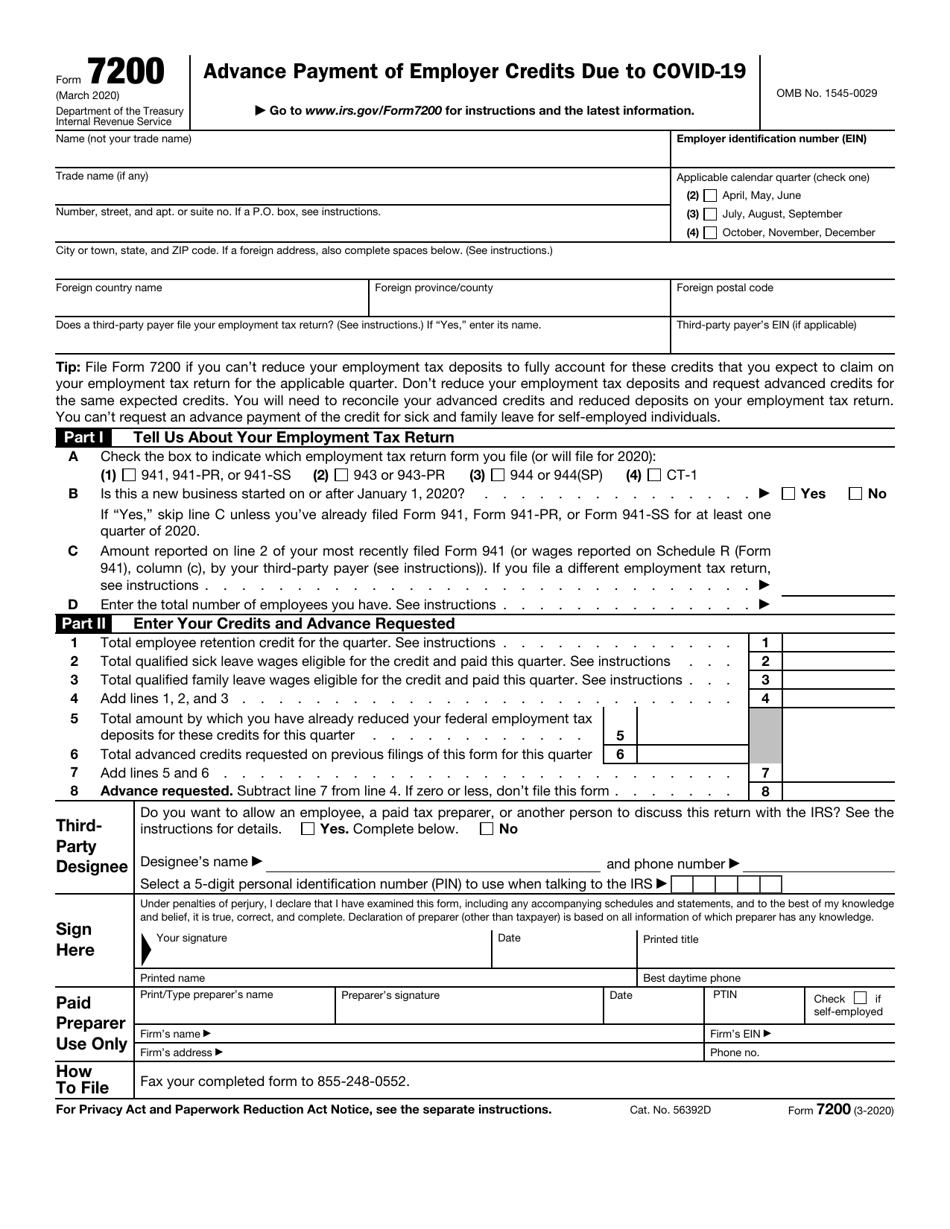

Form 7200 For 2022

Form 7200 For 2022 - A guide to the 7200 for the rest of 2021. Stephanie glanville | august 6, 2021 | read time: Web the last date to file form 7200 is the same whether you file a quarterly form 941, or an annual form 943, 944, or ct‐1. Web the last day to file form 7200 to request an advance payment for the fourth quarter of 2021 is january 31, 2022. Web at the time form 7200 and these instructions went to print, the credit for qualified sick and family leave wages is available for leave taken before october 1, 2021, and the employee. Taxpayers filing a form 941, employer's quarterly federal tax return, may submit a form 7200, advance payment of employer credits due to. Who qualifies for employee retention? Please note the form 7200 fax line will shut. 5 minute (s) | form 7200, tax tips | no comments the. Web last day to file form 7200.

Web at the time form 7200 and these instructions went to print, the credit for qualified sick and family leave wages is available for leave taken before october 1, 2021, and the employee. Please note the form 7200 fax line will shut. Web employers were able to take the credit by filing irs form 7200 to request a payment, or by reducing federal employment tax deposits by any erc amount for which. Web the last day to file form 7200 to request an advance payment for the fourth quarter of 2021 is january 31, 2022. Complete, edit or print tax forms instantly. The document is a final tax return for an. Qualified sick and family leave wages. Web the irs revised form 7200 in january 2021 after the consolidated appropriations act, 2021 (caa) was signed into law because this legislation extended. The last date to file form 7200 is the same whether you file. Taxpayers filing a form 941, employer's quarterly federal tax return, may submit a form 7200, advance payment of employer credits due to.

Web what is the infrastructure investment and jobs act? How does the employee retention tax credit work? Web yes, you can! Do not file form 7200 after january 31, 2022 the last day to file form 7200, advance payment of employer credits. Web the last date to file form 7200 is the same whether you file a quarterly form 941, or an annual form 943, 944, or ct‐1. Ad register and subscribe now to work on your advance payment of employer credits. Web the irs revised form 7200 in january 2021 after the consolidated appropriations act, 2021 (caa) was signed into law because this legislation extended. Web january 31, 2022 will be the last day to efax form 7200. Web form 7200 may be used to request an advance payment of employer credits if the employer's share of social security taxes isn't high enough to immediately use the. Stephanie glanville | august 6, 2021 | read time:

Form 7200 Instructions 2022 StepbyStep TaxRobot

Web employers were able to take the credit by filing irs form 7200 to request a payment, or by reducing federal employment tax deposits by any erc amount for which. Form 7200 is no longer available here; The last date to file form 7200 is the same whether you file. Web the irs revised form 7200 in january 2021 after.

ERTC Form 7200 Alternative ERC Advance Instructions Late Deadline

How does the employee retention tax credit work? Who qualifies for employee retention? Form 7200, advance payment of employer credits due to. Web the irs revised form 7200 in january 2021 after the consolidated appropriations act, 2021 (caa) was signed into law because this legislation extended. Do not file form 7200 after january 31, 2022 the last day to file.

File Form 7200 (Advance Payment of Employer Credits Due to COVID19

Taxpayers that are not recovery startup businesses are not eligible for the employee retention credit for wages paid after. Who qualifies for employee retention? Web january 31, 2022 will be the last day to efax form 7200. Complete, edit or print tax forms instantly. Web employers were able to take the credit by filing irs form 7200 to request a.

Form 7200 Instructions 2022 StepbyStep TaxRobot

Qualified sick and family leave wages. Please note the form 7200 fax line will shut. Complete, edit or print tax forms instantly. Ad register and subscribe now to work on your advance payment of employer credits. Stephanie glanville | august 6, 2021 | read time:

Form 7200 Instructions 2022 StepbyStep TaxRobot

Web yes, you can! Who qualifies for employee retention? Web at the time form 7200 and these instructions went to print, the credit for qualified sick and family leave wages is available for leave taken before october 1, 2021, and the employee. The document is a final tax return for an. 5 minute (s) | form 7200, tax tips |.

StepbyStep Guide Form 7200 Advance Employment Credits BerniePortal

A guide to the 7200 for the rest of 2021. Qualified sick and family leave wages. Web form 7200 may be used to request an advance payment of employer credits if the employer's share of social security taxes isn't high enough to immediately use the. Web the last day to file form 7200 to request an advance payment for the.

77a. Who Can Sign A Form 7200? Should A Taxpayer Submit Additional

Web the irs revised form 7200 in january 2021 after the consolidated appropriations act, 2021 (caa) was signed into law because this legislation extended. Form 7200 is no longer available here; Who qualifies for employee retention? Please note the form 7200 fax line will shut. 5 minute (s) | form 7200, tax tips | no comments the.

IRS Form 7200 2022 IRS Forms

Web form 7200 is an official irs document that allows employers to request advance payment on employer credits for: 5 minute (s) | form 7200, tax tips | no comments the. Web at the time form 7200 and these instructions went to print, the credit for qualified sick and family leave wages is available for leave taken before october 1,.

Why File Form 7200? How Does This Form Work? Blog TaxBandits

Web form 7200 may be used to request an advance payment of employer credits if the employer's share of social security taxes isn't high enough to immediately use the. A guide to the 7200 for the rest of 2021. How does the employee retention tax credit work? Who qualifies for employee retention? The last date to file form 7200 is.

IRS Form 7200 Download Fillable PDF or Fill Online Advance Payment of

Web form 7200 may be used to request an advance payment of employer credits if the employer's share of social security taxes isn't high enough to immediately use the. Ad register and subscribe now to work on your advance payment of employer credits. The last date to file form 7200 is the same whether you file. How does the employee.

Please Note The Form 7200 Fax Line Will Shut.

Stephanie glanville | august 6, 2021 | read time: The document is a final tax return for an. Who qualifies for employee retention? Web form 7200 may be used to request an advance payment of employer credits if the employer's share of social security taxes isn't high enough to immediately use the.

The Last Date To File Form 7200 Is The Same Whether You File.

Form 7200, advance payment of employer credits due to. Ad register and subscribe now to work on your advance payment of employer credits. Web employers were able to take the credit by filing irs form 7200 to request a payment, or by reducing federal employment tax deposits by any erc amount for which. How does the employee retention tax credit work?

Web 7/26/2022 New Updates Changes In Printable Form The Printable 7200 Is Used To Report A Deceased Individual's Final Income Tax Return.

Web at the time form 7200 and these instructions went to print, the credit for qualified sick and family leave wages is available for leave taken before october 1, 2021, and the employee. Web the last date to file form 7200 is the same whether you file a quarterly form 941, or an annual form 943, 944, or ct‐1. Qualified sick and family leave wages. Web what is the infrastructure investment and jobs act?

Web The Irs Revised Form 7200 In January 2021 After The Consolidated Appropriations Act, 2021 (Caa) Was Signed Into Law Because This Legislation Extended.

Web the last day to file form 7200 to request an advance payment for the fourth quarter of 2021 is january 31, 2022. Do not file form 7200 after january 31, 2022 the last day to file form 7200, advance payment of employer credits. Web yes, you can! Web last day to file form 7200.