Form 8962 Allocation Of Policy Amounts

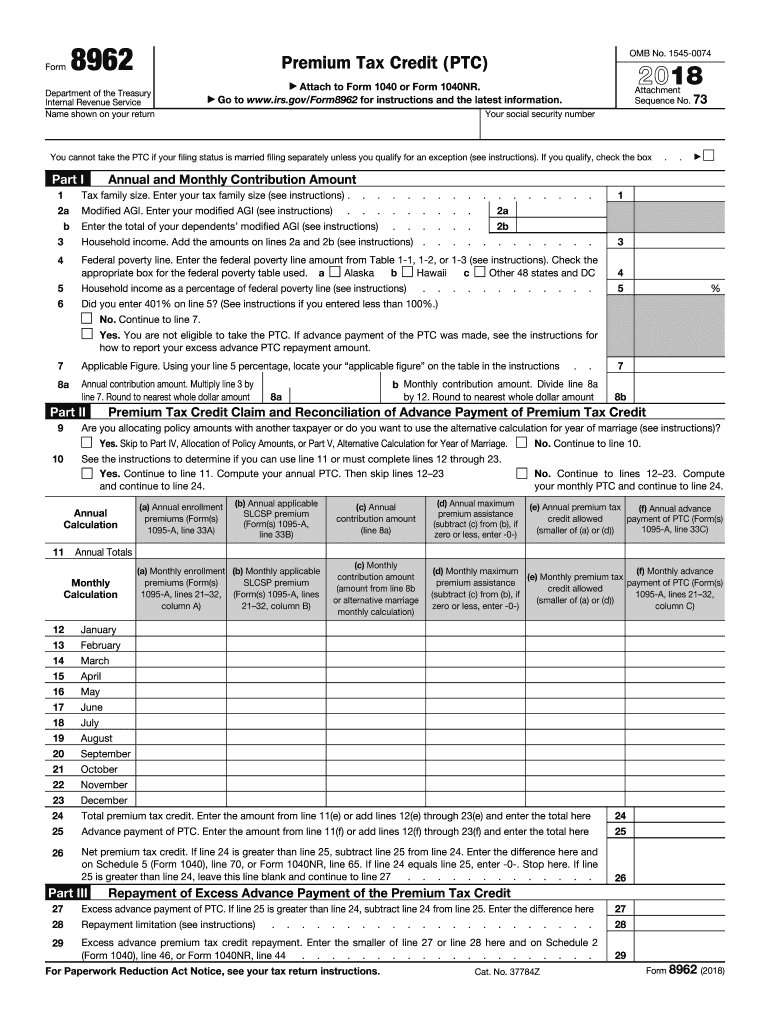

Form 8962 Allocation Of Policy Amounts - Web enter the first month you are allocating policy amounts. Web form 8962 is used to calculate the amount of premium tax credit you’re eligible to claim if you paid premiums for health insurance purchased through the health. Form 8962 shared policy allocation examples this article shows how to enter the shared. Complete, edit or print tax forms instantly. Web form 8962 (2016) page 2 part iv allocation of policy amounts complete the following information for up to four shared policy allocations. Use this form to figure the amount of your premium tax credit (ptc) 2022 8962 form. See instructions for allocation details. Web 2a b enter the total of your dependents' modified agi (see instructions). Web the information for policy allocation is found in the 8962 instructions part iv allocation of policy amounts. Form 8962 instructions for the 2016 version.

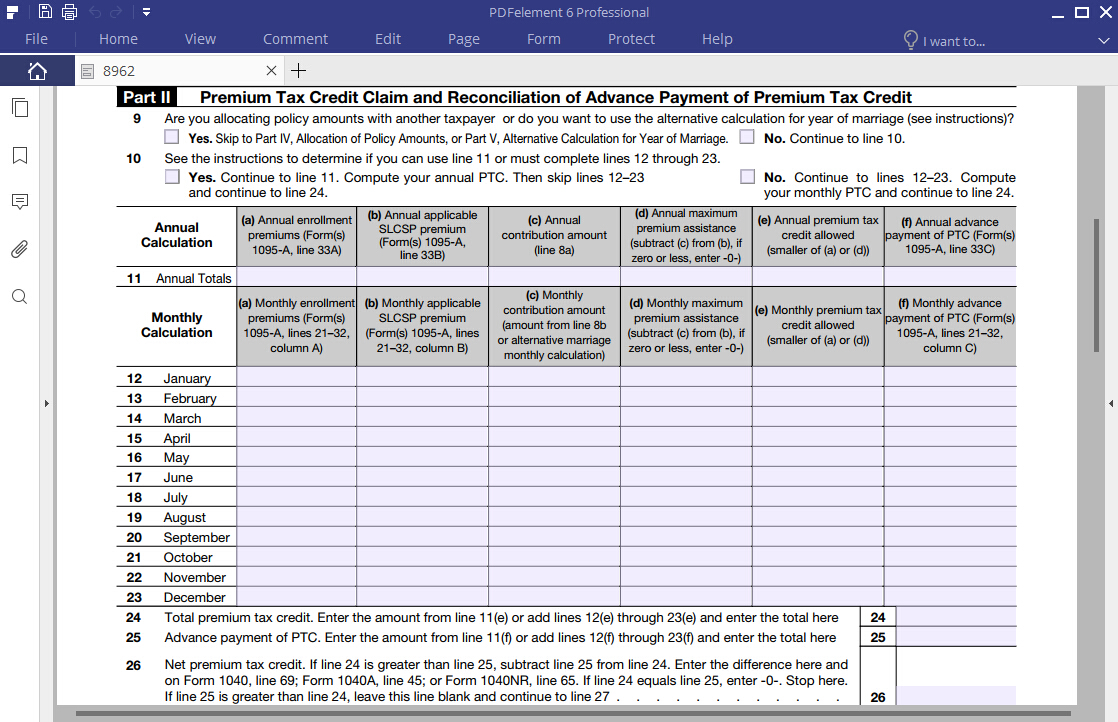

Web he is actually at 421% (form 8962 shows 401% for anything over 400%). Form 8962 is used either (1) to reconcile a premium tax. Web enter the first month you are allocating policy amounts. Web form 8962 is used to calculate the amount of premium tax credit you’re eligible to claim if you paid premiums for health insurance purchased through the health. Web taxpayers who divorce or legally separate during the tax year but obtained minimum essential coverage through the marketplace or a state health care exchange must. Complete, edit or print tax forms instantly. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web form 8962, premium tax credit (ptc), contains two parts that may need to be completed in certain situations. Add the amounts on lines 2a and 2b (see instructions). Web form 8962 (2023) page 2 part iv allocation of policy amounts complete the following information for up to four policy amount allocations.

Ad get ready for tax season deadlines by completing any required tax forms today. Web enter the first month you are allocating policy amounts. See instructions for allocation details. Web form 8962 (2021) page 2 part iv allocation of policy amounts complete the following information for up to four policy amount allocations. Web support taxslayer pro desktop payments, estimates & eic desktop: Web note that you cannot make this choice if you're allocating policy amounts with another taxpayer. See instructions for allocation details. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web allocation of policy amounts caution: Web the information for policy allocation is found in the 8962 instructions part iv allocation of policy amounts.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

See instructions for allocation details. Web form 8962, premium tax credit (ptc), contains two parts that may need to be completed in certain situations. Complete, edit or print tax forms instantly. Web allocation of policy amounts caution: See instructions for allocation details.

Breanna Image Of Form 8962

Complete, edit or print tax forms instantly. Form 8962 instructions for the 2016 version. Add the amounts on lines 2a and 2b (see instructions). See instructions for allocation details. Web he is actually at 421% (form 8962 shows 401% for anything over 400%).

Form 8962 Fill Out and Sign Printable PDF Template signNow

As lisa pointed out, if the taxpayer can contribute $2631 to a. Web support taxslayer pro desktop payments, estimates & eic desktop: Web note that you cannot make this choice if you're allocating policy amounts with another taxpayer. See instructions for allocation details. Form 8962 shared policy allocation examples this article shows how to enter the shared.

3 Easy Ways to Fill Out Form 8962 wikiHow

Web form 8962 (2023) page 2 part iv allocation of policy amounts complete the following information for up to four policy amount allocations. Complete, edit or print tax forms instantly. Web the information for policy allocation is found in the 8962 instructions part iv allocation of policy amounts. Web enter the first month you are allocating policy amounts. Web 2a.

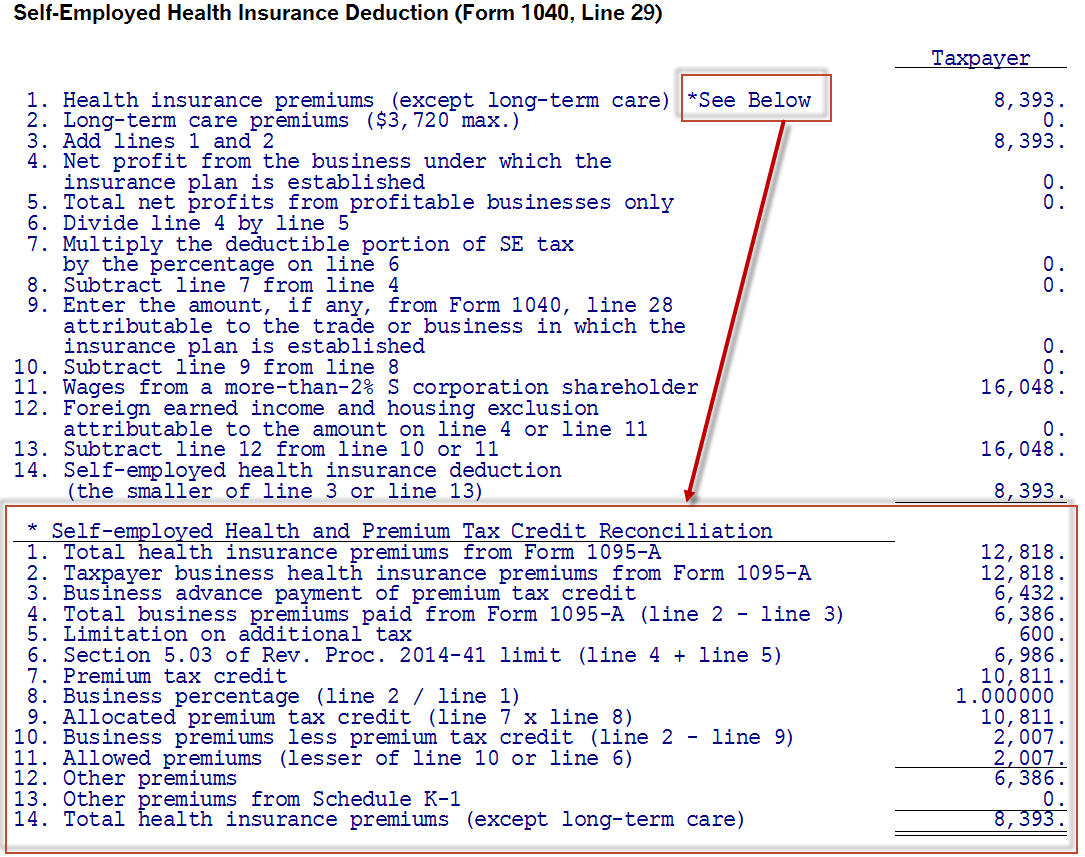

Calculating form 8962 with a selfemployed health insurance deduction

See instructions for allocation details. Web up to $40 cash back irs 8962 form. Web for a return containing a form 8962, premium tax credit (ptc), under part 1, if the total of line 2a and line 2b amounts are negative, a 0 dollar amount will appear in line 3,. Web allocation of policy amounts caution: See instructions for allocation.

Form 8962 Premium Tax Credit Definition

As lisa pointed out, if the taxpayer can contribute $2631 to a. Web note that you cannot make this choice if you're allocating policy amounts with another taxpayer. Form 8962 instructions for the 2016 version. Web taxpayers who divorce or legally separate during the tax year but obtained minimum essential coverage through the marketplace or a state health care exchange.

IRS Form 8962 Instruction for How to Fill it Right

As lisa pointed out, if the taxpayer can contribute $2631 to a. Ad get ready for tax season deadlines by completing any required tax forms today. Web form 8962 is used to calculate the amount of premium tax credit you’re eligible to claim if you paid premiums for health insurance purchased through the health. Web for a return containing a.

2020 Form 8962 Instructions Fill Online, Printable, Fillable, Blank

Web form 8962 (2023) page 2 part iv allocation of policy amounts complete the following information for up to four policy amount allocations. Enter the last month you are. Web for a return containing a form 8962, premium tax credit (ptc), under part 1, if the total of line 2a and line 2b amounts are negative, a 0 dollar amount.

Making Healthcare Affordable with IRS Form 8962 pdfFiller Blog

Web enter the first month you are allocating policy amounts. Web he is actually at 421% (form 8962 shows 401% for anything over 400%). Web up to $40 cash back irs 8962 form. Form 8962 shared policy allocation examples this article shows how to enter the shared. Form 8962 is used either (1) to reconcile a premium tax.

Fill Free fillable Form 8962 Premium Tax Credit PDF form

Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Complete, edit or print tax forms instantly. Web 2a b enter the total of your dependents' modified agi (see instructions). Web the information for policy allocation is found in the 8962 instructions part iv allocation of policy amounts. Add the amounts.

Web Note That You Cannot Make This Choice If You're Allocating Policy Amounts With Another Taxpayer.

Web form 8962 (2021) page 2 part iv allocation of policy amounts complete the following information for up to four policy amount allocations. Web the information for policy allocation is found in the 8962 instructions part iv allocation of policy amounts. Form 8962 instructions for the 2016 version. See instructions for allocation details.

Add The Amounts On Lines 2A And 2B (See Instructions).

Web taxpayers who divorce or legally separate during the tax year but obtained minimum essential coverage through the marketplace or a state health care exchange must. Enter the last month you are. Web form 8962, premium tax credit (ptc), contains two parts that may need to be completed in certain situations. Web form 8962 (2016) page 2 part iv allocation of policy amounts complete the following information for up to four shared policy allocations.

Web For A Return Containing A Form 8962, Premium Tax Credit (Ptc), Under Part 1, If The Total Of Line 2A And Line 2B Amounts Are Negative, A 0 Dollar Amount Will Appear In Line 3,.

Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web enter the first month you are allocating policy amounts. Web form 8962 is used to calculate the amount of premium tax credit you’re eligible to claim if you paid premiums for health insurance purchased through the health. Ad get ready for tax season deadlines by completing any required tax forms today.

Web 2A B Enter The Total Of Your Dependents' Modified Agi (See Instructions).

Web allocation of policy amounts caution: Web he is actually at 421% (form 8962 shows 401% for anything over 400%). Web form 8962 (2023) page 2 part iv allocation of policy amounts complete the following information for up to four policy amount allocations. Web up to $40 cash back irs 8962 form.

/affordable_care_act-9765a407b10444bb98b60706b31b0426.jpg)