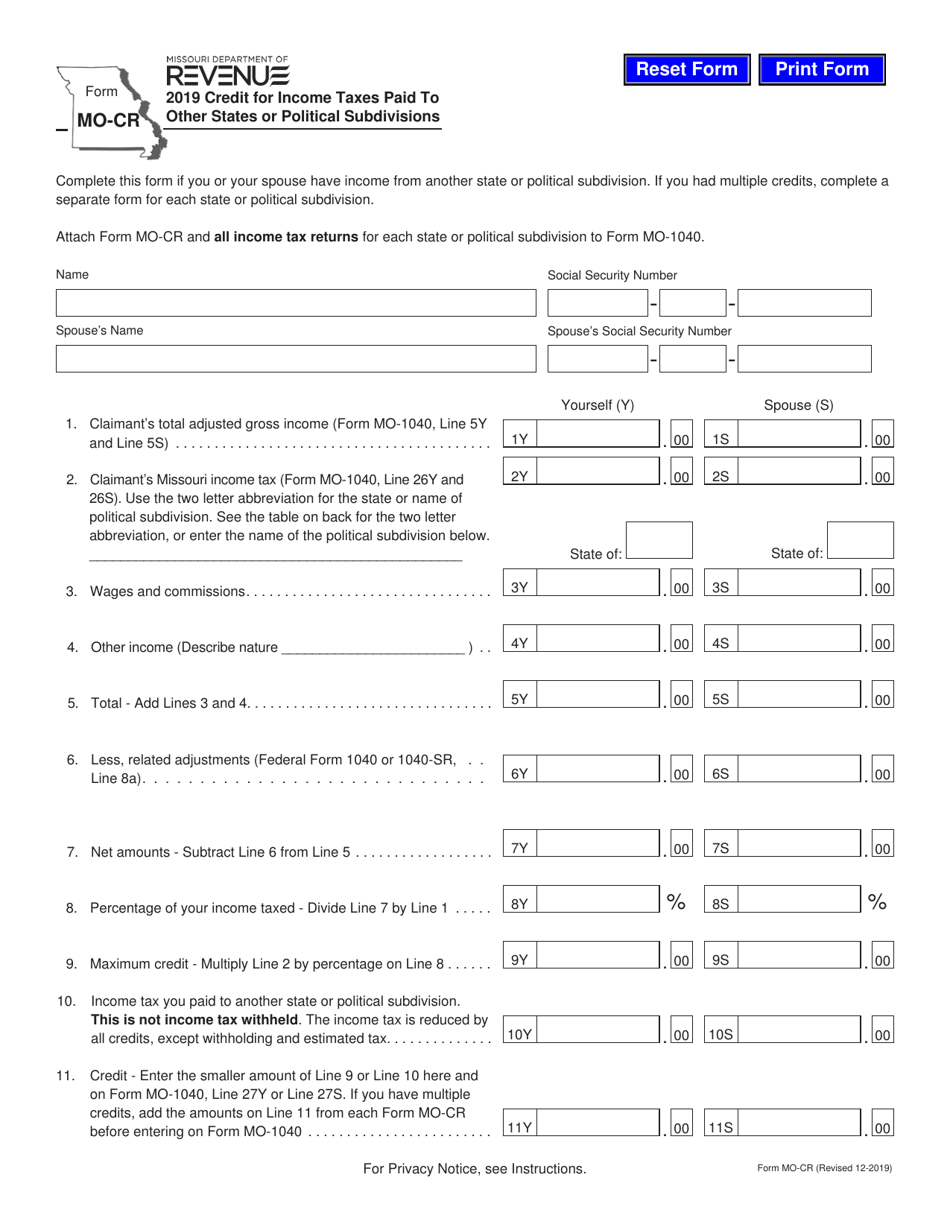

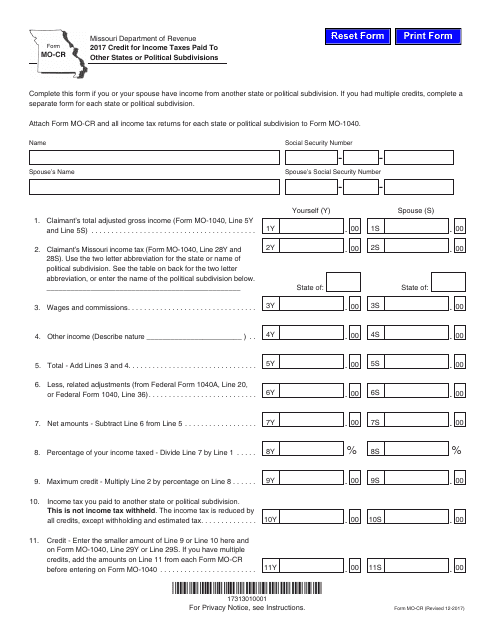

Form Mo Cr

Form Mo Cr - If you had multiple credits, complete a separate form for each state or. Web complete this form if you or your spouse have income from another state or political subdivision. Click other credits to expand the category, then click taxes paid to other. Yes no did you live in another state for part of the year?. This form is for income earned in tax year 2022, with tax returns due in april. Click state, then click missouri under the expanded state menu. Web missouri department of insurance Web 15 rows driver license forms and manuals find your form to search, type a keyword. Complete this form if you or your spouse have income from another state or political subdivision. Compute the missouri resident credit as follows:

Complete this form if you or your spouse have income from another state or political subdivision. From within your taxact return ( online or desktop), click state, then click. This form may be used by a resident individual, resident estate or resident trust. If you had multiple credits, complete a separate form for each state or. Click other credits to expand the category, then click taxes paid to other state credit. Compute the missouri resident credit as follows: Click state, then click missouri under the expanded state menu. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. If you had multiple credits, complete a separate form for each state or. Click on the state q&a tab, then click missouri directly below the blue tabs;

Web complete this form if you or your spouse have income from another state or political subdivision. Web missouri department of insurance Yes no did you live in another state for part of the year?. This form is for income earned in tax year 2022, with tax returns due in april. Web attach a copy of your federal extension (federal form 4868) with your missouri income tax return when you file. Click other credits to expand the category, then click taxes paid to other. If you had multiple credits, complete a separate form for each state or. Complete this form if you or your spouse have income from another state or political subdivision. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. If you had multiple credits, complete a.

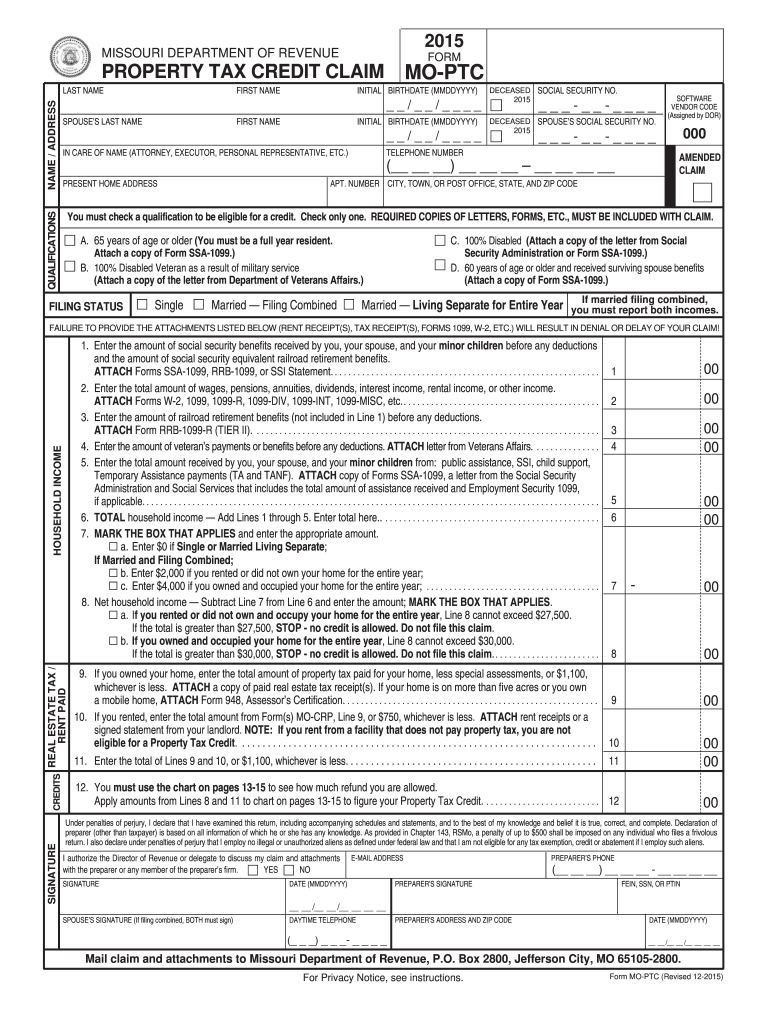

2015 Form MO MOPTC Fill Online, Printable, Fillable, Blank pdfFiller

Compute the missouri resident credit as follows: Web 15 rows driver license forms and manuals find your form to search, type a keyword. Web attach a copy of your federal extension (federal form 4868) with your missouri income tax return when you file. Click state, then click missouri under the expanded state menu. This form is for income earned in.

MolybdenumonChromium Dual Coating on Steel

Yes no did you live in another state for part of the year?. Click on the state q&a tab, then click missouri directly below the blue tabs; Complete this form if you or your spouse have income from another. Click other credits to expand the category, then click taxes paid to other state credit. Compute the missouri resident credit as.

Form Mo1120S 2015 SCorporation Tax Return Edit, Fill, Sign

Complete this form if you or your spouse have income from another state or political subdivision. Web complete this form if you or your spouse have income from another state or political subdivision. This form is for income earned in tax year 2022, with tax returns due in april. This form may be used by a resident individual, resident estate.

20152020 Form MO MO941 Fill Online, Printable, Fillable, Blank

Web missouri department of insurance This form is for income earned in tax year 2022, with tax returns due in april. Complete this form if you or your spouse have income from another. Compute the missouri resident credit as follows: Web complete this form if you or your spouse have income from another state or political subdivision.

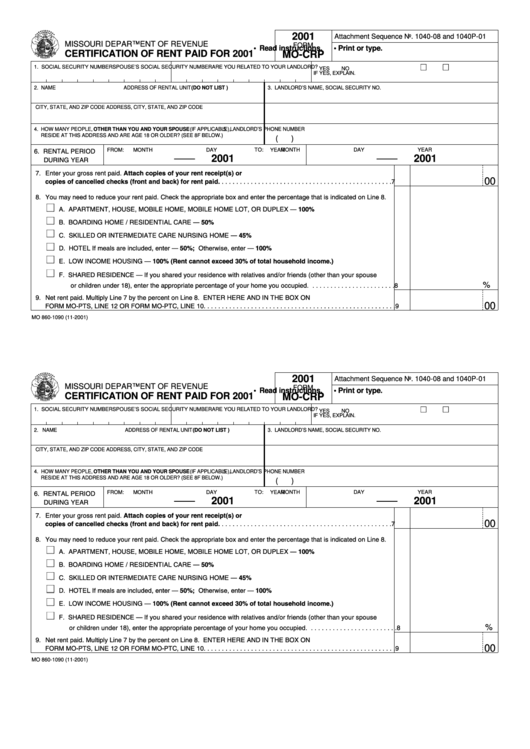

Form MoCrp Certification Of Rent Paid For 2001 printable pdf download

Click on the state q&a tab, then click missouri directly below the blue tabs; Complete this form if you or your spouse have income from another state or political subdivision. Web complete this form if you or your spouse have income from another state or political subdivision. Complete this form if you or your spouse have income from another. Web.

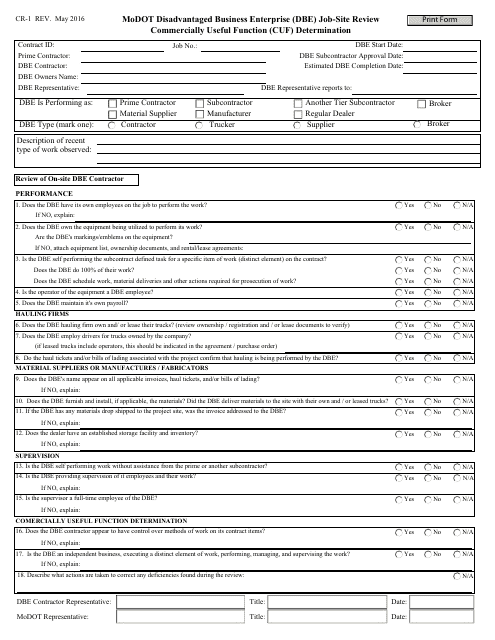

Form CR1 Download Fillable PDF or Fill Online Modot Disadvantaged

Click other credits to expand the category, then click taxes paid to other state credit. Web 15 rows driver license forms and manuals find your form to search, type a keyword. From within your taxact return ( online or desktop), click state, then click. Web missouri department of insurance This form is for income earned in tax year 2022, with.

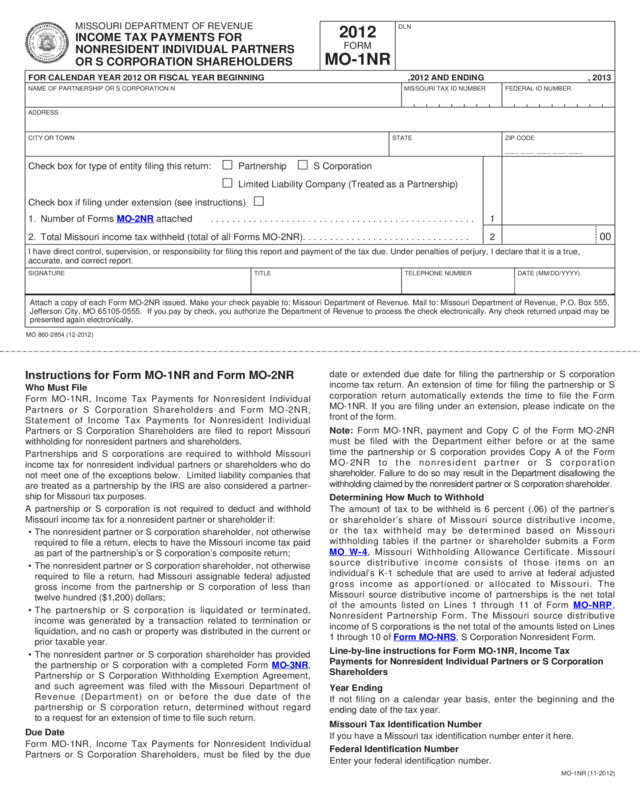

Form Mo1Nr Tax Payments For Nonresident Individual Partners

If you had multiple credits, complete a separate form for each state or. This form may be used by a resident individual, resident estate or resident trust. Yes no did you live in another state for part of the year?. Web missouri department of insurance Click other credits to expand the category, then click taxes paid to other.

Form MOCR Download Fillable PDF or Fill Online Credit for Taxes

Complete this form if you or your spouse have income from another. Web complete this form if you or your spouse have income from another state or political subdivision. Click other credits to expand the category, then click taxes paid to other. Web complete this form if you or your spouse have income from another state or political subdivision. If.

Form MOCR Download Fillable PDF or Fill Online Credit for Taxes

Yes no did you live in another state for part of the year?. Click on the state q&a tab, then click missouri directly below the blue tabs; Web complete this form if you or your spouse have income from another state or political subdivision. From within your taxact return ( online or desktop), click state, then click. Web 15 rows.

MO MOCRP 2020 Fill out Tax Template Online US Legal Forms

This form is for income earned in tax year 2022, with tax returns due in april. Web attach a copy of your federal extension (federal form 4868) with your missouri income tax return when you file. If you had multiple credits, complete a separate form for each state or. Compute the missouri resident credit as follows: Click state, then click.

Yes No Did You Live In Another State For Part Of The Year?.

Compute the missouri resident credit as follows: Web missouri department of insurance Click other credits to expand the category, then click taxes paid to other. Complete this form if you or your spouse have income from another state or political subdivision.

Web Attach A Copy Of Your Federal Extension (Federal Form 4868) With Your Missouri Income Tax Return When You File.

Web complete this form if you or your spouse have income from another state or political subdivision. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. If you had multiple credits, complete a separate form for each state or. Web 15 rows driver license forms and manuals find your form to search, type a keyword.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

This form may be used by a resident individual, resident estate or resident trust. Web complete this form if you or your spouse have income from another state or political subdivision. Click state, then click missouri under the expanded state menu. Click other credits to expand the category, then click taxes paid to other state credit.

From Within Your Taxact Return ( Online Or Desktop), Click State, Then Click.

If you had multiple credits, complete a separate form for each state or. If you had multiple credits, complete a. Click on the state q&a tab, then click missouri directly below the blue tabs; Complete this form if you or your spouse have income from another.