Form Cf 1040

Form Cf 1040 - Web schedule f (form 1040) 2022. Profit or loss from farming. What’s new tax rate schedule for trusts and estates. • sales of livestock held for draft, breeding, sport, or dairy purposes. Web complete cf 1040 form online with us legal forms. Albion, battle creek, big rapids, flint, grand rapids, grayling, hamtramck,. You file your 2022 tax return and pay the tax due by march 1, 2023. Form 1040 is used by citizens or. Save or instantly send your ready documents. Profit or loss from farming.

Form 1040 is used by citizens or. Web schedule f (form 1040) 2022. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Albion, battle creek, big rapids, flint, grand rapids, grayling, hamtramck,. Profit or loss from farming. What’s new tax rate schedule for trusts and estates. • sales of livestock held for draft, breeding, sport, or dairy purposes. Web instead, file schedule c (form 1040). Individual income tax return, including recent updates, related forms and instructions on how to file. Web income earned or received in the city while a nonresident (taxed at half the resident rate);

Profit or loss from farming. • sales of livestock held for draft, breeding, sport, or dairy purposes. What’s new tax rate schedule for trusts and estates. Form 1040 is used by citizens or. Income earned or received outside the city while a nonresident (not taxed); Web taxact supports michigan city tax returns. Web complete cf 1040 form online with us legal forms. Web income earned or received in the city while a nonresident (taxed at half the resident rate); Report statutory employee wages as zero enter t for taxpayer or s for spouse dates of employment during tax year nonresident wage allocation. Generally, for a credit or refund, form 1040x must be filed within 4 years of the due date (including.

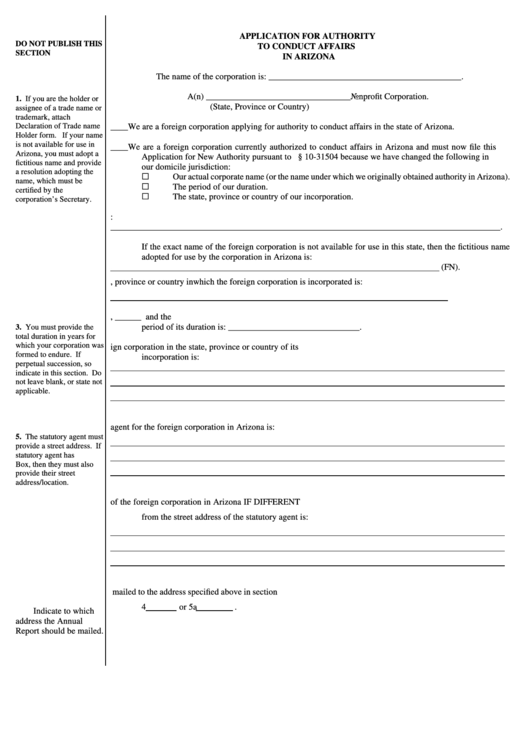

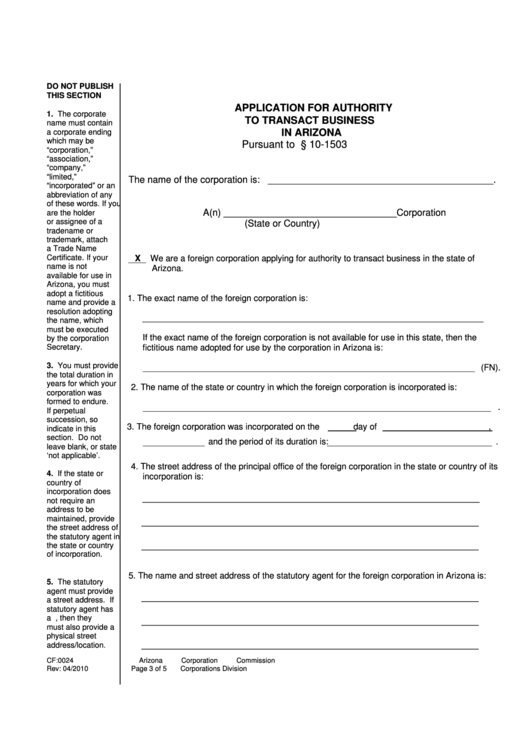

Form Cf0060 Application For Authority To Conduct Affairs In Arizona

Income earned or received outside the city while a nonresident (not taxed); Web schedule f (form 1040) 2022. Web income earned or received in the city while a nonresident (taxed at half the resident rate); These codes for the principal agricultural. Albion, battle creek, big rapids, flint, grand rapids, grayling, hamtramck,.

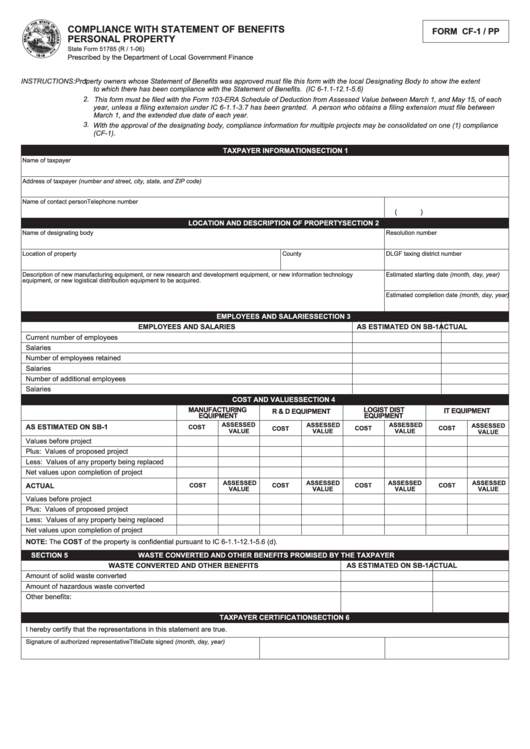

Fillable Form Cf1/pp (State Form 51765) Compliance With Statement Of

Web complete cf 1040 form online with us legal forms. Web instead, file schedule c (form 1040). Department of the treasury internal revenue service. These codes for the principal agricultural. Web schedule f (form 1040) 2022.

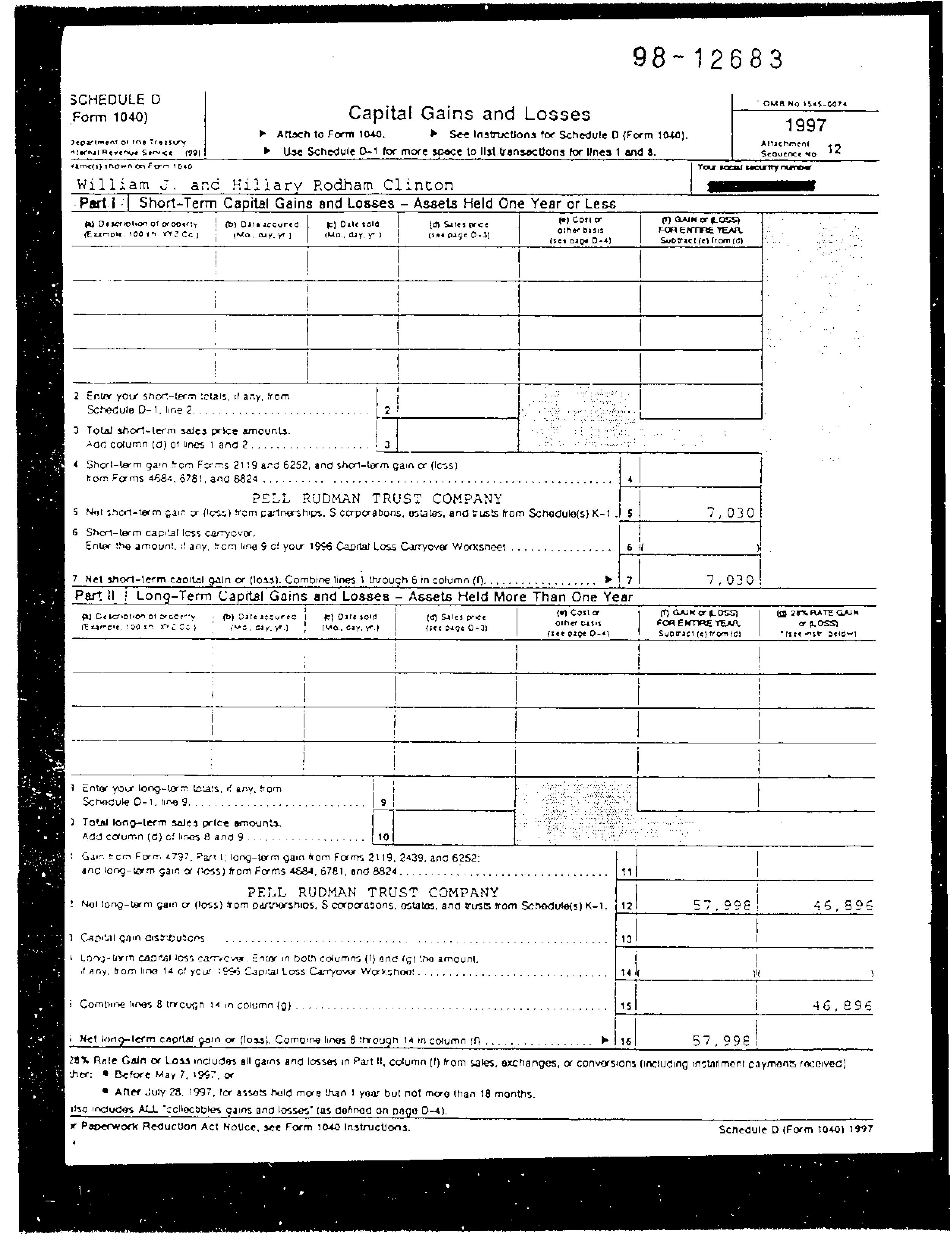

1997 U.S. Individual Tax Return (B_Clinton_1997)

Form 1040 is used by citizens or. Individual income tax return, including recent updates, related forms and instructions on how to file. Income earned or received outside the city while a nonresident (not taxed); 2 general instructions section references are to the internal revenue code. These codes for the principal agricultural.

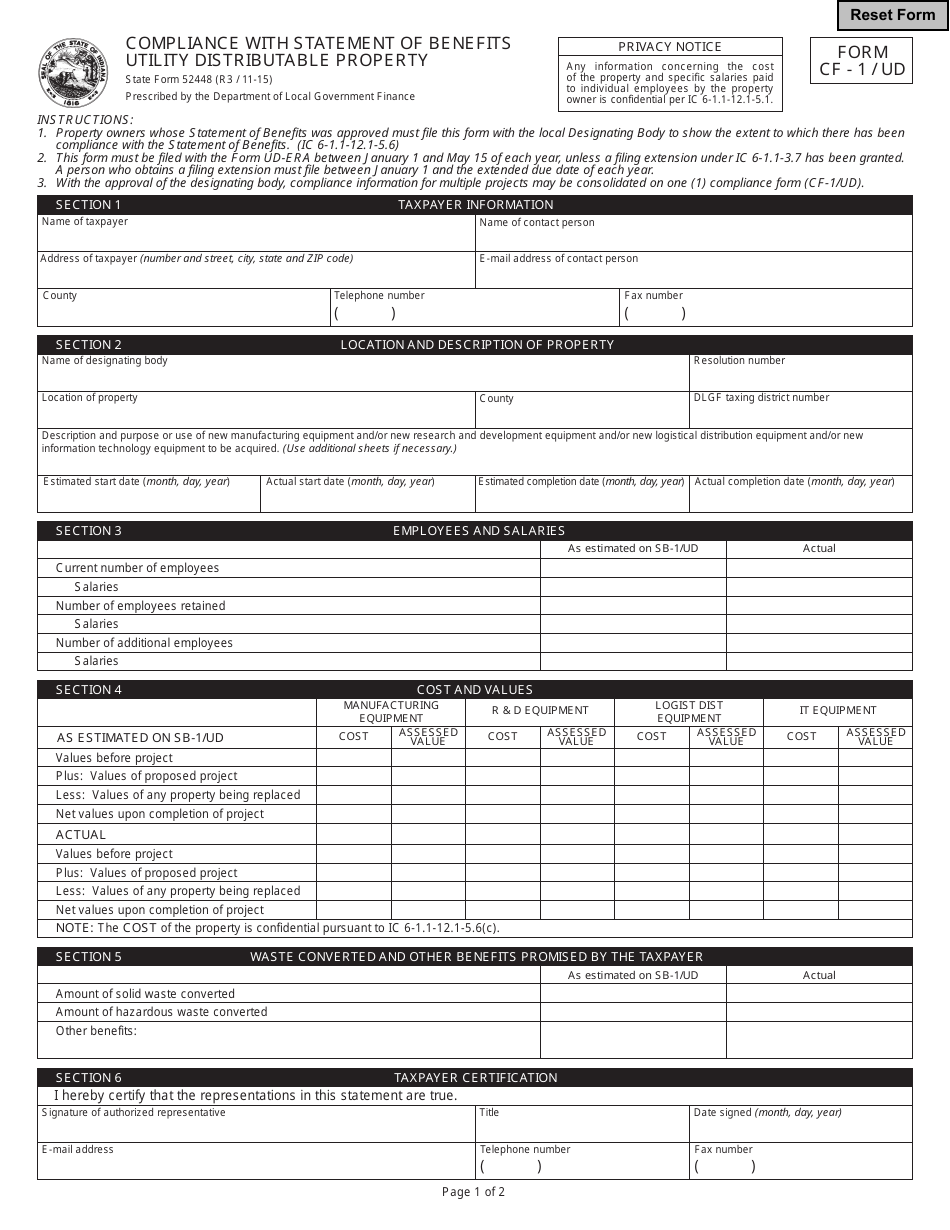

Form CF1/UD (State Form 52448) Download Fillable PDF or Fill Online

Save or instantly send your ready documents. Form 1040 is used by citizens or. 2 general instructions section references are to the internal revenue code. You file your 2022 tax return and pay the tax due by march 1, 2023. Web income earned or received in the city while a nonresident (taxed at half the resident rate);

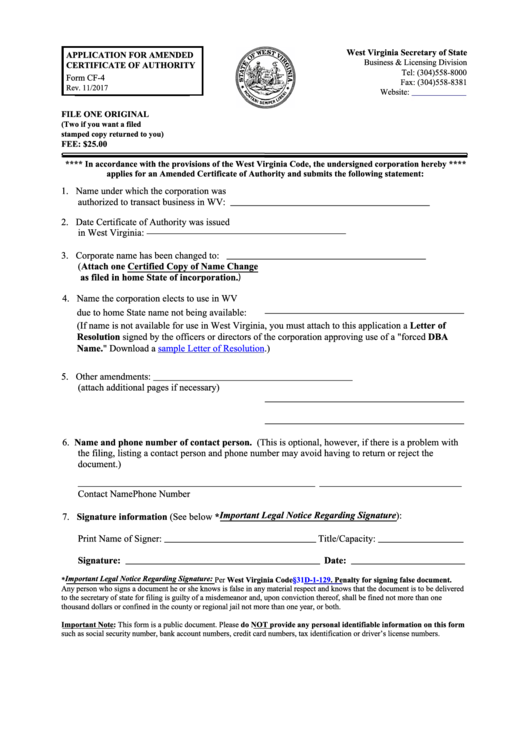

Fillable Form Cf4 Application For Amended Certificate Of Authority

Web taxact supports michigan city tax returns. Profit or loss from farming. Web instead, file schedule c (form 1040). Save or instantly send your ready documents. Individual income tax return, including recent updates, related forms and instructions on how to file.

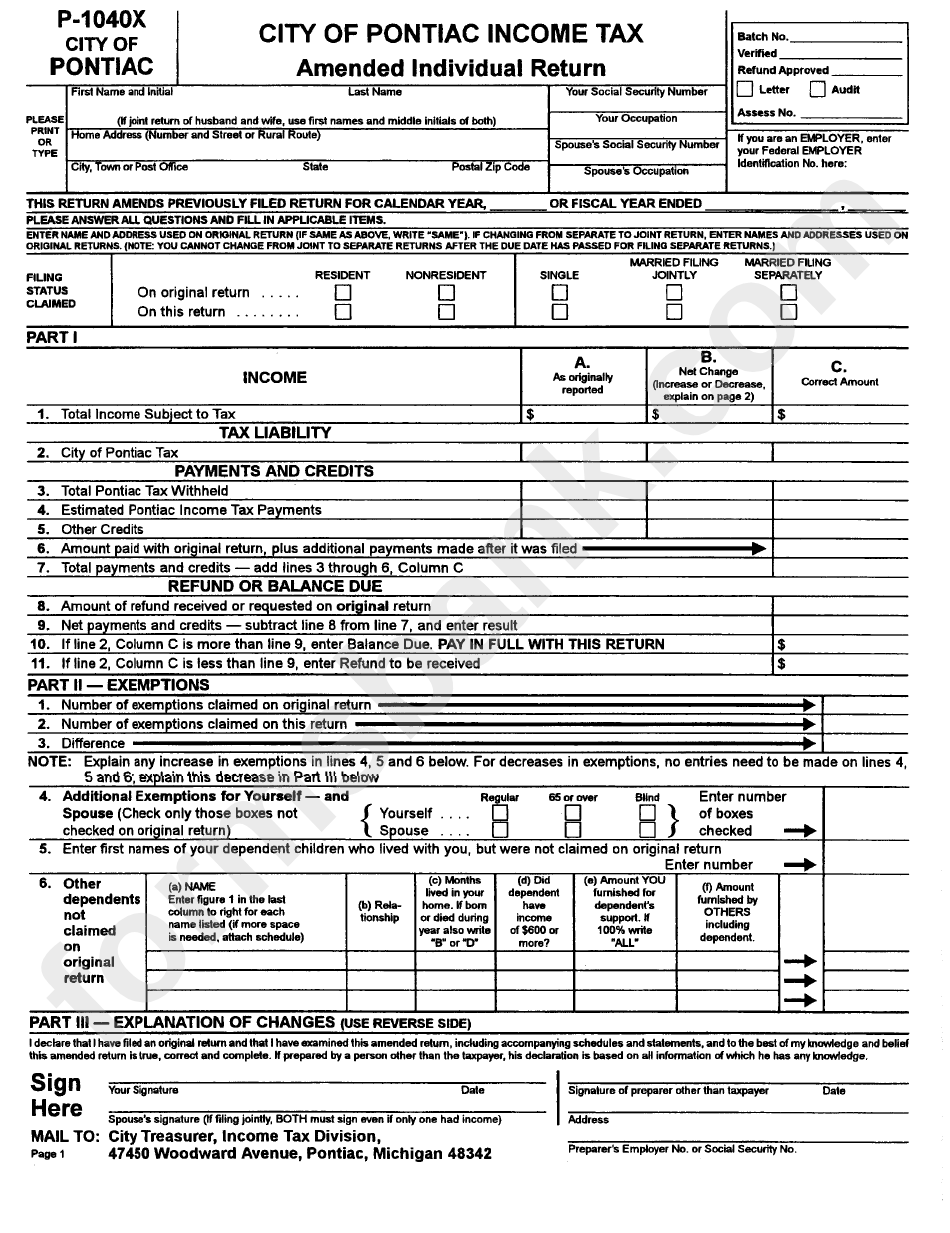

Form P1040x City Of Pontiac Tax Amended Individual Return

Web complete cf 1040 form online with us legal forms. These codes for the principal agricultural. • sales of livestock held for draft, breeding, sport, or dairy purposes. You file your 2022 tax return and pay the tax due by march 1, 2023. What’s new tax rate schedule for trusts and estates.

2015 Federal Tax Forms 1040 Tax forms

Report statutory employee wages as zero enter t for taxpayer or s for spouse dates of employment during tax year nonresident wage allocation. Individual income tax return, including recent updates, related forms and instructions on how to file. You file your 2022 tax return and pay the tax due by march 1, 2023. Easily fill out pdf blank, edit, and.

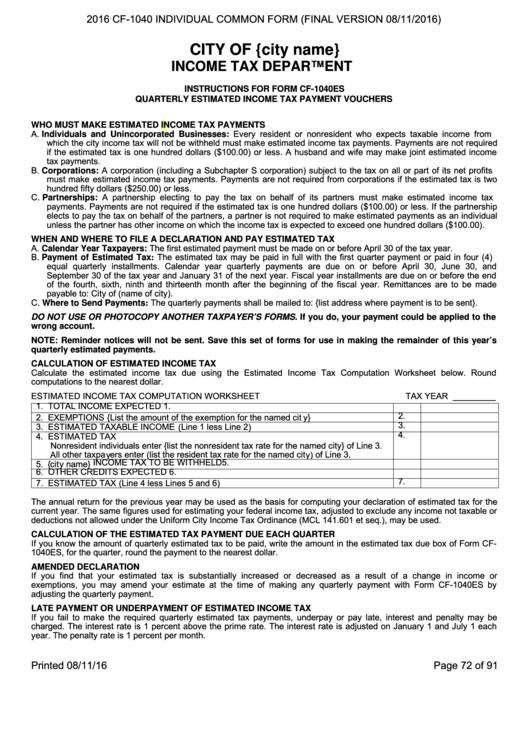

Form Cf1040 Individual Common Form 2016 printable pdf download

You file your 2022 tax return and pay the tax due by march 1, 2023. Profit or loss from farming. Web complete cf 1040 form online with us legal forms. Save or instantly send your ready documents. Albion, battle creek, big rapids, flint, grand rapids, grayling, hamtramck,.

Form Cf0024 Application For Authority To Transact Business In

Individual income tax return 2022 department of the treasury—internal revenue service omb no. Web income earned or received in the city while a nonresident (taxed at half the resident rate); Save or instantly send your ready documents. Department of the treasury internal revenue service. Web instead, file schedule c (form 1040).

Form 1040 Is Used By Citizens Or.

You file your 2022 tax return and pay the tax due by march 1, 2023. Generally, for a credit or refund, form 1040x must be filed within 4 years of the due date (including. Department of the treasury internal revenue service. Web information about form 1040, u.s.

Web Taxact Supports Michigan City Tax Returns.

Individual income tax return 2022 department of the treasury—internal revenue service omb no. 2 general instructions section references are to the internal revenue code. Save or instantly send your ready documents. Profit or loss from farming.

Report Statutory Employee Wages As Zero Enter T For Taxpayer Or S For Spouse Dates Of Employment During Tax Year Nonresident Wage Allocation.

Individual income tax return, including recent updates, related forms and instructions on how to file. Web complete cf 1040 form online with us legal forms. These codes for the principal agricultural. Department of the treasury internal revenue service.

Web Income Earned Or Received In The City While A Nonresident (Taxed At Half The Resident Rate);

Easily fill out pdf blank, edit, and sign them. Income earned or received outside the city while a nonresident (not taxed); Profit or loss from farming. • sales of livestock held for draft, breeding, sport, or dairy purposes.