Form 990 Schedule C

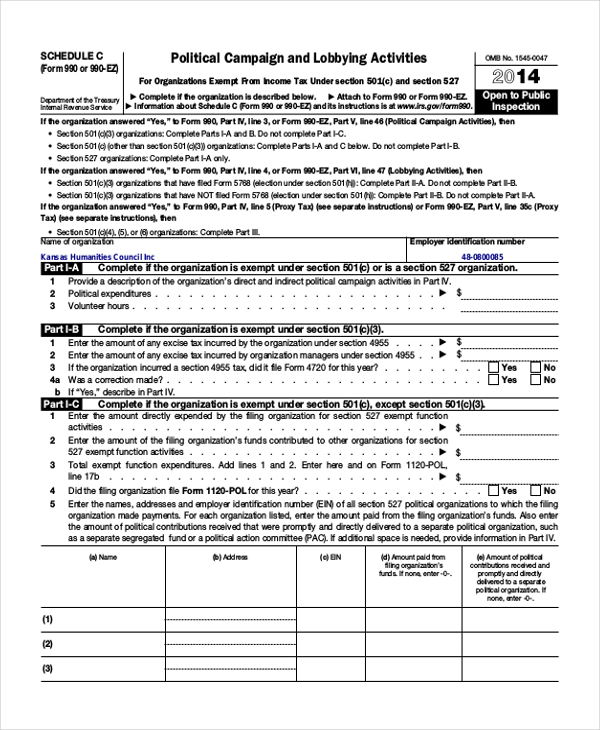

Form 990 Schedule C - This schedule is to provide required information about public charity status and public support. Web schedule c (form 990) department of the treasury internal revenue service political campaign and lobbying activities for organizations exempt from income tax under. Web review a list of form 990 schedules with instructions. Web organizations that are exempt under irc § 501(c)(4), (c)(5), and (c)(6) may lobby or engage in political activities without losing their exempt status, however, they. As you can tell from its title, profit or loss from business, it´s used to report both income and losses. Schedule c is used by certain nonprofit organizations to report additional information about their political campaign. Ad get ready for tax season deadlines by completing any required tax forms today. Web schedule r (form 990) 2022 related organizations and unrelated partnerships department of the treasury internal revenue service complete if the organization. Public charity status and public support. If you checked 12d of part i, complete sections a and d, and complete part v.).

Ad get ready for tax season deadlines by completing any required tax forms today. Read the irs instructions for 990 forms. Public charity status and public support. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. Purpose of schedule schedule c (form 990) is used by: Extracted financial data is not available for this tax period, but form 990 documents are. (column (b) must equal form 990, part x, col. • section 501(c) organizations, and • section 527 organizations. Web schedule c (form 990) 2022 page check if the filing organization belongs to an affiliated group (and list in part iv each affiliated group member’s name, address, ein, expenses,.

(column (b) must equal form 990, part x, col. The following schedules to form 990, return of organization exempt from income tax, do not have separate. Web review a list of form 990 schedules with instructions. Web after a great deal of whipsawing as the rules flipped back and forth, the nonprofit sector now has certainty from the irs: Purpose of schedule schedule c (form 990) is used by: Ad get ready for tax season deadlines by completing any required tax forms today. Section 501 (c) (4) and 501 (c) (6) organizations will not have. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Web schedule c is used by section 501 (c) organizations and section 527 organizations to furnish additional information on political campaign activities or. Read the irs instructions for 990 forms.

Electronic IRS Form 990 (Schedule K) 2018 2019 Printable PDF Sample

Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. Web schedule r (form 990) 2022 related organizations and unrelated partnerships department of the treasury internal revenue service complete if the organization. Web what is the purpose of.

Form 990 (Schedule R) 2019 Blank Sample to Fill out Online in PDF

Web instructions for form 990. Public charity status and public support. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. Web schedule a (form 990). Extracted financial data is not available for this tax period, but form.

Nonprofit Tax Tidbits Form 990 Schedule C Hawkins Ash CPAs

This schedule is to provide required information about public charity status and public support. Web review a list of form 990 schedules with instructions. Web schedule c is used by section 501 (c) organizations and section 527 organizations to furnish additional information on political campaign activities or. Web organizations that are exempt under irc § 501(c)(4), (c)(5), and (c)(6) may.

Download Instructions for IRS Form 990, 990EZ Schedule C Political

Purpose of schedule schedule c (form 990) is used by: Complete, edit or print tax forms instantly. Web schedule r (form 990) 2022 related organizations and unrelated partnerships department of the treasury internal revenue service complete if the organization. Web schedule c is used by section 501 (c) organizations and section 527 organizations to furnish additional information on political campaign.

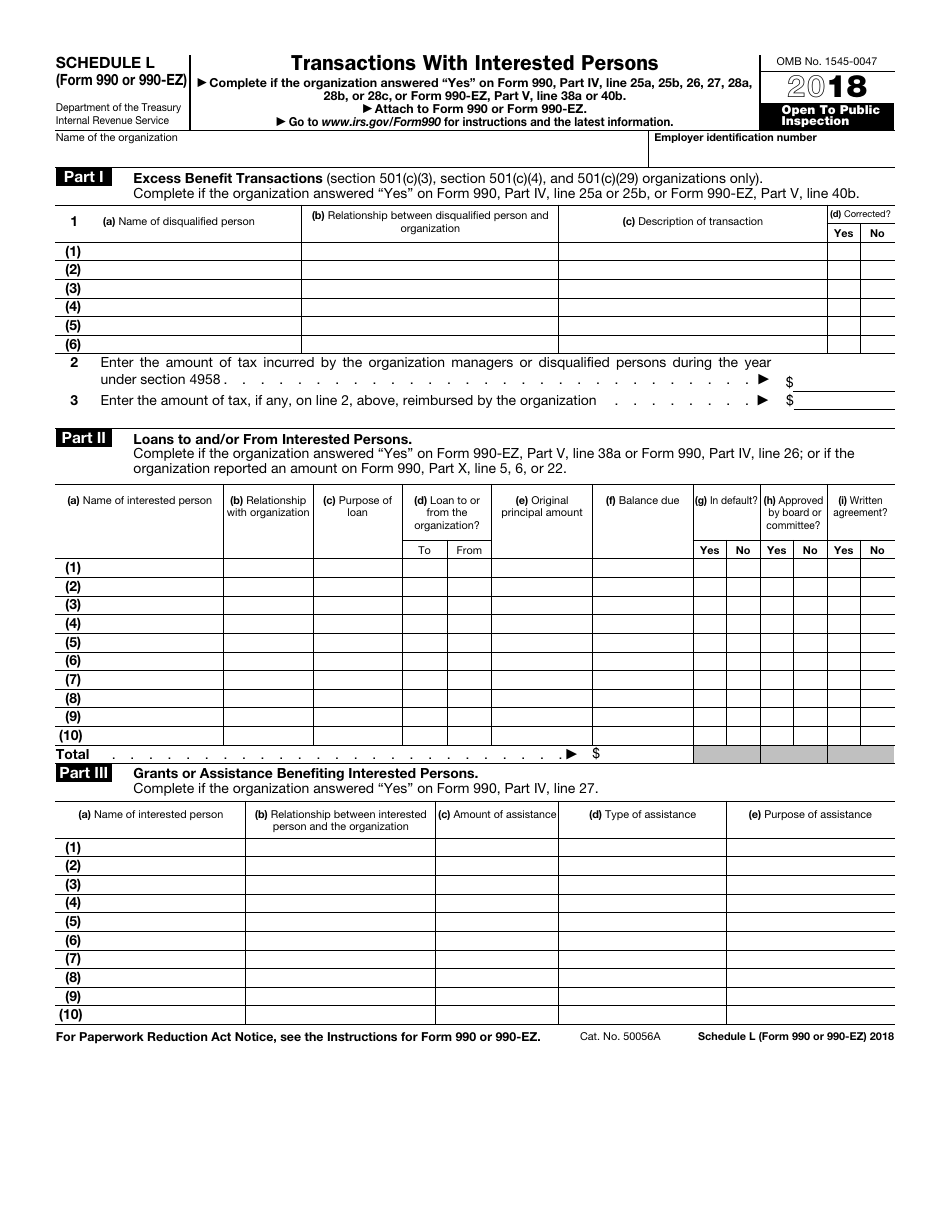

IRS Form 990 (990EZ) Schedule L Download Fillable PDF or Fill Online

Ad get ready for tax season deadlines by completing any required tax forms today. Web schedule r (form 990) 2022 related organizations and unrelated partnerships department of the treasury internal revenue service complete if the organization. Purpose of schedule schedule c (form 990) is used by: • section 501(c) organizations, and • section 527 organizations. Web schedule c (form 990).

FREE 9+ Sample Schedule C Forms in PDF MS Word

Schedule c is used by certain nonprofit organizations to report additional information about their political campaign. Web schedule c is used by section 501 (c) organizations and section 527 organizations to furnish additional information on political campaign activities or. Web after a great deal of whipsawing as the rules flipped back and forth, the nonprofit sector now has certainty from.

IRS Form 990 Schedule B 2018 2019 Printable & Fillable Sample in PDF

Read the irs instructions for 990 forms. Web after a great deal of whipsawing as the rules flipped back and forth, the nonprofit sector now has certainty from the irs: This schedule is to provide required information about public charity status and public support. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Read the irs.

Online IRS Form 990 (Schedule I) 2018 2019 Fillable and Editable

(column (b) must equal form 990, part x, col. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of.

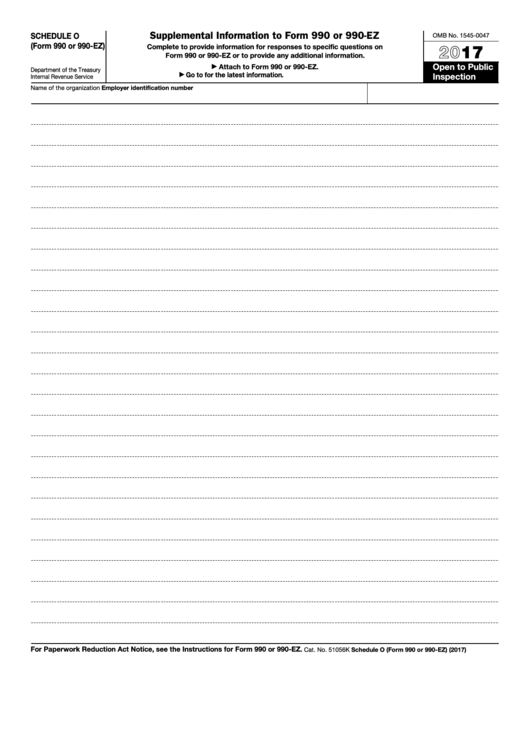

Fillable Schedule O (Form 990 Or 990Ez) Supplemental Information To

Section 501 (c) (4) and 501 (c) (6) organizations will not have. Schedule c is used by certain nonprofit organizations to report additional information about their political campaign. Public charity status and public support. Web instructions for form 990. Read the irs instructions for 990 forms.

IRS Form 990 (Schedule J) 2018 2019 Fill out and Edit Online PDF

Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. Web after a great deal of whipsawing as the rules flipped back and forth, the nonprofit sector now has certainty from the irs: Web organizations that are exempt.

Web Review A List Of Form 990 Schedules With Instructions.

This schedule is to provide required information about public charity status and public support. • section 501(c) organizations, and • section 527 organizations. Web schedule c (form 990) 2022 page check if the filing organization belongs to an affiliated group (and list in part iv each affiliated group member’s name, address, ein, expenses,. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or.

Web Organizations That Are Exempt Under Irc § 501(C)(4), (C)(5), And (C)(6) May Lobby Or Engage In Political Activities Without Losing Their Exempt Status, However, They.

Web schedule r (form 990) 2022 related organizations and unrelated partnerships department of the treasury internal revenue service complete if the organization. Read the irs instructions for 990 forms. As you can tell from its title, profit or loss from business, it´s used to report both income and losses. Web schedule c is the tax form filed by most sole proprietors.

Web Schedule A (Form 990).

Section 501 (c) (4) and 501 (c) (6) organizations will not have. Public charity status and public support. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. Web schedule c (form 990) department of the treasury internal revenue service political campaign and lobbying activities for organizations exempt from income tax under.

Web C D E Total.

Web instructions for form 990. Ad get ready for tax season deadlines by completing any required tax forms today. Schedule d (form 990) 2021 (continued) (column (d) must equal form 990, part x, column (b), line 10c.) two years back three years back four years back. If you checked 12d of part i, complete sections a and d, and complete part v.).