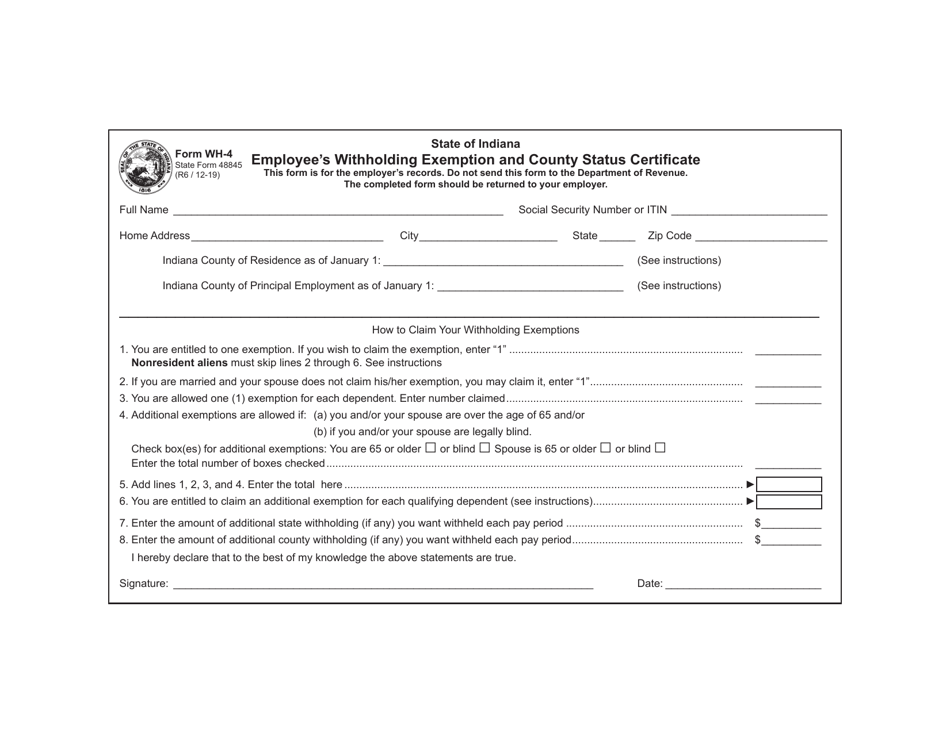

Form Wh4 Indiana

Form Wh4 Indiana - Web send wh 4 form 2019 via email, link, or fax. Generally, employers are required to withhold both state and county taxes from employees’ wages. These are state and county taxes that. You can also download it, export it or print it out. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Most employees are entitled to deduct $1,500 per year per qualifying dependent exemption. The form must be forwarded to the wage and hour division (whd) office which has jurisdiction. If you have employees working at your business, you’ll need to collect withholding taxes. Employee's withholding exemption and county status certificate. Table b is used to figure additional dependent exemptions.

If you have employees working at your business, you’ll need to collect withholding taxes. Print or type your full name, social. Generally, employers are required to withhold both state and county taxes from employees’ wages. The new form no longer uses withholding allowances. Employee's withholding exemption and county status certificate. Instead, there is a five. You can also download it, export it or print it out. Web send wh 4 form 2019 via email, link, or fax. Most employees are entitled to deduct $1,500 per year per qualifying dependent exemption. Register and file this tax online via intime.

Table b is used to figure additional dependent exemptions. You can also download it, export it or print it out. Generally, employers are required to withhold both state and county taxes from employees’ wages. Employee's withholding exemption and county status certificate. Web register and file this tax online via intime. Instead, there is a five. Web send wh 4 form 2019 via email, link, or fax. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Underpayment of indiana withholding filing. Register and file this tax online via intime.

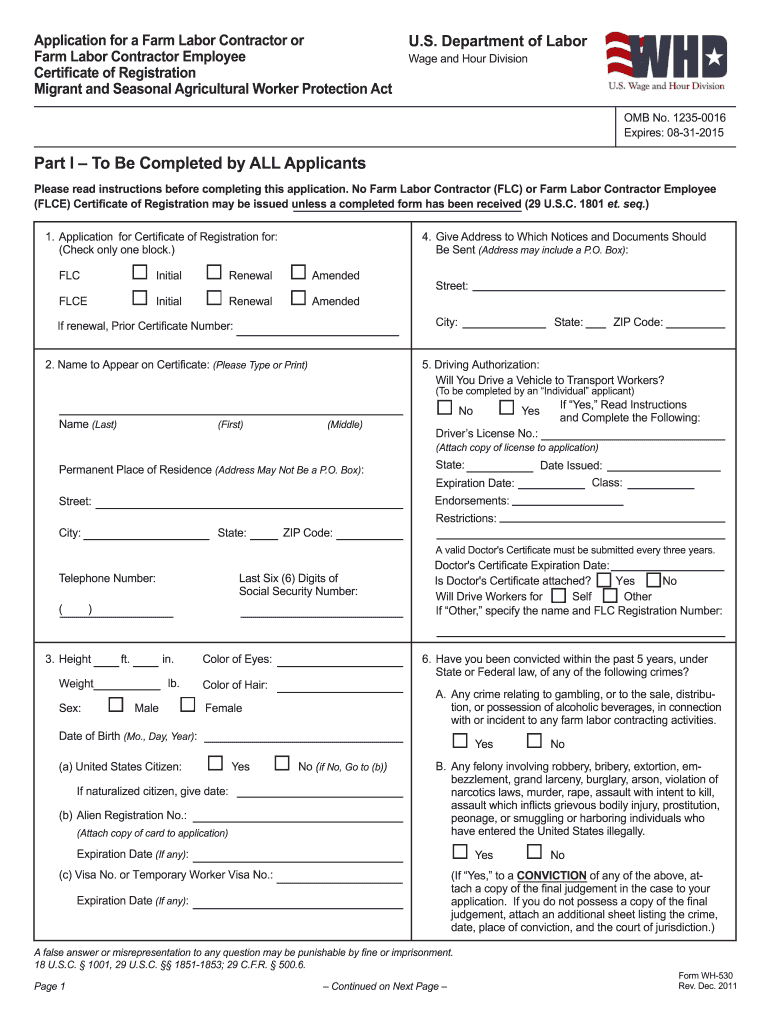

Wh 530 Fill Out and Sign Printable PDF Template signNow

The new form no longer uses withholding allowances. Table b is used to figure additional dependent exemptions. Print or type your full name, social. If you have employees working at your business, you’ll need to collect withholding taxes. Underpayment of indiana withholding filing.

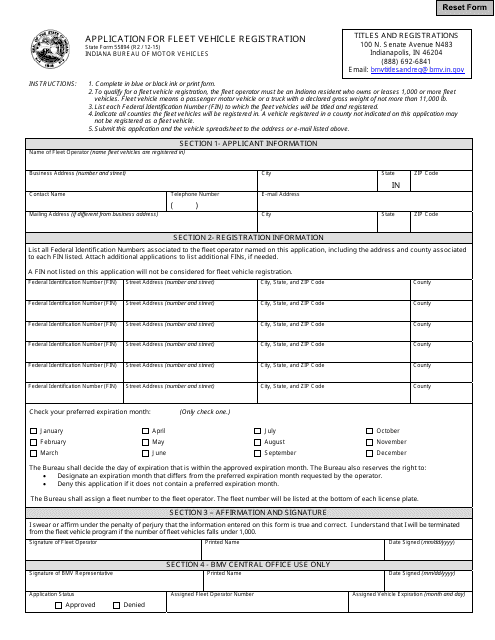

State Form 55894 Download Fillable PDF or Fill Online Application for

Table b is used to figure additional dependent exemptions. Register and file this tax online via intime. Web send wh 4 form 2019 via email, link, or fax. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Instead, there is a five.

Form WH4 (State Form 48845) Download Fillable PDF or Fill Online

Web send wh 4 form 2019 via email, link, or fax. Register and file this tax online via intime. These are state and county taxes that. The new form no longer uses withholding allowances. (a) you divorce (or are legally.

Indiana State Form 19634 Fill Online, Printable, Fillable, Blank

(a) you divorce (or are legally. Table b is used to figure additional dependent exemptions. These are state and county taxes that. Register and file this tax online via intime. The new form no longer uses withholding allowances.

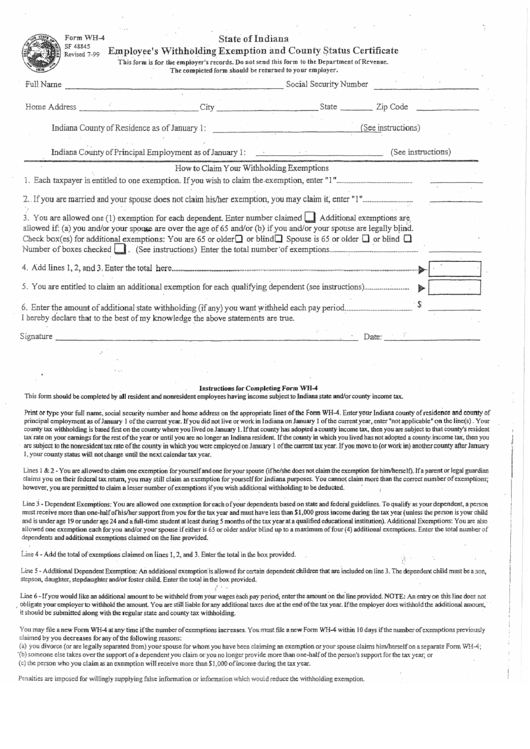

Form Wh4 Employee'S Withholding Exemption And County Status

Employee's withholding exemption and county status certificate. You can also download it, export it or print it out. These are state and county taxes that. Instead, there is a five. Table b is used to figure additional dependent exemptions.

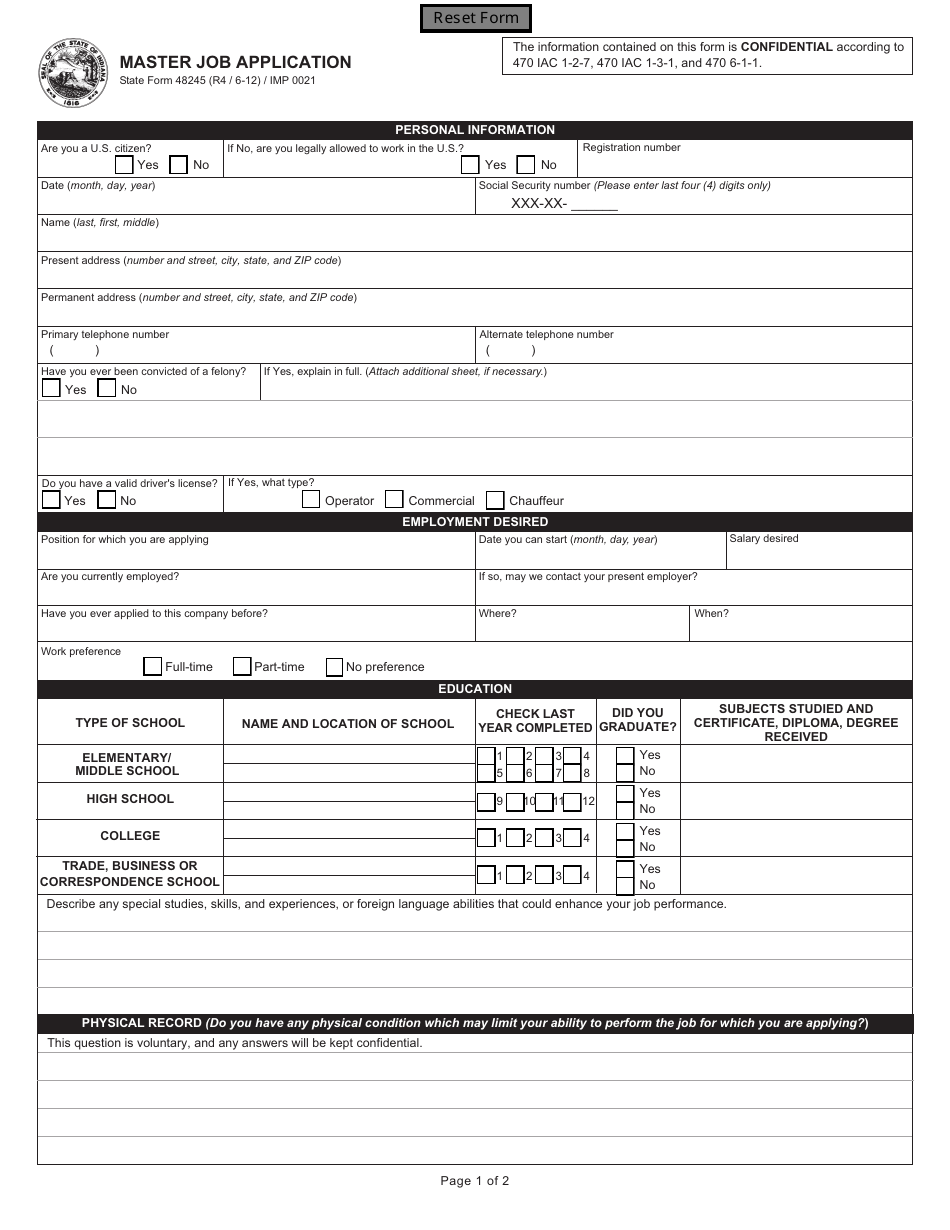

State Form 48245 Download Fillable PDF or Fill Online Master Job

Edit your 2019 indiana state withholding form online. If you have employees working at your business, you’ll need to collect withholding taxes. Instead, there is a five. These are state and county taxes that. (a) you divorce (or are legally.

20182023 Form DoL WH4 Fill Online, Printable, Fillable, Blank pdfFiller

These are state and county taxes that. Underpayment of indiana withholding filing. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Edit your 2019 indiana state withholding form online. If you have employees working at your business, you’ll need to collect withholding taxes.

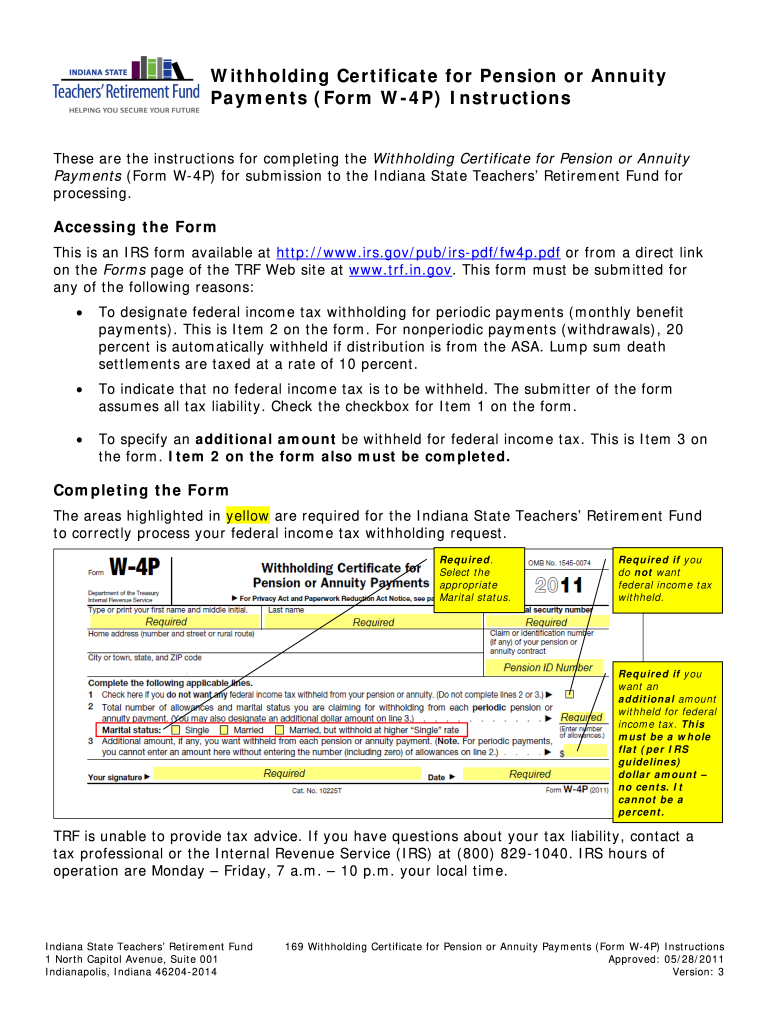

2011 Form IN SF 39530 Fill Online, Printable, Fillable, Blank pdfFiller

Generally, employers are required to withhold both state and county taxes from employees’ wages. Edit your 2019 indiana state withholding form online. Underpayment of indiana withholding filing. If you have employees working at your business, you’ll need to collect withholding taxes. The form must be forwarded to the wage and hour division (whd) office which has jurisdiction.

Indiana W4 Fill Out and Sign Printable PDF Template signNow

Underpayment of indiana withholding filing. You can also download it, export it or print it out. Print or type your full name, social. Instead, there is a five. Edit your 2019 indiana state withholding form online.

(A) You Divorce (Or Are Legally.

Print or type your full name, social. Employee's withholding exemption and county status certificate. The form must be forwarded to the wage and hour division (whd) office which has jurisdiction. Web register and file this tax online via intime.

Generally, Employers Are Required To Withhold Both State And County Taxes From Employees’ Wages.

Register and file this tax online via intime. Table b is used to figure additional dependent exemptions. If you have employees working at your business, you’ll need to collect withholding taxes. You can also download it, export it or print it out.

Web This Form Should Be Completed By All Resident And Nonresident Employees Having Income Subject To Indiana State And/Or County Income Tax.

Instead, there is a five. Most employees are entitled to deduct $1,500 per year per qualifying dependent exemption. Underpayment of indiana withholding filing. These are state and county taxes that.

Web Send Wh 4 Form 2019 Via Email, Link, Or Fax.

The new form no longer uses withholding allowances. Edit your 2019 indiana state withholding form online.