Form 8023 Instructions

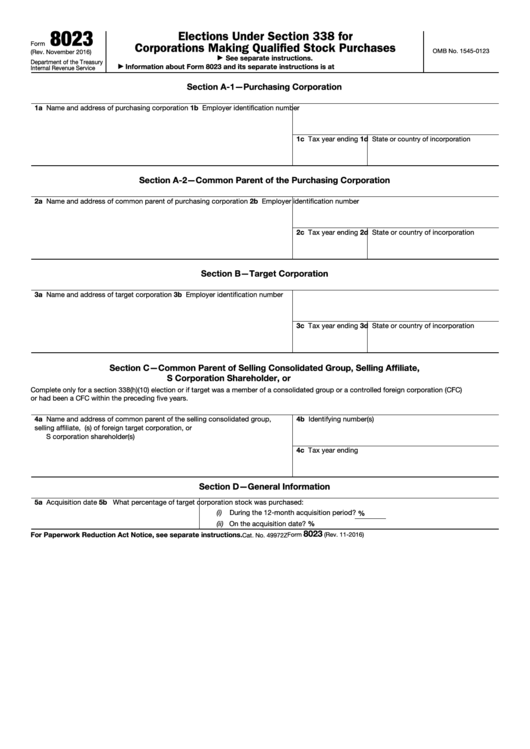

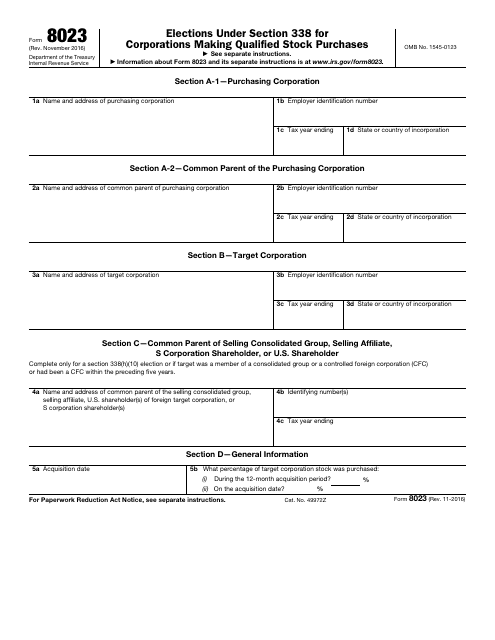

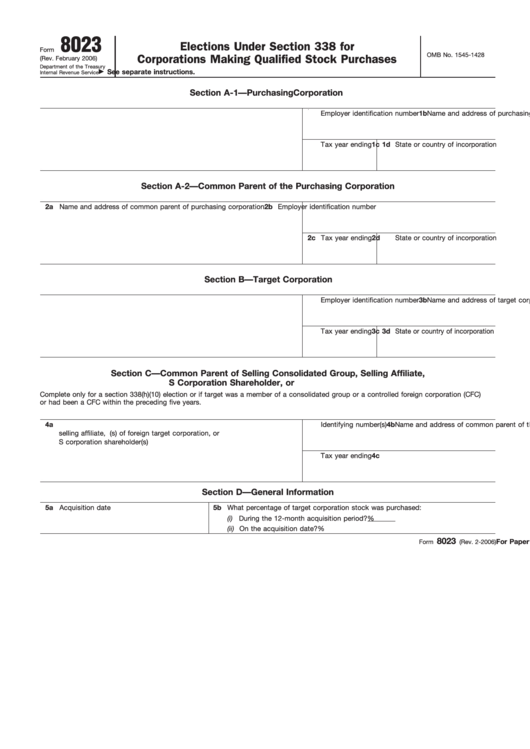

Form 8023 Instructions - Generally, the purchasing corporation must file form 8023. Web who must file. Web about form 8023, elections under section 338 for corporations making qualified stock purchases. Alternatively, form 8023 may be mailed to irs at the address provided in the instructions to. Web the form must be filed if the taxpayer meets both of the following conditions: November 2016) department of the treasury internal revenue service. , the irs is implementing the temporary procedure for fax transmission of form 8023, elections under section 338 for corporations making qualified stock purchases. Selling shareholders if form 8023 is filed for a target Generally, a purchasing corporation must file form 8023 for the target. Purchasing corporations use this form to make elections under section 338 for the target corporation if they made a qualified stock.

Elections under section 338 for corporations making qualified stock purchases. (1) the taxpayer's worldwide gross income (defined in the form's instructions) in the tax year is more than $75,000, and (2) one of three specified criteria (described in the form's instructions) relating to residency in a u.s. Alternatively, form 8023 may be mailed to irs at the address provided in the instructions to. Purchasing corporations use this form to make elections under section 338 for the target corporation if they made a qualified stock. The irs will now accept taxpayers' completed form 8023 sent by fax to +1 844 253 9765. Shareholders of controlled foreign purchasing. If a section 338 (h) (10) election is made for a target, form 8023 must be filed jointly by the purchasing corporation and the common parent of the selling consolidated group (or the selling affiliate or an s corporation shareholder (s)). Web who must file. Web form 8023 must be filed as described in the form and its instructions and also must be attached to the form 5471, “information returns of u.s. Web about form 8023, elections under section 338 for corporations making qualified stock purchases.

Information about form 8023 and its separate instructions is at. Selling shareholders if form 8023 is filed for a target Generally, a purchasing corporation must file form 8023 for the target. Web the form must be filed if the taxpayer meets both of the following conditions: (1) the taxpayer's worldwide gross income (defined in the form's instructions) in the tax year is more than $75,000, and (2) one of three specified criteria (described in the form's instructions) relating to residency in a u.s. Web we last updated the elections under section 338 for corporations making qualified stock purchases in february 2023, so this is the latest version of form 8023, fully updated for tax year 2022. If a section 338 (h) (10) election is made for a target, form 8023 must be filed jointly by the purchasing corporation and the common parent of the selling consolidated group (or the selling affiliate or an s corporation shareholder (s)). Purchasing corporations use this form to make elections under section 338 for the target corporation if they made a qualified stock. November 2016) department of the treasury internal revenue service. , the irs is implementing the temporary procedure for fax transmission of form 8023, elections under section 338 for corporations making qualified stock purchases.

Cms 1500 Claim Form Instructions 2016 Form Resume Examples XE8je6e3Oo

Web about form 8023, elections under section 338 for corporations making qualified stock purchases. Web form 8023 must be filed as described in the form and its instructions and also must be attached to the form 5471, “information returns of u.s. Web the form must be filed if the taxpayer meets both of the following conditions: Web who must file..

Fillable Form 8023 Elections Under Section 338 For Corporations

Persons with respect to certain foreign corporations,” filed with respect to the purchasing corporation by each united states shareholder for the purchasing corporation's taxable year that includes. Web we last updated the elections under section 338 for corporations making qualified stock purchases in february 2023, so this is the latest version of form 8023, fully updated for tax year 2022..

IRS Form 8023 Download Fillable PDF or Fill Online Elections Under

Web form 8023 must be filed as described in the form and its instructions and also must be attached to the form 5471, “information returns of u.s. Information about form 8023 and its separate instructions is at. Web the form must be filed if the taxpayer meets both of the following conditions: Web we last updated the elections under section.

Form 8023 Elections under Section 338 for Corporations Making

Selling shareholders if form 8023 is filed for a target Generally, a purchasing corporation must file form 8023 for the target. Web who must file. Web about form 8023, elections under section 338 for corporations making qualified stock purchases. Alternatively, form 8023 may be mailed to irs at the address provided in the instructions to.

Cms 1500 Form Instructions 2016 Form Resume Examples MoYoGlEYZB

November 2016) department of the treasury internal revenue service. Web form 8023 must be filed as described in the form and its instructions and also must be attached to the form 5471, “information returns of u.s. Special instructions for foreign purchasing corporations. The irs will now accept taxpayers' completed form 8023 sent by fax to +1 844 253 9765. Purchasing.

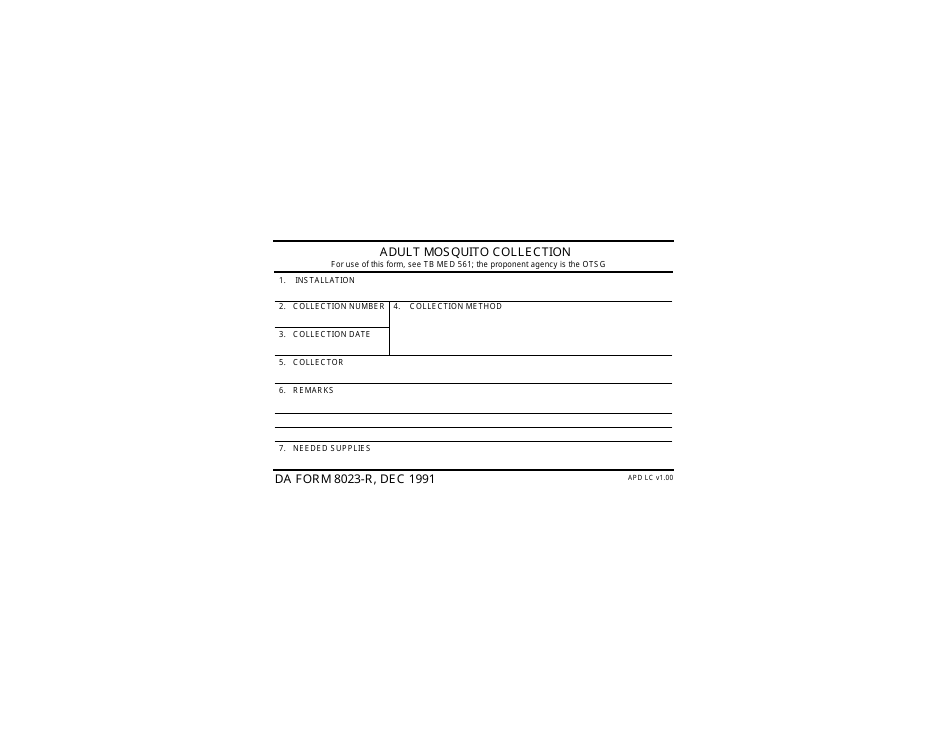

DA Form 8023r Download Fillable PDF or Fill Online Adult Mosquito

Selling shareholders if form 8023 is filed for a target Persons with respect to certain foreign corporations,” filed with respect to the purchasing corporation by each united states shareholder for the purchasing corporation's taxable year that includes. Web the form must be filed if the taxpayer meets both of the following conditions: Shareholders of controlled foreign purchasing. Elections under section.

Fillable Form 8023 Elections Under Section 338 For Corporations

Generally, a purchasing corporation must file form 8023 for the target. Generally, the purchasing corporation must file form 8023. November 2016) department of the treasury internal revenue service. Persons with respect to certain foreign corporations,” filed with respect to the purchasing corporation by each united states shareholder for the purchasing corporation's taxable year that includes. The irs will now accept.

Health Screening Forms (COVID Form)

Persons with respect to certain foreign corporations,” filed with respect to the purchasing corporation by each united states shareholder for the purchasing corporation's taxable year that includes. Special instructions for foreign purchasing corporations. Generally, the purchasing corporation must file form 8023. Alternatively, form 8023 may be mailed to irs at the address provided in the instructions to. Web the form.

Form 8023 Elections under Section 338 for Corporations Making

Shareholders of controlled foreign purchasing. November 2016) department of the treasury internal revenue service. Unless otherwise specifically noted, the general rules and requirements in these instructions apply to foreign purchasing corporations. Generally, the purchasing corporation must file form 8023. Selling shareholders if form 8023 is filed for a target

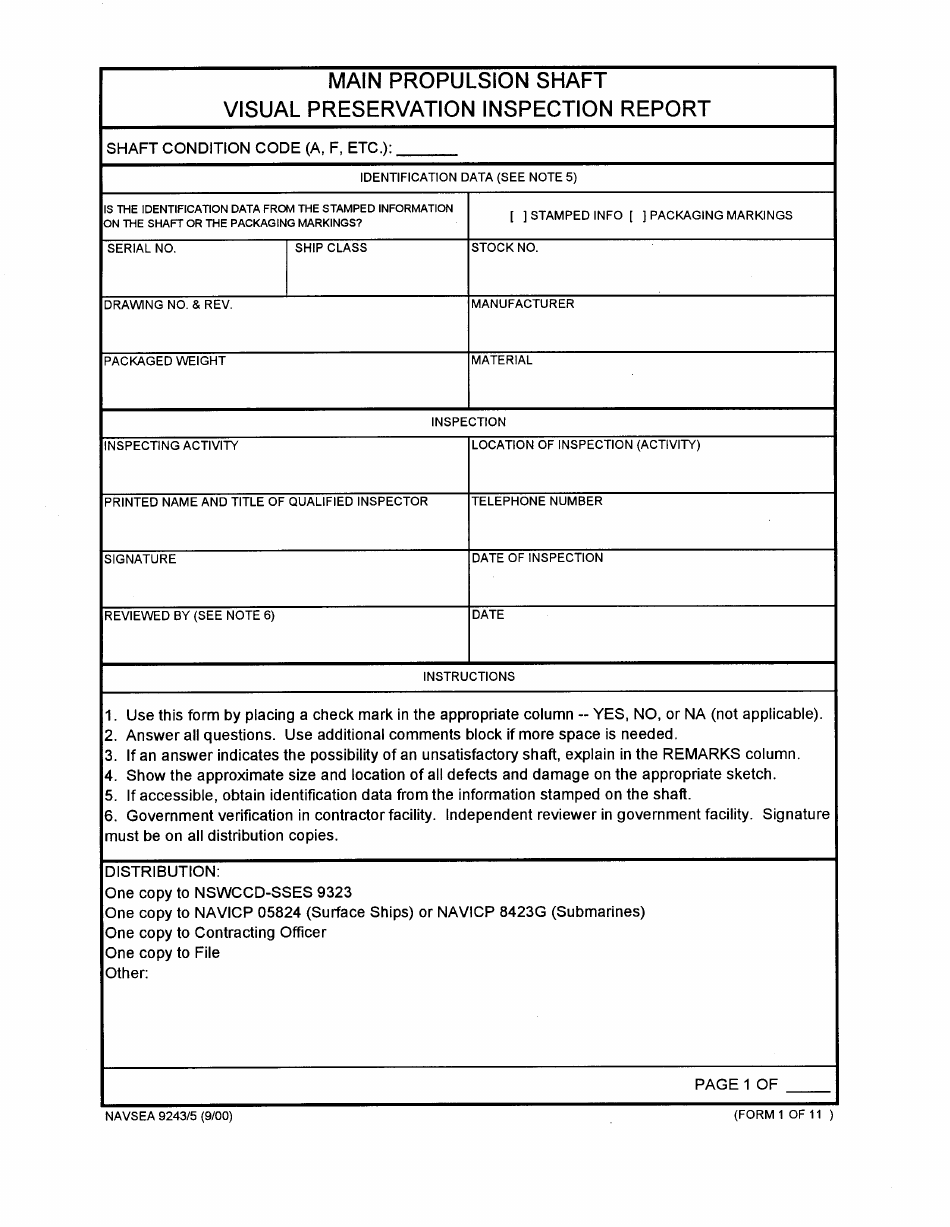

Form NAVSEA9243/5 Download Printable PDF or Fill Online Main Propulsion

, the irs is implementing the temporary procedure for fax transmission of form 8023, elections under section 338 for corporations making qualified stock purchases. Web the form must be filed if the taxpayer meets both of the following conditions: Persons with respect to certain foreign corporations,” filed with respect to the purchasing corporation by each united states shareholder for the.

Web We Last Updated The Elections Under Section 338 For Corporations Making Qualified Stock Purchases In February 2023, So This Is The Latest Version Of Form 8023, Fully Updated For Tax Year 2022.

Web the form must be filed if the taxpayer meets both of the following conditions: Web about form 8023, elections under section 338 for corporations making qualified stock purchases. Web who must file. , the irs is implementing the temporary procedure for fax transmission of form 8023, elections under section 338 for corporations making qualified stock purchases.

Elections Under Section 338 For Corporations Making Qualified Stock Purchases.

Web form 8023 must be filed as described in the form and its instructions and also must be attached to the form 5471, “information returns of u.s. Purchasing corporations use this form to make elections under section 338 for the target corporation if they made a qualified stock. Shareholders of controlled foreign purchasing. Generally, a purchasing corporation must file form 8023 for the target.

Alternatively, Form 8023 May Be Mailed To Irs At The Address Provided In The Instructions To.

Selling shareholders if form 8023 is filed for a target If a section 338 (h) (10) election is made for a target, form 8023 must be filed jointly by the purchasing corporation and the common parent of the selling consolidated group (or the selling affiliate or an s corporation shareholder (s)). Persons with respect to certain foreign corporations,” filed with respect to the purchasing corporation by each united states shareholder for the purchasing corporation's taxable year that includes. Generally, the purchasing corporation must file form 8023.

Information About Form 8023 And Its Separate Instructions Is At.

November 2016) department of the treasury internal revenue service. (1) the taxpayer's worldwide gross income (defined in the form's instructions) in the tax year is more than $75,000, and (2) one of three specified criteria (described in the form's instructions) relating to residency in a u.s. The irs will now accept taxpayers' completed form 8023 sent by fax to +1 844 253 9765. Unless otherwise specifically noted, the general rules and requirements in these instructions apply to foreign purchasing corporations.