Form 990 Deadline 2022

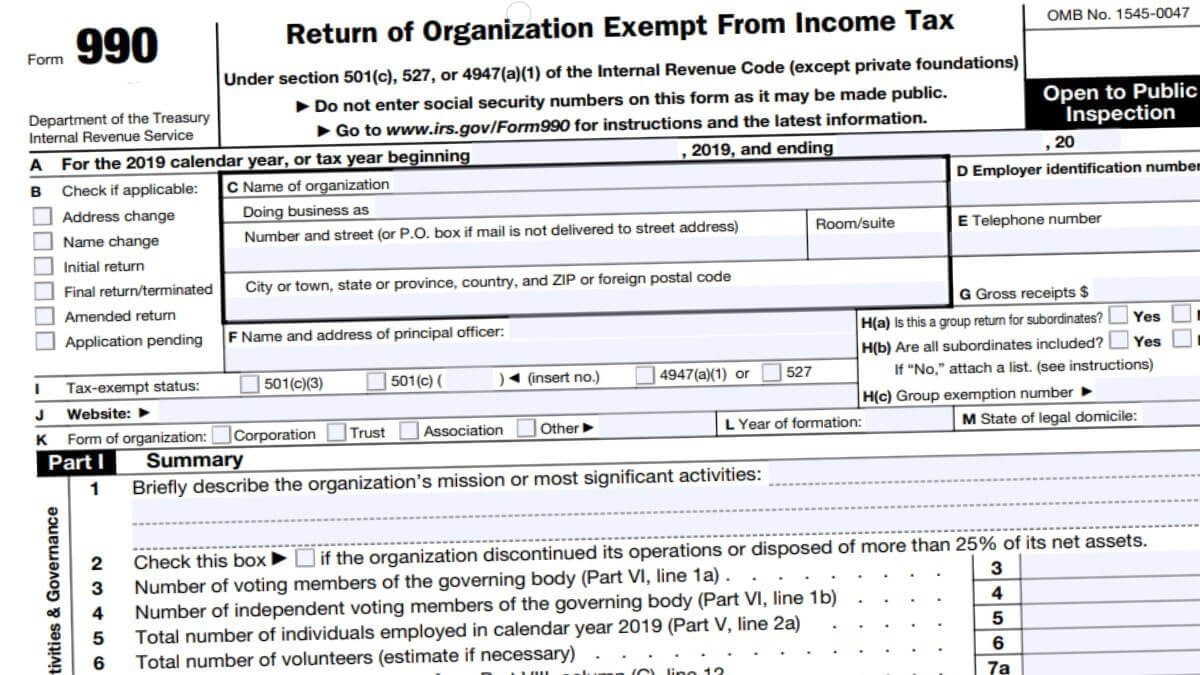

Form 990 Deadline 2022 - As the time for calendar year nonprofits to file their. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Web monday, april 25, 2022 by justin d. Web calendar year organization filing deadline. Exempt organizations with a filing obligation. For organizations with an accounting tax period starting on april. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to. To use the table, you must know. Web this means that if an organization runs on a calendar tax year, its 990 deadline for the 2022 tax year will be may 15, 2023. January 31, 2022 was this helpful to you?

Web rock hill, sc / accesswire / may 15, 2023 / today is a major deadline for nonprofit organizations to file their tax returns with the irs. Many organizations also have state. Web today is also the deadline for organizations that had a 990 deadline on november 15, 2022, and filed an extension. Which form should your organization file?. Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. January 31, 2022 was this helpful to you? For organizations on a calendar year, the form 990 is due. Complete, edit or print tax forms instantly. Exempt organizations with a filing obligation. Web this means that if an organization runs on a calendar tax year, its 990 deadline for the 2022 tax year will be may 15, 2023.

January 31, 2022 was this helpful to you? Ad get ready for tax season deadlines by completing any required tax forms today. If a deadline falls on a. Exempt organizations with a filing obligation. Web form 990 return due date: Web initial due date extended due date; For organizations on a calendar year, the form 990 is due. Web calendar year organization filing deadline. Web april 11, 2022 | most organizations must file the internal revenue service (“irs”) form 990 or request an extension by may 15. Complete, edit or print tax forms instantly.

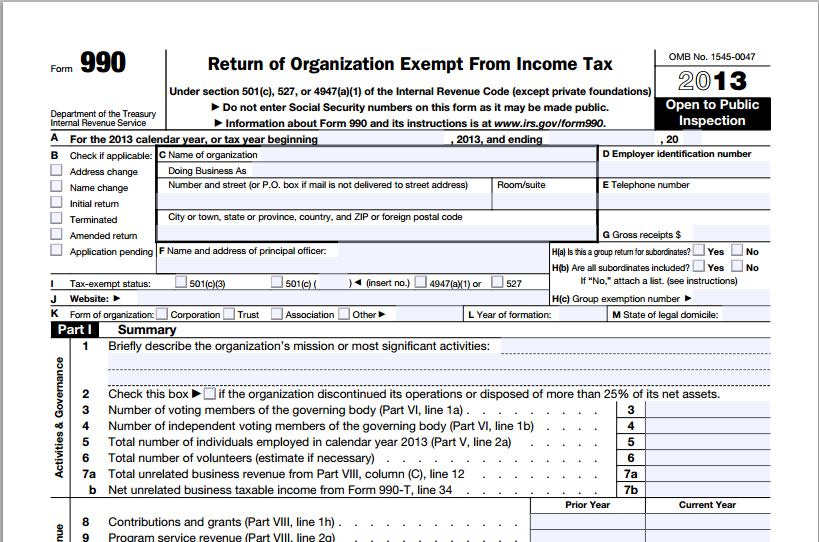

What Is A 990 N E Postcard hassuttelia

If a deadline falls on a. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Which form should your organization file?. Web rock hill, sc / accesswire / may 15, 2023 / today is a major deadline for nonprofit organizations.

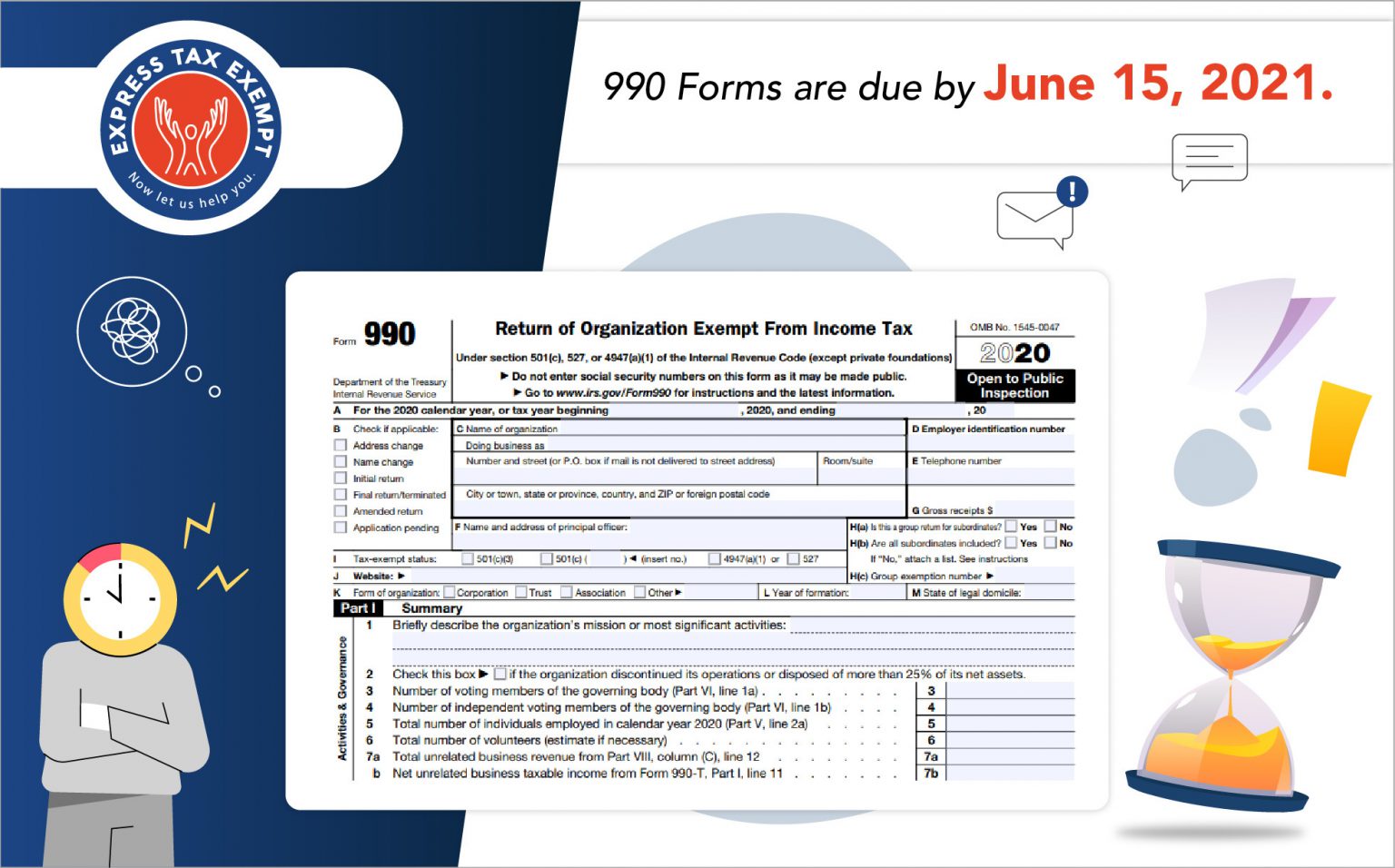

Is June 15, 2021 Your IRS Form 990 Deadline? What You Need to Know

Web initial due date extended due date; If a deadline falls on a. Exempt organizations with a filing obligation. Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. To use the table, you must know.

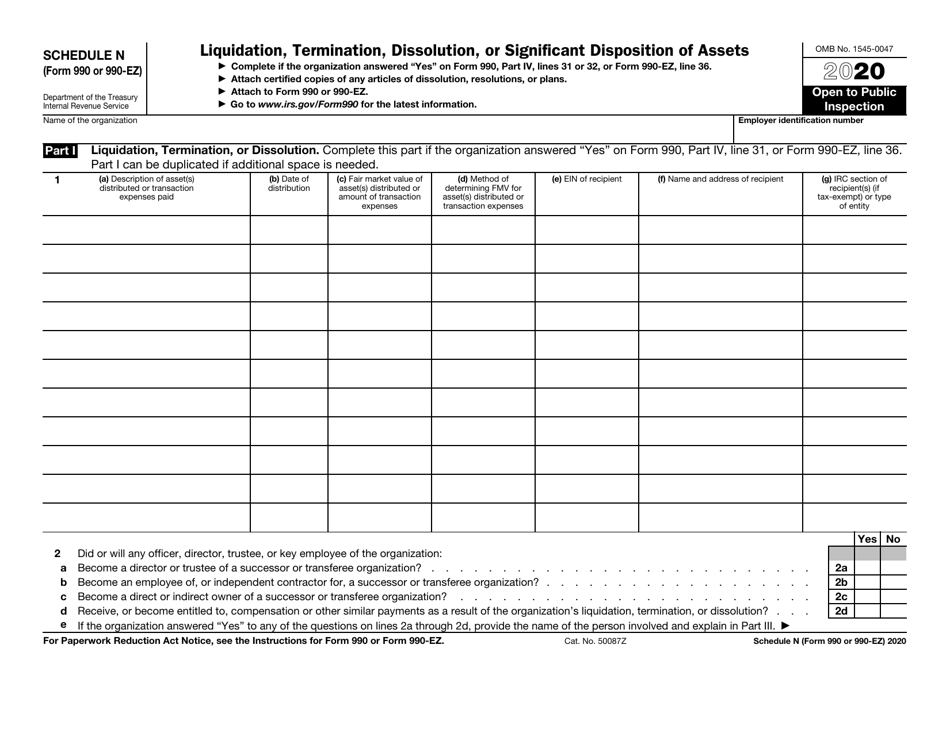

IRS Form 990 (990EZ) Schedule N Download Fillable PDF or Fill Online

Web monday, april 25, 2022 by justin d. You can electronically file tax returns for the 2020, 2021, and 2022 tax years. Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. January 31, 2022 was this helpful to you? As the time for calendar year nonprofits to file.

Today Is Your Last Chance to Meet the Form 990 Deadline!

Web this year, may 16 is the deadline to file form 990 for calendar year taxpayers because may 15 falls on a sunday. Ad get ready for tax season deadlines by completing any required tax forms today. Web calendar year organization filing deadline. As the time for calendar year nonprofits to file their. Many organizations also have state.

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

If a deadline falls on a. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. January 31, 2022 was this helpful to you? Many organizations also have state. For organizations with an accounting tax period starting on april.

What Nonprofits Need to Know About the July 15, 2021 Form 990 Deadline

Web initial due date extended due date; Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to. Web monday, april 25, 2022 by justin d. Web this year, may 16 is the deadline to file form 990 for.

IRS Form 990EZ 2018 2019 Printable & Fillable Sample in PDF

Web today is also the deadline for organizations that had a 990 deadline on november 15, 2022, and filed an extension. Many organizations also have state. Web calendar year organization filing deadline. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021.

Today is Your Form 990 Deadline! It's Your Last Chance to Extend Your

Web april 11, 2022 | most organizations must file the internal revenue service (“irs”) form 990 or request an extension by may 15. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Web form 990 return due date: Web rock.

It's Time to Get Prepared For the Form 990 Deadline

Web today is also the deadline for organizations that had a 990 deadline on november 15, 2022, and filed an extension. To use the table, you must know. Web rock hill, sc / accesswire / may 15, 2023 / today is a major deadline for nonprofit organizations to file their tax returns with the irs. Web monday, april 25, 2022.

990 Form 2021

As the time for calendar year nonprofits to file their. Web this year, may 16 is the deadline to file form 990 for calendar year taxpayers because may 15 falls on a sunday. Web monday, april 25, 2022 by justin d. Web form 990 is due on the 15th day of the 5th month following the end of the organization's.

Web Today Is Also The Deadline For Organizations That Had A 990 Deadline On November 15, 2022, And Filed An Extension.

Web this year, may 16 is the deadline to file form 990 for calendar year taxpayers because may 15 falls on a sunday. Web calendar year organization filing deadline. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Exempt organizations with a filing obligation.

Web Form 990 Return Due Date:

Web this means that if an organization runs on a calendar tax year, its 990 deadline for the 2022 tax year will be may 15, 2023. Web monday, april 25, 2022 by justin d. Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. If a deadline falls on a.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Complete, edit or print tax forms instantly. Many organizations also have state. You can electronically file tax returns for the 2020, 2021, and 2022 tax years. As the time for calendar year nonprofits to file their.

For Organizations With An Accounting Tax Period Starting On April.

For organizations on a calendar year, the form 990 is due. Web initial due date extended due date; Web rock hill, sc / accesswire / may 15, 2023 / today is a major deadline for nonprofit organizations to file their tax returns with the irs. January 31, 2022 was this helpful to you?