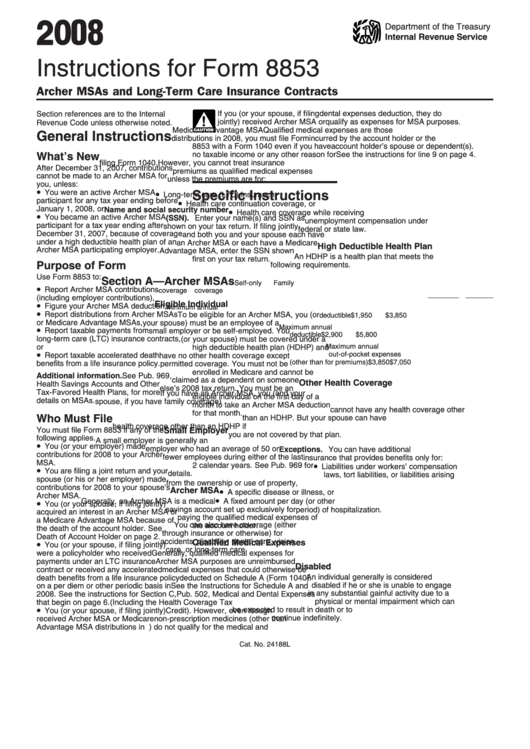

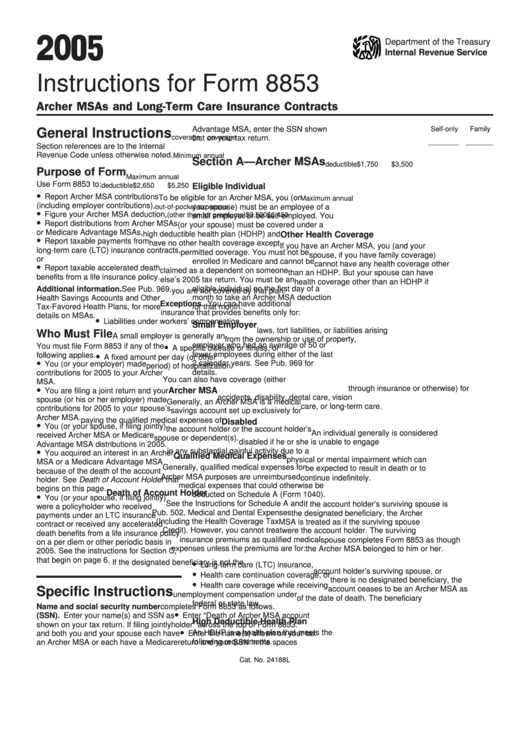

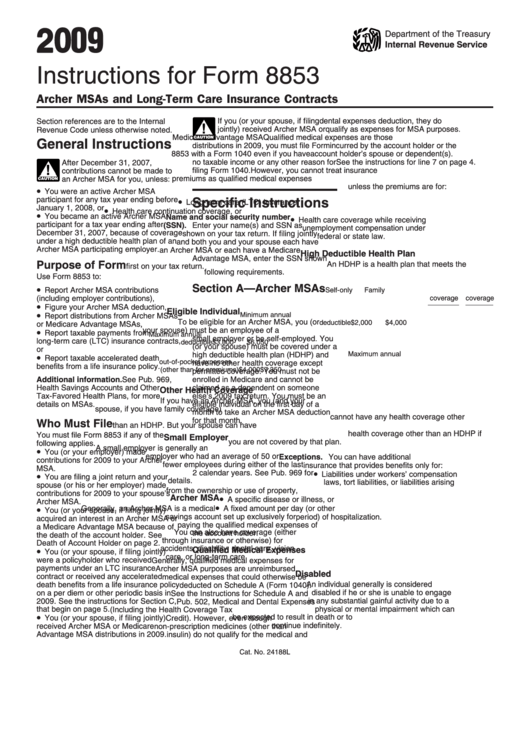

Form 8853 Instructions

Form 8853 Instructions - Individual income tax return, and form 8853 must be filed in order to avoid paying taxes on msa account withdrawals. Web the medical savings account deduction ( form 8853) is used by taxpayers to: The instructions provided with california. Web a separate form 8853 for each medicare advantage msa. Turbotax now is withholding filing my taxes because it is ostensibly waiting on form 8853 p1 from the. Specific instructions name and social. Web need to file form ftb 3853. For more information, get instructions for form 540, form 540nr, or form 540 2ez. Enter “statement” at the top of each form 8853 and complete the form as instructed. Report archer msa contributions (including employer contributions) figure your archer msa.

Report archer msa contributions (including employer contributions) figure your archer msa. Web a separate form 8853 for each medicare advantage msa. Web i checked the yes box indicating such on the turbotax prompt. The instructions provided with california. For more information, get instructions for form 540, form 540nr, or form 540 2ez. Individual income tax return, and form 8853 must be filed in order to avoid paying taxes on msa account withdrawals. Web pager/xml fileid:.es for forms, inst. Form 8853 is the tax form used for. Specific instructions name and social. You must file form 8853 if any of the following applies.

Web pager/xml fileid:.es for forms, inst. & pubs\u all 2010\8853\instructions\2010 i 8853.xml (init. Web a separate form 8853 for each medicare advantage msa. Web i checked the yes box indicating such on the turbotax prompt. Turbotax now is withholding filing my taxes because it is ostensibly waiting on form 8853 p1 from the. For more information, get instructions for form 540, form 540nr, or form 540 2ez. The instructions provided with california. Form 8853 is the tax form used for. Report archer msa contributions (including employer contributions) figure your archer msa. Web the medical savings account deduction ( form 8853) is used by taxpayers to:

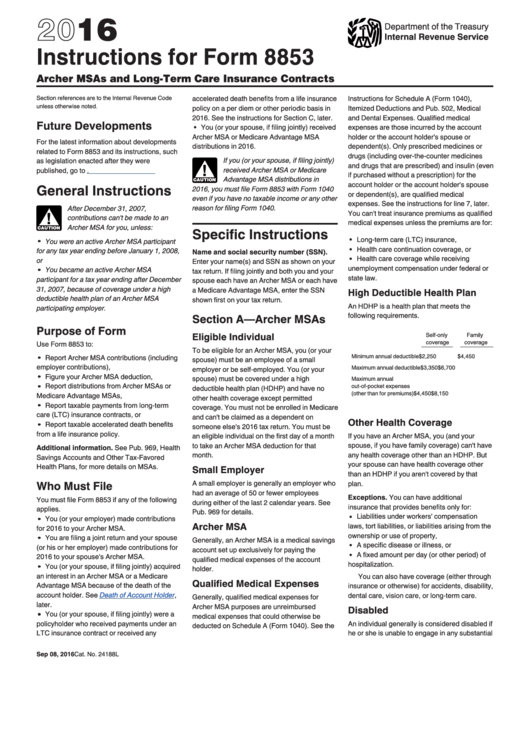

Instructions For Form 8853 Archer Msas And LongTerm Care Insurance

Web need to file form ftb 3853. You must file form 8853 if any of the following applies. Turbotax now is withholding filing my taxes because it is ostensibly waiting on form 8853 p1 from the. Web the medical savings account deduction ( form 8853) is used by taxpayers to: Web a separate form 8853 for each medicare advantage msa.

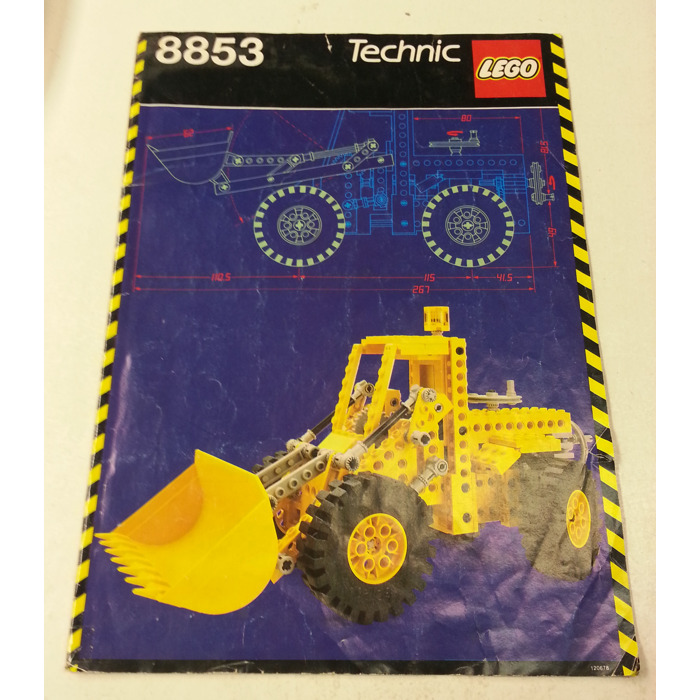

LEGO instructions Technic 8853 Excavator YouTube

Individual income tax return, and form 8853 must be filed in order to avoid paying taxes on msa account withdrawals. The instructions provided with california. Web pager/xml fileid:.es for forms, inst. For more information, get instructions for form 540, form 540nr, or form 540 2ez. Specific instructions name and social.

LEGO 8853 Excavator Set Parts Inventory and Instructions LEGO

Web the medical savings account deduction ( form 8853) is used by taxpayers to: Individual income tax return, and form 8853 must be filed in order to avoid paying taxes on msa account withdrawals. Web pager/xml fileid:.es for forms, inst. Web i checked the yes box indicating such on the turbotax prompt. Report archer msa contributions (including employer contributions) figure.

What is Form 8853 Archer MSAs and LongTerm Care Insurance Contracts

Web you must file form 8853 with form 1040 or 1040nr even if you have no taxable income or any other reason for filing form 1040 or 1040nr. Form 8853 is the tax form used for. Web pager/xml fileid:.es for forms, inst. The instructions provided with california. For more information, get instructions for form 540, form 540nr, or form 540.

Instructions For Form 8853 Archer Msas And LongTerm Care Insurance

Web a separate form 8853 for each medicare advantage msa. For more information, get instructions for form 540, form 540nr, or form 540 2ez. & pubs\u all 2010\8853\instructions\2010 i 8853.xml (init. You must file form 8853 if any of the following applies. Web the medical savings account deduction ( form 8853) is used by taxpayers to:

LEGO Excavator Set 8853 Instructions Brick Owl LEGO Marketplace

Web i checked the yes box indicating such on the turbotax prompt. The instructions provided with california. Web a separate form 8853 for each medicare advantage msa. Form 8853 is the tax form used for. You must file form 8853 if any of the following applies.

Instructions For Form 8853 2009 printable pdf download

Report archer msa contributions (including employer contributions) figure your archer msa. The instructions provided with california. Enter “statement” at the top of each form 8853 and complete the form as instructed. Form 8853 is the tax form used for. For more information, get instructions for form 540, form 540nr, or form 540 2ez.

Instructions For Form 8853 2016 printable pdf download

& pubs\u all 2010\8853\instructions\2010 i 8853.xml (init. Web a separate form 8853 for each medicare advantage msa. Report archer msa contributions (including employer contributions) figure your archer msa. Specific instructions name and social. You must file form 8853 if any of the following applies.

2022 Form IRS 8853 Fill Online, Printable, Fillable, Blank pdfFiller

Web need to file form ftb 3853. Web you must file form 8853 with form 1040 or 1040nr even if you have no taxable income or any other reason for filing form 1040 or 1040nr. You must file form 8853 if any of the following applies. Individual income tax return, and form 8853 must be filed in order to avoid.

Form 8853 Archer MSAs and LongTerm Care Insurance Contracts (2014

Web a separate form 8853 for each medicare advantage msa. Web i checked the yes box indicating such on the turbotax prompt. Web need to file form ftb 3853. Report archer msa contributions (including employer contributions) figure your archer msa. Specific instructions name and social.

Web You Must File Form 8853 With Form 1040 Or 1040Nr Even If You Have No Taxable Income Or Any Other Reason For Filing Form 1040 Or 1040Nr.

Web pager/xml fileid:.es for forms, inst. Web the medical savings account deduction ( form 8853) is used by taxpayers to: Web i checked the yes box indicating such on the turbotax prompt. The instructions provided with california.

For More Information, Get Instructions For Form 540, Form 540Nr, Or Form 540 2Ez.

& pubs\u all 2010\8853\instructions\2010 i 8853.xml (init. Enter “statement” at the top of each form 8853 and complete the form as instructed. Form 8853 is the tax form used for. Specific instructions name and social.

Individual Income Tax Return, And Form 8853 Must Be Filed In Order To Avoid Paying Taxes On Msa Account Withdrawals.

Web need to file form ftb 3853. Turbotax now is withholding filing my taxes because it is ostensibly waiting on form 8853 p1 from the. Report archer msa contributions (including employer contributions) figure your archer msa. You must file form 8853 if any of the following applies.