Form 8949 Code H

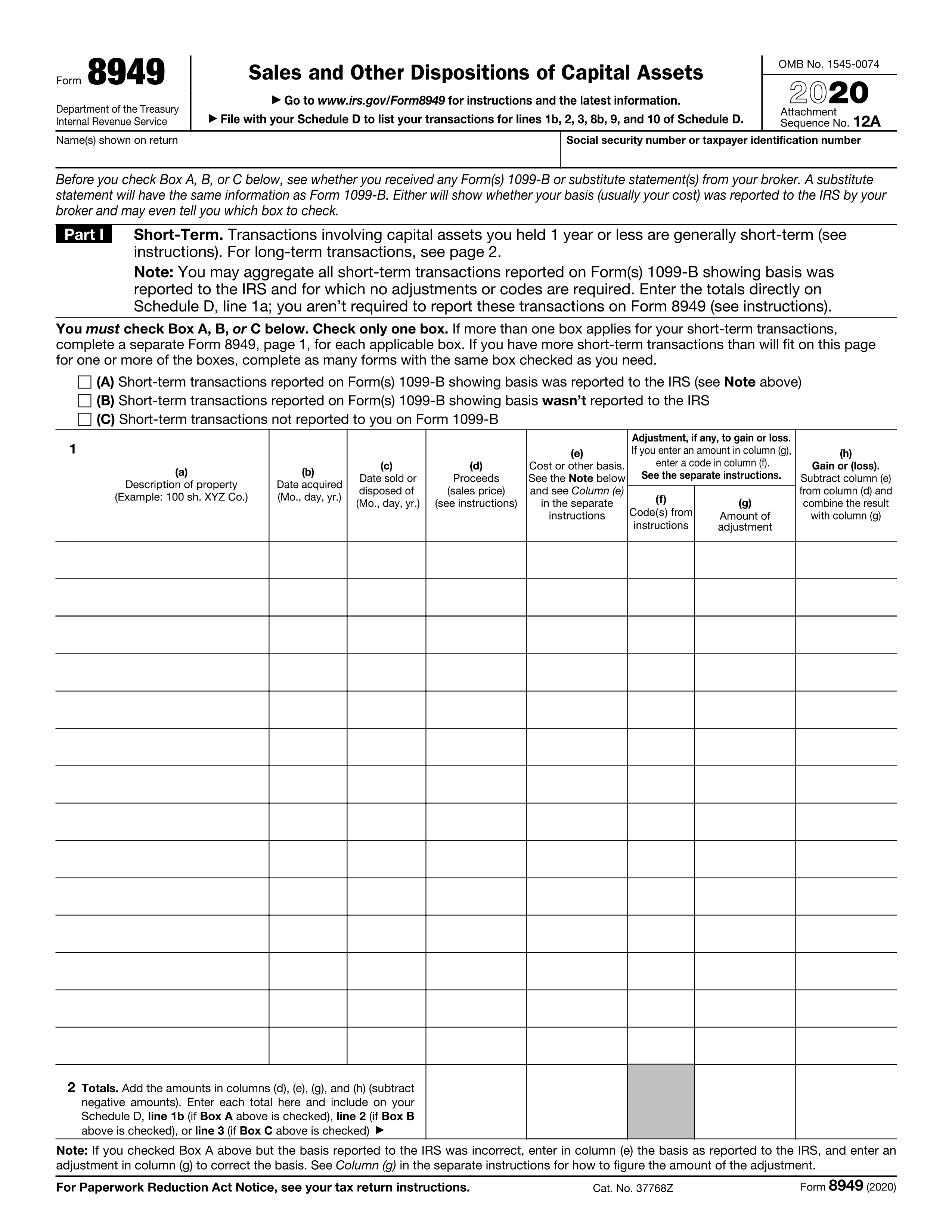

Form 8949 Code H - Report the sale or exchange on form 8949 as you would if you were not taking the exclusion. Web these adjustment codes will be included on form 8949, which will print along with schedule d. Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the latest. Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g. File form 8949 with the schedule d for the return you are filing. The same information should be entered in part ii for any long. Report the sale or exchange on form 8949 as you would if you weren't. Web report the transaction on form 8949 as you would if you were the actual owner, but also enter any resulting gain as a negative adjustment (in parentheses) in column (g) or any. Web 8 rows support form 8949 adjustment codes (1040) form 8949 adjustment codes are. The adjustment amount will also be listed on form 8949 and will transfer over to.

Web download or print the 2022 federal form 8949 (sales and other dispositions of capital assets) for free from the federal internal revenue service. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. Web thus, on irs form 8949, a taxpayer has to report capital gains and losses. The same information should be entered in part ii for any long. Moreover, while reporting cryptocurrency transactions a taxpayer must keep these irs. Web 8 rows support form 8949 adjustment codes (1040) form 8949 adjustment codes are. Report the sale or exchange on form 8949 as you would if you weren't. Individuals use form 8949 to report the following. Follow the instructions for the code you need to generate below. Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the latest.

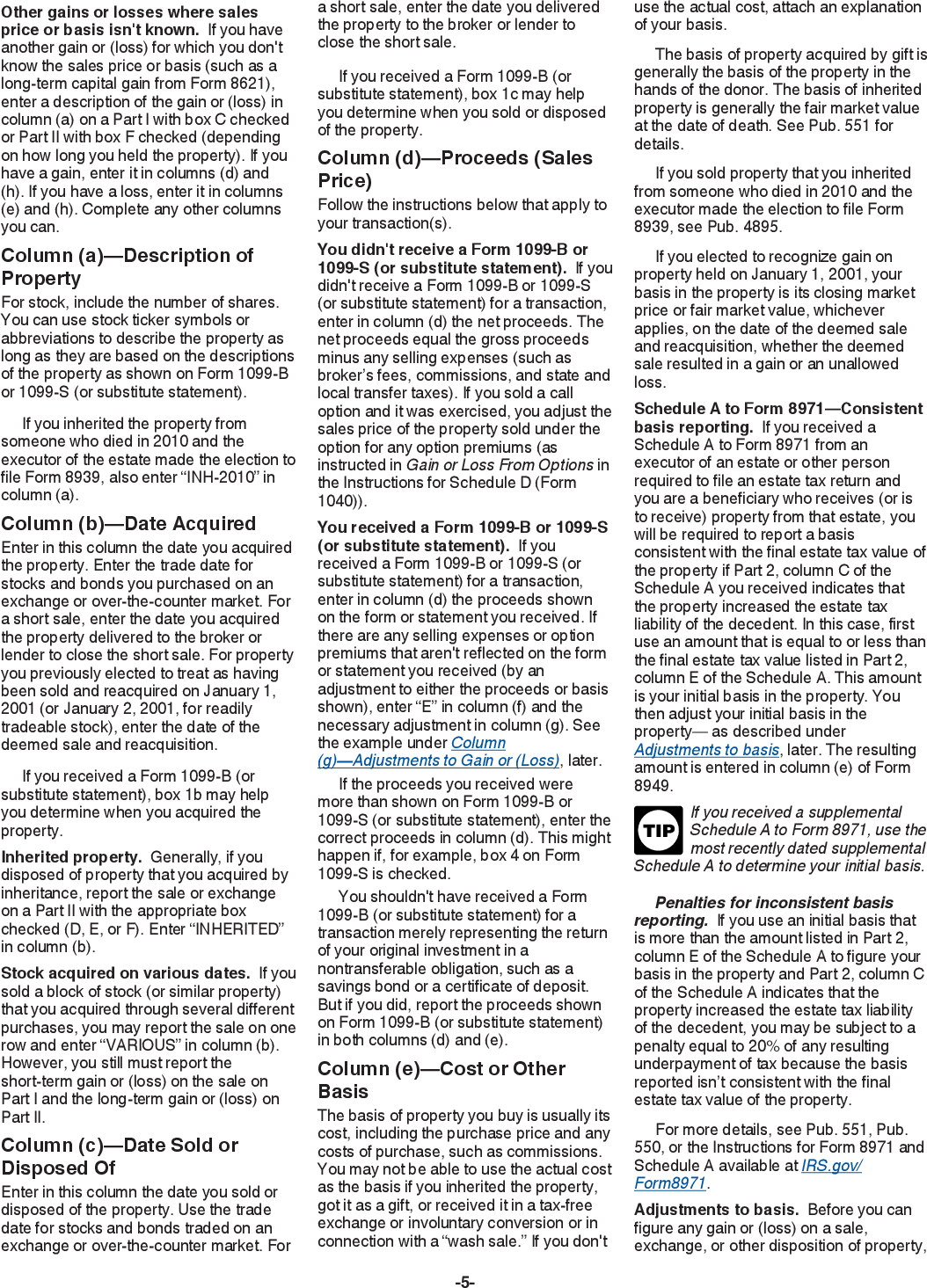

Web use form 8949 to report sales and exchanges of capital assets. Web gain or loss on line 2, total the amounts for proceeds, cost or other basis, adjustments (if any) and gain or loss. •the sale or exchange of a capital asset not reported on another form or schedule. Report the sale or exchange on form 8949 as you would if you weren't. Web thus, on irs form 8949, a taxpayer has to report capital gains and losses. Web these adjustment codes will be included on form 8949, which will print along with schedule d. Web 12 rows you sold or exchanged your main home at a gain, must report the sale or exchange on form 8949, and can exclude some or all of the gain… h: Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the latest. Web to include a code h for the sale of home on schedule d, form 8949, column (f) code (s), do the following: Follow the instructions for the code you need to generate below.

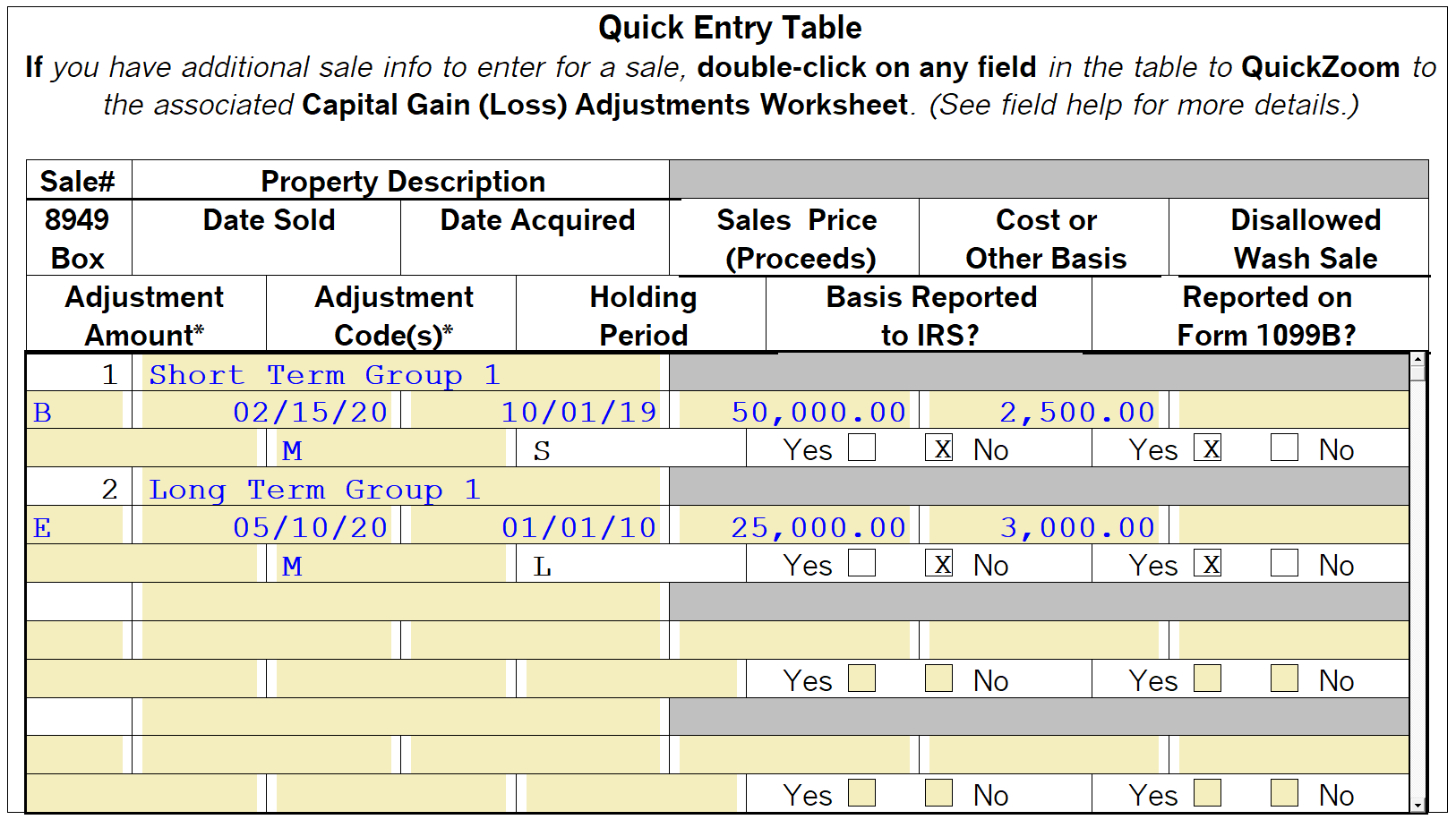

Attach a summary to the Schedule D and Form 8949 in ProSeries

Moreover, while reporting cryptocurrency transactions a taxpayer must keep these irs. Web 8 rows support form 8949 adjustment codes (1040) form 8949 adjustment codes are. Report the sale or exchange on form 8949 as you would if you weren't. Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g. Web gain or.

IRS Form 8949.

Web 12 rows you sold or exchanged your main home at a gain, must report the sale or exchange on form 8949, and can exclude some or all of the gain… h: •the sale or exchange of a capital asset not reported on another form or schedule. Web download or print the 2022 federal form 8949 (sales and other dispositions.

Online IRS Instructions 8949 2019 Fillable and Editable PDF Template

Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the latest. Web these adjustment codes will be included on form 8949, which will print along with schedule d. Follow the instructions for the code you need to generate below. Web use form 8949 to report sales.

Online generation of Schedule D and Form 8949 for 10.00

Individuals use form 8949 to report the following. Web report the transaction on form 8949 as you would if you were the actual owner, but also enter any resulting gain as a negative adjustment (in parentheses) in column (g) or any. Report the sale or exchange on form 8949 as you would if you weren't. Web thus, on irs form.

Check boxes D and E refer to longterm transactions displayed on Part II.

Report the sale or exchange on form 8949 as you would if you weren't. Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g. Web 8 rows support form 8949 adjustment codes (1040) form 8949 adjustment codes are. Web to include a code h for the sale of home on schedule d,.

In the following Form 8949 example,the highlighted section below shows

Web 8 rows support form 8949 adjustment codes (1040) form 8949 adjustment codes are. Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g. Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the latest. The adjustment amount.

Tax Form 8949 Instructions for Reporting Capital Gains and Losses

File form 8949 with the schedule d for the return you are filing. Web use form 8949 to report sales and exchanges of capital assets. Web for the main home sale exclusion, the code is h. Report the sale or exchange on form 8949 as you would if you weren't. Web download or print the 2022 federal form 8949 (sales.

How to Report the Sale of a U.S. Rental Property Madan CA

Web thus, on irs form 8949, a taxpayer has to report capital gains and losses. Web gain or loss on line 2, total the amounts for proceeds, cost or other basis, adjustments (if any) and gain or loss. Individuals use form 8949 to report the following. The same information should be entered in part ii for any long. Web these.

Form 8949 Edit, Fill, Sign Online Handypdf

Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g. Web 12 rows you sold or exchanged your main home at a gain, must report the sale or exchange on form 8949, and can exclude some or all of the gain… h: Individuals use form 8949 to report the following. Web these.

Form 8949 problems YouTube

Web gain or loss on line 2, total the amounts for proceeds, cost or other basis, adjustments (if any) and gain or loss. Web 12 rows you sold or exchanged your main home at a gain, must report the sale or exchange on form 8949, and can exclude some or all of the gain… h: Web form 8949 department of.

Web Gain, Form 8949 Will Show The Adjustment As A Negative Number In The Amount Of The Net Gain, With Adjustment Code H And Basis Type F And No Net Gain/Loss.

The same information should be entered in part ii for any long. Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g. File form 8949 with the schedule d for the return you are filing. Report the sale or exchange on form 8949 as you would if you weren't.

Web To Include A Code H For The Sale Of Home On Schedule D, Form 8949, Column (F) Code (S), Do The Following:

Web for the main home sale exclusion, the code is h. Web use form 8949 to report sales and exchanges of capital assets. Moreover, while reporting cryptocurrency transactions a taxpayer must keep these irs. Report the sale or exchange on form 8949 as you would if you were not taking the exclusion.

Follow The Instructions For The Code You Need To Generate Below.

Web report the transaction on form 8949 as you would if you were the actual owner, but also enter any resulting gain as a negative adjustment (in parentheses) in column (g) or any. Web 8 rows support form 8949 adjustment codes (1040) form 8949 adjustment codes are. Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the latest. Individuals use form 8949 to report the following.

Web Gain Or Loss On Line 2, Total The Amounts For Proceeds, Cost Or Other Basis, Adjustments (If Any) And Gain Or Loss.

Web thus, on irs form 8949, a taxpayer has to report capital gains and losses. Web these adjustment codes will be included on form 8949, which will print along with schedule d. •the sale or exchange of a capital asset not reported on another form or schedule. Web overview of form 8949: