Garnishment Hardship Form

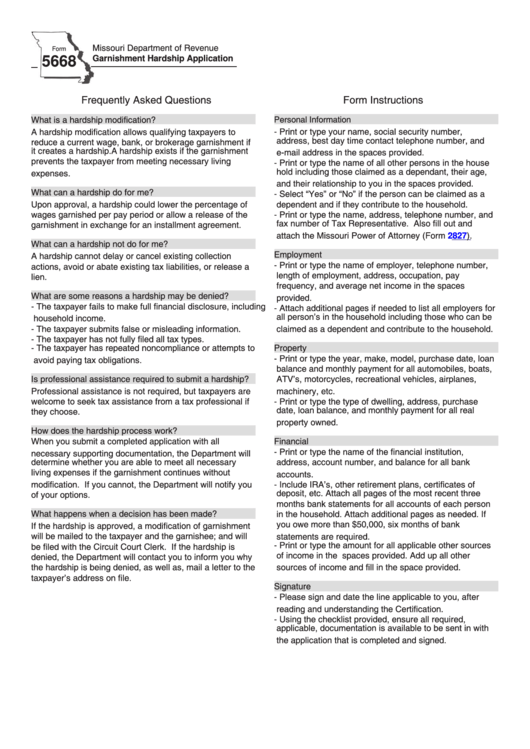

Garnishment Hardship Form - All parties involved must follow these procedures correctly. Web what is a hardship modification? Web specified tax return preparers use form 8944 to request an undue hardship waiver from the section 6011(e)(3) requirement to electronically file returns of income tax imposed by. You must provide a signed financial statement along. A garnishment allows a creditor to take money. A percent of your disposable earnings, which is 85 percent of. If the agency and the debtor have agreed to an exact dollar amount to be deducted from the debtors's wages, insert the dollar amount in section. As a general rule, the defendant. The court may issue an order. What are some reasons a hardship may be denied?

If you want to apply for a deferment on loans that are held by. Contact the irs at the telephone number on the levy or correspondence immediately. Web what if a levy on my wages, bank, or other account is causing a hardship? What are some reasons a hardship may be denied? Your request must be in writing and mailed or delivered to. Web if the garnishment is for private student loan debt, the exempt amount paid to you will be the greater of the following: Web a garnishment is a way for a creditor who has a judgment against you to collect the judgment if you do not voluntarily pay it. The court may issue an order. Web to qualify for an economic hardship deferment, you must either be on public assistance or be employed full time but earning an income that is less than 150% of. If you default on a student loan, you should be given at least 30 days written notice of the garnishment.

A percent of your disposable earnings, which is 85 percent of. Web the usual modes of attacking a garnishment directly are by motion to quash or vacate the writ of garnishment or to quash or discharge the writ. 639 cfs forms, mail one original form (with an original signature), one copy of the form, and one copy of the court order. Upon approval, a hardship could lower the. Web to qualify for an economic hardship deferment, you must either be on public assistance or be employed full time but earning an income that is less than 150% of. What are some reasons a hardship may be denied? You must provide a signed financial statement along. Web specified tax return preparers use form 8944 to request an undue hardship waiver from the section 6011(e)(3) requirement to electronically file returns of income tax imposed by. Web up to 25% cash back wage garnishments for student loans. Ad real estate, landlord tenant, estate planning, power of attorney, affidavits and more!

Ky Garnishment Wage Form Fill Online, Printable, Fillable, Blank

Web if the garnishment is for private student loan debt, the exempt amount paid to you will be the greater of the following: If you want to apply for a deferment on loans that are held by. Web what is a hardship modification? Our personal finance documents can assist you in any financial transaction. What can a hardship not do.

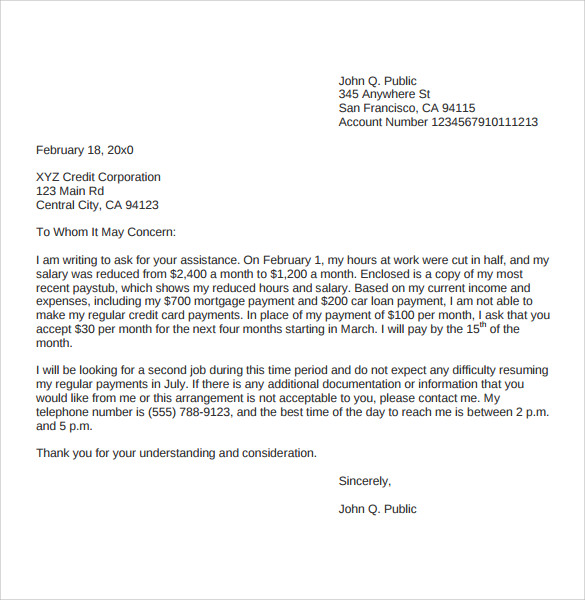

how to write a letter to a creditor for hardship Credit dispute

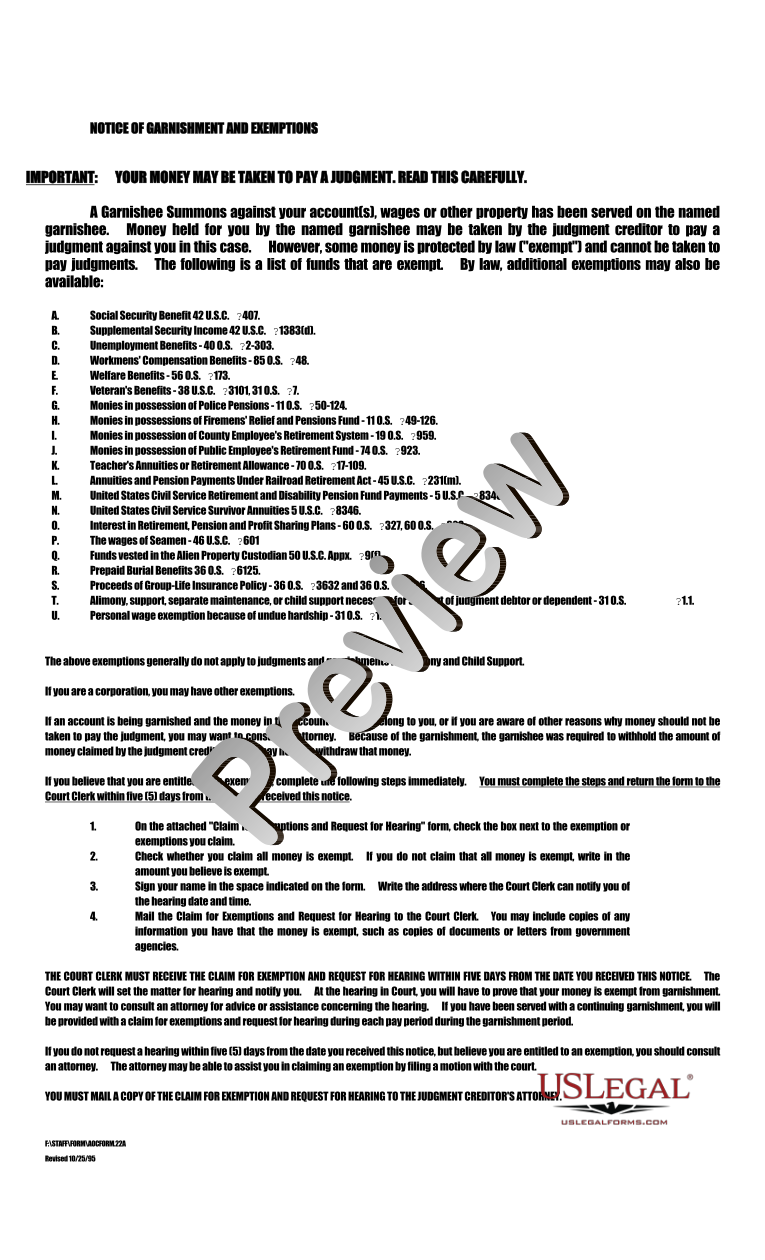

Web specified tax return preparers use form 8944 to request an undue hardship waiver from the section 6011(e)(3) requirement to electronically file returns of income tax imposed by. Upon approval, a hardship could lower the. Web 10 rows to give info to debtor about amount of the creditor's claims, existence of exemptions, and notice about how to respond to creditor's.

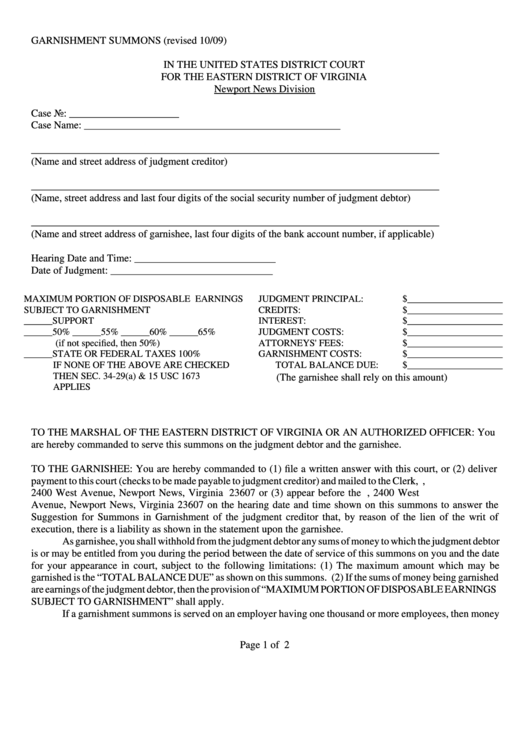

Garnishment Summons Form Newport News Division, Virginia printable

If you default on a student loan, you should be given at least 30 days written notice of the garnishment. A percent of your disposable earnings, which is 85 percent of. If the agency and the debtor have agreed to an exact dollar amount to be deducted from the debtors's wages, insert the dollar amount in section. If you want.

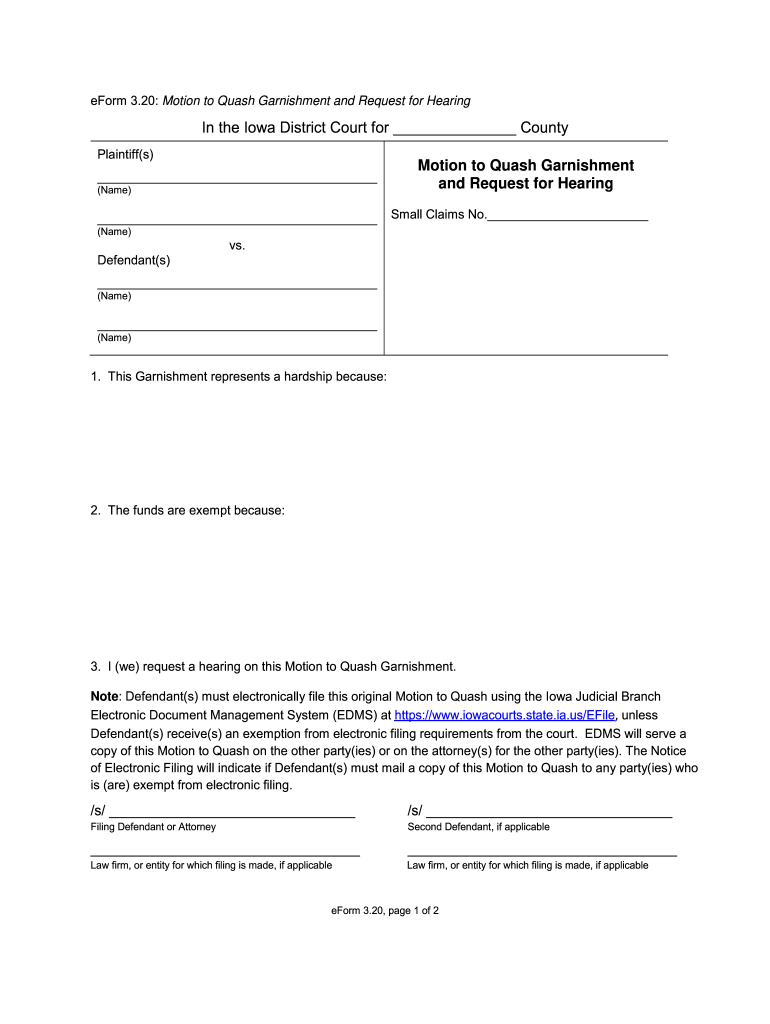

Iowa motion to quash form Fill out & sign online DocHub

Web a hardship exists if the garnishment prevents the taxpayer from meeting necessary living expenses. Contact the irs at the telephone number on the levy or correspondence immediately. Ad cover all of your legal bases with rocket lawyer's personal finance documents. Web the wage garnishment provisions of the consumer credit protection act (ccpa) protect employees from discharge by their employers.

Garnishment Hardship Form US Legal Forms

All parties involved must follow these procedures correctly. If the agency and the debtor have agreed to an exact dollar amount to be deducted from the debtors's wages, insert the dollar amount in section. Upon approval, a hardship could lower the. Contact the irs at the telephone number on the levy or correspondence immediately. Web what if a levy on.

Form 5668 Garnishment Hardship Application Edit, Fill, Sign Online

Ad cover all of your legal bases with rocket lawyer's personal finance documents. If your paycheck is being garnished, your employer is the garnishee. Web the usual modes of attacking a garnishment directly are by motion to quash or vacate the writ of garnishment or to quash or discharge the writ. Web specified tax return preparers use form 8944 to.

FREE 9+ Sample Financial Hardship Letter Templates in PDF MS Word

Request for administrative wage garnishment hearing. As a general rule, the defendant. If your paycheck is being garnished, your employer is the garnishee. Web if you object to garnishment of your wages for the debt described in the notice, you can use this form to request a hearing. If you want to apply for a deferment on loans that are.

Writing A Hardship Letter Wage Garnishment Sample Hardship Letter

What can a hardship not do for me? What can a hardship do for me? A garnishment allows a creditor to take money. Download and complete your dd form 2789 in pdf format, click here. Your request must be in writing and mailed or delivered to.

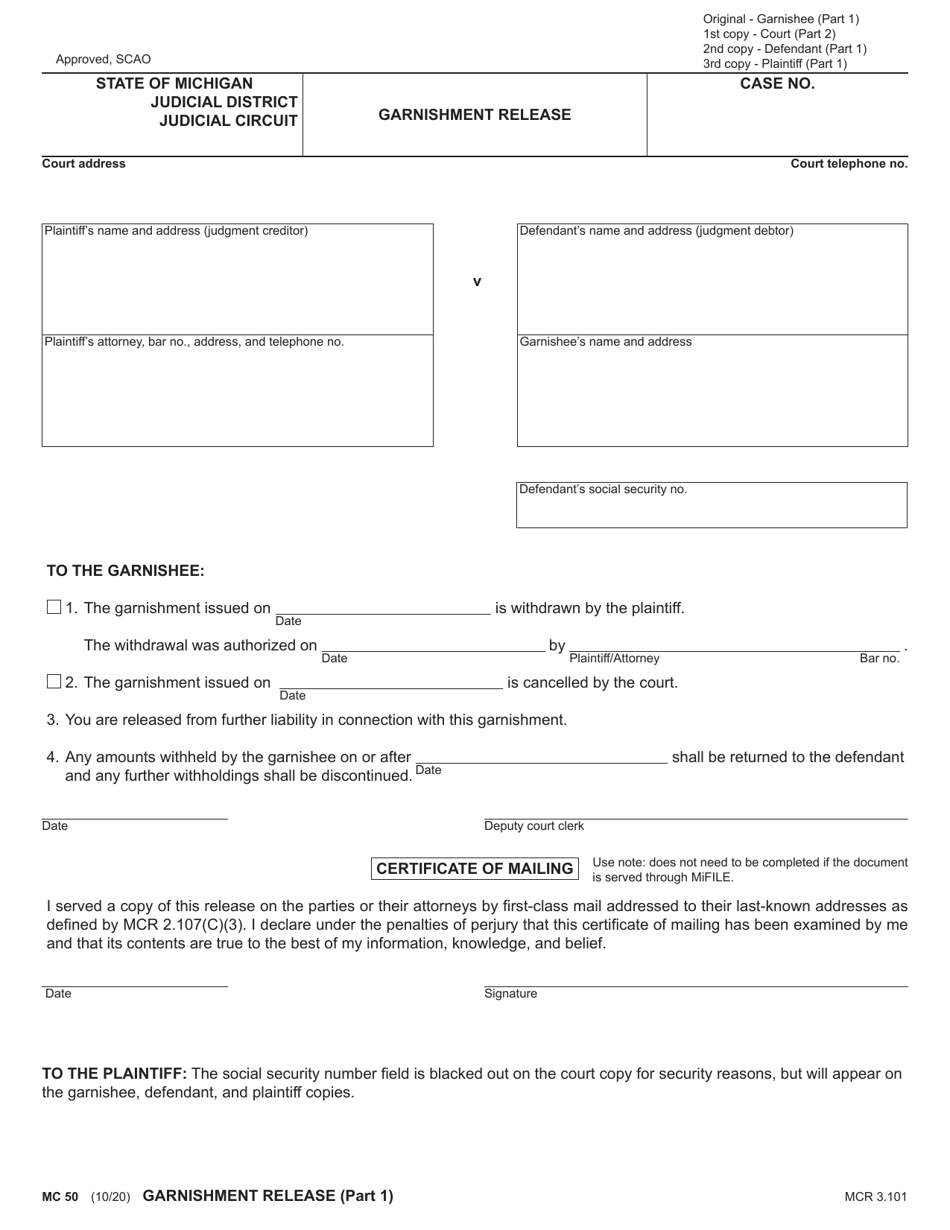

Form MC50 Download Fillable PDF or Fill Online Garnishment Release

You must provide a signed financial statement along. Our personal finance documents can assist you in any financial transaction. If your paycheck is being garnished, your employer is the garnishee. Your request must be in writing and mailed or delivered to. Request for administrative wage garnishment hearing.

Fillable Form 5668 Garnishment Hardship Application printable pdf

Web garnishment procedures are governed by arizona law and are extremely complicated. What are some reasons a hardship may be denied? Your request must be in writing and mailed or delivered to. If you default on a student loan, you should be given at least 30 days written notice of the garnishment. Contact the irs at the telephone number on.

What Can A Hardship Do For Me?

Web 10 rows to give info to debtor about amount of the creditor's claims, existence of exemptions, and notice about how to respond to creditor's claim by delivering or mailing. Ad cover all of your legal bases with rocket lawyer's personal finance documents. 639 cfs forms, mail one original form (with an original signature), one copy of the form, and one copy of the court order. All parties involved must follow these procedures correctly.

Web To Qualify For An Economic Hardship Deferment, You Must Either Be On Public Assistance Or Be Employed Full Time But Earning An Income That Is Less Than 150% Of.

Web specified tax return preparers use form 8944 to request an undue hardship waiver from the section 6011(e)(3) requirement to electronically file returns of income tax imposed by. Web the wage garnishment provisions of the consumer credit protection act (ccpa) protect employees from discharge by their employers because their wages have been garnished. If the agency and the debtor have agreed to an exact dollar amount to be deducted from the debtors's wages, insert the dollar amount in section. Web if the garnishment is for private student loan debt, the exempt amount paid to you will be the greater of the following:

Ad Real Estate, Landlord Tenant, Estate Planning, Power Of Attorney, Affidavits And More!

Web include your name and account number on any documentation that you are required to submit with this form. A percent of your disposable earnings, which is 85 percent of. Our personal finance documents can assist you in any financial transaction. The court may issue an order.

If You Want To Apply For A Deferment On Loans That Are Held By.

Your request must be in writing and mailed or delivered to. Web if you object to garnishment of your wages for the debt described in the notice, you can use this form to request a hearing. As a general rule, the defendant. If your paycheck is being garnished, your employer is the garnishee.