Form 8822-B

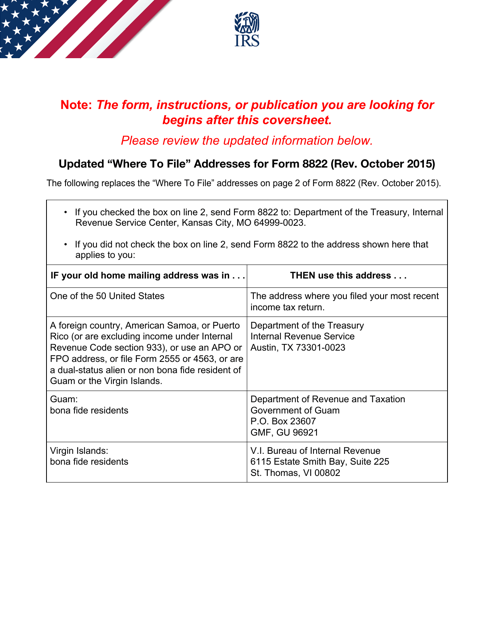

Form 8822-B - Generally, it takes 4 to 6 weeks to process a change of address. The irs has mandated new requirements to report a change in the identity of a responsible party for entities that have an employer identification. Changing both home and business addresses? What is it and who needs to file it? The 8822 form is used by individuals to update personal address information with the irs. Only businesses with an employer identification number (ein) can use this form for changes to their address and responsible party. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney. Identity of your responsible party. Web separate form 8822 for each child. Changes in responsible parties must be reported to the irs within 60 days.

Identity of your responsible party. You can print other federal tax forms here. The irs has mandated new requirements to report a change in the identity of a responsible party for entities that have an employer identification. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney. Generally, it takes 4 to 6 weeks to process a change of address. Only businesses with an employer identification number (ein) can use this form for changes to their address and responsible party. Web separate form 8822 for each child. The 8822 form is used by individuals to update personal address information with the irs. What is it and who needs to file it? Changing both home and business addresses?

The 8822 form is used by individuals to update personal address information with the irs. Only businesses with an employer identification number (ein) can use this form for changes to their address and responsible party. The irs has mandated new requirements to report a change in the identity of a responsible party for entities that have an employer identification. Changing both home and business addresses? Changes in responsible parties must be reported to the irs within 60 days. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney. You can print other federal tax forms here. Identity of your responsible party. What is it and who needs to file it? Generally, it takes 4 to 6 weeks to process a change of address.

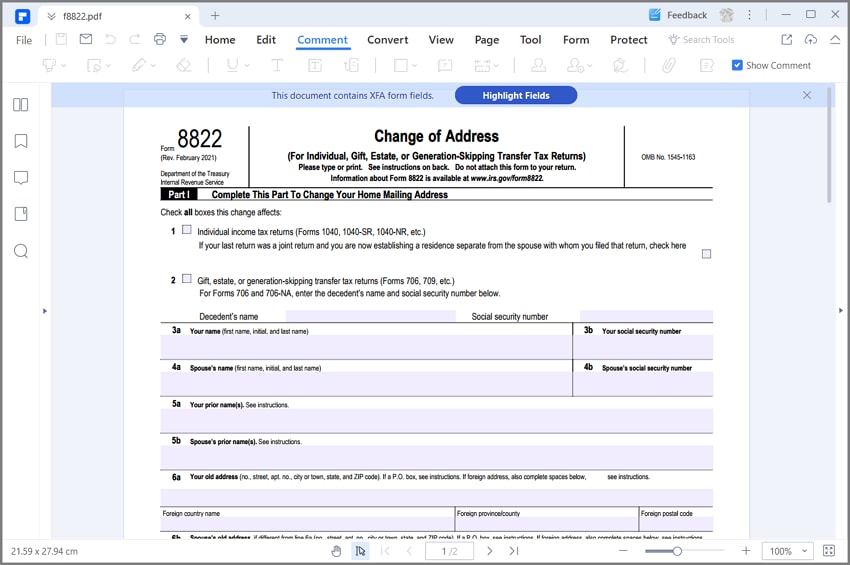

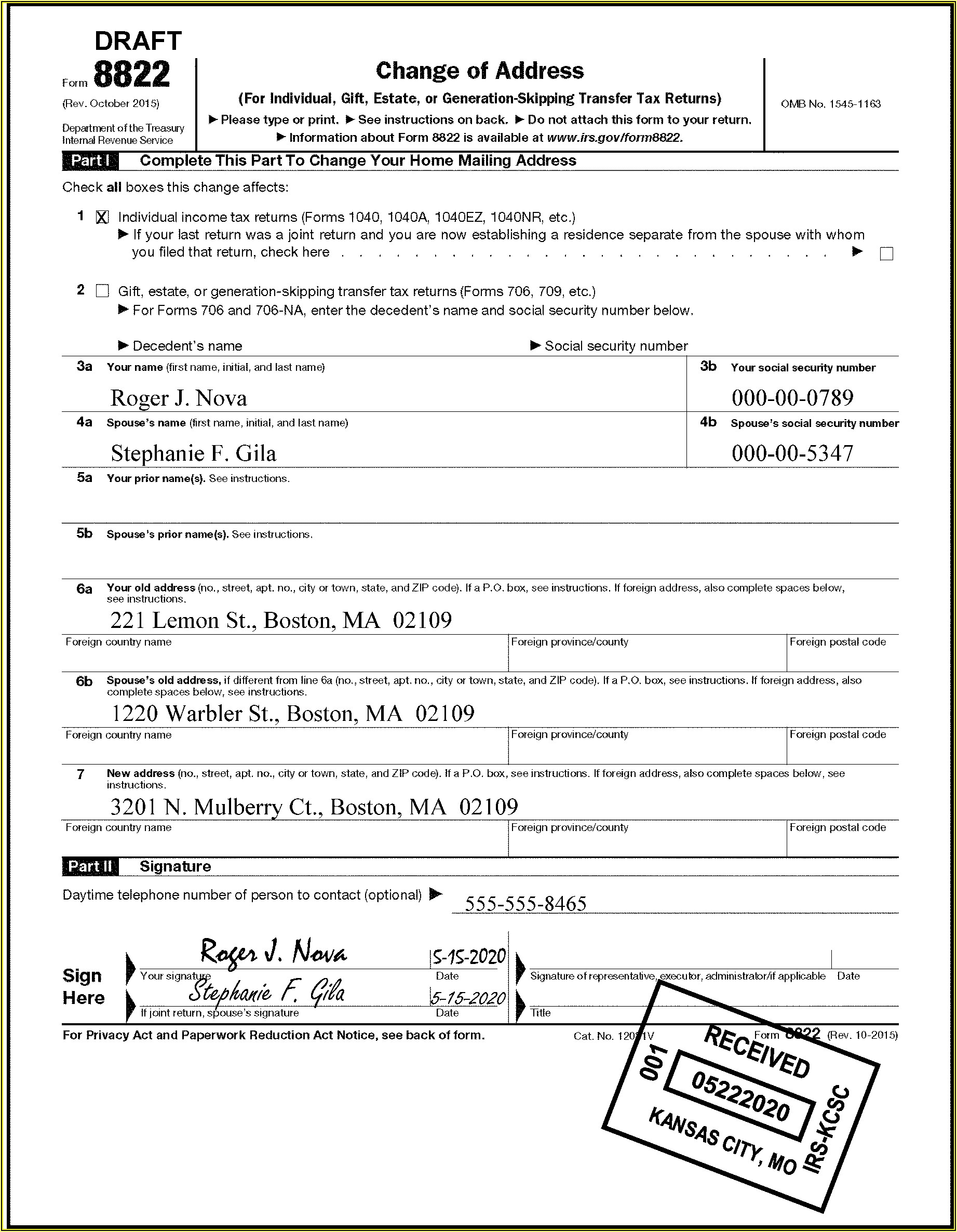

IRS Form 8822 Download Fillable PDF or Fill Online Change of Address

Changing both home and business addresses? What is it and who needs to file it? Identity of your responsible party. Generally, it takes 4 to 6 weeks to process a change of address. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney.

IRS Form 8822 The Best Way to Fill it

The 8822 form is used by individuals to update personal address information with the irs. You can print other federal tax forms here. Identity of your responsible party. Only businesses with an employer identification number (ein) can use this form for changes to their address and responsible party. Changes in responsible parties must be reported to the irs within 60.

Printable Irs Form 8822 B Form Resume Examples X42M7drYkG

Web separate form 8822 for each child. What is it and who needs to file it? The 8822 form is used by individuals to update personal address information with the irs. Changes in responsible parties must be reported to the irs within 60 days. Generally, it takes 4 to 6 weeks to process a change of address.

Form 8822 B 2019 Fillable and Editable PDF Template

If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney. Changing both home and business addresses? Web separate form 8822 for each child. Only businesses with an employer identification number (ein) can use this form for changes to their address and responsible party. The irs has mandated new requirements to.

FORM 8822 AUTOFILL PDF

What is it and who needs to file it? The 8822 form is used by individuals to update personal address information with the irs. Changing both home and business addresses? Identity of your responsible party. Generally, it takes 4 to 6 weeks to process a change of address.

Gallery of Irs form 8822 B 2017 Best Of Power attorney form Mississippi

Identity of your responsible party. The irs has mandated new requirements to report a change in the identity of a responsible party for entities that have an employer identification. Changes in responsible parties must be reported to the irs within 60 days. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power.

Irs Business Name Change Form 8822b Armando Friend's Template

Changing both home and business addresses? The irs has mandated new requirements to report a change in the identity of a responsible party for entities that have an employer identification. Web separate form 8822 for each child. What is it and who needs to file it? Changes in responsible parties must be reported to the irs within 60 days.

Does your plan need IRS Form 8822B? Retirement Learning Center

Only businesses with an employer identification number (ein) can use this form for changes to their address and responsible party. The irs has mandated new requirements to report a change in the identity of a responsible party for entities that have an employer identification. Changing both home and business addresses? You can print other federal tax forms here. Generally, it.

Form 8822 Change of Address (2014) Free Download

What is it and who needs to file it? The 8822 form is used by individuals to update personal address information with the irs. Changing both home and business addresses? Generally, it takes 4 to 6 weeks to process a change of address. The irs has mandated new requirements to report a change in the identity of a responsible party.

FORM 8822 AUTOFILL PDF

Web separate form 8822 for each child. The irs has mandated new requirements to report a change in the identity of a responsible party for entities that have an employer identification. Only businesses with an employer identification number (ein) can use this form for changes to their address and responsible party. Changing both home and business addresses? The 8822 form.

You Can Print Other Federal Tax Forms Here.

Changing both home and business addresses? Generally, it takes 4 to 6 weeks to process a change of address. The irs has mandated new requirements to report a change in the identity of a responsible party for entities that have an employer identification. Changes in responsible parties must be reported to the irs within 60 days.

If You Are A Representative Signing For The Taxpayer, Attach To Form 8822 A Copy Of Your Power Of Attorney.

What is it and who needs to file it? Web separate form 8822 for each child. The 8822 form is used by individuals to update personal address information with the irs. Identity of your responsible party.