Form 593 Example

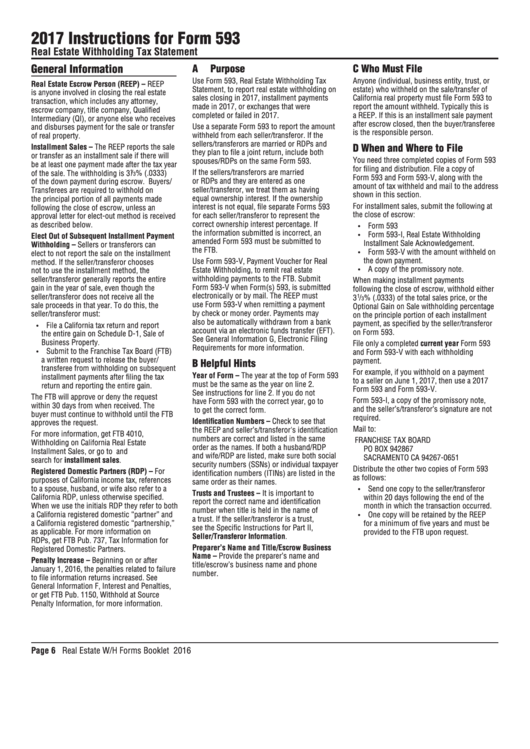

Form 593 Example - Purpose use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that. Web provide a copy of form 593 to seller and qi by due date. Comply with our simple steps to have your form 593 b well prepared quickly: For example, if you withhold on a payment to a seller on june 1, 2020, then. _________________________ part i remitter information • reep • qualified intermediary buyer/transferee. Completing the 593 form 2022 with signnow will give better confidence that. I will complete form 593 for the principal portion of each installment. Web rate the 2021 593 instructions form. Web as of january 1, 2020, california real estate withholding changed. The united states and any of its agencies or instrumentalities.

For example, if you withhold on a payment to a seller on june 1, 2020, then. Web use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2018, installment payments made in 2018, or exchanges that were. Web on form 593, real estate withholding statement, of the principal portion of each installment payment. _________________________ part i remitter information • reep • qualified intermediary buyer/transferee. When the buyer/transferee sends the withholding on the final installment payment, write “final installment payment” on the bottom of side 1 of form 593. I will complete form 593 for the principal portion of each installment. Web serving northern california what can we do for you? Statement, to report real estate withholding . • the transfer of this. Web as of january 1, 2020, california real estate withholding changed.

Web serving northern california what can we do for you? Statement, to report real estate withholding . Purpose use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that. Traditional sales with no exemption from. Web rate the 2021 593 instructions form. I will complete form 593 for the principal portion of each installment. Completing the 593 form 2022 with signnow will give better confidence that. See instructions for form 593, part iv. The united states and any of its agencies or instrumentalities. A familiar title for anyone who has sold or purchased property.

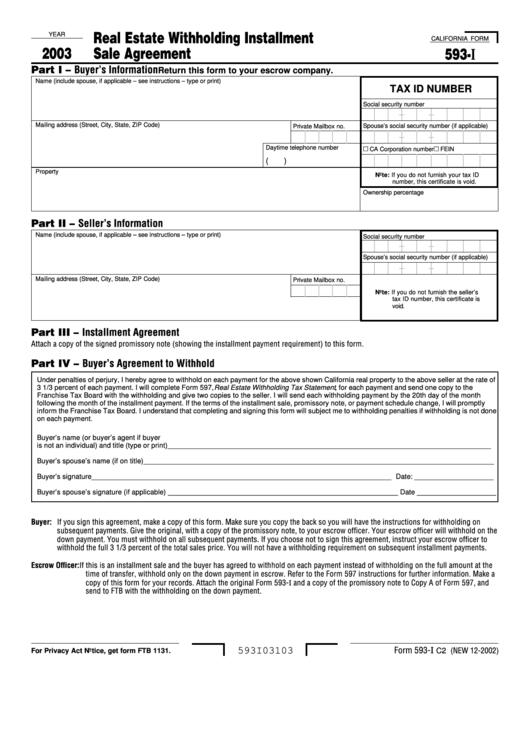

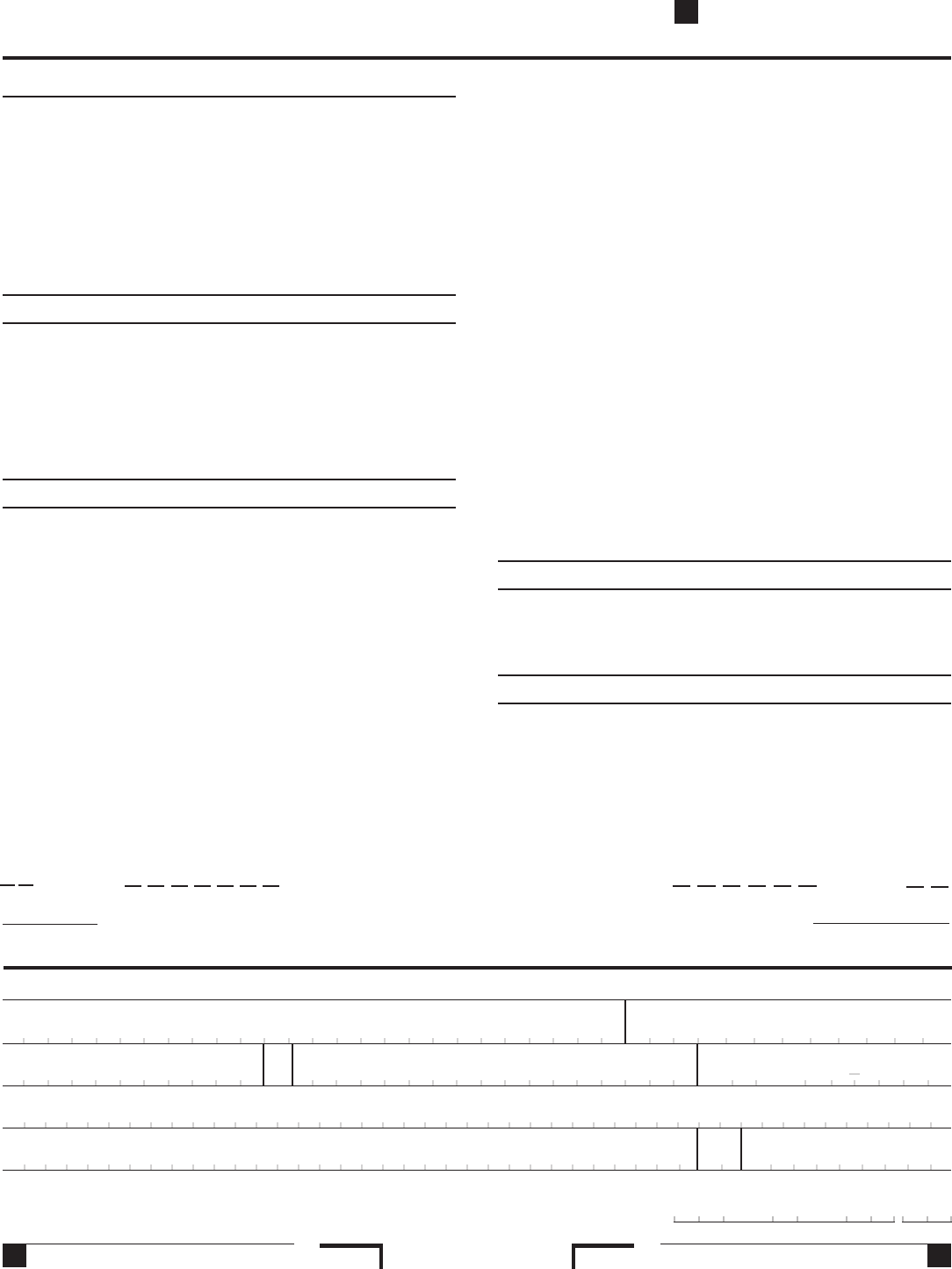

Form 593I Real Estate Withholding Installment Sale Agreement

The united states and any of its agencies or instrumentalities. Web 593 escrow or exchange no. Web as of january 1, 2020, california real estate withholding changed. An explanation for sellers when real estate is sold in california, the state requires that income tax for that sale must be. Web rate the 2021 593 instructions form.

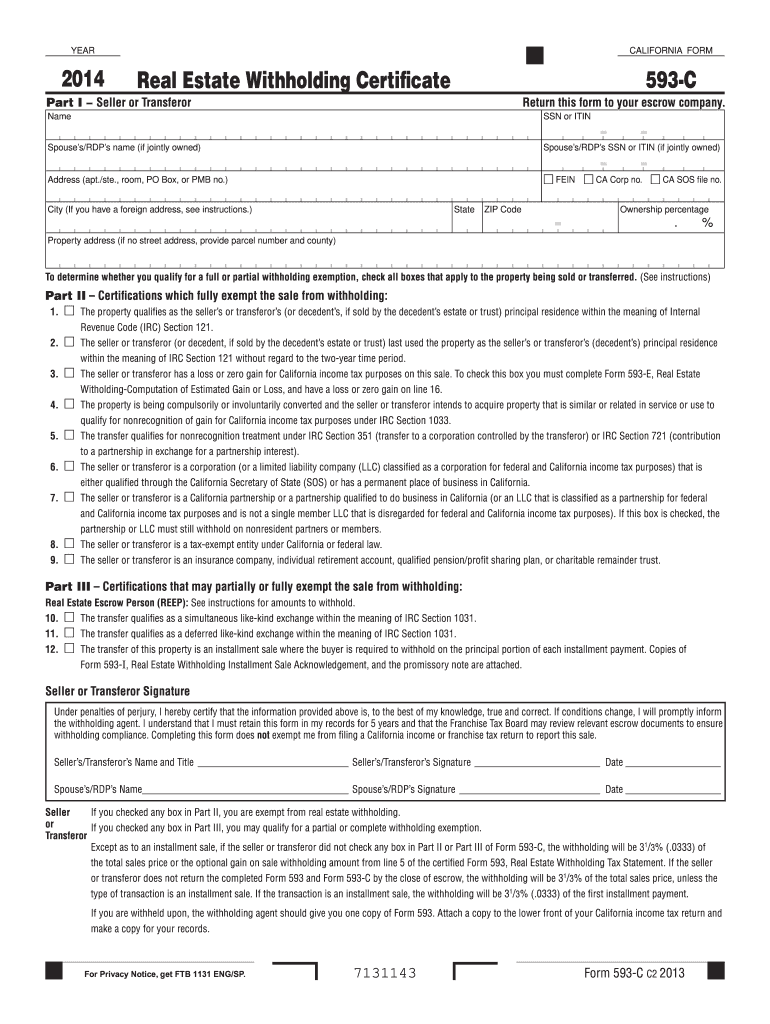

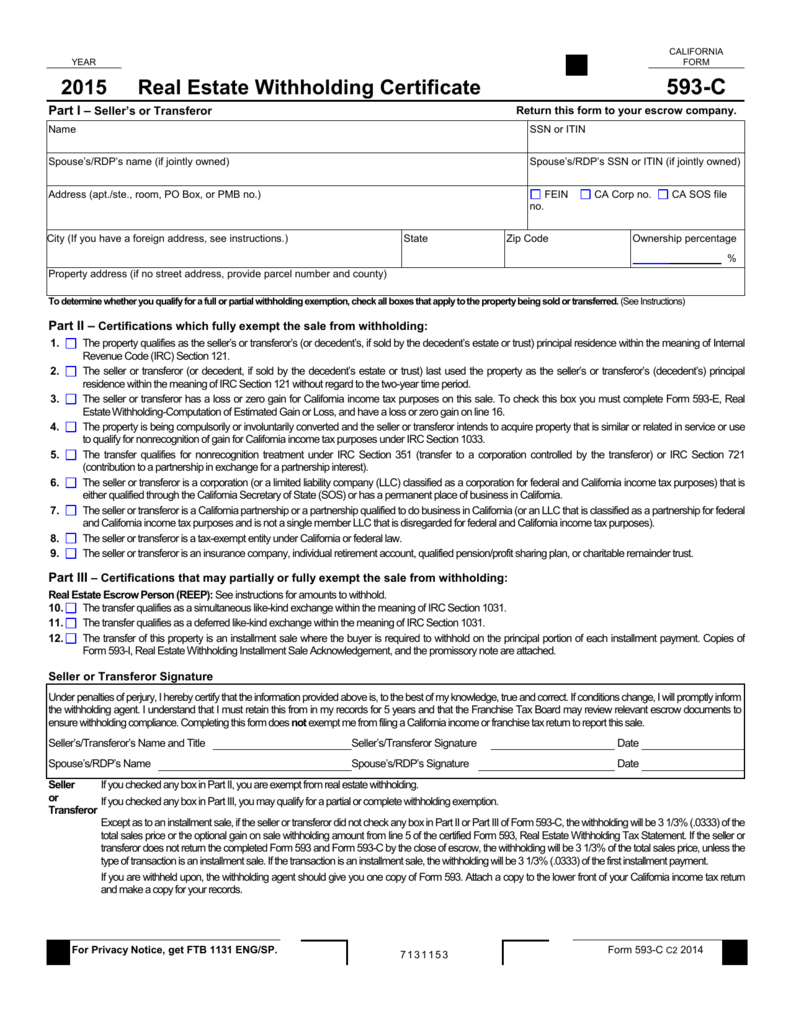

Form 593 C Real Estate Withholding Certificate California Fill Out

We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate. Completing the 593 form 2022 with signnow will give better confidence that. Purpose use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that. • the transfer of this..

Standard Form 593 T 20202022 Fill and Sign Printable Template Online

For example, if you withhold on a payment to a seller on june 1, 2020, then. Transmits the information safely to the servers. Web provide a copy of form 593 to seller and qi by due date. Web as of january 1, 2020, california real estate withholding changed. Traditional sales with no exemption from.

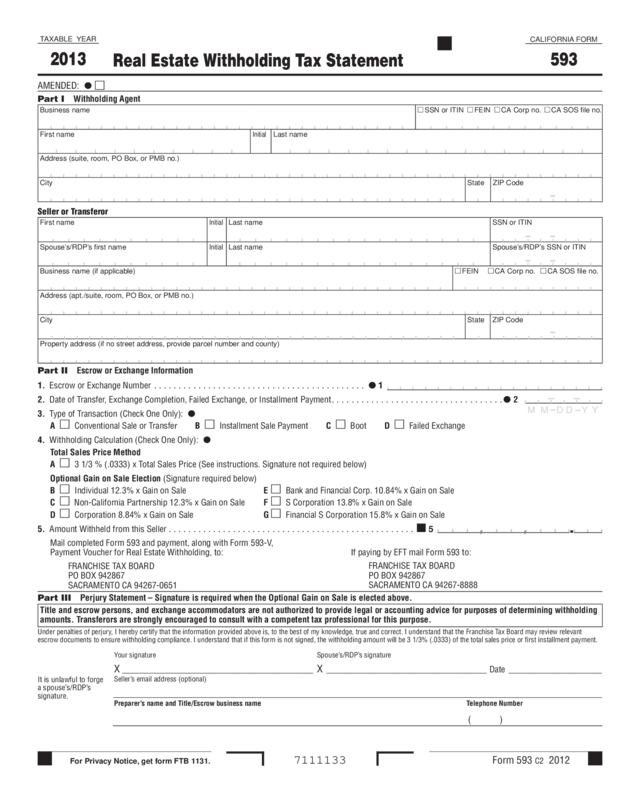

2013 Form 593 Real Estate Withholding Tax Statement Edit, Fill

Web use form 593, real estate withholding tax . Statement, to report real estate withholding . Completing the 593 form 2022 with signnow will give better confidence that. Web 593 escrow or exchange no. A familiar title for anyone who has sold or purchased property.

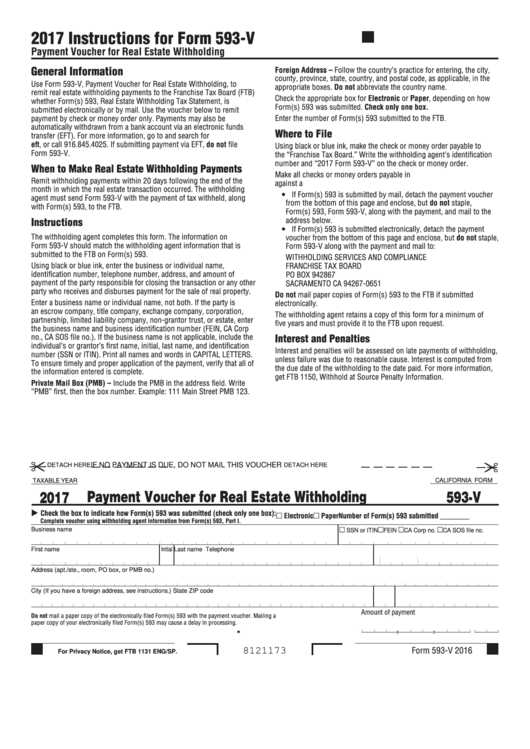

Fillable Form 593V Payment Voucher For Real Estate Withholding

I will complete form 593 for the principal portion of each installment. Purpose use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that. Statement, to report real estate withholding . Transmits the information safely to the servers. Web provide a copy of form 593 to seller and.

Ca Form 593 slidesharetrick

Traditional sales with no exemption from. Completing the 593 form 2022 with signnow will give better confidence that. Comply with our simple steps to have your form 593 b well prepared quickly: I will complete form 593 for the principal portion of each installment. Web provide a copy of form 593 to seller and qi by due date.

Form 593 C slidesharetrick

For example, if you withhold on a payment to a seller on june 1,. For example, if you withhold on a payment to a seller on june 1, 2020, then. A familiar title for anyone who has sold or purchased property. I will complete form 593 for the principal portion of each installment. Statement, to report real estate withholding .

2016 Form 593E Real Estate Withholding Edit, Fill, Sign Online

The united states and any of its agencies or instrumentalities. Comply with our simple steps to have your form 593 b well prepared quickly: Web as of january 1, 2020, california real estate withholding changed. Transmits the information safely to the servers. Statement, to report real estate withholding .

Instructions For Form 593 Real Estate Withholding Tax Statement

Web as of january 1, 2020, california real estate withholding changed. An explanation for sellers when real estate is sold in california, the state requires that income tax for that sale must be. Web use form 593, real estate withholding tax . Web rate the 2021 593 instructions form. • the transfer of this.

Form 593V Franchise Tax Board Edit, Fill, Sign Online Handypdf

Web 593 escrow or exchange no. Traditional sales with no exemption from. Transmits the information safely to the servers. Web use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2018, installment payments made in 2018, or exchanges that were. See instructions for form 593, part iv.

For Example, If You Withhold On A Payment To A Seller On June 1,.

An explanation for sellers when real estate is sold in california, the state requires that income tax for that sale must be. Completing the 593 form 2022 with signnow will give better confidence that. Web on form 593, real estate withholding statement, of the principal portion of each installment payment. Traditional sales with no exemption from.

Comply With Our Simple Steps To Have Your Form 593 B Well Prepared Quickly:

A california form 593 real estate withholding certificate executed by seller (the “ withholding exemption certificate ”). Web provide a copy of form 593 to seller and qi by due date. The united states and any of its agencies or instrumentalities. Web 593 escrow or exchange no.

A Familiar Title For Anyone Who Has Sold Or Purchased Property.

Web use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2018, installment payments made in 2018, or exchanges that were. California law excludes the following entities from withholding: Statement, to report real estate withholding . When the buyer/transferee sends the withholding on the final installment payment, write “final installment payment” on the bottom of side 1 of form 593.

Web Serving Northern California What Can We Do For You?

I will complete form 593 for the principal portion of each installment. Calculating the most accurate 593 form california form 593; Web as of january 1, 2020, california real estate withholding changed. We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate.