Form 8843 How To Fill

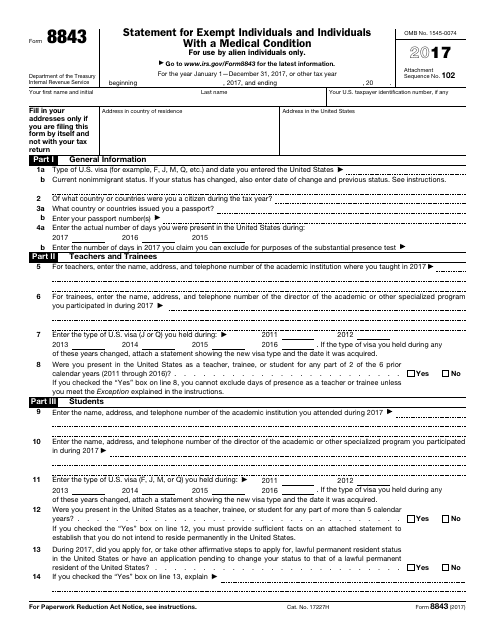

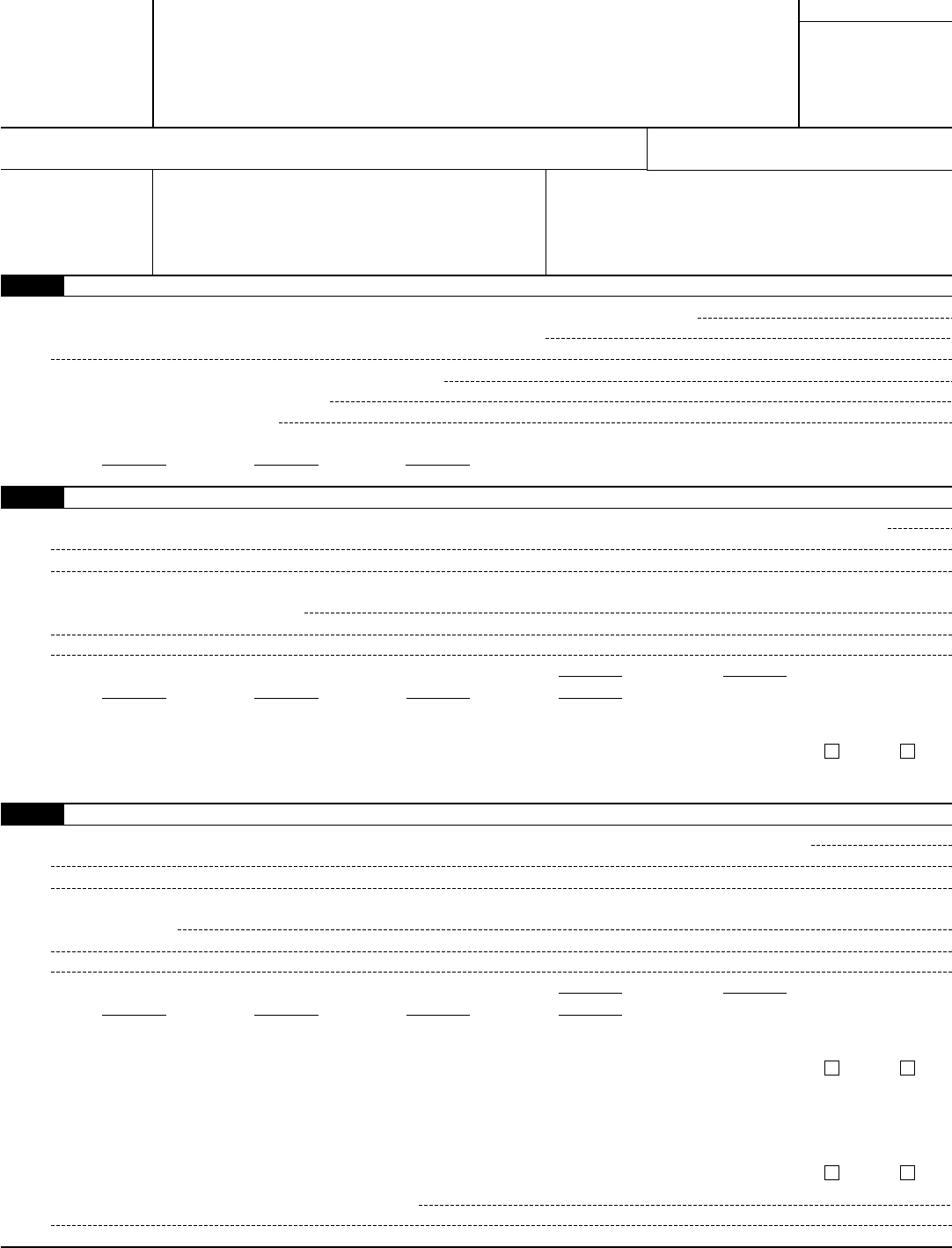

Form 8843 How To Fill - Web follow these guidelines to properly and quickly complete irs 8843. Ad download or email form 8843 & more fillable forms, register and subscribe now! Web please fill in the residence address in your home tax country (where you are a citizen or where you reside and would usually pay any taxes).” part i: Web enter your passport number(s) 4a enter the actual number of days you were present in the united states during: For use by alien individuals only. Web there are several ways to submit form 4868. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. How do i complete form 8843? Web use form 843 to claim or request the following. To ensure proper processing, write “branded prescription drug fee” across the top of form 843.

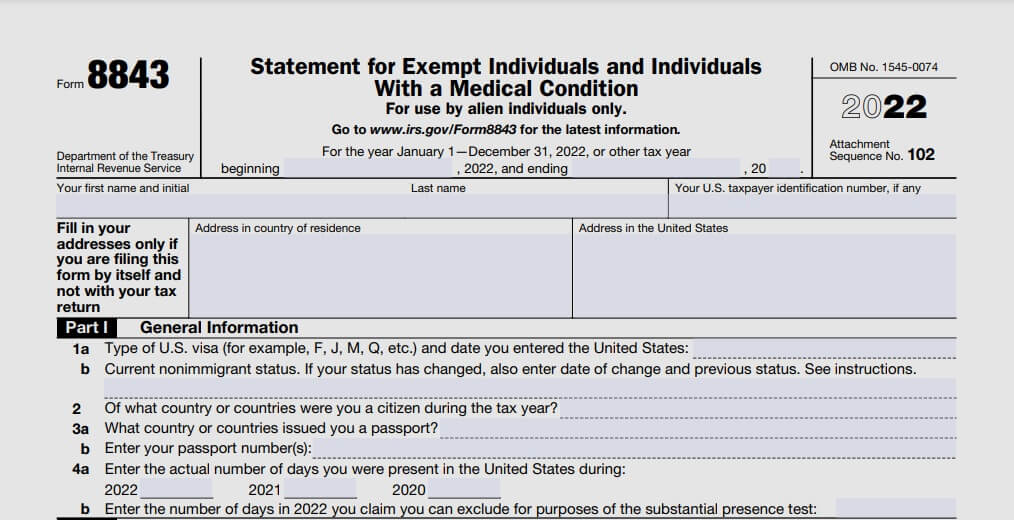

Web use form 843 to claim or request the following. 2021 2020 2019 enter the number of days in 2021 you. Source income in 2022 you only need complete the irs form. Click the button get form to open it and begin editing. Ad register and subscribe now to work on your irs 8843 & more fillable forms. You must file form 8843 by june 15, 2022. A refund of tax, other than a tax for which a different form must be used. Web fill in your address (only if you are not filing a tax return). Web please fill in the residence address in your home tax country (where you are a citizen or where you reside and would usually pay any taxes).” part i: Department of the treasury internal revenue service.

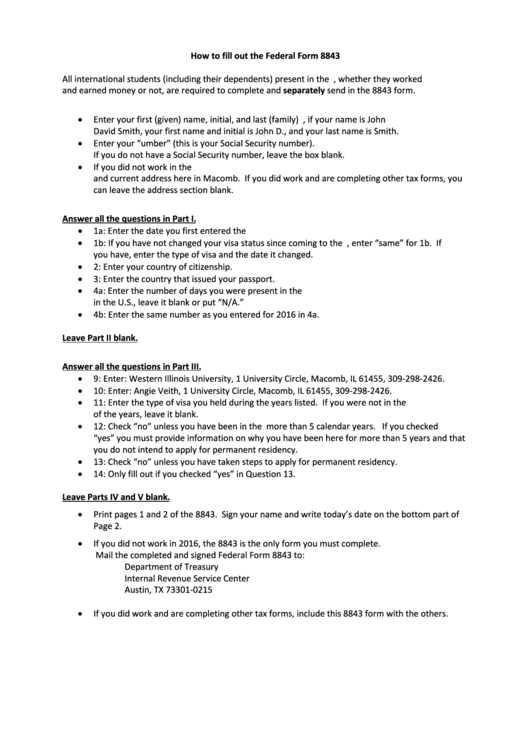

To ensure proper processing, write “branded prescription drug fee” across the top of form 843. Web who should complete only form 8843? In 2021, whether they worked and earned money or not,. Ad register and subscribe now to work on your irs 8843 & more fillable forms. Web use form 843 to claim or request the following. Source income in 2022 you only need complete the irs form. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web how to fill out the federal form 8843 all international students & scholars (including their dependents) present in the u.s. Statement for exempt individuals and individuals with a medical condition. A refund of tax, other than a tax for which a different form must be used.

How To Fill Out The Federal Form 8843 printable pdf download

Web enter your passport number(s) 4a enter the actual number of days you were present in the united states during: Web follow these guidelines to properly and quickly complete irs 8843. Web a nonresident alien present in the u.s. How do i complete form 8843? Write your first (given) name.

IRS Form 8843 Download Fillable PDF or Fill Online Statement for Exempt

Web how to fill out the federal form 8843 all international students & scholars (including their dependents) present in the u.s. Ad download or email form 8843 & more fillable forms, register and subscribe now! Web please fill in the residence address in your home tax country (where you are a citizen or where you reside and would usually pay.

Form 8843. What is it? And how do I file it? Official

2021 2020 2019 enter the number of days in 2021 you. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. There is one tax form that all nonresident alien taxpayers must file even if they have no income and are not currently. Write your first (given) name. Source income in.

Form 8843 Edit, Fill, Sign Online Handypdf

There is one tax form that all nonresident alien taxpayers must file even if they have no income and are not currently. Web use form 843 to claim or request the following. Source income in 2022 you only need complete the irs form. Web filling out form 8843 agenda • general rules • information to gather • these instructions are.

What is Form 8843 and How Do I File it? Sprintax Blog

Web there are several ways to submit form 4868. Write your first (given) name. Web use form 843 to claim or request the following. Source income in 2022 you only need complete the irs form. Ad download or email form 8843 & more fillable forms, register and subscribe now!

Form 8843 Instructions How to fill out 8843 form online & file it

Web enter your passport number(s) 4a enter the actual number of days you were present in the united states during: (see do not use form 843 when you must. Web how to fill out the federal form 8843 all international students & scholars (including their dependents) present in the u.s. Mail the tax return and the form 8843 by the.

IRS Form 8843 Editable and Printable Statement to Fill out

Source income in 2022 you only need complete the irs form. A refund of tax, other than a tax for which a different form must be used. Web there are several ways to submit form 4868. If you are a nonresident tax filer, and have no u.s. Write your first (given) name.

Form 8919 2021 Fill Online, Printable, Fillable, Blank pdfFiller

Web how to fill out the federal form 8843 all international students & scholars (including their dependents) present in the u.s. Write your first (given) name. Irs form 8843 is a tax form used be foreign nationals to document the number of days spent outside of the u.s. (see do not use form 843 when you must. There is one.

[2016 버전] 미국 유학생 텍스 리턴 3편 (Form 8843 작성법) Bluemoneyzone

Web enter your passport number(s) 4a enter the actual number of days you were present in the united states during: A refund of tax, other than a tax for which a different form must be used. Web filling out form 8843 agenda • general rules • information to gather • these instructions are for those filing form 8843 only. (see.

Form 8843 Statement for Exempt Individuals and Individuals with a

Click the button get form to open it and begin editing. (see do not use form 843 when you must. To ensure proper processing, write “branded prescription drug fee” across the top of form 843. Source income in 2022 you only need complete the irs form. Web enter your passport number(s) 4a enter the actual number of days you were.

2021 2020 2019 Enter The Number Of Days In 2021 You.

Ad register and subscribe now to work on your irs 8843 & more fillable forms. Department of the treasury internal revenue service. Web overview of form 8843. Write your first (given) name.

For Use By Alien Individuals Only.

Web follow these guidelines to properly and quickly complete irs 8843. Web there are several ways to submit form 4868. Mail the tax return and the form 8843 by the due date (including extensions) to the address shown in the tax. Web a nonresident alien present in the u.s.

How Do I Complete Form 8843?

(see do not use form 843 when you must. Web who should complete only form 8843? Web how to fill out the federal form 8843 all international students & scholars (including their dependents) present in the u.s. Source income in 2022 you only need complete the irs form.

To Ensure Proper Processing, Write “Branded Prescription Drug Fee” Across The Top Of Form 843.

There is one tax form that all nonresident alien taxpayers must file even if they have no income and are not currently. Web filling out form 8843 agenda • general rules • information to gather • these instructions are for those filing form 8843 only. Web use form 843 to claim or request the following. Web fill in your address (only if you are not filing a tax return).

![[2016 버전] 미국 유학생 텍스 리턴 3편 (Form 8843 작성법) Bluemoneyzone](https://img1.daumcdn.net/thumb/R800x0/?scode=mtistory2&fname=https:%2F%2Ft1.daumcdn.net%2Fcfile%2Ftistory%2F2638E83958C218ED0B)