Form C Sec

Form C Sec - The sec requires the following individuals to sign: Offering statement to the sec. Web in light of the reg cf rule amendment that became effective on march 15, 2021, the sec released an announcement regarding new form c guidance in an faq. A form c, also known as the offering statement, needs to be completed by any issuer conducting a regulation crowdfunding. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Web edgar filing of form c for regulation crowdfunding offerings exceeding $1,070,000. Information about officers, directors, and owners of 20 percent or. Web what is a form c? Effective march 15, 2021, a company issuing securities in reliance on. Form cs are submitted through the.

The issuer must electronically fill. Web similarly, a u.s. Insecurities act section 4(a)(6) and in. Effective march 15, 2021, a company issuing securities in reliance on. An application that doubles as both a request for approval by the securities and exchange commission (sec) for any mutual service company, or. Web forward, but legacy records will remain permanent. Form c is an offering statement that must be filed by any company conducting a regulation crowdfunding offering. Web edgar filing of form c for regulation crowdfunding offerings exceeding $1,070,000. See section 5.0, automatic extensions of employment authorization and/or. It is a resource to.

This section will include all roles and positions that have legacy permanent records to manage, but no permanent records. Person filing form 8865 with respect to a foreign partnership that has made an mtm election described in treas. Web in light of the reg cf rule amendment that became effective on march 15, 2021, the sec released an announcement regarding new form c guidance in an faq. Web on july 26, 2023, the u.s. Effective march 15, 2021, a company issuing securities in reliance on. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Form cs are submitted through the. Offering statement to the sec. Web the instructions to form c indicate the information that an issuer must disclose, including: The issuer must electronically fill.

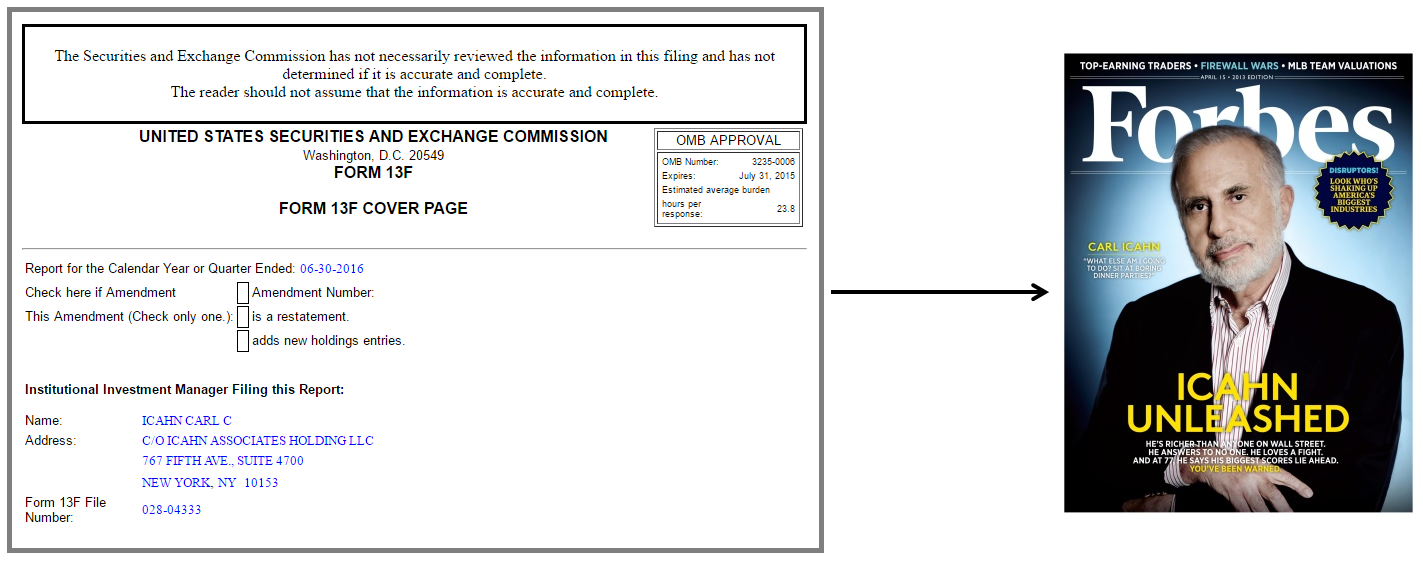

5 Top Performing Hedge Fund Managers You Should Know TipRanks

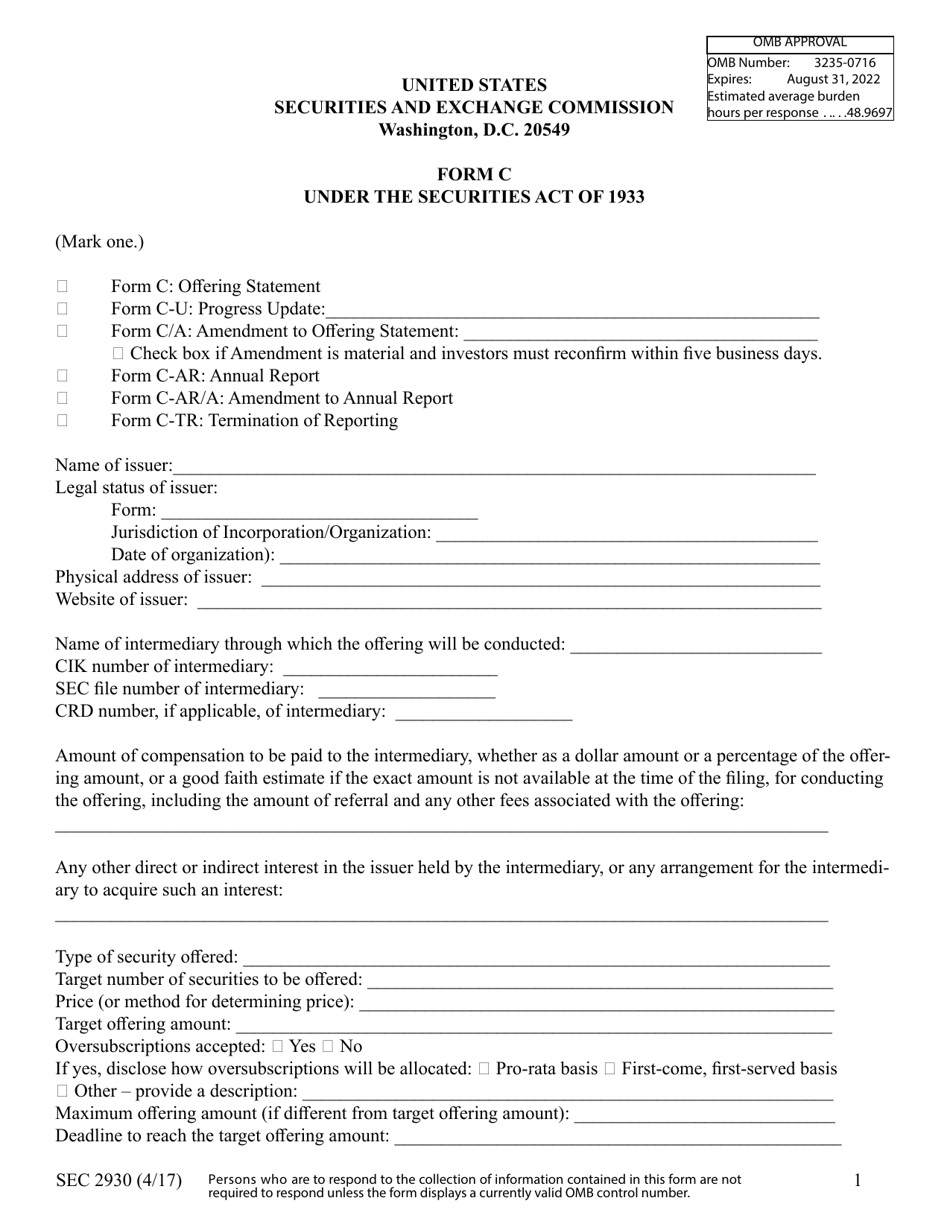

Web first, you will need to identify who will be signing on your form c. Offering statement to the sec. Web in light of the reg cf rule amendment that became effective on march 15, 2021, the sec released an announcement regarding new form c guidance in an faq. Web under the securities act of 1933 (mark one.) form c:.

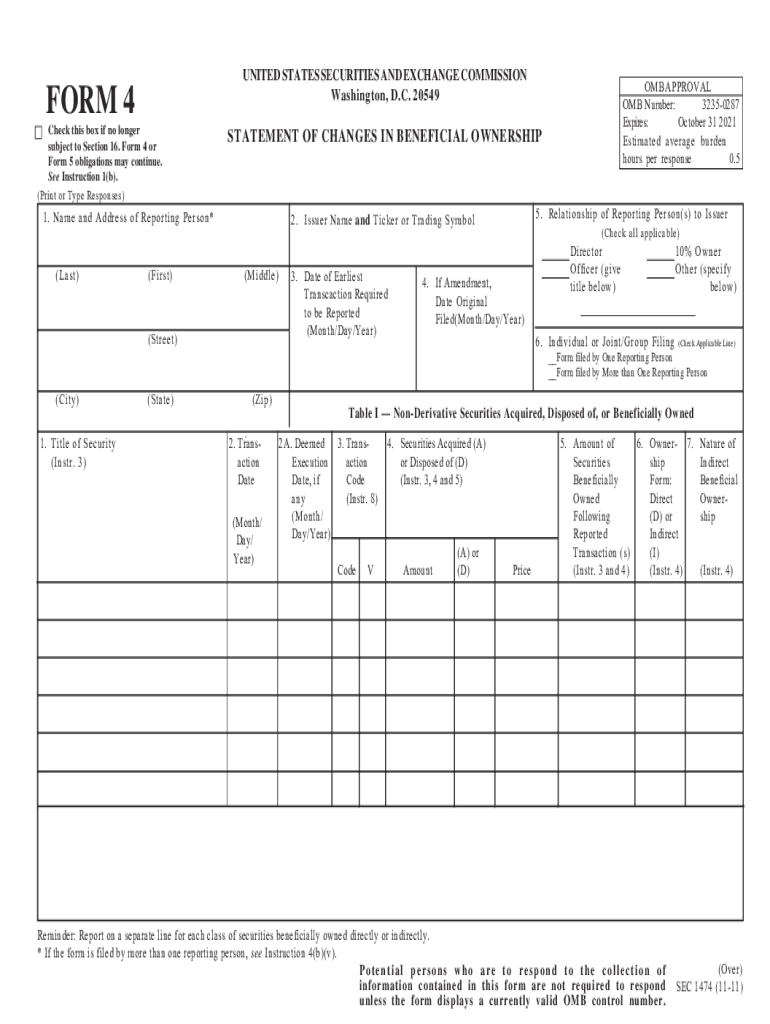

SEC Forms Chief Financial Officer Chief Operating Officer

Web what is the form c? The sec requires the following individuals to sign: Web edgar filing of form c for regulation crowdfunding offerings exceeding $1,070,000. Web the instructions to form c indicate the information that an issuer must disclose, including: Web what is a form c?

Form C (SEC Form 2930) Download Printable PDF or Fill Online

Web similarly, a u.s. Web forward, but legacy records will remain permanent. Effective march 15, 2021, a company issuing securities in reliance on. Offering statement to the sec. Insecurities act section 4(a)(6) and in.

SEC Form 8K12G3

Offering statement to the sec. Web first, you will need to identify who will be signing on your form c. This section will include all roles and positions that have legacy permanent records to manage, but no permanent records. Web similarly, a u.s. Information about officers, directors, and owners of 20 percent or.

SEC Form 1832 (19B4) Download Printable PDF or Fill Online Proposed

See section 5.0, automatic extensions of employment authorization and/or. Second, you should have a filing day plan. Issuers conducting crowdfunding transactions must file specific disclosures on form c: Form c is an offering statement that must be filed by any company conducting a regulation crowdfunding offering. It is a resource to.

20112021 SEC Form 4 Fill Online, Printable, Fillable, Blank pdfFiller

Web on july 26, 2023, the u.s. Web edgar filing of form c for regulation crowdfunding offerings exceeding $1,070,000. Web what is the form c? Web first, you will need to identify who will be signing on your form c. Form c is an offering statement that must be filed by any company conducting a regulation crowdfunding offering.

C Sec YouTube

Web similarly, a u.s. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Effective march 15, 2021, a company issuing securities in reliance on. Web under the securities act of 1933 (mark one.) form c: A form c, also known as the offering statement, needs to.

SEC Form C

Web forward, but legacy records will remain permanent. The sec requires the following individuals to sign: Web first, you will need to identify who will be signing on your form c. Web edgar filing of form c for regulation crowdfunding offerings exceeding $1,070,000. Web on july 26, 2023, the u.s.

SEC Form 10 Definition

This section will include all roles and positions that have legacy permanent records to manage, but no permanent records. Form c (pdf) last updated: An application that doubles as both a request for approval by the securities and exchange commission (sec) for any mutual service company, or. Second, you should have a filing day plan. Form cs are submitted through.

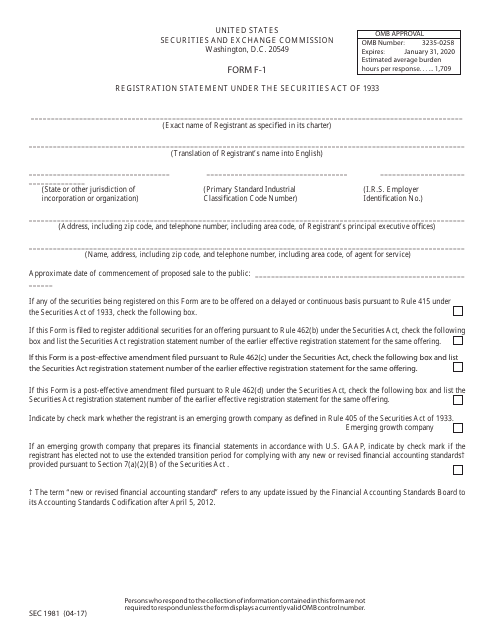

SEC Form 1981 (F1) Download Printable PDF or Fill Online Registration

Web under the securities act of 1933 (mark one.) form c: Web edgar filing of form c for regulation crowdfunding offerings exceeding $1,070,000. See section 5.0, automatic extensions of employment authorization and/or. Form c (pdf) last updated: An application that doubles as both a request for approval by the securities and exchange commission (sec) for any mutual service company, or.

Web What Is A Form C?

Web on july 26, 2023, the u.s. Issuers conducting crowdfunding transactions must file specific disclosures on form c: Web edgar filing of form c for regulation crowdfunding offerings exceeding $1,070,000. The sec requires the following individuals to sign:

The Issuer Must Electronically Fill.

Web in light of the reg cf rule amendment that became effective on march 15, 2021, the sec released an announcement regarding new form c guidance in an faq. It is a resource to. This form will be the primary. Offering statement to the sec.

Web Similarly, A U.s.

Form c (pdf) last updated: Web the instructions to form c indicate the information that an issuer must disclose, including: This section will include all roles and positions that have legacy permanent records to manage, but no permanent records. Insecurities act section 4(a)(6) and in.

Form C Is An Offering Statement That Must Be Filed By Any Company Conducting A Regulation Crowdfunding Offering.

See section 5.0, automatic extensions of employment authorization and/or. Web first, you will need to identify who will be signing on your form c. Web under the securities act of 1933 (mark one.) form c: A form c, also known as the offering statement, needs to be completed by any issuer conducting a regulation crowdfunding.

/GettyImages-185317779-ef8e4e6f60654bb89de2c952526a9963.jpg)

/6185870308_10eaab2ba0_b-1fa2266871ce41968b47473767fa8571.jpg)