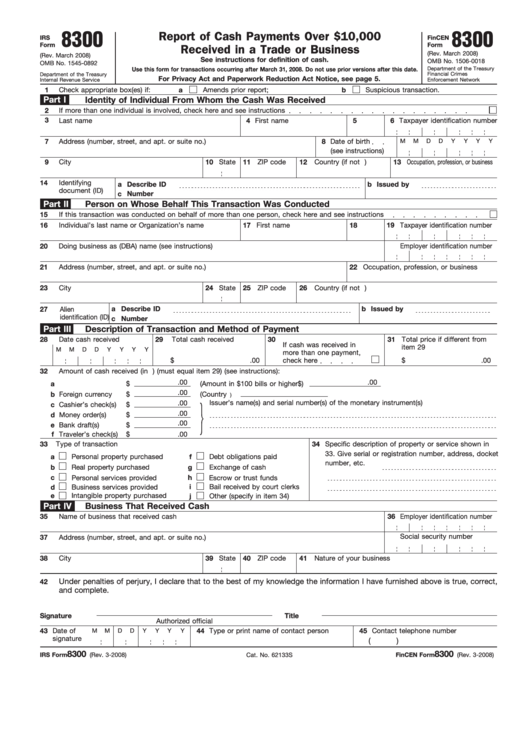

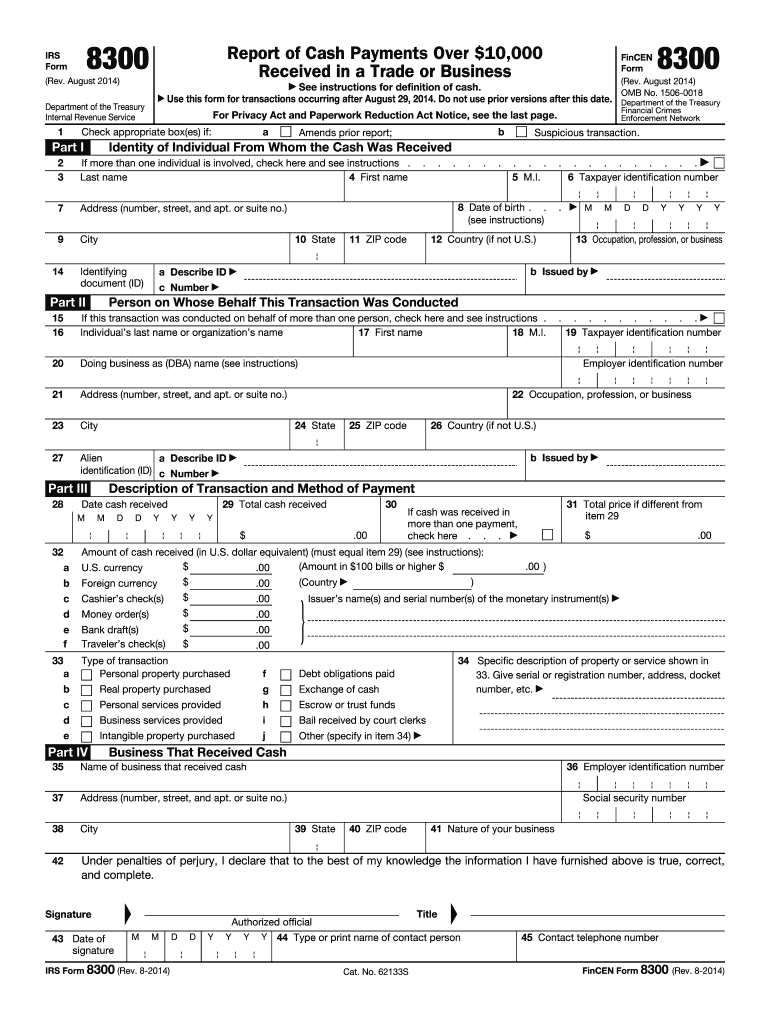

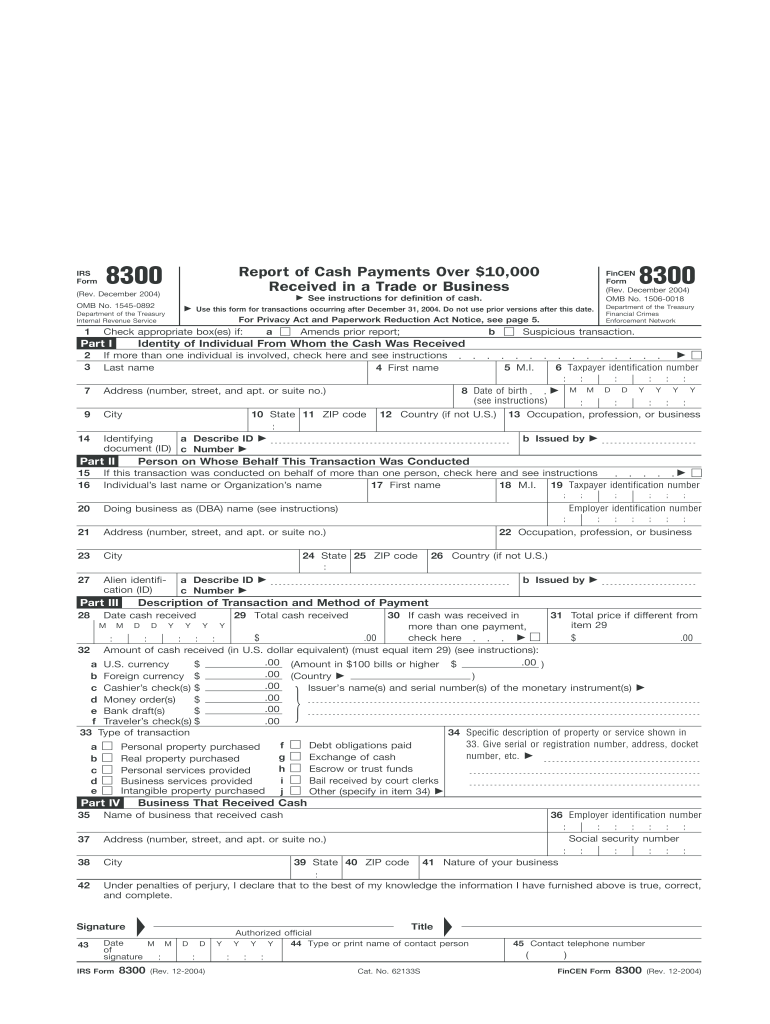

Form 8300 Car Dealer

Form 8300 Car Dealer - Yes, the weekly lease or loan payments constitute payments on the same transaction (the leasing or purchase of the vehicle). Web introduction the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of cash. Web we know that you have high expectations, and as a car dealer we enjoy the challenge of meeting and exceeding those standards each and every time. Dealerships can also call the irs criminal. Web by looking at the annual registration form gotten when the property taxes and tag renewal are paid. Web the dealership can report suspicious transactions by checking the “suspicious transaction” box (box 1b) on the top line of form 8300. Web dealers must report to irs (using irs/fincen form 8300) the receipt of cash/cash equivalents in excess of $10,000 in a single transaction or two or more related. I have never bought in cash, but made a car down payment for $10,000. Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes. Web either way, the dealer needs to file only one form 8300.

If you buy a car and do not get title at the time of the sale, or if agreed within 60. Web by looking at the annual registration form gotten when the property taxes and tag renewal are paid. Web form 8300 is a document that must be filed with the irs when an individual or business receives a cash payment over $10,000. Any business or person that receives over $10,000 in cash as part of business transaction must complete a document called. Web dealing with large cash payments: File form 8300 by the 15th day after the date the cash was received. The dealership received that much. Web we know that you have high expectations, and as a car dealer we enjoy the challenge of meeting and exceeding those standards each and every time. A dealership doesn’t file form 8300 if a customer pays with a $7,000 wire transfer and a $4,000 cashier check. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file form.

Web by looking at the annual registration form gotten when the property taxes and tag renewal are paid. If that date falls on a saturday, sunday, or legal holiday, file the form on the next business day. Yes, the weekly lease or loan payments constitute payments on the same transaction (the leasing or purchase of the vehicle). File form 8300 by the 15th day after the date the cash was received. Web for example, if an automobile dealership sells a car to a customer and receives cash payments from the customer, their mother, and their father, the dealership would: Web form 8300 compliance for car dealers any business or person that receives over $10,000 in cash as part of business transaction must complete a document called form 8300. Web introduction the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of cash. Web we know that you have high expectations, and as a car dealer we enjoy the challenge of meeting and exceeding those standards each and every time. Web form 8300 compliance for car dealers. Any business or person that receives over $10,000 in cash as part of business transaction must complete a document called.

IRS Form 8300 It's Your Yale

A notice was sent to me that said a. Web either way, the dealer needs to file only one form 8300. Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes. Web we know that you have high expectations, and as a car.

The IRS Form 8300 and How it Works

Web who must file form 8300? Web form 8300 is a document that must be filed with the irs when an individual or business receives a cash payment over $10,000. Web we know that you have high expectations, and as a car dealer we enjoy the challenge of meeting and exceeding those standards each and every time. Web form 8300.

20142022 Form IRS 8300 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 8300 compliance for car dealers any business or person that receives over $10,000 in cash as part of business transaction must complete a document called form 8300. I have never bought in cash, but made a car down payment for $10,000. Web the dealership can report suspicious transactions by checking the “suspicious transaction” box (box 1b) on the.

2004 Form IRS 8300 Fill Online, Printable, Fillable, Blank PDFfiller

Web dealing with large cash payments: Web the dealership can report suspicious transactions by checking the “suspicious transaction” box (box 1b) on the top line of form 8300. I have never bought in cash, but made a car down payment for $10,000. Web we know that you have high expectations, and as a car dealer we enjoy the challenge of.

IRS Form 8300 Info & Requirements for Reporting Cash Payments

Web accordingly, when your dealership receives more than $10,000 in cash in one transaction or in two or more related transactions, you must report this by filing the. Web by looking at the annual registration form gotten when the property taxes and tag renewal are paid. Web form 8300 compliance for car dealers any business or person that receives over.

IRS Form 8300 Reporting Cash Sales Over 10,000

Web dealers must report to irs (using irs/fincen form 8300) the receipt of cash/cash equivalents in excess of $10,000 in a single transaction or two or more related. Yes, the weekly lease or loan payments constitute payments on the same transaction (the leasing or purchase of the vehicle). Web the dealership can report suspicious transactions by checking the “suspicious transaction”.

[View 37+] Sample Letter For Form 8300

Web accordingly, when your dealership receives more than $10,000 in cash in one transaction or in two or more related transactions, you must report this by filing the. A dealership doesn’t file form 8300 if a customer pays with a $7,000 wire transfer and a $4,000 cashier check. Any business or person that receives over $10,000 in cash as part.

Fillable Form 8300 Report Of Cash Payments Over 10,000 Received In A

Web dealers must report to irs (using irs/fincen form 8300) the receipt of cash/cash equivalents in excess of $10,000 in a single transaction or two or more related. Web dealing with large cash payments: Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial.

IRS Form 8300 Info & Requirements for Reporting Cash Payments

Web accordingly, when your dealership receives more than $10,000 in cash in one transaction or in two or more related transactions, you must report this by filing the. Web dealing with large cash payments: Web form 8300 compliance for car dealers. Web who must file form 8300? If that date falls on a saturday, sunday, or legal holiday, file the.

Fillable Form 8300 Report Of Cash Payments Over 10,000 Usd Received

Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes. A notice was sent to me that said a. The equifax data breach what dealers should know. Web who must file form 8300? Web what does the irs do with forms 8300 they.

Web Form 8300 Compliance For Car Dealers Any Business Or Person That Receives Over $10,000 In Cash As Part Of Business Transaction Must Complete A Document Called Form 8300.

Web we know that you have high expectations, and as a car dealer we enjoy the challenge of meeting and exceeding those standards each and every time. Dealerships can also call the irs criminal. Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes. Any business or person that receives over $10,000 in cash as part of business transaction must complete a document called.

Web The Dealership Required To File A Form 8300?

Web dealers must report to irs (using irs/fincen form 8300) the receipt of cash/cash equivalents in excess of $10,000 in a single transaction or two or more related. The dealership received that much. Web the dealership can report suspicious transactions by checking the “suspicious transaction” box (box 1b) on the top line of form 8300. The equifax data breach what dealers should know.

A Notice Was Sent To Me That Said A.

Web form 8300 compliance for car dealers. Web form 8300 is a document that must be filed with the irs when an individual or business receives a cash payment over $10,000. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file form. Web accordingly, when your dealership receives more than $10,000 in cash in one transaction or in two or more related transactions, you must report this by filing the.

A Dealership Doesn’t File Form 8300 If A Customer Pays With A $7,000 Wire Transfer And A $4,000 Cashier Check.

Web for example, if an automobile dealership sells a car to a customer and receives cash payments from the customer, their mother, and their father, the dealership would: Web introduction the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of cash. Web by looking at the annual registration form gotten when the property taxes and tag renewal are paid. Yes, the weekly lease or loan payments constitute payments on the same transaction (the leasing or purchase of the vehicle).

![[View 37+] Sample Letter For Form 8300](https://www.carbuyingtips.com/pics/irs-form-8300.jpg)