Form 940 For 2023

Form 940 For 2023 - For each state with a credit reduction rate greater than zero,. The due date for filing form 940 for 2021 is january 31,. If an employee agreed to receive form w2 electronically, post it on a website accessible to the employee and notify the. Web 940 form 2023 1 numbers and dates you need to know before filling out 940 form as of 2022, the tax rate is set at 6% for the first $7,000. Upload, modify or create forms. Web form 940 not required. If employers pay their taxes on time,. Form 940, employer's annual federal unemployment tax return. Web form 940 has you enter information about the state unemployment taxes paid to show that you qualify for the 5.4% tax credit. Exempt under 501c (3) of irc.

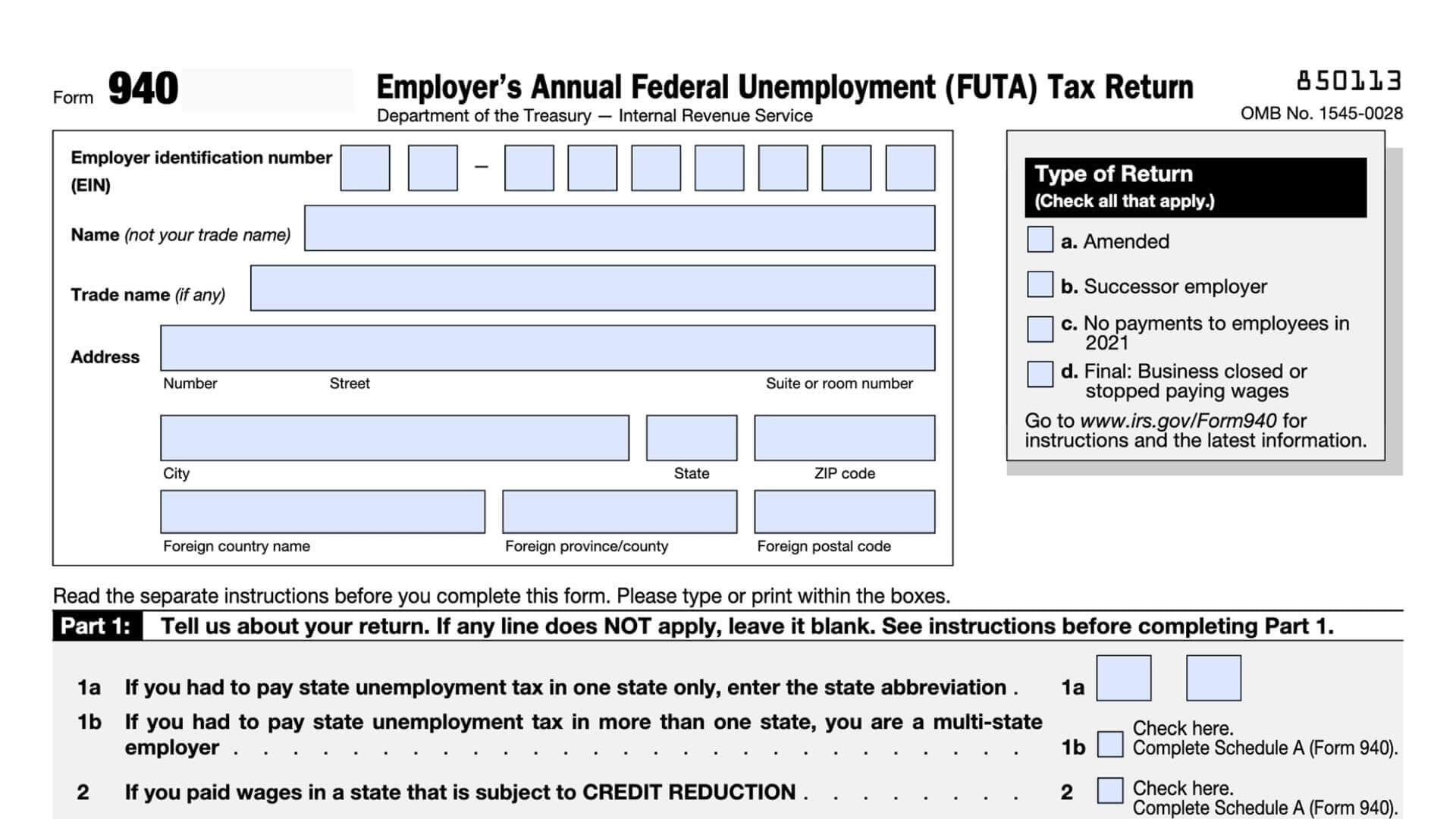

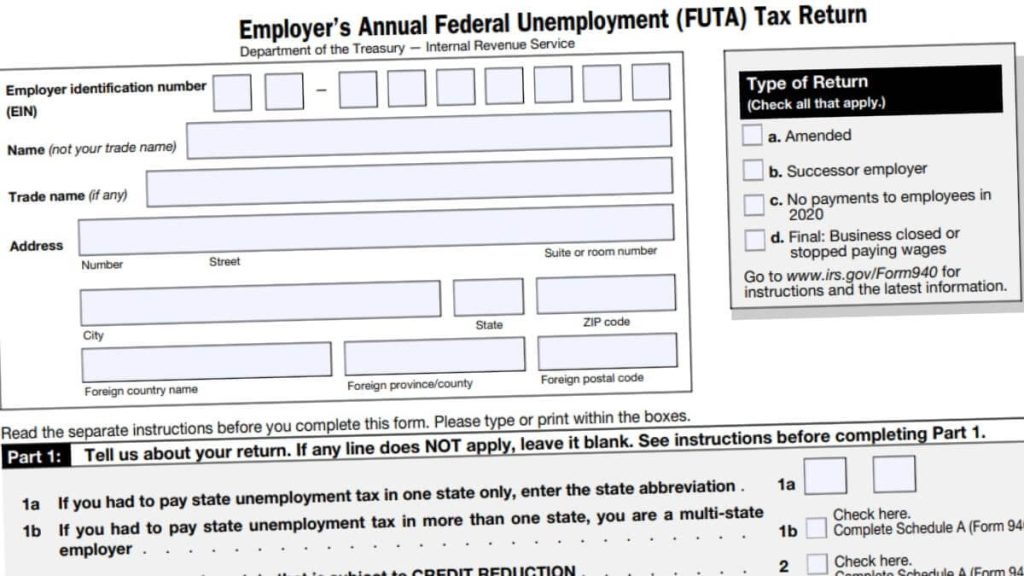

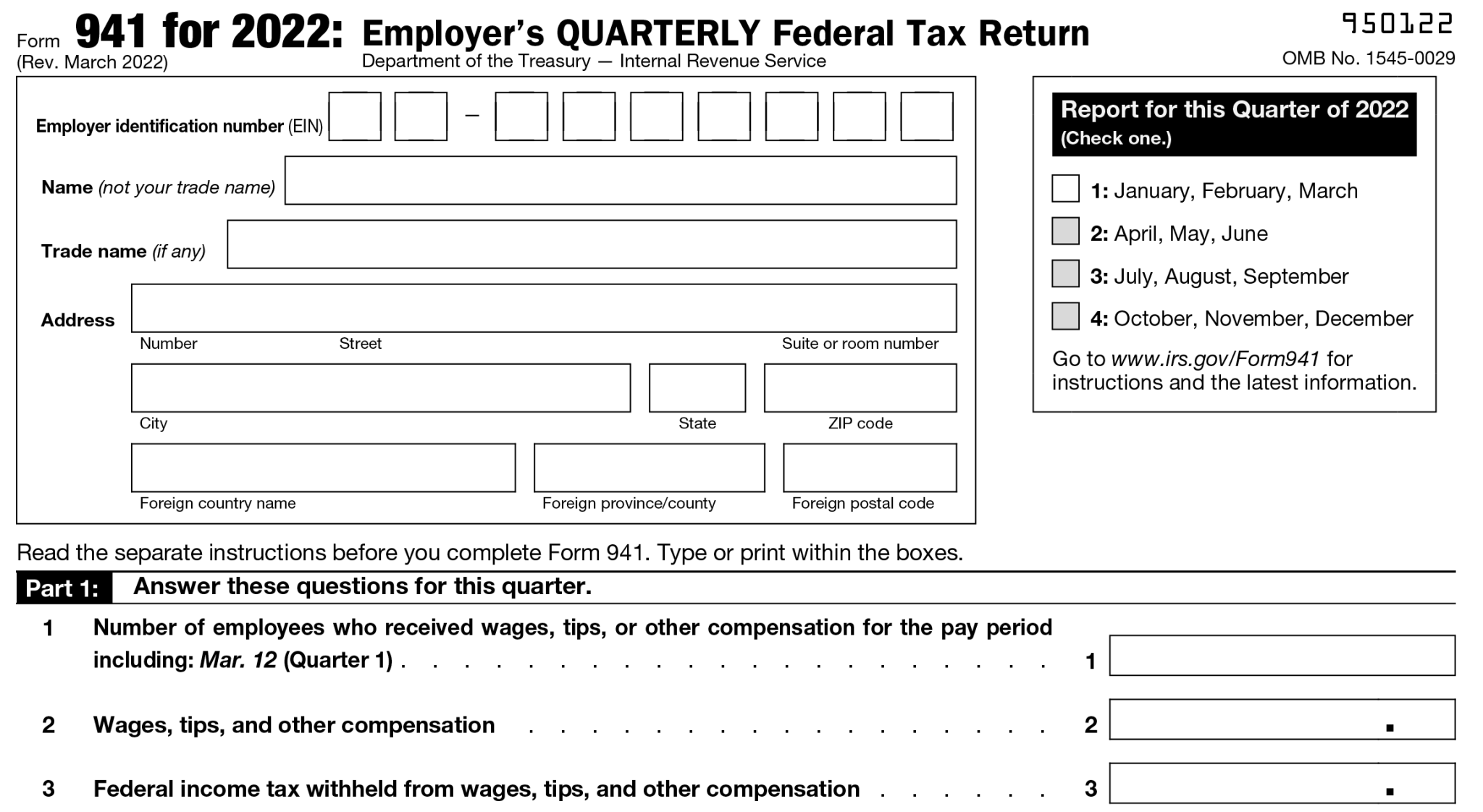

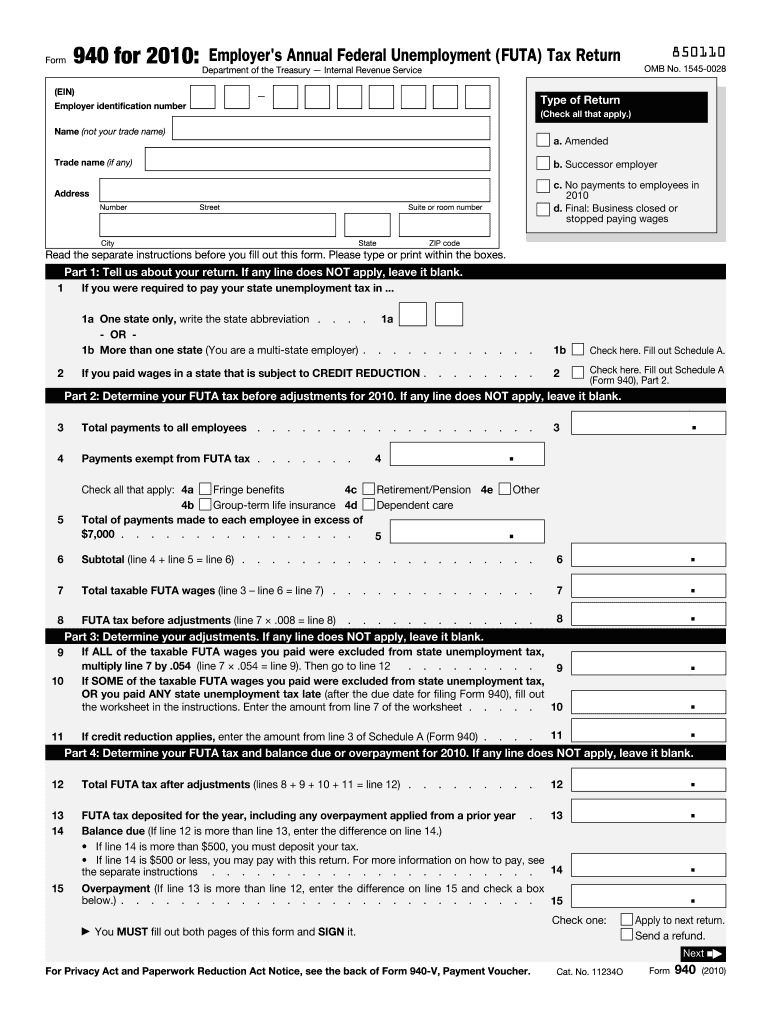

Web wage and tax statement, for 2022 by january 31, 2023. Web unlike your futa payments, which are due every calendar quarter, you must submit form 940 annually. For each state with a credit reduction rate greater than zero,. Employer’s quarterly federal tax return (form 941), employer’s annual federal unemployment tax return (form 940), wage. Employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113 omb no. Web federal forms, internal revenue service (irs): Place an “x” in the box of every state in which you had to pay state unemployment tax this year. Reporting february tip income of $20 or more to employers (form 4070). For more information about a cpeo’s. Form 940, employer's annual federal unemployment tax return.

Employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113 omb no. Web wage and tax statement, for 2022 by january 31, 2023. Reporting february tip income of $20 or more to employers (form 4070). For each state with a credit reduction rate greater than zero,. Web unlike your futa payments, which are due every calendar quarter, you must submit form 940 annually. Exempt under 501c (3) of irc. Web up to $32 cash back form 940 is an annual tax form that documents your company’s contributions to federal unemployment taxes. Upload, modify or create forms. For more information about a cpeo’s. Web employment tax forms:

940 Form 2023

Try it for free now! Employer’s quarterly federal tax return (form 941), employer’s annual federal unemployment tax return (form 940), wage. Web form 940 has you enter information about the state unemployment taxes paid to show that you qualify for the 5.4% tax credit. Web the deadline for filing the following annual payroll forms is january 31, 2023. Web employment.

940 Form 2023 Fillable Form 2023

Web 940 form 2023 1 numbers and dates you need to know before filling out 940 form as of 2022, the tax rate is set at 6% for the first $7,000. For more information about a cpeo’s. Don’t forget about futa taxes. Place an “x” in the box of every state in which you had to pay state unemployment tax.

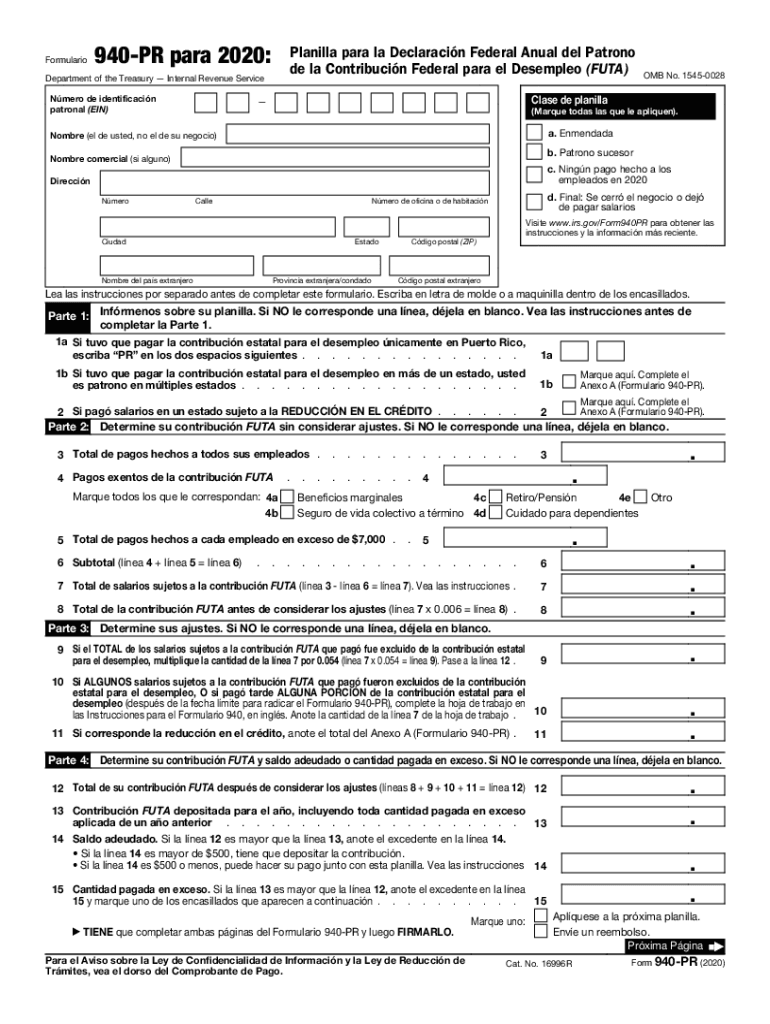

Form 940 pr 2023 Fill online, Printable, Fillable Blank

For each state with a credit reduction rate greater than zero,. Employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113 omb no. Employer’s quarterly federal tax return (form 941), employer’s annual federal unemployment tax return (form 940), wage. Try it for free now! Web unlike your futa payments, which are due every calendar.

Form 940 Instructions How to Fill It Out and Who Needs to File It

Web unlike your futa payments, which are due every calendar quarter, you must submit form 940 annually. Employer’s quarterly federal tax return (form 941), employer’s annual federal unemployment tax return (form 940), wage. For each state with a credit reduction rate greater than zero,. Web form 940 not required. Web federal forms, internal revenue service (irs):

940 Form 2023

Place an “x” in the box of every state in which you had to pay state unemployment tax this year. Web employment tax forms: Web form 940 for 2022: Web cpeos must generally file form 940 and schedule r (form 940), allocation schedule for aggregate form 940 filers, electronically. Web form 940 not required.

Fillable Form 940 For 2023 Fillable Form 2023

If an employee agreed to receive form w2 electronically, post it on a website accessible to the employee and notify the. Web wage and tax statement, for 2022 by january 31, 2023. Place an “x” in the box of every state in which you had to pay state unemployment tax this year. Web 940 form 2023 1 numbers and dates.

Form 940 PR Employer's Annual Federal Unemployment FUTA Tax Return

If employers pay their taxes on time,. Web form 940 for 2022: Don’t forget about futa taxes. Exempt under 501c (3) of irc. Employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113 omb no.

2010 form 940 Fill out & sign online DocHub

Exempt under 501c (3) of irc. If employers pay their taxes on time,. Upload, modify or create forms. Don’t forget about futa taxes. Reporting february tip income of $20 or more to employers (form 4070).

F940 Instructions 2021 Fill Out and Sign Printable PDF Template signNow

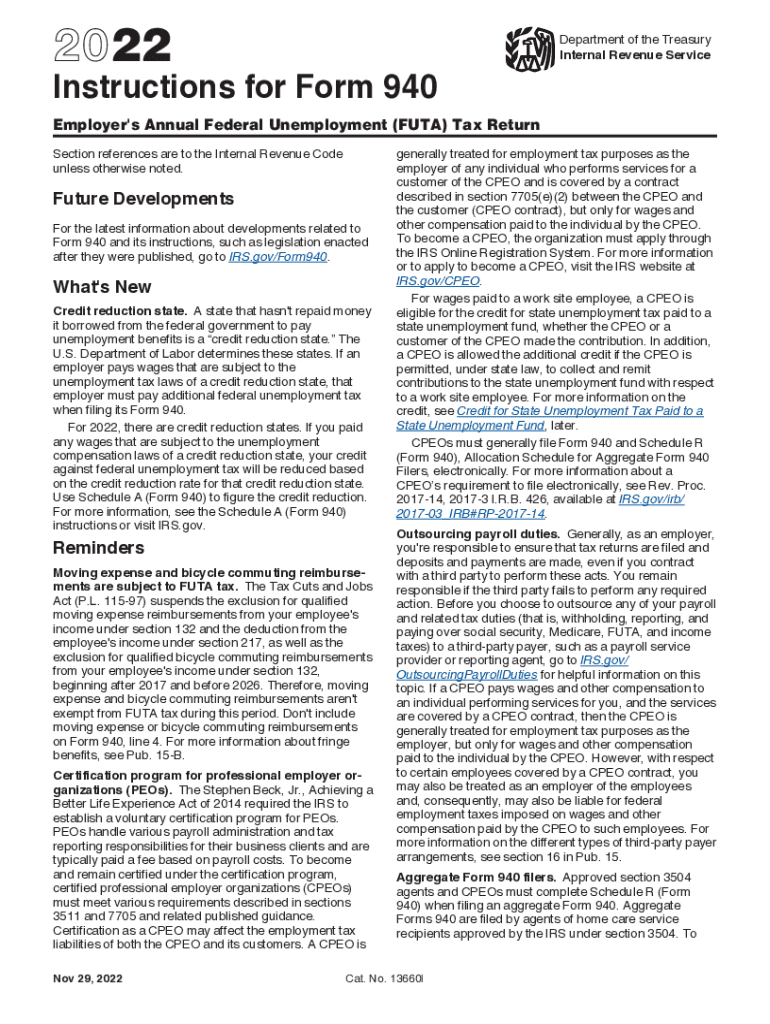

Web june 8, 2023 · 5 minute read the revised drafts of form 940 (employer’s annual federal unemployment (futa) tax return) and form 940 schedule a (multi. Web in a major step in the new digital intake scanning initiative, the irs has already scanned more than 120,000 paper forms 940 since the start of 2023, this is a. Web form.

940 Form 2023 Fillable Form 2023

Upload, modify or create forms. Reporting february tip income of $20 or more to employers (form 4070). Web 940 form 2023 1 numbers and dates you need to know before filling out 940 form as of 2022, the tax rate is set at 6% for the first $7,000. For each state with a credit reduction rate greater than zero,. Web.

Web Federal Forms, Internal Revenue Service (Irs):

Web june 8, 2023 · 5 minute read the revised drafts of form 940 (employer’s annual federal unemployment (futa) tax return) and form 940 schedule a (multi. Form 940, employer's annual federal unemployment tax return. Web unlike your futa payments, which are due every calendar quarter, you must submit form 940 annually. Place an “x” in the box of every state in which you had to pay state unemployment tax this year.

Web Wage And Tax Statement, For 2022 By January 31, 2023.

Web form 940 not required. Web the deadline for filing the following annual payroll forms is january 31, 2023. Web form 940 has you enter information about the state unemployment taxes paid to show that you qualify for the 5.4% tax credit. Try it for free now!

Web 940 Form 2023 1 Numbers And Dates You Need To Know Before Filling Out 940 Form As Of 2022, The Tax Rate Is Set At 6% For The First $7,000.

Web form 940 for 2022: For more information about a cpeo’s. Web employment tax forms: If an employee agreed to receive form w2 electronically, post it on a website accessible to the employee and notify the.

Reporting February Tip Income Of $20 Or More To Employers (Form 4070).

The due date for filing form 940 for 2021 is january 31,. Don’t forget about futa taxes. Form 940 must be filed with the irs annually to report federal. Ad get ready for tax season deadlines by completing any required tax forms today.