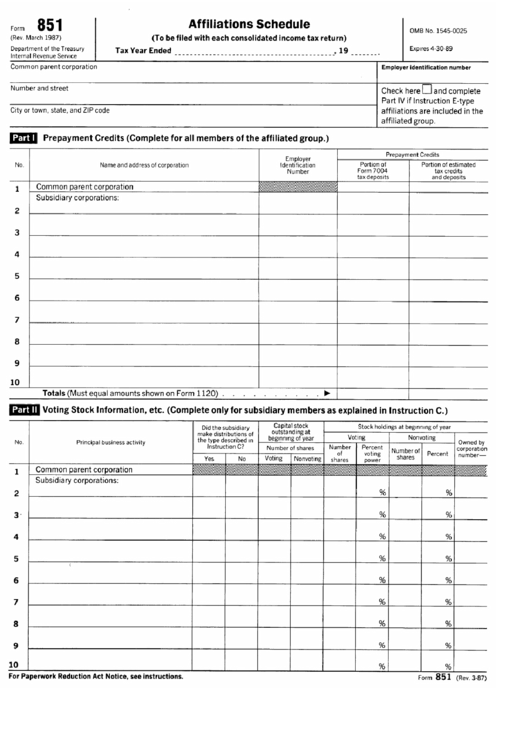

Form 851 Instructions

Form 851 Instructions - If the equitable owners of any capital stock shown above were other than the holders of record, provide details of the changes. Web the parent corporation of an affiliated group files form 851 with its consolidated income tax return to: Please print or type clearly. Use the schedule below to record any changes that occurred during the tax year that caused the corporations included in the consolidated return to change. Web determined by the secretary. We recommend that you review these requirements before completing and submitting your form. Identify the common parent corporation and each member of the affiliated group. You may only obtain the information if you certify you are authorized to receive the information for one of the. Corporate income/franchise tax affiliations schedule: Request for research or verification of motor vehicle record.

Florida corporate income/franchise tax return for 2022 tax year. Identify the common parent corporation and each member of the affiliated group. Web determined by the secretary. 06/2023) alaska.gov/dmv state of alaska. List all affected corporations and indicate whether they are deletions or additions by checking the correct box. Agrees to provide ccc any documentation it requires to determine eligibility that verifies and supports all information provided, including the producer’s certification, Corporate income/franchise tax affiliations schedule: If the equitable owners of any capital stock shown above were other than the holders of record, provide details of the changes. By signing this application, the producer: The checklist is an optional tool to use as you prepare your form, but does not replace statutory, regulatory, and form instruction requirements.

You may only obtain the information if you certify you are authorized to receive the information for one of the. Please print or type clearly. Web determined by the secretary. Web the parent corporation of an affiliated group files form 851 with its consolidated income tax return to: List all affected corporations and indicate whether they are deletions or additions by checking the correct box. 06/2023) alaska.gov/dmv state of alaska. Florida corporate income/franchise tax return for 2022 tax year. If the equitable owners of any capital stock shown above were other than the holders of record, provide details of the changes. The checklist is an optional tool to use as you prepare your form, but does not replace statutory, regulatory, and form instruction requirements. Request for research or verification of motor vehicle record.

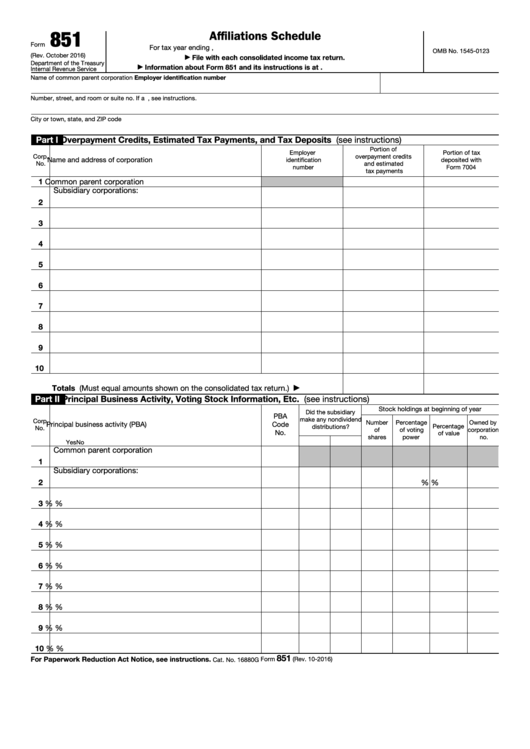

Fillable Form 851 Affiliations Schedule For Tax Year Ending 2016

Please print or type clearly. Florida partnership information return with instructions: We recommend that you review these requirements before completing and submitting your form. Florida corporate income/franchise tax return for 2022 tax year. List all affected corporations and indicate whether they are deletions or additions by checking the correct box.

Technic Farm Tractor [Lego 851] Lego, Lego instructions, Lego creations

Corporate income/franchise tax affiliations schedule: Web information requested on a form that is subject to the paperwork reduction act unless the form displays a valid omb control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any internal revenue law. List all affected.

Form 851 Affiliations Schedule (2010) Free Download

Web determined by the secretary. Corporate income/franchise tax affiliations schedule: Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any internal revenue law. Report the amount of overpayment credits, estimated tax payments, and tax deposits attributable to each corporation. If the equitable owners of.

Magic Form 851 Beli Dantelli Yüksek Bel Siyah Hamile Külotu

The checklist is an optional tool to use as you prepare your form, but does not replace statutory, regulatory, and form instruction requirements. Web information requested on a form that is subject to the paperwork reduction act unless the form displays a valid omb control number. Use the schedule below to record any changes that occurred during the tax year.

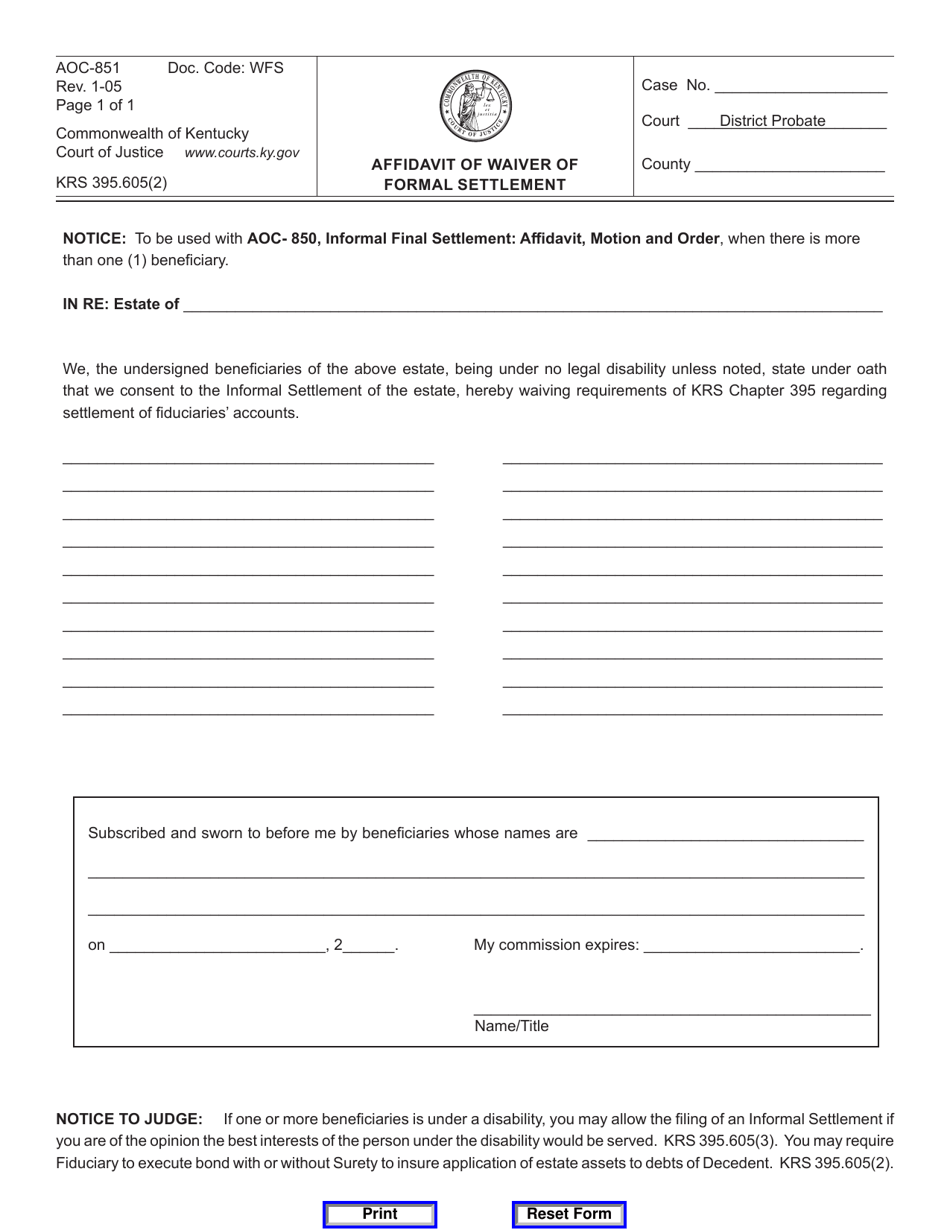

Form AOC851 Download Fillable PDF or Fill Online Affidavit of Waiver

List all affected corporations and indicate whether they are deletions or additions by checking the correct box. Please print or type clearly. Request for research or verification of motor vehicle record. The checklist is an optional tool to use as you prepare your form, but does not replace statutory, regulatory, and form instruction requirements. Web determined by the secretary.

FL F851 2016 Fill out Tax Template Online US Legal Forms

If the equitable owners of any capital stock shown above were other than the holders of record, provide details of the changes. Please print or type clearly. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any internal revenue law. We recommend that you.

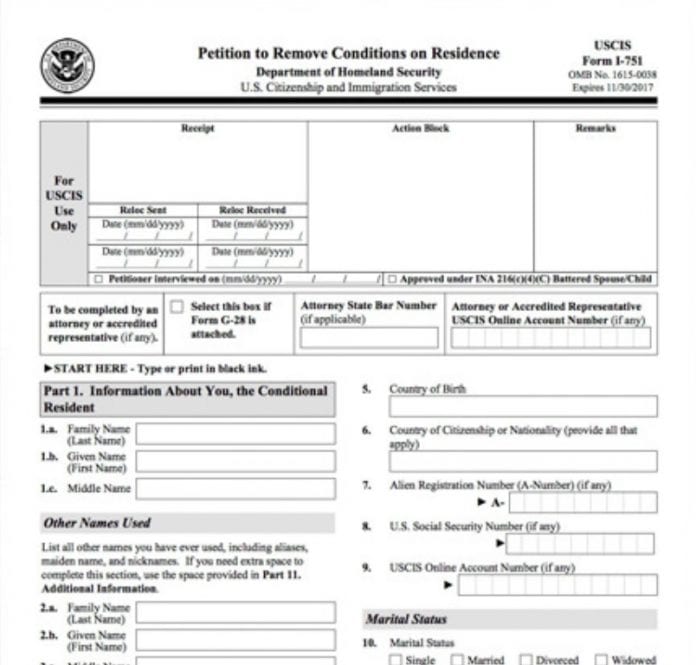

USCIS sends automatic 18month residency extension notices to Removal

Report the amount of overpayment credits, estimated tax payments, and tax deposits attributable to each corporation. We recommend that you review these requirements before completing and submitting your form. Use the schedule below to record any changes that occurred during the tax year that caused the corporations included in the consolidated return to change. You may only obtain the information.

Form 851 Affiliations Schedule (2010) Free Download

Report the amount of overpayment credits, estimated tax payments, and tax deposits attributable to each corporation. Web determined by the secretary. Florida corporate income/franchise tax return for 2022 tax year. Corporate income/franchise tax affiliations schedule: By signing this application, the producer:

Form 851 Affiliations Schedule printable pdf download

List all affected corporations and indicate whether they are deletions or additions by checking the correct box. If the equitable owners of any capital stock shown above were other than the holders of record, provide details of the changes. Web determined by the secretary. Florida corporate income/franchise tax return for 2022 tax year. Web the parent corporation of an affiliated.

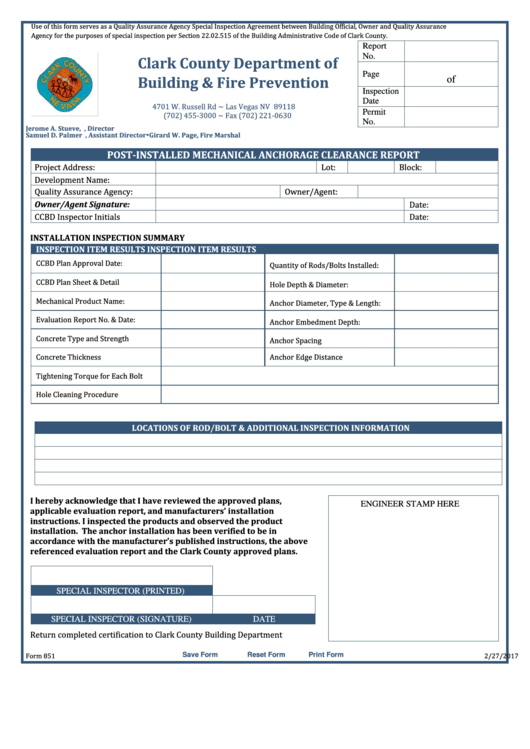

Fillable Form 851 PostInstalled Mechanical Anchorage Clearance

Please print or type clearly. If the equitable owners of any capital stock shown above were other than the holders of record, provide details of the changes. Web information requested on a form that is subject to the paperwork reduction act unless the form displays a valid omb control number. Web the parent corporation of an affiliated group files form.

You May Only Obtain The Information If You Certify You Are Authorized To Receive The Information For One Of The.

The checklist is an optional tool to use as you prepare your form, but does not replace statutory, regulatory, and form instruction requirements. Report the amount of overpayment credits, estimated tax payments, and tax deposits attributable to each corporation. Corporate income/franchise tax affiliations schedule: Florida corporate income/franchise tax return for 2022 tax year.

Use The Schedule Below To Record Any Changes That Occurred During The Tax Year That Caused The Corporations Included In The Consolidated Return To Change.

Web determined by the secretary. List all affected corporations and indicate whether they are deletions or additions by checking the correct box. By signing this application, the producer: 06/2023) alaska.gov/dmv state of alaska.

Florida Partnership Information Return With Instructions:

Web the parent corporation of an affiliated group files form 851 with its consolidated income tax return to: Please print or type clearly. Agrees to provide ccc any documentation it requires to determine eligibility that verifies and supports all information provided, including the producer’s certification, Request for research or verification of motor vehicle record.

Books Or Records Relating To A Form Or Its Instructions Must Be Retained As Long As Their Contents May Become Material In The Administration Of Any Internal Revenue Law.

If the equitable owners of any capital stock shown above were other than the holders of record, provide details of the changes. Web information requested on a form that is subject to the paperwork reduction act unless the form displays a valid omb control number. We recommend that you review these requirements before completing and submitting your form. Identify the common parent corporation and each member of the affiliated group.

![Technic Farm Tractor [Lego 851] Lego, Lego instructions, Lego creations](https://i.pinimg.com/originals/36/74/67/367467d145379579172b6d9b1daee010.jpg)