Form 712 For Annuity

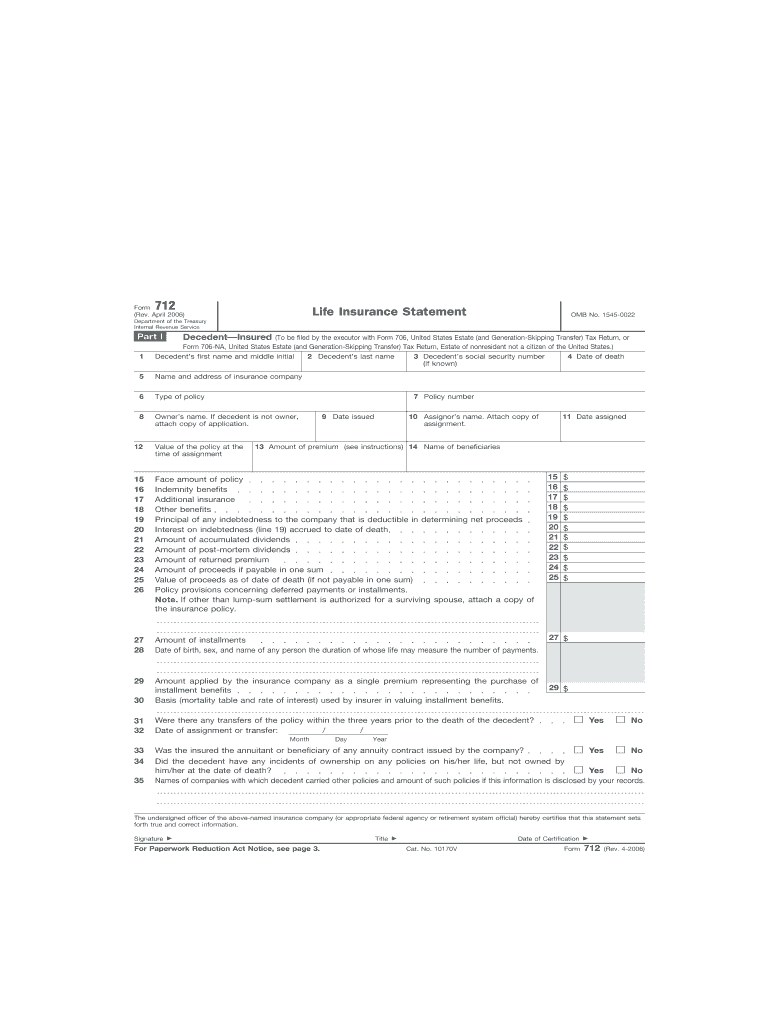

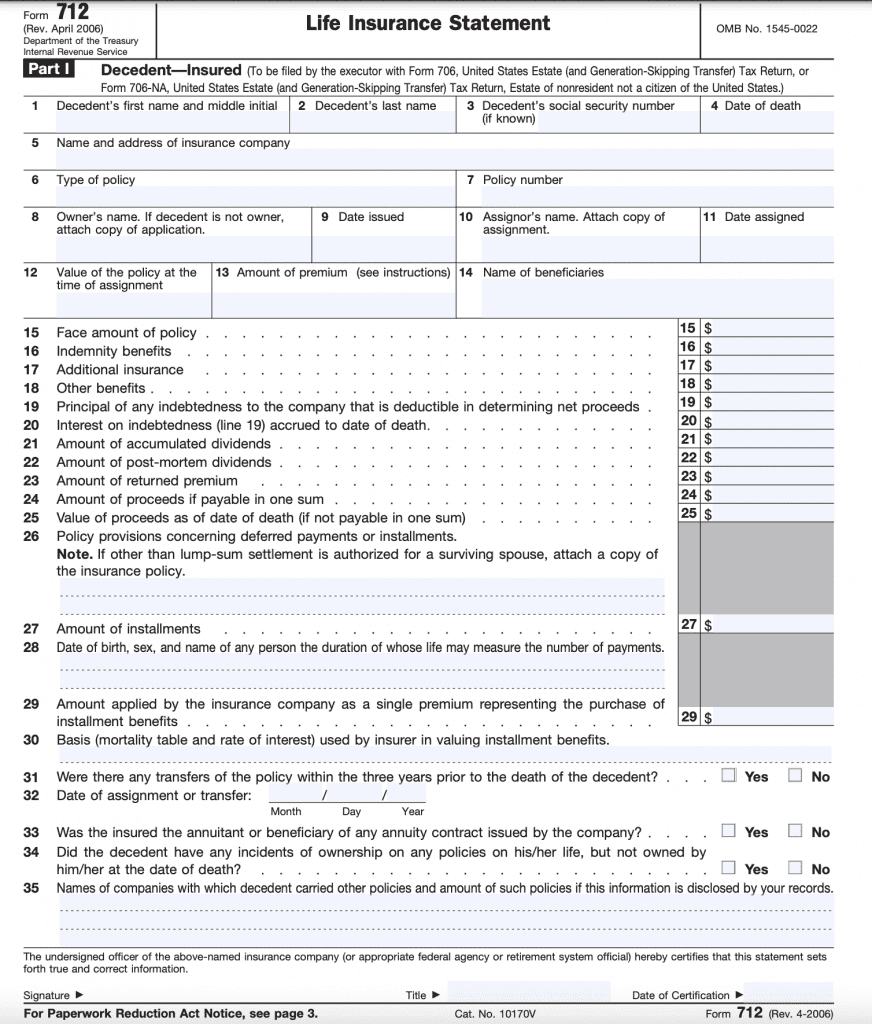

Form 712 For Annuity - Web requested new annuity registration. Estate tax one of an executor's responsibilities is determining the total value of the estate, as estates larger. Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Web examples include form 712, life insurance statement; Web irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Web retirement tax forms for participants certain securities products and services are offered through pruco securities, llc and prudential investment management services, llc, both members sipc and located in newark, nj, or prudential annuities distributors, inc., located in shelton, ct. At the request of the estate’s administrator/executor, we will complete this form to provide the value of the policy as of the date of death. Web form 712 reports the value of life insurance policies for estate tax purposes. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706:

Web examples include form 712, life insurance statement; Web irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Estate tax one of an executor's responsibilities is determining the total value of the estate, as estates larger. Ownership changes on riversource® annuities issued in california with the enhanced legacy® or securesource legacy® benefit require the acknowledgment to be initialed. See statement of financial condition Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Trust and power of appointment instruments;. Web form 712 reports the value of life insurance policies for estate tax purposes. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706:

Web irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. It also asks if the policy was transferred three years prior to the death of the insured. Trust and power of appointment instruments;. Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Web requested new annuity registration. Estate tax one of an executor's responsibilities is determining the total value of the estate, as estates larger. Web retirement tax forms for participants certain securities products and services are offered through pruco securities, llc and prudential investment management services, llc, both members sipc and located in newark, nj, or prudential annuities distributors, inc., located in shelton, ct. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: At the request of the estate’s administrator/executor, we will complete this form to provide the value of the policy as of the date of death. Ownership changes on riversource® annuities issued in california with the enhanced legacy® or securesource legacy® benefit require the acknowledgment to be initialed.

Form 712 Fill Out and Sign Printable PDF Template signNow

Ownership changes on riversource® annuities issued in california with the enhanced legacy® or securesource legacy® benefit require the acknowledgment to be initialed. This form must be signed by all current and new owners or authorized person(s). Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. This form is not filed.

IRS Form 712 A Guide to the Life Insurance Statement

Ownership changes on riversource® annuities issued in california with the enhanced legacy® or securesource legacy® benefit require the acknowledgment to be initialed. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: It also asks if the policy was transferred three years prior to the death of the insured..

IRS Form 712 A Guide to the Life Insurance Statement

Estate tax one of an executor's responsibilities is determining the total value of the estate, as estates larger. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: This form must be signed by all current and new owners or authorized person(s). Web form 712 reports the value of.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

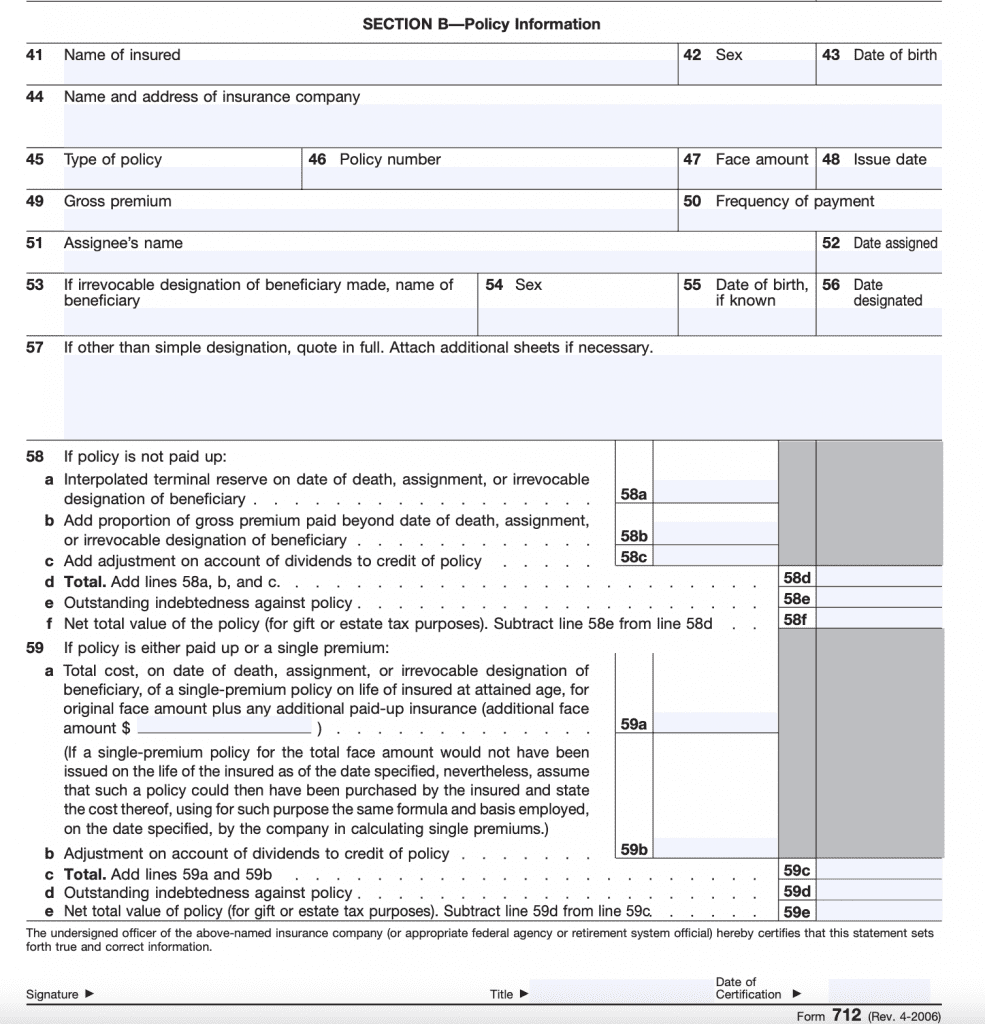

See statement of financial condition Web the purpose of the federal form 712 is to identify the policy's face amount, any accumulated dividends, terminal dividends, the amount of the proceeds, as well as personal information on the insured such as date of birth/death, social security number, and sex. Estate tax one of an executor's responsibilities is determining the total value.

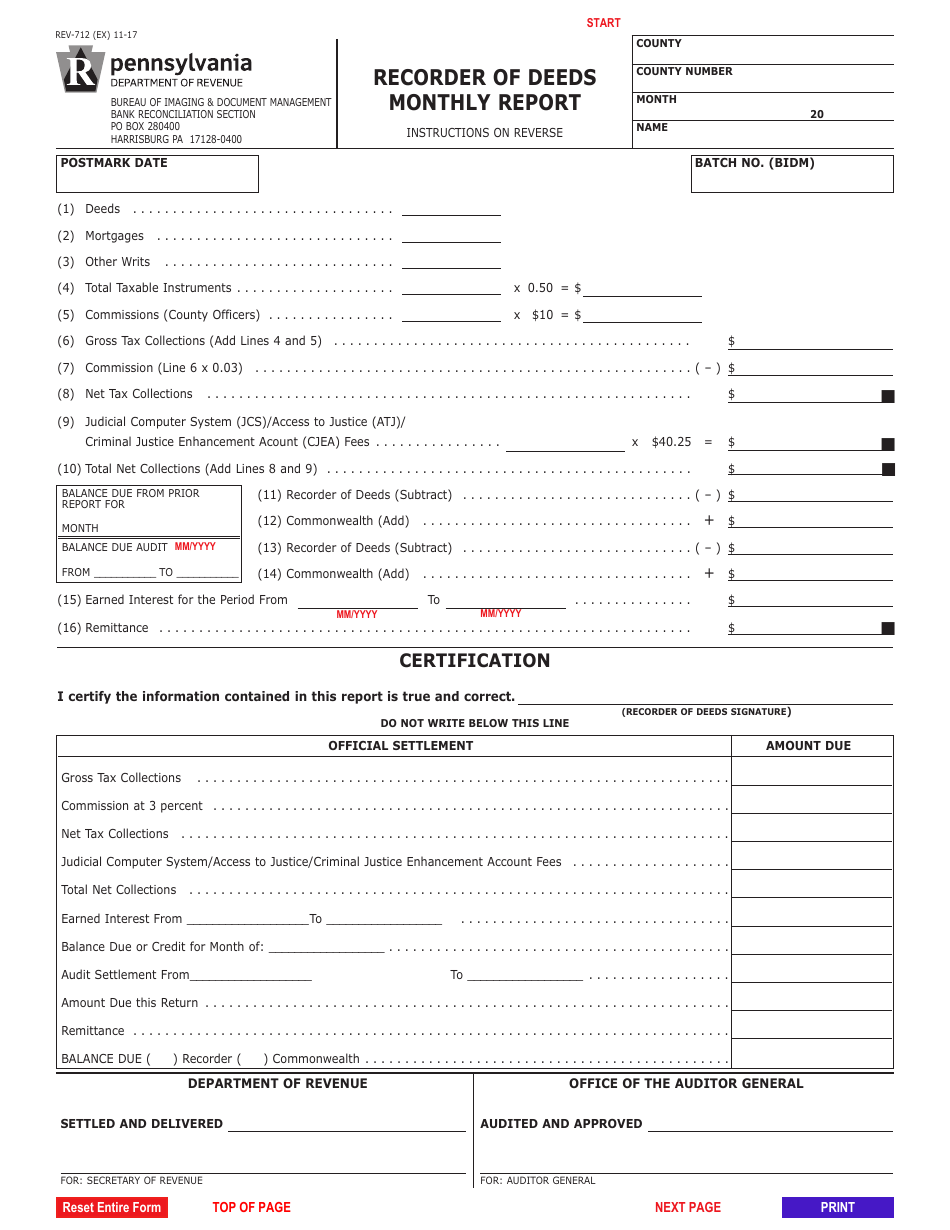

Form REV712 Download Fillable PDF or Fill Online Recorder of Deeds

Ownership changes on riversource® annuities issued in california with the enhanced legacy® or securesource legacy® benefit require the acknowledgment to be initialed. Web form 712 reports the value of life insurance policies for estate tax purposes. This form must be signed by all current and new owners or authorized person(s). Web information about form 712, life insurance statement, including recent.

Ceta Form Bt/1365 13 Mm Manyetik Lokma Uç (Somun Tutucu) 65 Mm

It also asks if the policy was transferred three years prior to the death of the insured. Web retirement tax forms for participants certain securities products and services are offered through pruco securities, llc and prudential investment management services, llc, both members sipc and located in newark, nj, or prudential annuities distributors, inc., located in shelton, ct. Web irs form.

Form 712 Life Insurance Statement (2006) Free Download

Ownership changes on riversource® annuities issued in california with the enhanced legacy® or securesource legacy® benefit require the acknowledgment to be initialed. At the request of the estate’s administrator/executor, we will complete this form to provide the value of the policy as of the date of death. Web the purpose of the federal form 712 is to identify the policy's.

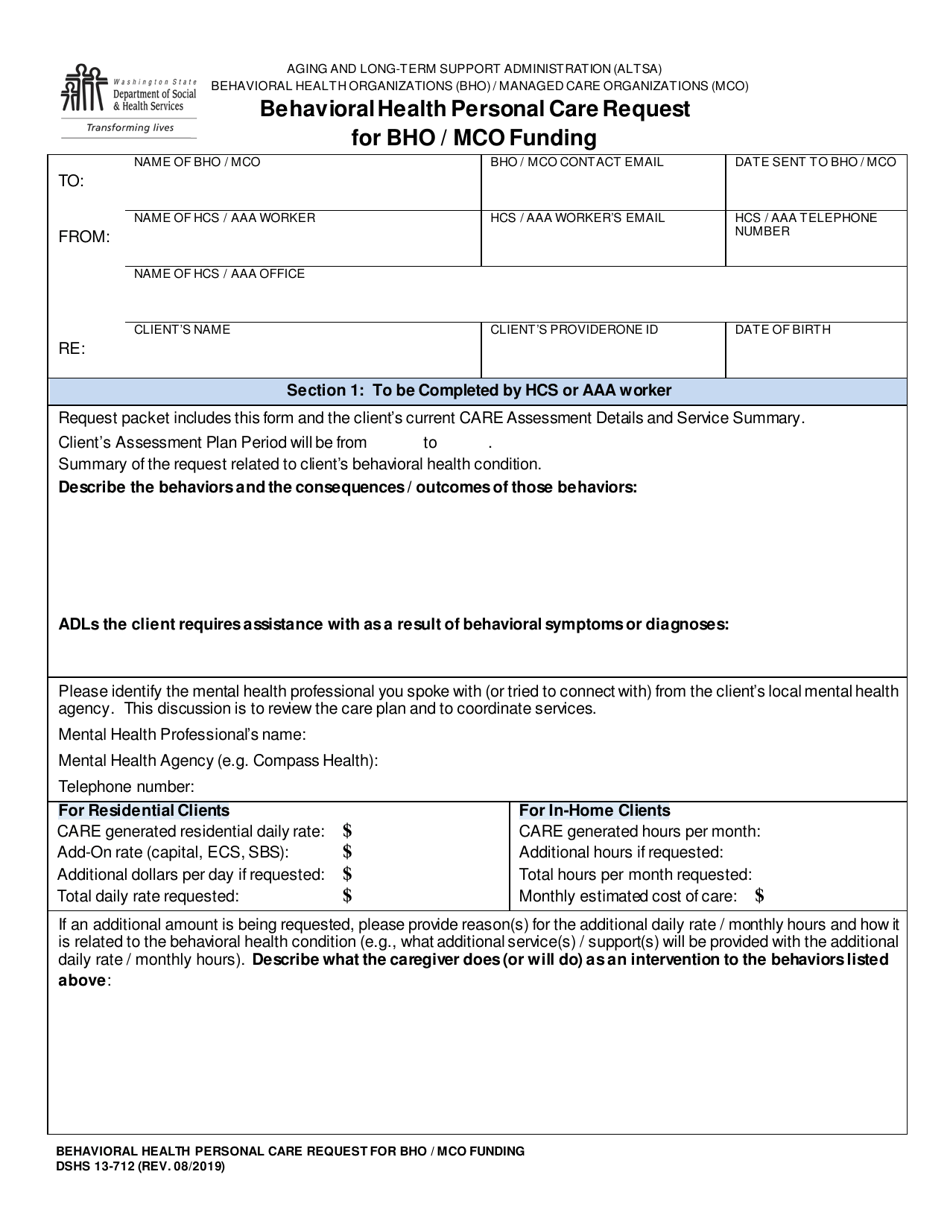

DSHS Form 13712 Download Printable PDF or Fill Online Behavioral

This form must be signed by all current and new owners or authorized person(s). Web the purpose of the federal form 712 is to identify the policy's face amount, any accumulated dividends, terminal dividends, the amount of the proceeds, as well as personal information on the insured such as date of birth/death, social security number, and sex. Web retirement tax.

Form 712 Life Insurance Statement (2006) Free Download

Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. At the request of the estate’s administrator/executor, we will complete this form to provide the value of the policy as of the date of death. Estate tax one of an executor's responsibilities is determining the total value of the estate, as.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

See statement of financial condition At the request of the estate’s administrator/executor, we will complete this form to provide the value of the policy as of the date of death. This form must be signed by all current and new owners or authorized person(s). Web examples include form 712, life insurance statement; Web requested new annuity registration.

Web Irs Form 712 Is An Informational Tax Form That Is Used To Report The Value Of Life Insurance Policies As Part Of An Estate Tax Return.

Web irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Web examples include form 712, life insurance statement; Ownership changes on riversource® annuities issued in california with the enhanced legacy® or securesource legacy® benefit require the acknowledgment to be initialed. Web form 712 reports the value of life insurance policies for estate tax purposes.

Trust And Power Of Appointment Instruments;.

Web retirement tax forms for participants certain securities products and services are offered through pruco securities, llc and prudential investment management services, llc, both members sipc and located in newark, nj, or prudential annuities distributors, inc., located in shelton, ct. See statement of financial condition This form must be signed by all current and new owners or authorized person(s). Web requested new annuity registration.

Web Information About Form 712, Life Insurance Statement, Including Recent Updates, Related Forms, And Instructions On How To File.

It also asks if the policy was transferred three years prior to the death of the insured. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: Web the purpose of the federal form 712 is to identify the policy's face amount, any accumulated dividends, terminal dividends, the amount of the proceeds, as well as personal information on the insured such as date of birth/death, social security number, and sex. Estate tax one of an executor's responsibilities is determining the total value of the estate, as estates larger.