Form 720 Due Date

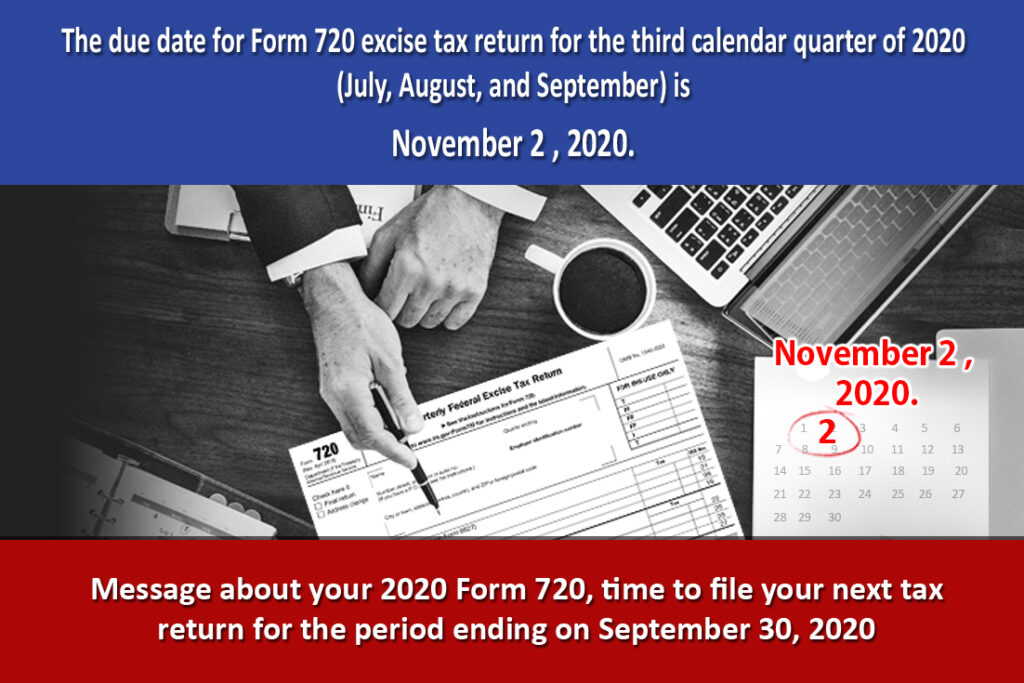

Form 720 Due Date - Web although form 720 is a quarterly return, for pcori, form 720 is filed annually only, by july 31. Deferral until october 31, 2020, for filing and. Web form 720 is a quarterly return that comes due one month after the end of the quarter for which you’re reporting excise taxes. Web by following these steps, you can confidently submit your irs form 720 and fulfill your reporting obligations. Web if the due date for filing form 720 falls on a weekend or legal holiday, you can file by the next business day. June 2023) department of the treasury internal revenue service. The deadlines for filing are april 30th, july 31st, october 31st, and january 31st following the respective quarter. For instructions and the latest information. Web dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date (weekends and holidays considered) tax year Web the form 720 is due on the last day of the month following the end of the quarter.

Web if the due date for filing form 720 falls on a weekend or legal holiday, you can file by the next business day. The deadlines for filing are april 30th, july 31st, october 31st, and january 31st following the respective quarter. See the instructions for form 720. Web dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date (weekends and holidays considered) tax year The 720 tax form is due on a quarterly basis. Due date to file irs form 720 for 2023. Quarterly federal excise tax return. For example, you must file a form 720 by april 30 for the quarter ending on march 31. Web form 720 is a quarterly return that comes due one month after the end of the quarter for which you’re reporting excise taxes. Web by following these steps, you can confidently submit your irs form 720 and fulfill your reporting obligations.

Due date to file irs form 720 for 2023. Web form 720 is a quarterly return that comes due one month after the end of the quarter for which you’re reporting excise taxes. For alternative method taxpayers, the report must be filed by the due date of the form 720 that includes an adjustment to the separate account for the uncollected tax. Web the form 720 is due on the last day of the month following the end of the quarter. See the instructions for form 720. Web by following these steps, you can confidently submit your irs form 720 and fulfill your reporting obligations. Deferral until october 31, 2020, for filing and. Web dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date (weekends and holidays considered) tax year Quarterly federal excise tax return. Paying your excise taxes you must pay excise taxes semimonthly.

Form 720 IRS Authorized Electronic Filing Service

Quarterly federal excise tax return. The deadlines for filing are april 30th, july 31st, october 31st, and january 31st following the respective quarter. Web form 720 is a quarterly return that comes due one month after the end of the quarter for which you’re reporting excise taxes. Due date to file irs form 720 for 2023. Web if the due.

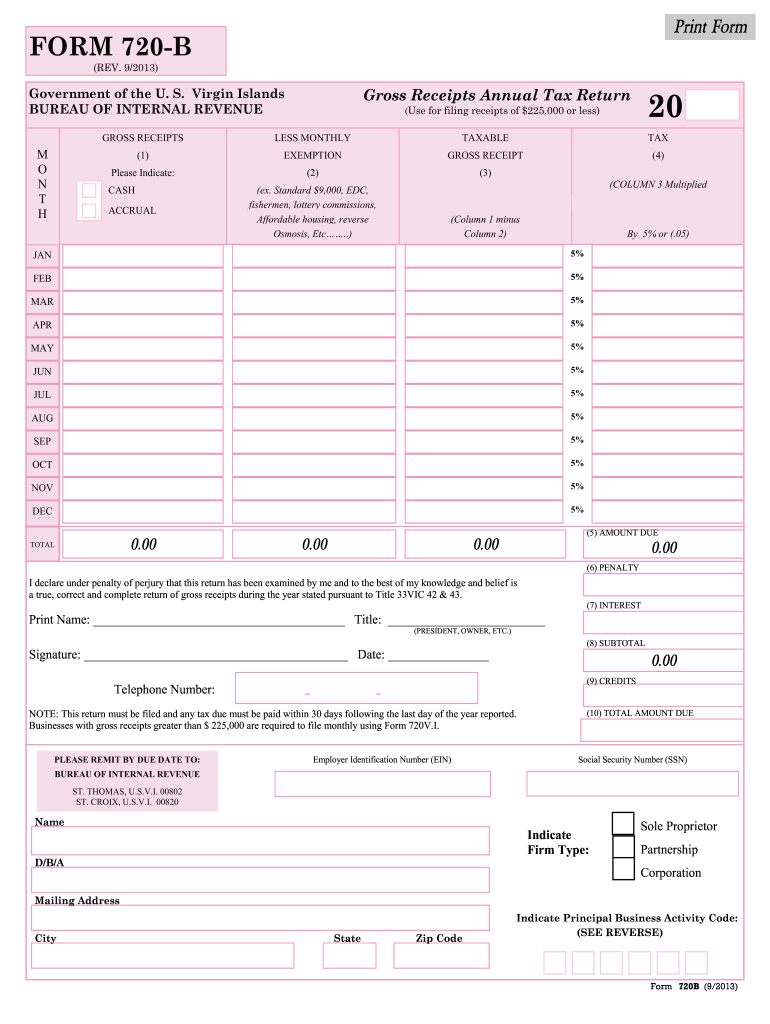

20132022 Form VI 720B Fill Online, Printable, Fillable, Blank pdfFiller

Paying your excise taxes you must pay excise taxes semimonthly. Web form 720 is a quarterly return that comes due one month after the end of the quarter for which you’re reporting excise taxes. The 720 tax form is due on a quarterly basis. Quarterly federal excise tax return. Web although form 720 is a quarterly return, for pcori, form.

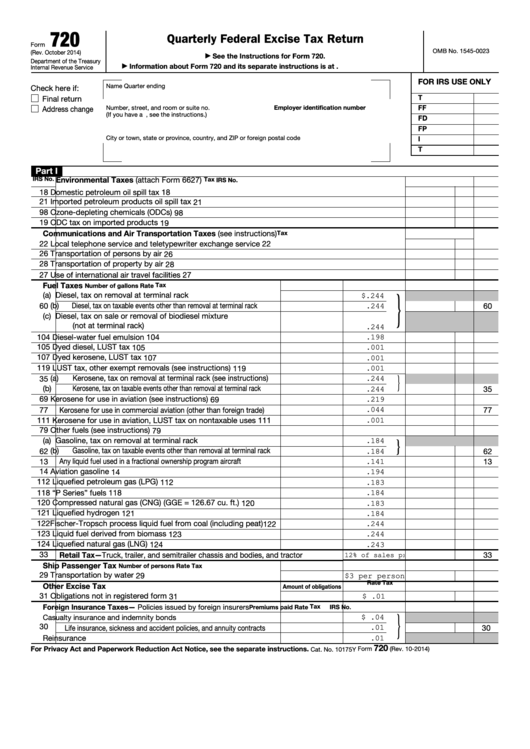

Fillable Form 720 Quarterly Federal Excise Tax Return printable pdf

Web by following these steps, you can confidently submit your irs form 720 and fulfill your reporting obligations. Web for regular method taxpayers, the report must be filed by the due date of the form 720 on which the tax would have been reported. Deferral until october 31, 2020, for filing and. Deferral until october 31, 2020, for filing and.

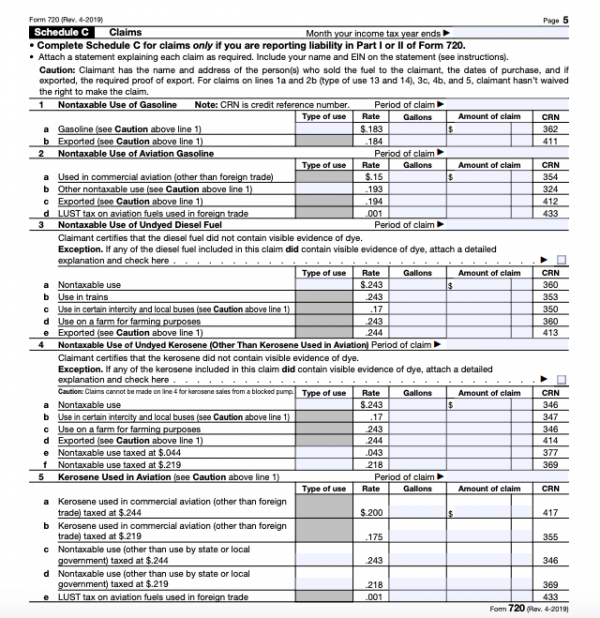

IRS Form 720 Instructions for the PatientCentered Research

Web if the due date for filing form 720 falls on a weekend or legal holiday, you can file by the next business day. Web for regular method taxpayers, the report must be filed by the due date of the form 720 on which the tax would have been reported. For alternative method taxpayers, the report must be filed by.

Form 720 Quarterly Federal Excise Tax Return

Paying your excise taxes you must pay excise taxes semimonthly. For alternative method taxpayers, the report must be filed by the due date of the form 720 that includes an adjustment to the separate account for the uncollected tax. The 720 tax form is due on a quarterly basis. Web if the due date for filing form 720 falls on.

Form 720 Instructions Where to Get IRS Form 720 and How to Fill It Out

Deferral until october 31, 2020, for filing and. For alternative method taxpayers, the report must be filed by the due date of the form 720 that includes an adjustment to the separate account for the uncollected tax. The 720 tax form is due on a quarterly basis. For example, you must file a form 720 by april 30 for the.

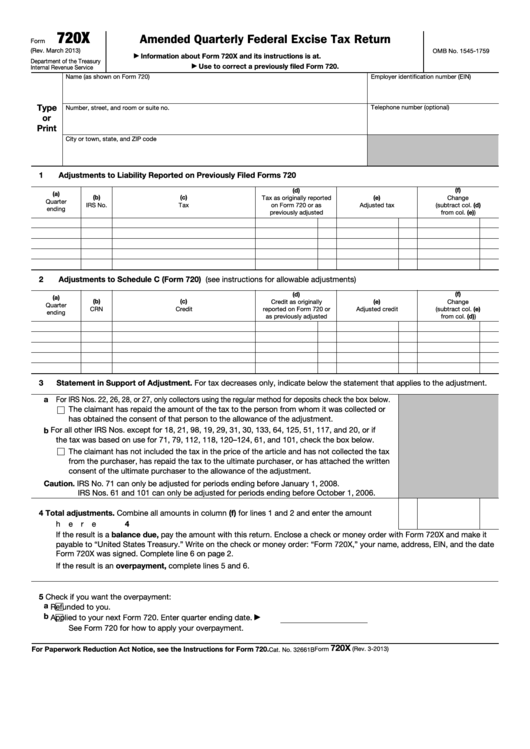

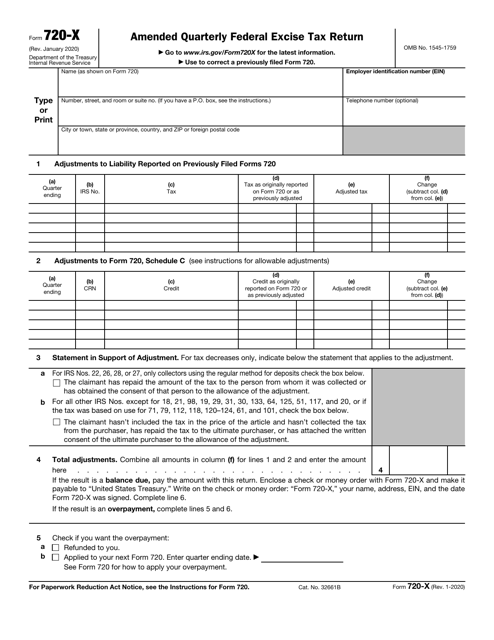

Fillable Form 720X Amended Quarterly Federal Excise Tax Return

Due date to file irs form 720 for 2023. June 2023) department of the treasury internal revenue service. Web for regular method taxpayers, the report must be filed by the due date of the form 720 on which the tax would have been reported. Deferral until october 31, 2020, for filing and paying certain excise taxes for 1st quarter 2020..

IRS Form 720X Download Fillable PDF or Fill Online Amended Quarterly

Web the form 720 is due on the last day of the month following the end of the quarter. Quarterly federal excise tax return. Web although form 720 is a quarterly return, for pcori, form 720 is filed annually only, by july 31. Web for regular method taxpayers, the report must be filed by the due date of the form.

Fill Free fillable Form 720X Amended Quarterly Federal Excise Tax

Web for regular method taxpayers, the report must be filed by the due date of the form 720 on which the tax would have been reported. Paying your excise taxes you must pay excise taxes semimonthly. Deferral until october 31, 2020, for filing and. Due date to file irs form 720 for 2023. Deferral until october 31, 2020, for filing.

How to Complete Form 720 Quarterly Federal Excise Tax Return

For example, you must file a form 720 by april 30 for the quarter ending on march 31. For alternative method taxpayers, the report must be filed by the due date of the form 720 that includes an adjustment to the separate account for the uncollected tax. The deadlines for filing are april 30th, july 31st, october 31st, and january.

See The Instructions For Form 720.

The 720 tax form is due on a quarterly basis. For instructions and the latest information. For alternative method taxpayers, the report must be filed by the due date of the form 720 that includes an adjustment to the separate account for the uncollected tax. Web if the due date for filing form 720 falls on a weekend or legal holiday, you can file by the next business day.

Deferral Until October 31, 2020, For Filing And Paying Certain Excise Taxes For 1St Quarter 2020.

Web the form 720 is due on the last day of the month following the end of the quarter. Quarterly federal excise tax return. Web dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date (weekends and holidays considered) tax year June 2023) department of the treasury internal revenue service.

Web By Following These Steps, You Can Confidently Submit Your Irs Form 720 And Fulfill Your Reporting Obligations.

Web for regular method taxpayers, the report must be filed by the due date of the form 720 on which the tax would have been reported. For example, you must file a form 720 by april 30 for the quarter ending on march 31. Paying your excise taxes you must pay excise taxes semimonthly. The deadlines for filing are april 30th, july 31st, october 31st, and january 31st following the respective quarter.

Web Although Form 720 Is A Quarterly Return, For Pcori, Form 720 Is Filed Annually Only, By July 31.

Due date to file irs form 720 for 2023. Web form 720 is a quarterly return that comes due one month after the end of the quarter for which you’re reporting excise taxes. Deferral until october 31, 2020, for filing and.