Form 8233 Irs

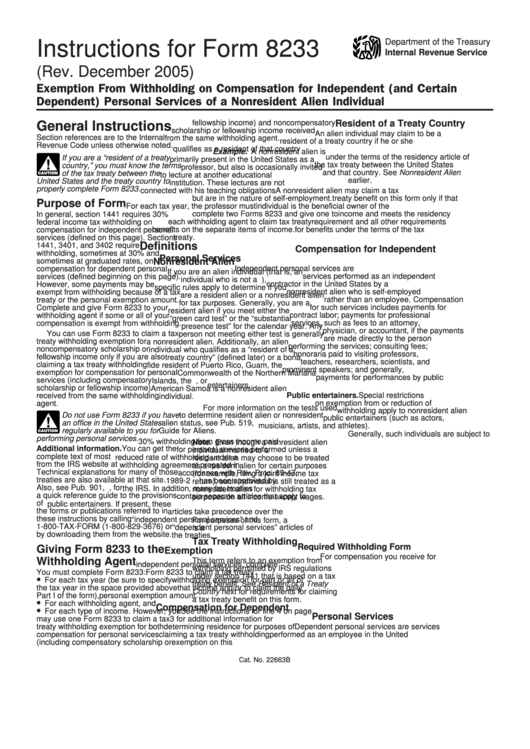

Form 8233 Irs - Web provide the payor with a properly completed form 8233 for the tax year. When to file form 8233 Web form 8233 ( exemption from withholding on compensation for independent and certain dependent personal services of a nonresident alien individual) is one of many tax forms used by nonresident aliens who are working in the united states. Put simply, its primary function is to claim an exemption from any tax on income from within the united. Exemption on the payee’s tax return September 2018) department of the treasury internal revenue service. Web you can use form 8233 to claim a tax treaty withholding exemption for noncompensatory scholarship or fellowship income only if you are also claiming a tax treaty withholding exemption for compensation for personal services (including compensatory scholarship or fellowship income) received from the same withholding agent. This form is used if an employee is a resident of another country that has a tax treaty with the us that exempts the employee from some or all federal income taxes. Agent or manager (or whoever in the u.s. For instructions and the latest information.

By filing form 8233, they are looking to claim an exemption from federal income tax withholding (fitw) based on a tax treaty. When to file form 8233 Agent or manager (or whoever in the u.s. September 2018) department of the treasury internal revenue service. Web provide the payor with a properly completed form 8233 for the tax year. Web form 8233 ( exemption from withholding on compensation for independent and certain dependent personal services of a nonresident alien individual) is one of many tax forms used by nonresident aliens who are working in the united states. Exemption on the payee’s tax return Web form 8233 is valid for only one (1) year. Social security number or individual taxpayer identification number (itin). Web you can use form 8233 to claim a tax treaty withholding exemption for noncompensatory scholarship or fellowship income only if you are also claiming a tax treaty withholding exemption for compensation for personal services (including compensatory scholarship or fellowship income) received from the same withholding agent.

Exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual. For instructions and the latest information. Web form 8233 ( exemption from withholding on compensation for independent and certain dependent personal services of a nonresident alien individual) is one of many tax forms used by nonresident aliens who are working in the united states. Social security number or individual taxpayer identification number (itin). Will be paying the artist.) This form is used if an employee is a resident of another country that has a tax treaty with the us that exempts the employee from some or all federal income taxes. September 2018) department of the treasury internal revenue service. Form 8233 must be provided annually by the nonresident alien (foreign student, trainee, teacher, researcher, etc.) who remains in the united states for more than one year and is receiving compensation for independent and dependent personal services. Web form 8233 must be completed by a foreign artist in order to claim an exemption from withholding pursuant to a tax treaty. Web you can use form 8233 to claim a tax treaty withholding exemption for noncompensatory scholarship or fellowship income only if you are also claiming a tax treaty withholding exemption for compensation for personal services (including compensatory scholarship or fellowship income) received from the same withholding agent.

Form 8233 Exemption from Withholding on Compensation for Independent

This form is used by non resident alien individuals to claim exemption from withholding on compensation for personal services because of an. When to file form 8233 Social security number or individual taxpayer identification number (itin). For instructions and the latest information. Has tax treaties with multiple countries.

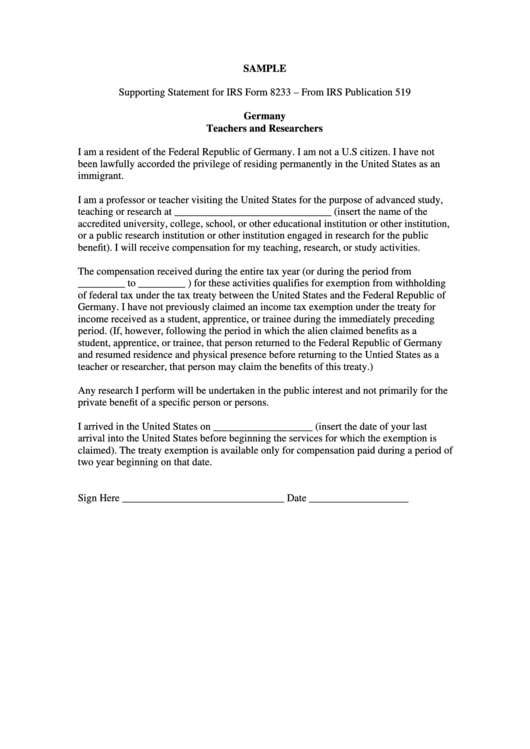

Supporting Statement For Irs Form 8233 From Irs Publication 519

September 2018) department of the treasury internal revenue service. The form 8233 must report the payee’s taxpayer identification number (tin), generally the payee’s u.s. By filing form 8233, they are looking to claim an exemption from federal income tax withholding (fitw) based on a tax treaty. This form is used by non resident alien individuals to claim exemption from withholding.

irs form 8233 printable pdf file enter the appropriate calendar year

Exemption on the payee’s tax return Will be paying the artist.) This form is used if an employee is a resident of another country that has a tax treaty with the us that exempts the employee from some or all federal income taxes. Web form 8233 is a federal individual income tax form. Web form 8233 must be completed by.

3.21.263 IRS Individual Taxpayer Identification Number (ITIN) RealTime

Web provide the payor with a properly completed form 8233 for the tax year. Web form 8233 must be completed by a foreign artist in order to claim an exemption from withholding pursuant to a tax treaty. This form is used by non resident alien individuals to claim exemption from withholding on compensation for personal services because of an. Social.

Form 8233 Exemption from Withholding on Compensation for Independent

Social security number or individual taxpayer identification number (itin). Exemption on the payee’s tax return Put simply, its primary function is to claim an exemption from any tax on income from within the united. Agent or manager (or whoever in the u.s. September 2018) department of the treasury internal revenue service.

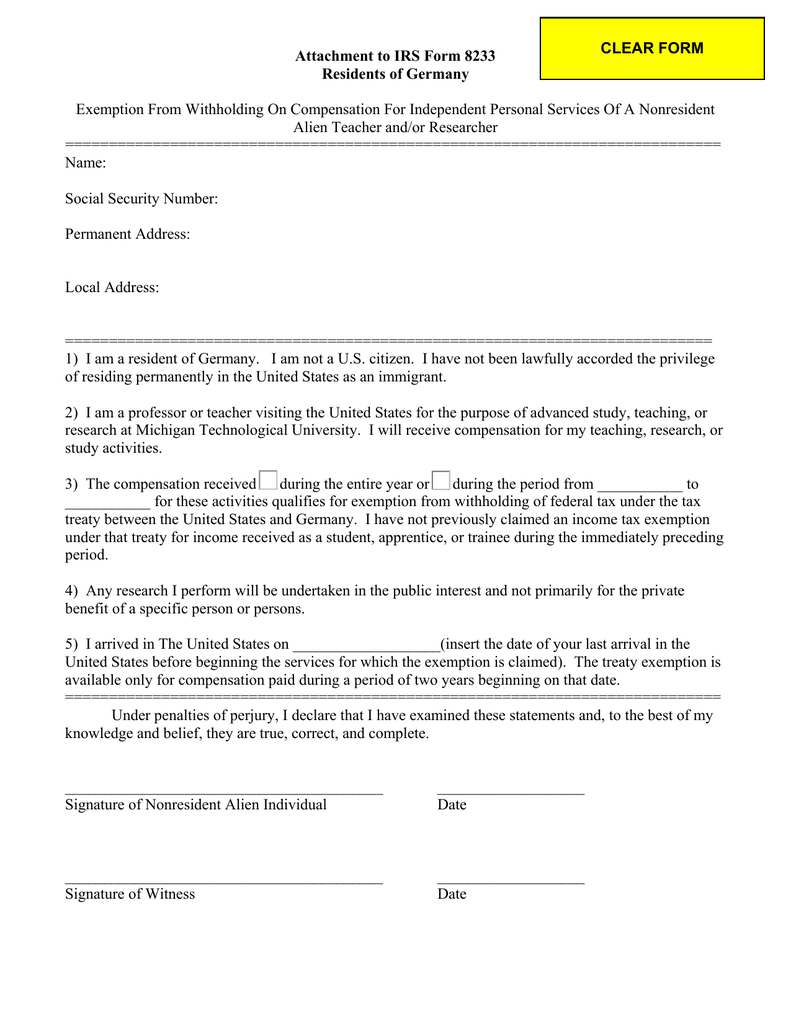

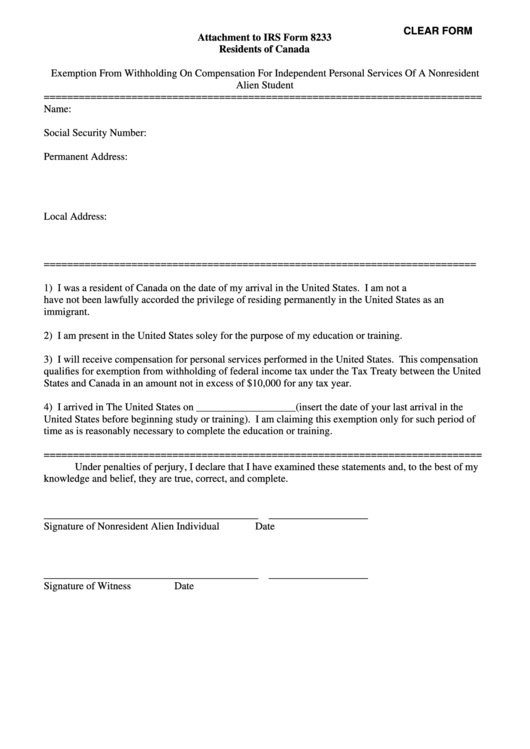

Attachment to IRS Form 8233 Residents of Germany

Put simply, its primary function is to claim an exemption from any tax on income from within the united. Social security number or individual taxpayer identification number (itin). Form 8233 must be provided annually by the nonresident alien (foreign student, trainee, teacher, researcher, etc.) who remains in the united states for more than one year and is receiving compensation for.

IRS 8233 2001 Fill out Tax Template Online US Legal Forms

Web you can use form 8233 to claim a tax treaty withholding exemption for noncompensatory scholarship or fellowship income only if you are also claiming a tax treaty withholding exemption for compensation for personal services (including compensatory scholarship or fellowship income) received from the same withholding agent. Will be paying the artist.) Web form 8233 is valid for only one.

Applying for a tax payment plan Don't Mess With Taxes

Form 8233 must be provided annually by the nonresident alien (foreign student, trainee, teacher, researcher, etc.) who remains in the united states for more than one year and is receiving compensation for independent and dependent personal services. When to file form 8233 Web form 8233 is valid for only one (1) year. The artist then submits the form to the.

Fillable Exemption From Withholding On Compensation For Independent

Web provide the payor with a properly completed form 8233 for the tax year. Social security number or individual taxpayer identification number (itin). Will be paying the artist.) For instructions and the latest information. Exemption on the payee’s tax return

Instructions For Form 8233 printable pdf download

Web form 8233 is valid for only one (1) year. Web form 8233 is a federal individual income tax form. Web provide the payor with a properly completed form 8233 for the tax year. Web form 8233 must be completed by a foreign artist in order to claim an exemption from withholding pursuant to a tax treaty. September 2018) department.

This Form Is Used By Non Resident Alien Individuals To Claim Exemption From Withholding On Compensation For Personal Services Because Of An.

The artist must also provide either an ssn or itin on form 8233. How does a tax treaty work? For instructions and the latest information. Form 8233 must be provided annually by the nonresident alien (foreign student, trainee, teacher, researcher, etc.) who remains in the united states for more than one year and is receiving compensation for independent and dependent personal services.

Agent Or Manager (Or Whoever In The U.s.

The artist then submits the form to the u.s. Exemption on the payee’s tax return Put simply, its primary function is to claim an exemption from any tax on income from within the united. September 2018) department of the treasury internal revenue service.

Web Form 8233 ( Exemption From Withholding On Compensation For Independent And Certain Dependent Personal Services Of A Nonresident Alien Individual) Is One Of Many Tax Forms Used By Nonresident Aliens Who Are Working In The United States.

Web form 8233 is a federal individual income tax form. Exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual. Has tax treaties with multiple countries. By filing form 8233, they are looking to claim an exemption from federal income tax withholding (fitw) based on a tax treaty.

Web Form 8233 Must Be Completed By A Foreign Artist In Order To Claim An Exemption From Withholding Pursuant To A Tax Treaty.

The form 8233 must report the payee’s taxpayer identification number (tin), generally the payee’s u.s. Social security number or individual taxpayer identification number (itin). When to file form 8233 Web provide the payor with a properly completed form 8233 for the tax year.