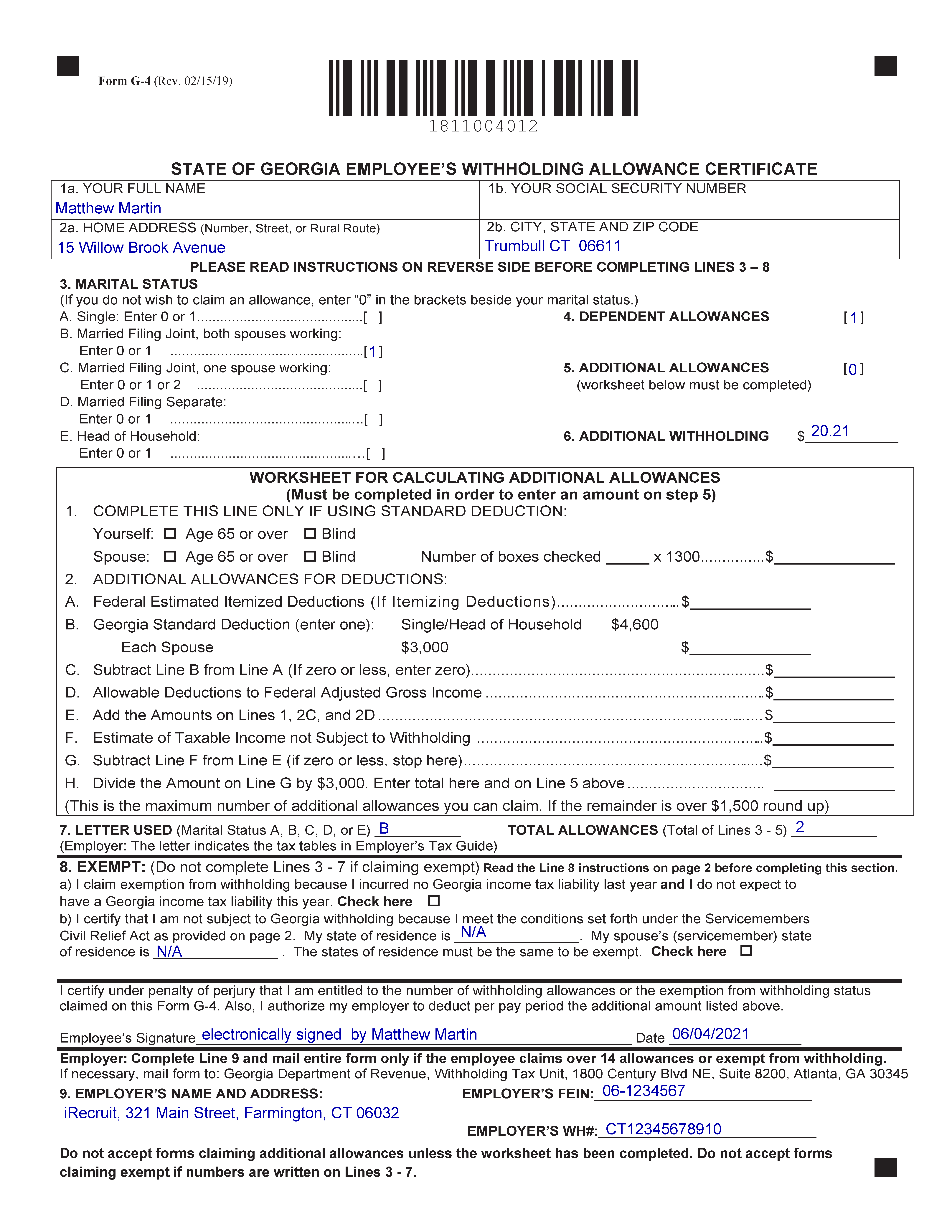

G4 Form Example

G4 Form Example - It confirms that the applicant will be employed by an international organization located in the u.s., and thus will receive a salary from this organization. Therefore, you do not qualify to claim exempt. Staff to submit a request for g4/g1 visa depending on the appointment type. Your employer withheld $500 of georgia income tax from your wages. Web examples:your employer withheld $500 of georgia income tax from your wages. Marital status (if you do not wish to claim an. The amount on line 4 of form 500ez (or line 16 of form 500) was $100. Are you still looking for a fast and convenient tool to fill out fillable g4 at a reasonable price? Address to send form 4720. You will need to check the designated international organizations in the foreign affairs manual, which is available on the us immigration website.

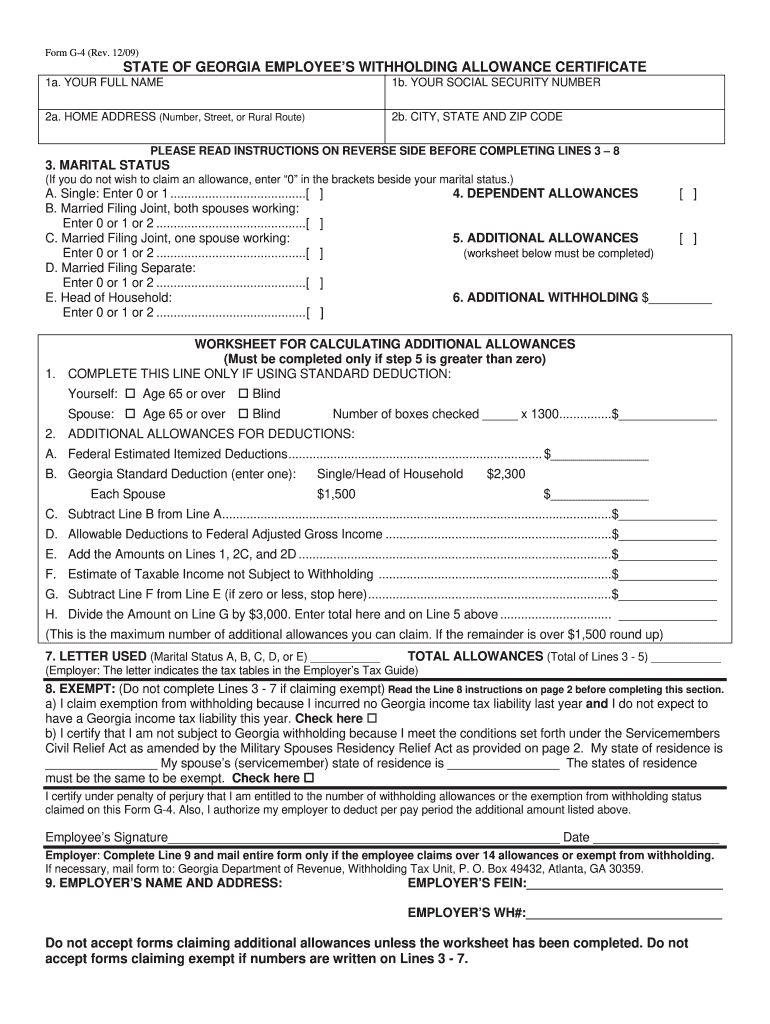

Follow the simple instructions below: Marital status (if you do not wish to claim an. File your georgia and federal tax returns online with turbotax in minutes. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. You cannot take the single allowance and the head of household allowance in. Therefore, you do not qualify to claim exempt. Save or instantly send your ready documents. Get your online template and fill it in using progressive features. The united nations is an example of an international organization. Are you still looking for a fast and convenient tool to fill out fillable g4 at a reasonable price?

Your employer withheld $500 of georgia income tax from your wages. Web examples:your employer withheld $500 of georgia income tax from your wages. Filling it in correctly and updating it when necessary ensures accurate payroll Therefore, you do not qualify to claim exempt. Government document used to support an application for an a, e or g nonimmigrant visa. Enjoy smart fillable fields and interactivity. File your georgia and federal tax returns online with turbotax in minutes. Your employer withheld $500 of georgia income tax from your wages. Select personal employees to learn more. Write the number of allowances you are claiming in the brackets beside your marital status.

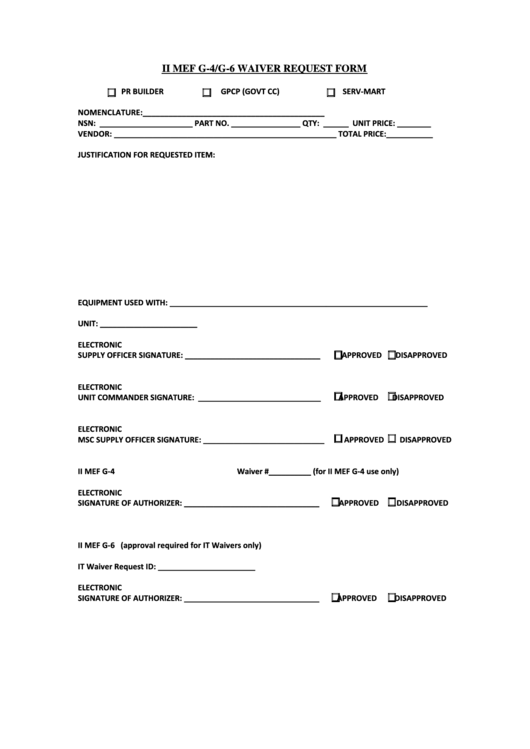

iConnect Including Different State W4s, Tied to Work Location

What is the g4 form? Get your online template and fill it in using progressive features. Easily fill out pdf blank, edit, and sign them. It confirms that the applicant will be employed by an international organization located in the u.s., and thus will receive a salary from this organization. Enjoy smart fillable fields and interactivity.

G4 Form

Select personal employees to learn more. Staff to submit a request for g4/g1 visa depending on the appointment type. Your employer withheld $500 of georgia income tax from your wages. Enjoy smart fillable fields and interactivity. What is the g4 form?

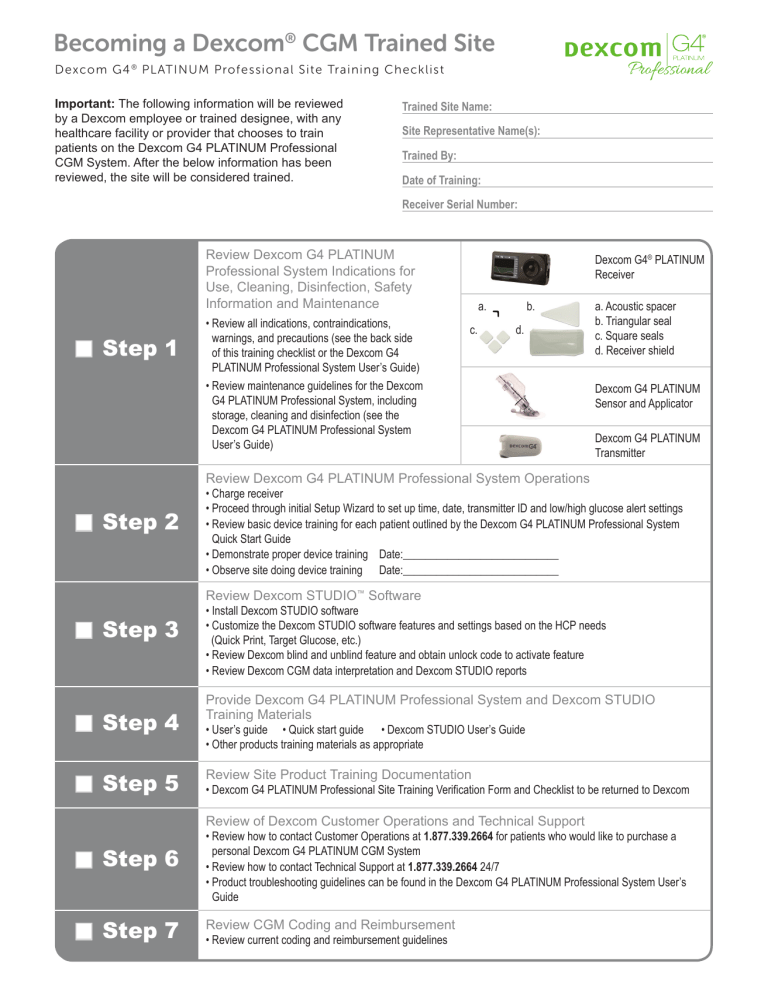

G4 Professional User manual Manualzz

File now with turbotax related georgia individual income tax forms: Your tax liability is the amount on line 4 (or line 16);therefore, you do not qualify to claim exempt. Your employer withheld $500 of georgia income tax from your wages. Enjoy smart fillable fields and interactivity. Your employer withheld $500 of georgia income tax from your wages.

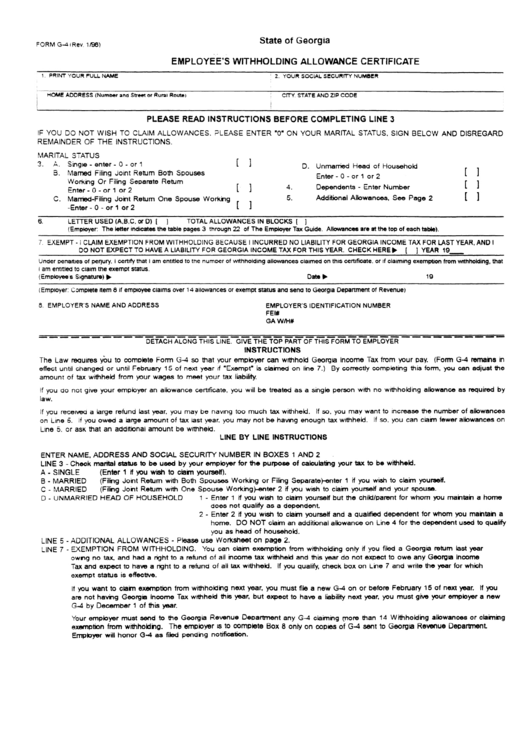

Ga Employee Withholding Form 2022 2023

Filling it in correctly and updating it when necessary ensures accurate payroll Your employer withheld $500 of georgia income tax from your wages. The united nations is an example of an international organization. Write the number of allowances you are claiming in the brackets beside your marital status. These nonimmigrants’ immediate family members are generally eligible for a corresponding dependent.

HP Z2 G4 Series Small Form Factor B&H Custom Workstation

Your employer withheld $500 of georgia income tax from your wages. Your tax liability is the amount on line 4 (or line 16); Web ★ 4.8 satisfied 40 votes how to fill out and sign form g 4 2023 online? Enjoy smart fillable fields and interactivity. Easily fill out pdf blank, edit, and sign them.

G4 App

Web ★ 4.8 satisfied 40 votes how to fill out and sign form g 4 2023 online? File now with turbotax related georgia individual income tax forms: Form 4868, application for automatic extension of time to file u.s. Easily fill out pdf blank, edit, and sign them. Select personal employees to learn more.

Fillable Form G4 Employee'S Withholding Allowance Certificate

Marital status (if you do not wish to claim an. Therefore, you do not qualify to claim exempt. Get your online template and fill it in using progressive features. What is the g4 form? These nonimmigrants’ immediate family members are generally eligible for a corresponding dependent nonimmigrant status.

How to fill out the G4 form in 2021 YouTube

Therefore, you do not qualify to claim exempt. Write the number of allowances you are claiming in the brackets beside your marital status. The amount on line 4 of form 500ez (or line 16 of form 500) was $100. Therefore, you do not qualify to claim exempt. Government document used to support an application for an a, e or g.

iMac G4 Form, meet function iMore

Enter the number of dependent allowances you are entitled to claim. Easily fill out pdf blank, edit, and sign them. The forms will be effective with the first paycheck. Get your online template and fill it in using progressive features. Are you still looking for a fast and convenient tool to fill out fillable g4 at a reasonable price?

2000 Form GA DoR G4 Fill Online, Printable, Fillable, Blank PDFfiller

It confirms that the applicant will be employed by an international organization located in the u.s., and thus will receive a salary from this organization. Web employers in georgia will need to know georgia employee withholding to set up their payroll. Your tax liability is the amount on line 4 (or line 16); Web you can apply for the g4.

Web Efile Your Georgia Tax Return Now Efiling Is Easier, Faster, And Safer Than Filling Out Paper Tax Forms.

What is the g4 form? Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Your tax liability is the amount on line 4 (or line 16); The amount on line 4 of form 500ez (or line 16 of form 500) was $100.

Filling It In Correctly And Updating It When Necessary Ensures Accurate Payroll

Select personal employees to learn more. Your employer withheld $500 of georgia income tax from your wages. Your tax liability is the amount on line 4 (or line 16);therefore, you do not qualify to claim exempt. Form 4720, return of certain excise taxes on charities and other persons under chapters 41 and 42 of the internal revenue code.

Save Or Instantly Send Your Ready Documents.

Complete this section only if your household includes additional residents who are qualifying dependents. Your employer withheld $500 of georgia income tax from your wages. It confirms that the applicant will be employed by an international organization located in the u.s., and thus will receive a salary from this organization. Therefore, you do not qualify to claim exempt.

You Must Enter 1 On 3E To Use This Allowance.

Enjoy smart fillable fields and interactivity. Address to send form 4720. Your employer withheld $500 of georgia income tax from your wages. Are you still looking for a fast and convenient tool to fill out fillable g4 at a reasonable price?