Form 941 X 2021

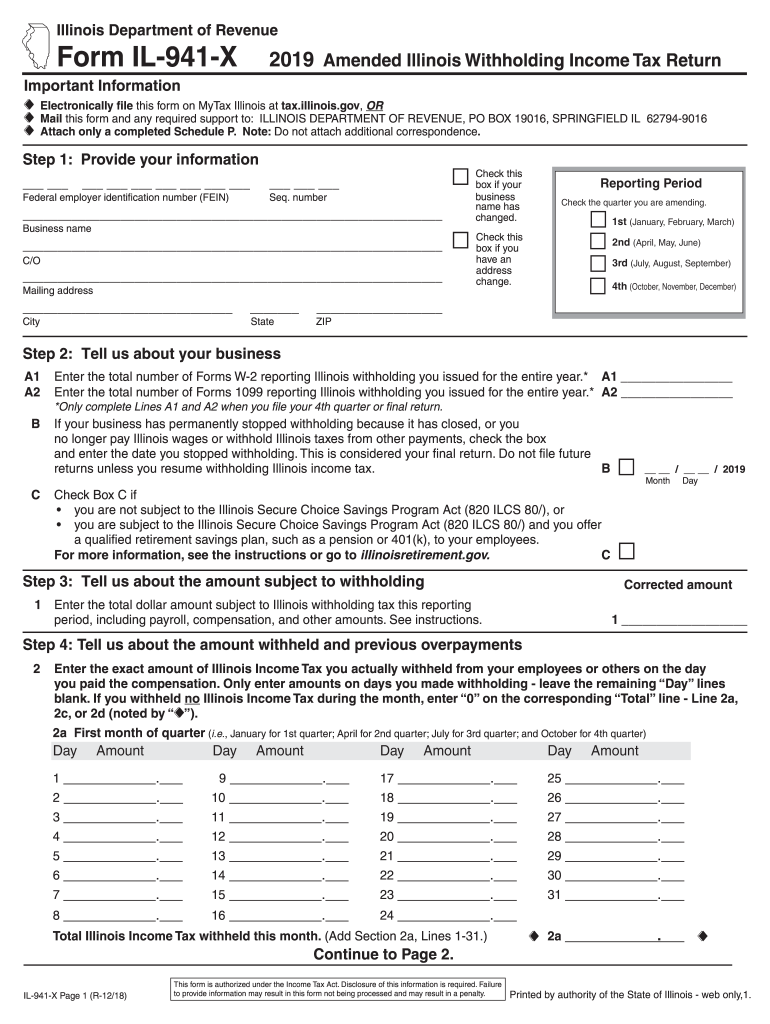

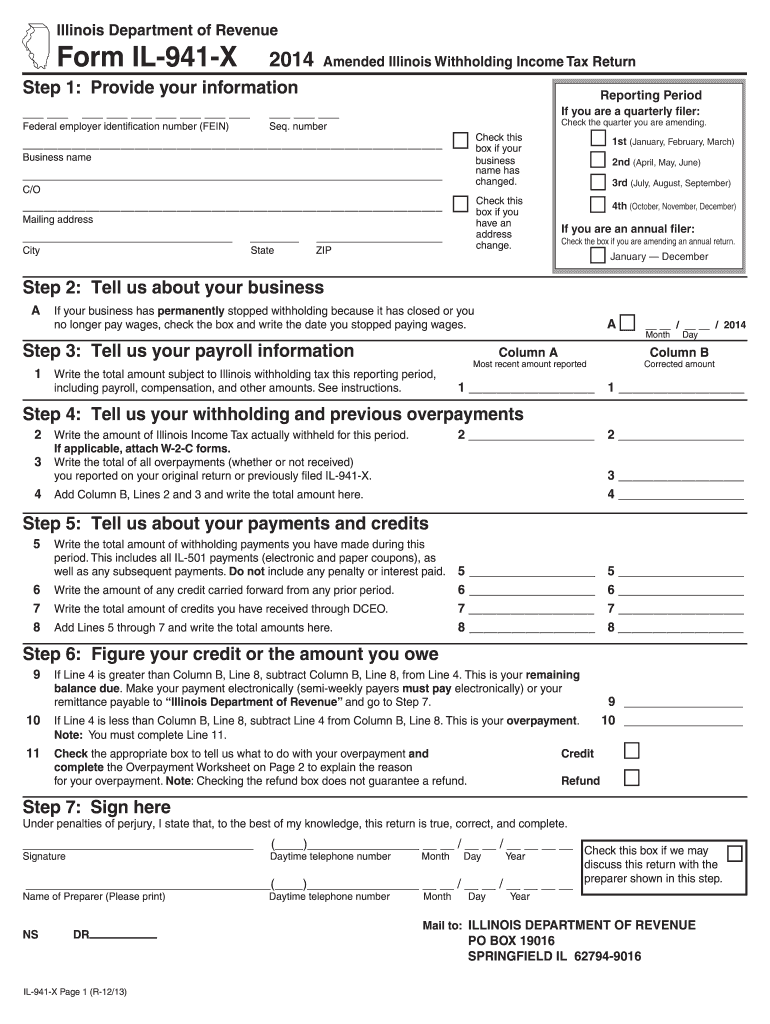

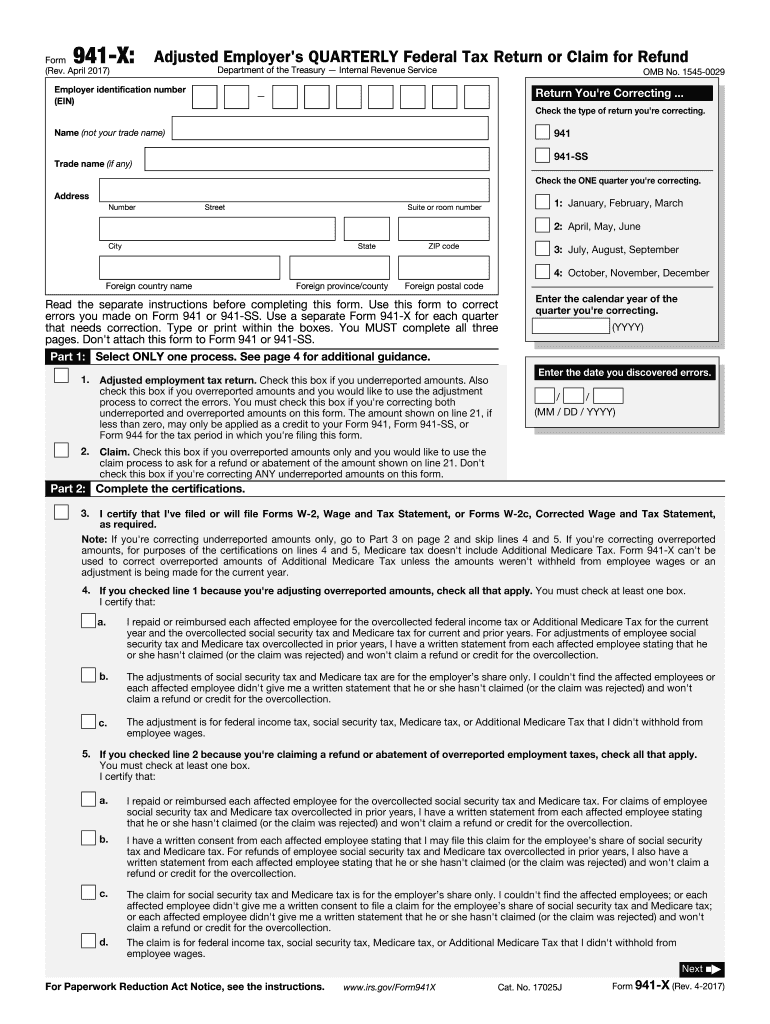

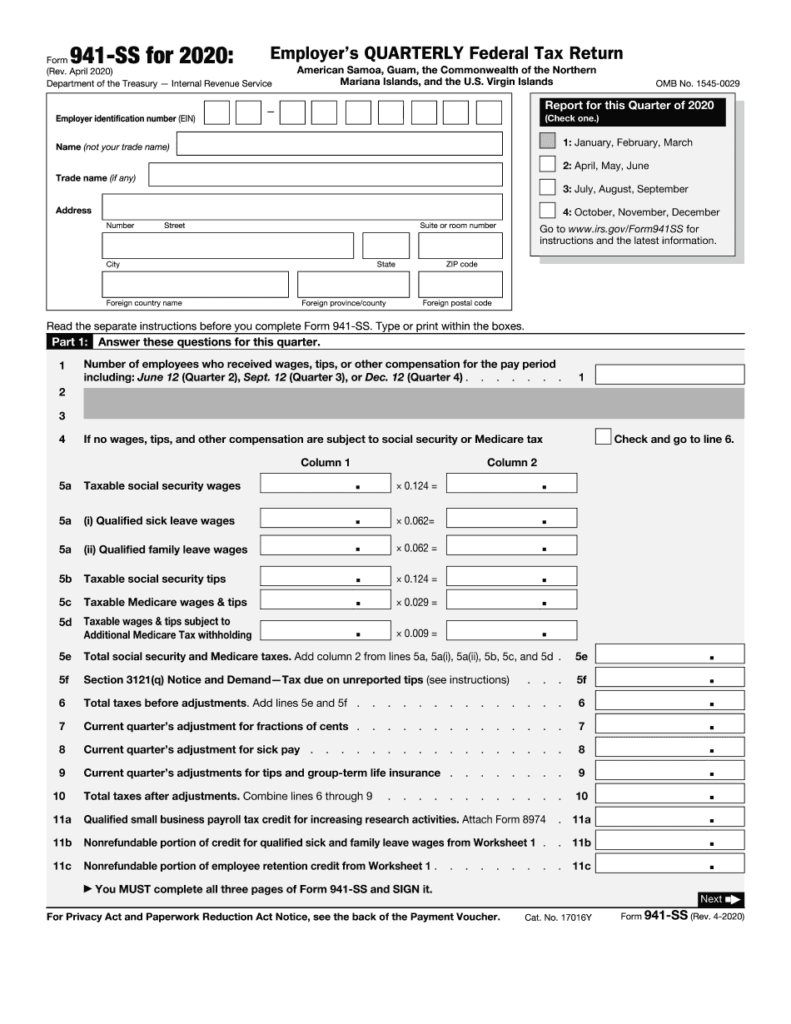

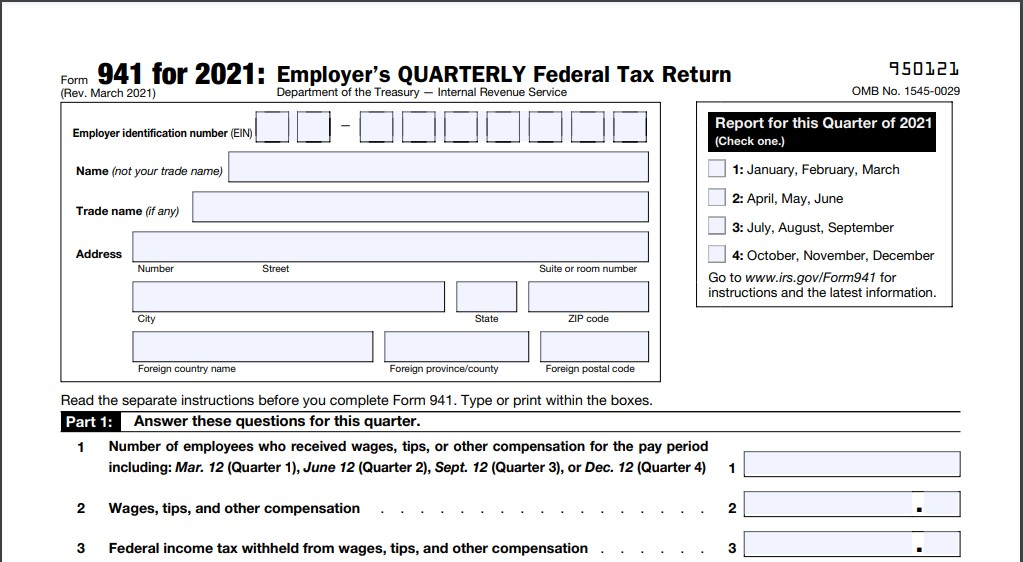

Form 941 X 2021 - Type or print within the boxes. We are eligible for erc due to a 57.2% decline in gross receipts in q2 2020 compared to q2 2019. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Type or print within the boxes. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. See the instructions for line 42. April, may, june read the separate instructions before completing this form. Illinois withholding income tax return: Click the link to load the instructions from the irs website. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code

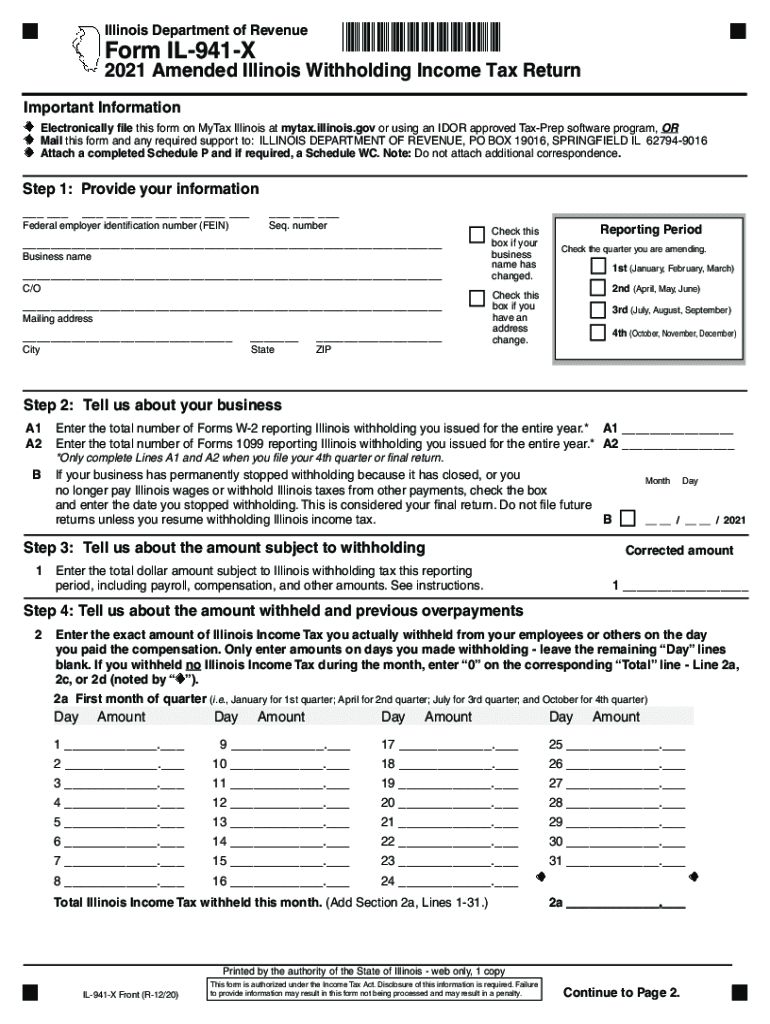

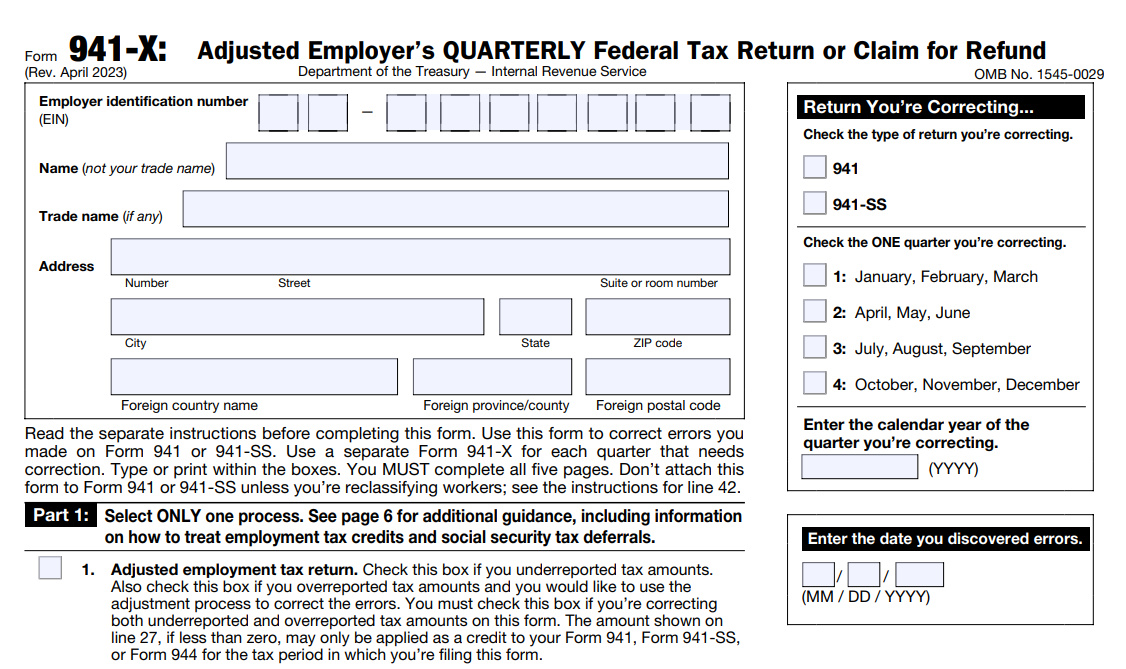

For all quarters in 2020, the deadline to apply for the erc is april 15, 2024, and for all quarters in 2021, the deadline is april 15, 2025. Web the final dates for eligible businesses to claim the ertc is with their quarterly form 941 tax filings, due july 31, oct. Read the separate instructions before you complete form 941. April 2022) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Type or print within the boxes. Web there are only two deadlines: Amended illinois withholding income tax return: We’re here to guide you through that process.

Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Type or print within the boxes. April 2022) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. We are eligible for erc due to a 57.2% decline in gross receipts in q2 2020 compared to q2 2019. The sum of line 30 and line 31 multiplied by the credit percentage of either 50% (2020) or 70% (2021) should equal the total erc presented on. See the instructions for line 42. October, november, december go to www.irs.gov/form941 for instructions and the latest information. You must complete all five pages. Web report for this quarter of 2021 (check one.) 1: If you are located in.

Form Il 941 X Fill Out and Sign Printable PDF Template signNow

Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. For all quarters in 2020, the deadline to apply for the erc is april 15, 2024, and for all quarters in 2021, the deadline is april 15, 2025. Type or print within the boxes. The sum of line 30.

How to fill out IRS Form 941 2019 PDF Expert

Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. If you are located in. See the instructions for line 42. April 2022) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. October, november, december go to www.irs.gov/form941.

[Solved] Form 941 for 2021 Employer's QUARTERLY Federal Tax Return

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. You must complete all five pages. Read the separate instructions before you complete form 941. Web report for this quarter of 2021 (check one.) 1: The sum of line 30 and line 31 multiplied by the credit percentage of.

Il 941 X Form Fill Out and Sign Printable PDF Template signNow

Web there are only two deadlines: Read the separate instructions before you complete form 941. April, may, june read the separate instructions before completing this form. We’re here to guide you through that process. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file.

941 Form Fill Out and Sign Printable PDF Template signNow

April 2022) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. These instructions have been updated for changes under the american rescue plan act of 2021 (the arp). We are eligible for erc due to a 57.2% decline in gross receipts in q2 2020 compared to q2 2019. Web.

Printable 941 Tax Form 2021 Printable Form 2022

Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. This requires corrections because we were not aware of erc when we filed our original form 941. Web report for this quarter of 2021 (check one.) 1: We are eligible for erc due to a 57.2% decline in gross.

2021 Form IL DoR IL941X Fill Online, Printable, Fillable, Blank

This requires corrections because we were not aware of erc when we filed our original form 941. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name.

Worksheet 1 941x

Web there are only two deadlines: We’re here to guide you through that process. We are eligible for erc due to a 57.2% decline in gross receipts in q2 2020 compared to q2 2019. You must complete all five pages. Illinois withholding income tax return:

Printable 941 Form 2021 Printable Form 2022

Read the separate instructions before you complete form 941. Type or print within the boxes. For all quarters in 2020, the deadline to apply for the erc is april 15, 2024, and for all quarters in 2021, the deadline is april 15, 2025. See the instructions for line 42. April, may, june read the separate instructions before completing this form.

File 941 Online How to File 2023 Form 941 electronically

Web there are only two deadlines: Type or print within the boxes. We are eligible for erc due to a 57.2% decline in gross receipts in q2 2020 compared to q2 2019. Type or print within the boxes. Click the link to load the instructions from the irs website.

October, November, December Go To Www.irs.gov/Form941 For Instructions And The Latest Information.

Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web the final dates for eligible businesses to claim the ertc is with their quarterly form 941 tax filings, due july 31, oct. April, may, june read the separate instructions before completing this form.

The Sum Of Line 30 And Line 31 Multiplied By The Credit Percentage Of Either 50% (2020) Or 70% (2021) Should Equal The Total Erc Presented On.

Read the separate instructions before you complete form 941. These instructions have been updated for changes under the american rescue plan act of 2021 (the arp). Type or print within the boxes. Type or print within the boxes.

Read The Separate Instructions Before You Complete Form 941.

March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code For instructions and the latest information. Web there are only two deadlines: Type or print within the boxes.

You Must Complete All Five Pages.

Web report for this quarter of 2021 (check one.) 1: If you are located in. This requires corrections because we were not aware of erc when we filed our original form 941. Amended illinois withholding income tax return: