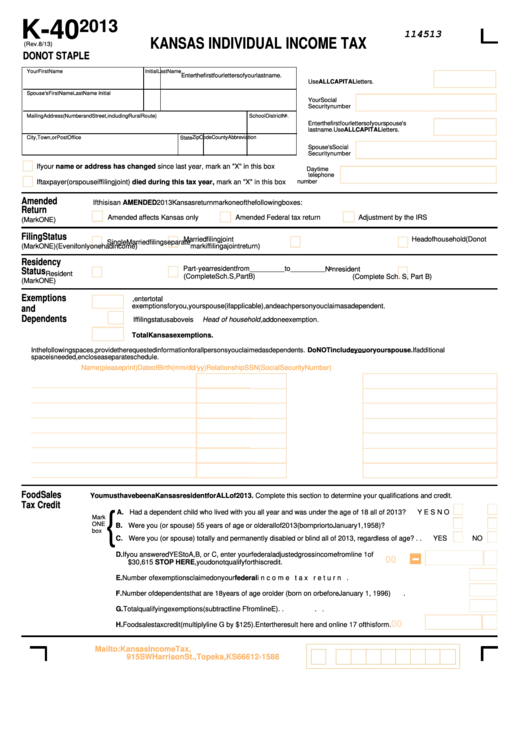

Form K 40

Form K 40 - Kansas income tax, kansas dept. Who can use webfile for a homestead refund claim? Web in this case, do the following: Our experts can get your taxes done right. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: What do i need to file? Web some 46% of americans ages 75 and older and 24% of those ages 65 to 74 report having a disability, according to estimates from the census bureau’s 2021. 1) you are required to file a federal income tax return; Exemptions and dependents enter the total exemptions for you, your spouse (if applicable), and each. A filing with the securities and exchange commission (sec), also known as the registration and annual report for canadian securities form.

Who can use webfile for a homestead refund claim? Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Who can use webfile for an income tax return? Web some 46% of americans ages 75 and older and 24% of those ages 65 to 74 report having a disability, according to estimates from the census bureau’s 2021. Kansas income tax, kansas dept. A filing with the securities and exchange commission (sec), also known as the registration and annual report for canadian securities form. Web in this case, do the following: For purposes of this release,. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: It makes up about 0.012% (120 ppm) of the total amount of potassium found.

1) you are required to file a federal income tax return; Web community discussions taxes deductions & credits still need to file? Exemptions and dependents enter the total exemptions for you, your spouse (if applicable), and each. Kansas income tax, kansas dept. A filing with the securities and exchange commission (sec), also known as the registration and annual report for canadian securities form. Web filing what browsers are supported? Web some 46% of americans ages 75 and older and 24% of those ages 65 to 74 report having a disability, according to estimates from the census bureau’s 2021. For purposes of this release,. What do i need to file? Web in this case, do the following:

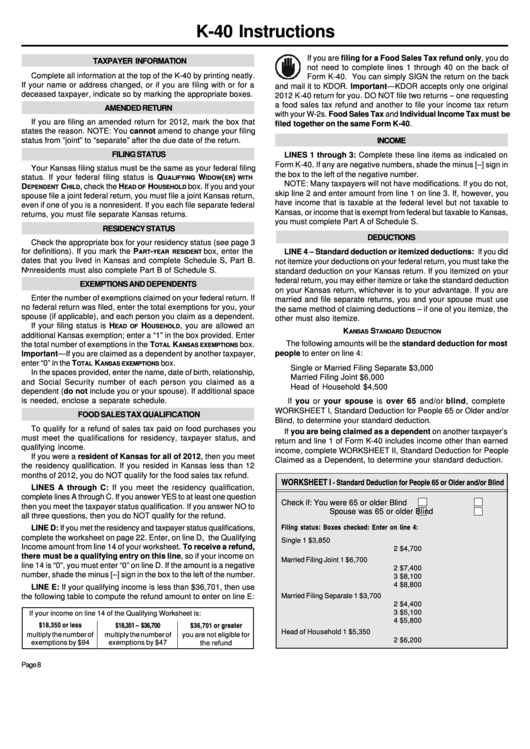

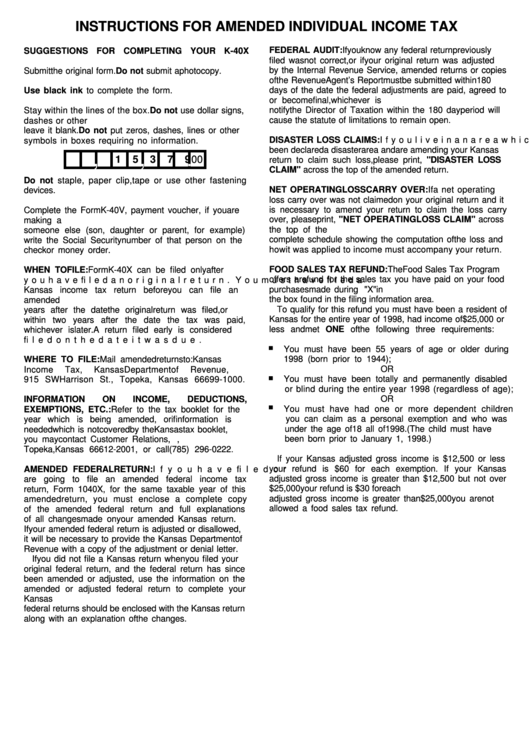

Form K40 Instructions Kansas Individual Tax And/or Food Sales

Exemptions and dependents enter the total exemptions for you, your spouse (if applicable), and each. Web community discussions taxes deductions & credits still need to file? Who can use webfile for a homestead refund claim? Get started > apq level 2 on kansas return, its. Printable kansas state tax forms for.

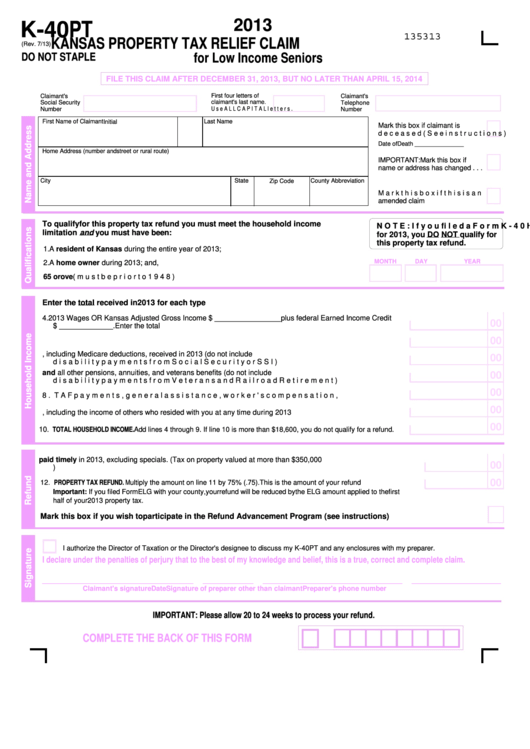

Fillable Form K40pt Kansas Property Tax Relief Claim For Low

Please use the link below to. Web some 46% of americans ages 75 and older and 24% of those ages 65 to 74 report having a disability, according to estimates from the census bureau’s 2021. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Web in this case,.

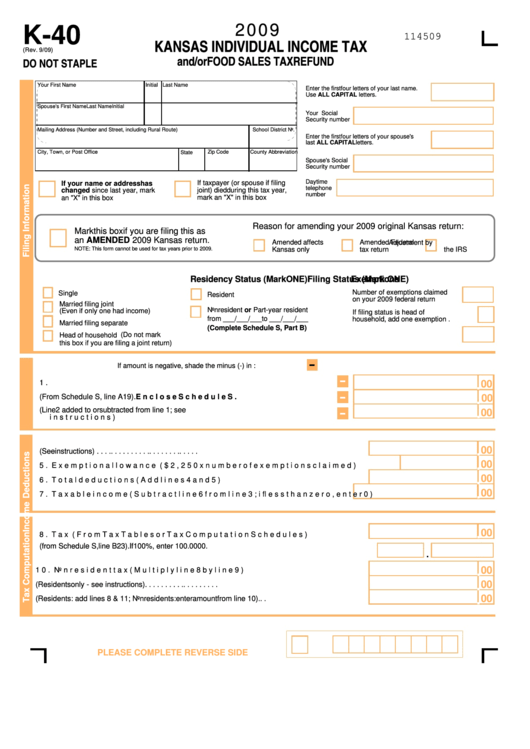

Tax Return Instructions 2009

Who can use webfile for an income tax return? Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Printable kansas state tax forms for. Web enter the result here and on line 18 of this form: 1) you are required to file a federal income tax return;

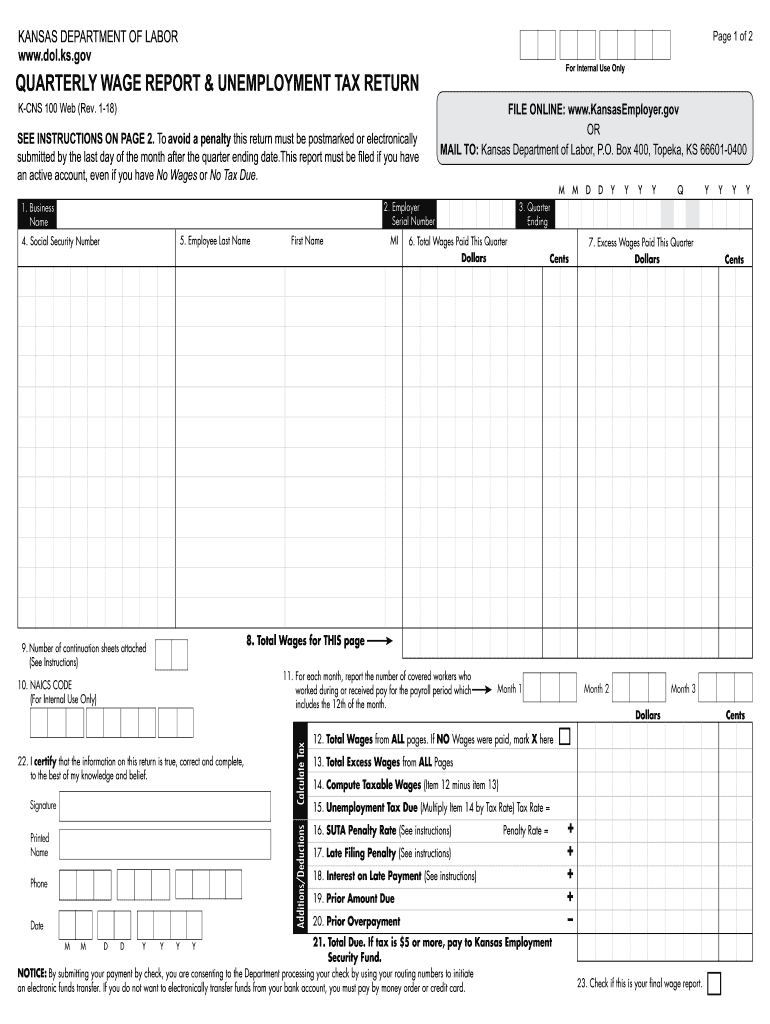

20182023 Form KS KCNS 100 Fill Online, Printable, Fillable, Blank

Who can use webfile for an income tax return? Exemptions and dependents enter the total exemptions for you, your spouse (if applicable), and each. Web community discussions taxes deductions & credits still need to file? A filing with the securities and exchange commission (sec), also known as the registration and annual report for canadian securities form. Get started > apq.

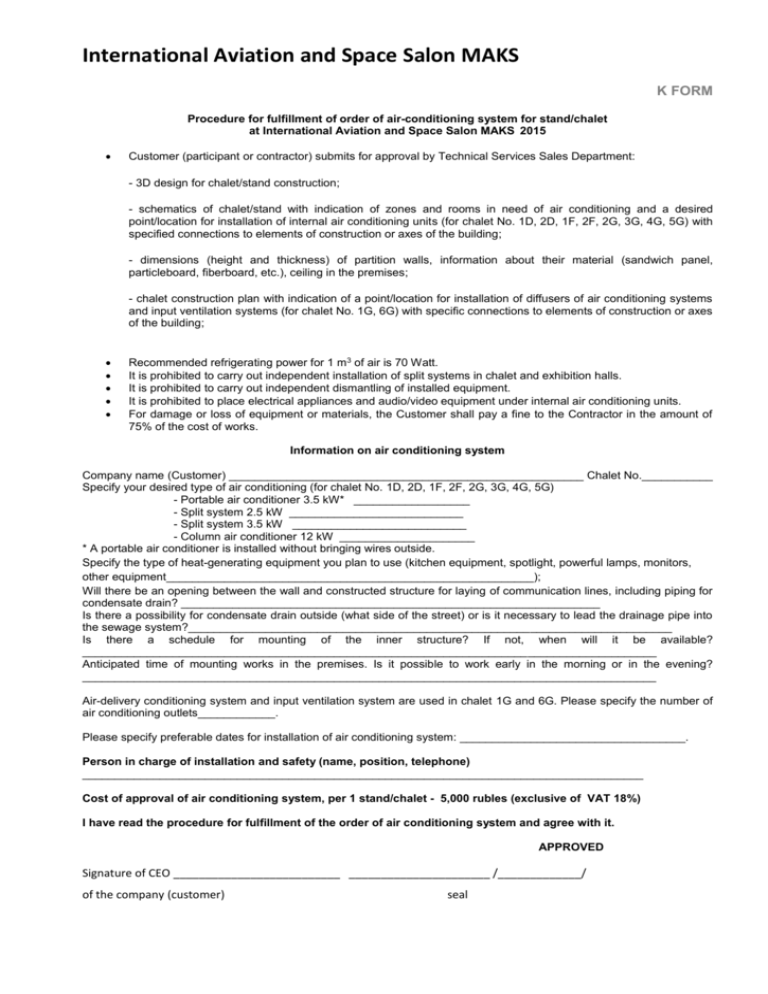

Form K

Kansas income tax, kansas dept. What do i need to file? Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Who can use webfile for a homestead refund claim? Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue.

Instructions For Amended Individual Tax (Form K40x) Kansas

Kansas income tax, kansas dept. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: What do i need to file? Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result.

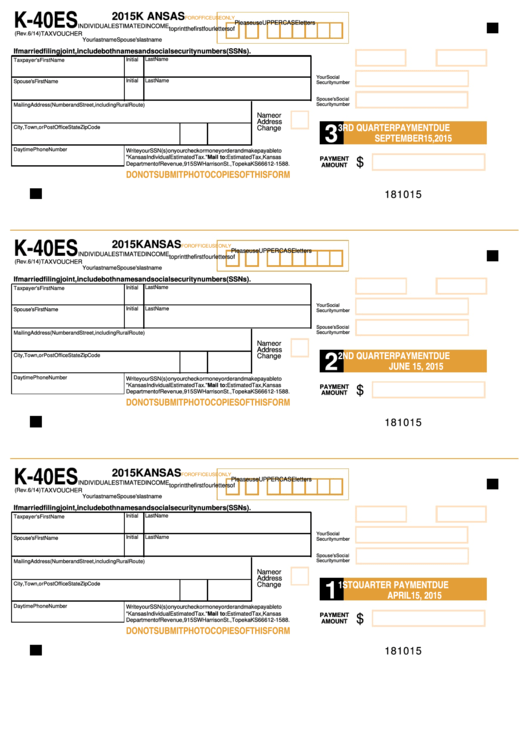

Fillable Form K40es Individual Estimated Tax Voucher

Please use the link below to. Web filing what browsers are supported? Who can use webfile for a homestead refund claim? Our experts can get your taxes done right. Web some 46% of americans ages 75 and older and 24% of those ages 65 to 74 report having a disability, according to estimates from the census bureau’s 2021.

Fillable Form K40 Kansas Individual Tax 2013 printable pdf

Printable kansas state tax forms for. Our experts can get your taxes done right. Get started > apq level 2 on kansas return, its. Web community discussions taxes deductions & credits still need to file? For more information about the.

2018 Form KS DoR K40 Fill Online, Printable, Fillable, Blank PDFfiller

Web enter the first four letters of your last name. Web enter the result here and on line 18 of this form: For purposes of this release,. Who can use webfile for a homestead refund claim? What do i need to file?

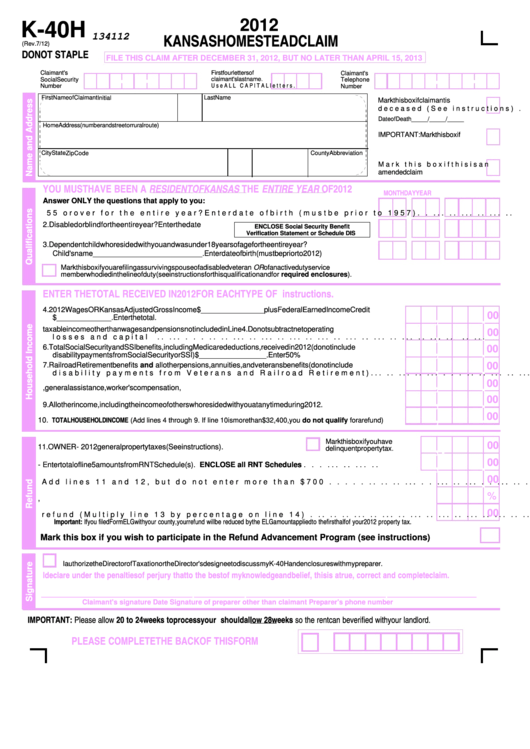

Form K40h Kansas Homestead Claim 2012 printable pdf download

It makes up about 0.012% (120 ppm) of the total amount of potassium found. 1) you are required to file a federal income tax return; Web enter the first four letters of your last name. Web some 46% of americans ages 75 and older and 24% of those ages 65 to 74 report having a disability, according to estimates from.

For Purposes Of This Release,.

Printable kansas state tax forms for. Who can use webfile for an income tax return? Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if:

Web Community Discussions Taxes Deductions & Credits Still Need To File?

It makes up about 0.012% (120 ppm) of the total amount of potassium found. What do i need to file? Web filing what browsers are supported? We last updated the individual.

Who Can Use Webfile For A Homestead Refund Claim?

Web enter the result here and on line 18 of this form: For more information about the. Please use the link below to. Web some 46% of americans ages 75 and older and 24% of those ages 65 to 74 report having a disability, according to estimates from the census bureau’s 2021.

Get Started > Apq Level 2 On Kansas Return, Its.

Web enter the first four letters of your last name. A filing with the securities and exchange commission (sec), also known as the registration and annual report for canadian securities form. Our experts can get your taxes done right. 1) you are required to file a federal income tax return;