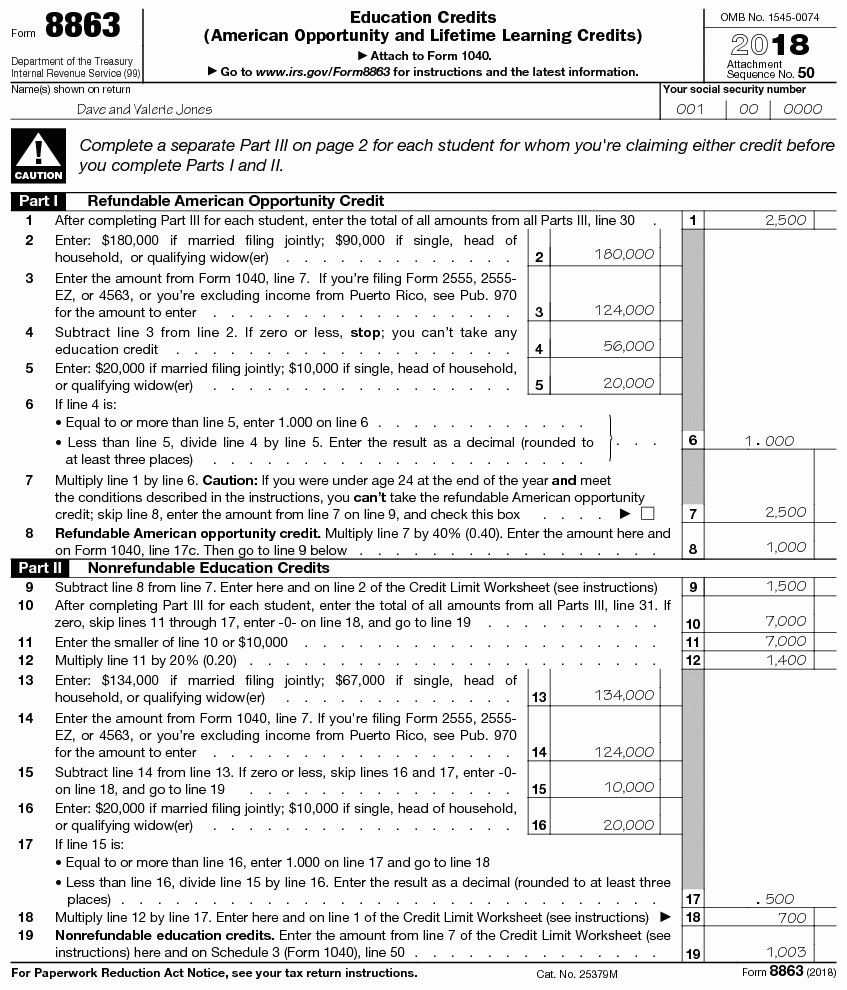

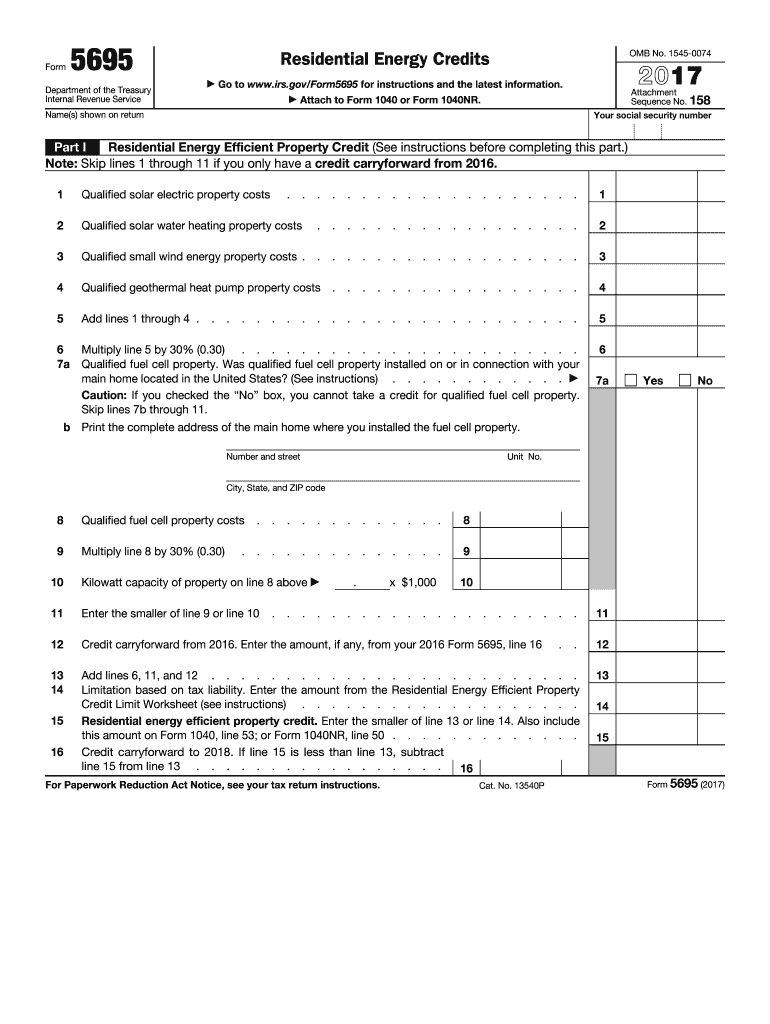

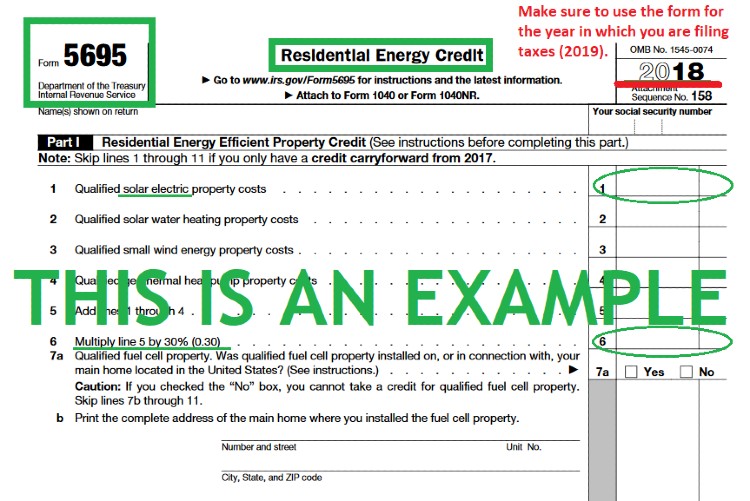

Form 5695 Line 17C

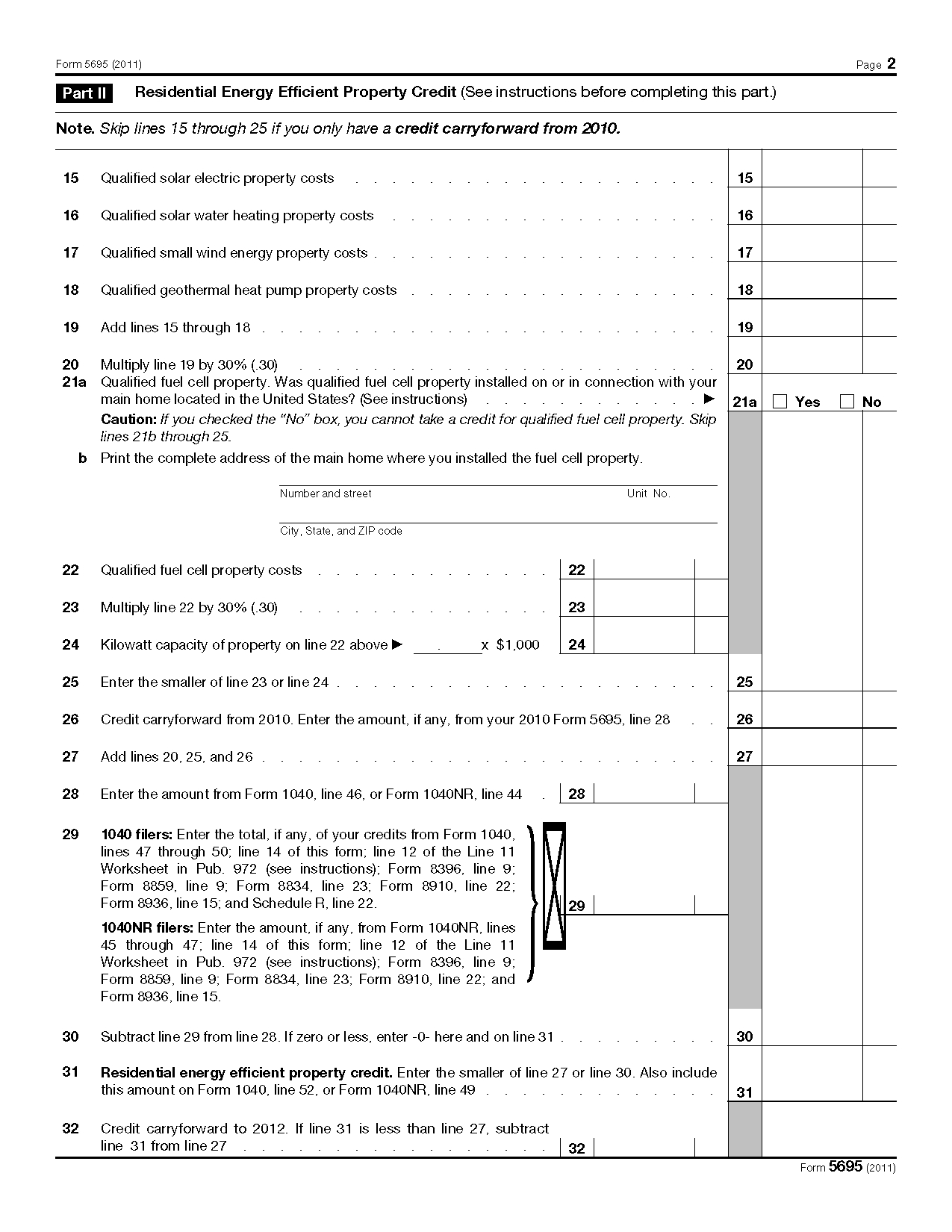

Form 5695 Line 17C - (form 5695, part ii, line 17a). Web purpose of form use form 5695 to figure and take your residential energy credits. The residential energy efficient property credit, and the. Web 17 a were the qualified energy efficiency improvements or residential energy property costs for your main home located in the united states? It contains 1 bedroom and 1. The residential energy credits are: Web purpose of form use form 5695 to figure and take your residential energy credits. The residential energy credits are: Condo located at 317 w 95th st unit 5c, new york, ny 10025 sold for $745,000 on jan 19, 2022. Our templates are regularly updated.

1= some expenses used in construction (form 5695, part ii, line 17c). Web irs form 5695 helps you apply for a credit that is equivalent to 30% of your investment, thus, saving a lot of your energy consumption. Web zestimate® home value: The residential energy credits are: It contains 1 bedroom and 1. Use form 5695 to figure and take. Web purpose of form use form 5695 to figure and take your residential energy credits. The residential energy efficient property credit, and the. 317 w 95th st apt 5c, new york, ny is a condo home that contains 696 sq ft and was built in 1908. Web 1= improvements and costs were not made to main home located in u.s.

The residential energy credits are: Figure the amount to be entered on line 24 of both forms (but not. Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Web enter a 1 in 1= improvements and costs were not made to main home located in u.s. (form 5695, part ii, line 17a). • the residential clean energy credit, and • the energy. The internal revenue service (irs). Web zestimate® home value: • the residential energy efficient property credit, and • the. Web complete lines 17a through 17c and 19 through 24 of a separate form 5695 for each main home.

Instructions for filling out IRS Form 5695 Everlight Solar

• the residential clean energy credit, and • the energy. 1= some expenses used in construction (form 5695, part ii, line 17c). The residential energy credits are: Web enter a 1 in 1= improvements and costs were not made to main home located in u.s. 317 w 95th st apt 5c, new york, ny is a condo home that contains.

Form Instructions Is Available For How To File 5695 2018 —

Web residential energy credits department of the treasury internal revenue service ago to www.irs.gov/form5695for instructions and the latest information. Web purpose of form use form 5695 to figure and take your residential energy credits. Web complete lines 17a through 17c and 19 through 24 of a separate form 5695 for each main home. Web 17 a were the qualified energy.

Energy Efficient Home Improvement Tax Credit 2018 Home Improvement

View sales history, tax history, home value estimates, and overhead. Web purpose of form use form 5695 to figure and take your residential energy credits. Web irs form 5695 helps you apply for a credit that is equivalent to 30% of your investment, thus, saving a lot of your energy consumption. The internal revenue service (irs). Web 17 a were.

How to Claim the Federal Solar Investment Tax Credit Solar Sam

Web irs form 5695 helps you apply for a credit that is equivalent to 30% of your investment, thus, saving a lot of your energy consumption. The residential energy credits are: It contains 1 bedroom and 1. The residential energy efficient property credit, and the. • the residential clean energy credit, and • the energy.

5695 form Fill out & sign online DocHub

View sales history, tax history, home value estimates, and overhead. You can download or print current. Web purpose of form use form 5695 to figure and take your residential energy credits. The residential energy efficient property credit, and the. 317 w 95th st apt 5c, new york, ny is a condo home that contains 696 sq ft and was built.

Form 5695 Instructional YouTube

Use form 5695 to figure and take. (form 5695, part ii, line 17a) enter a 1 in 1= some expenses used in. Our templates are regularly updated. The residential energy credits are: Web purpose of form use form 5695 to figure and take your residential energy credits.

Form 5695 YouTube

View sales history, tax history, home value estimates, and overhead. Web purpose of form use form 5695 to figure and take your residential energy credits. Web department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. Web purpose of form use form 5695 to figure and take your residential energy credits. Web zestimate® home.

Filing For The Solar Tax Credit Wells Solar

You can download or print current. The residential energy credits are: Web purpose of form use form 5695 to figure and take your residential energy credits. Web irs form 5695 helps you apply for a credit that is equivalent to 30% of your investment, thus, saving a lot of your energy consumption. The residential energy credits are:

Ev Federal Tax Credit Form

The residential energy credits are: Web purpose of form use form 5695 to figure and take your residential energy credits. • the residential energy efficient property credit, and • the. Our templates are regularly updated. Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file.

Form 5695 Residential Energy Credits —

You can download or print current. Web follow the simple instructions below: (form 5695, part ii, line 17a). Web purpose of form use form 5695 to figure and take your residential energy credits. Web department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information.

The Residential Energy Efficient Property Credit, And The.

Our templates are regularly updated. Web department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. February 2020) department of the treasury internal revenue service. Web purpose of form use form 5695 to figure and take your residential energy credits.

The Residential Energy Credits Are:

Web purpose of form use form 5695 to figure and take your residential energy credits. Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Web irs form 5695 helps you apply for a credit that is equivalent to 30% of your investment, thus, saving a lot of your energy consumption. Web purpose of form use form 5695 to figure and take your residential energy credits.

Web 1= Improvements And Costs Were Not Made To Main Home Located In U.s.

The residential energy efficient property credit, and the. Condo located at 317 w 95th st unit 5c, new york, ny 10025 sold for $745,000 on jan 19, 2022. Web zestimate® home value: Web purpose of form use form 5695 to figure and take your residential energy credits.

• The Residential Energy Efficient Property Credit, And • The.

Use form 5695 to figure and take. The residential energy credits are: Web complete lines 17a through 17c and 19 through 24 of a separate form 5695 for each main home. The residential energy credits are: