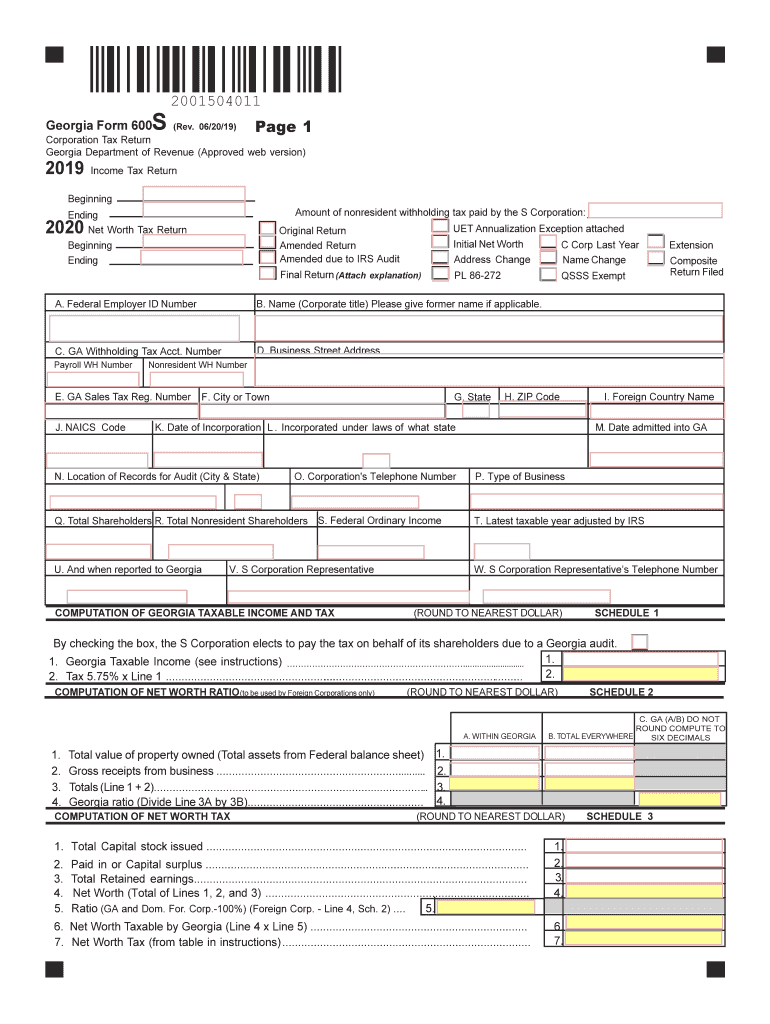

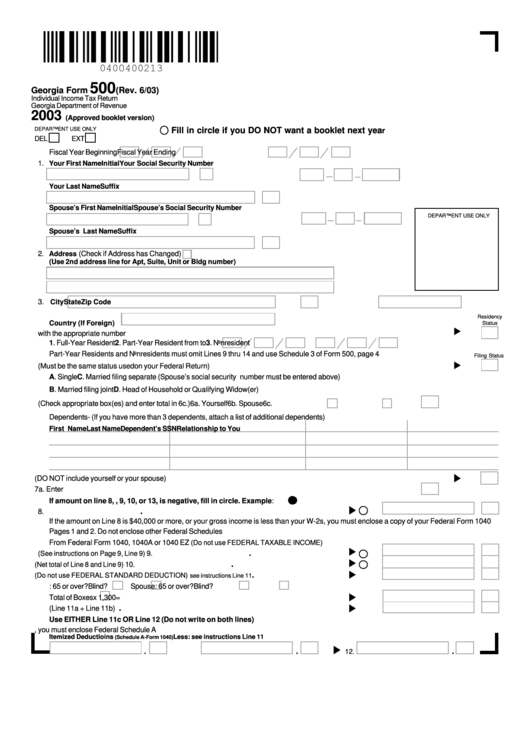

Georgia State Tax Form 500

Georgia State Tax Form 500 - Please use the link below to. However, you can pay by mail or in person using an estimated tax payment voucher. Select “this year's tax forms”. Get everything done in minutes. Web 500 individual income tax return what's new? Dependents (if you have more than 4. Web georgia state income tax. 06/20/19) amended individual income tax return georgia department of revenue use this form for the 2019 tax year only. Form 500 requires you to list multiple forms of income, such as wages, interest, or alimony. Get ready for tax season deadlines by completing any required tax forms today.

Complete, edit or print tax forms instantly. Web 500 individual income tax return what's new? Ad fill, sign, email ga 500 & more fillable forms, register and subscribe now! Dependents (if you have more than 4. 06/20/19) amended individual income tax return georgia department of revenue use this form for the 2019 tax year only. Web georgia form 500x (rev. Web paying your estimated tax electronically is the fastest method. Web georgia individual income tax is based on your federal adjusted gross income (your income before taxes), adjustments that are required by georgia law, and your filing. Web georgia state income tax. 06/20/19) individual income tax return.

Web georgia state income tax. Web ga tax withheld georgia form500 individual income tax return georgia department of revenue 2020 14a. Web georgia individual income tax is based on your federal adjusted gross income (your income before taxes), adjustments that are required by georgia law, and your filing. Web print blank form > georgia department of revenue zoom in; Web paying your estimated tax electronically is the fastest method. Web complete, save and print the form online using your browser. Select “this year's tax forms”. Web 500 individual income tax return what's new? Ad download or email ga form 500 & more fillable forms, register and subscribe now! Get ready for tax season deadlines by completing any required tax forms today.

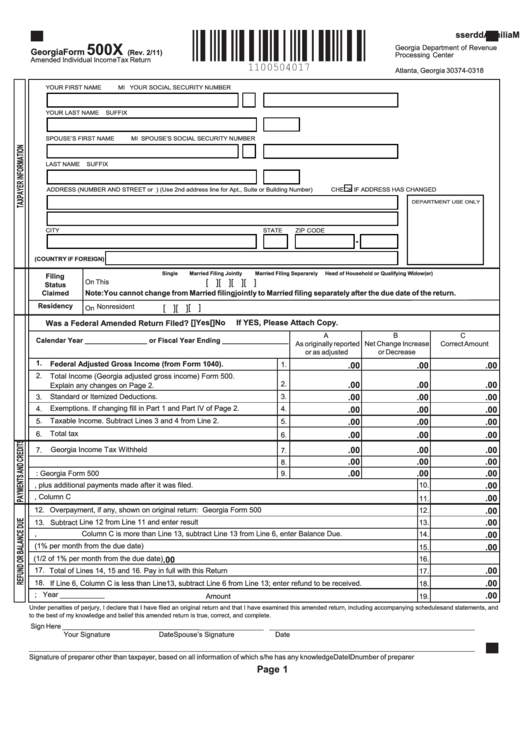

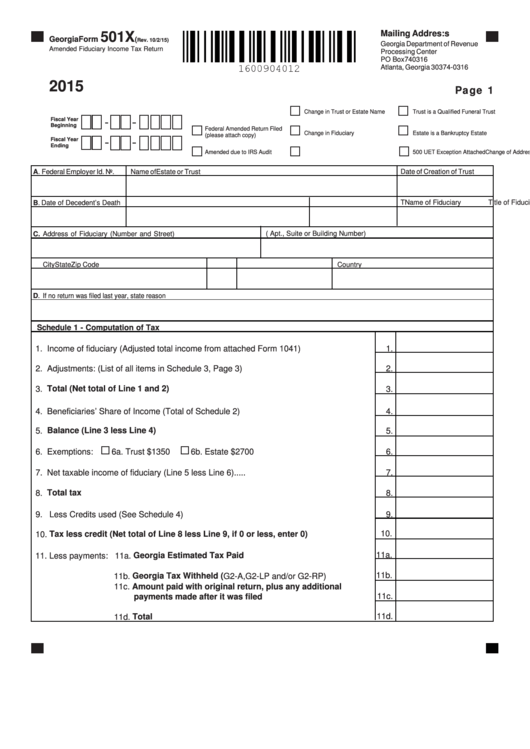

Fillable Form 500x Amended Individual Tax Return

Form 500 requires you to list multiple forms of income, such as wages, interest, or alimony. Web form 500 is the general income tax return form for all georgia residents. Enter the number from line 6c. Web 500 individual income tax return what's new? 06/20/19) amended individual income tax return georgia department of revenue use this form for the 2019.

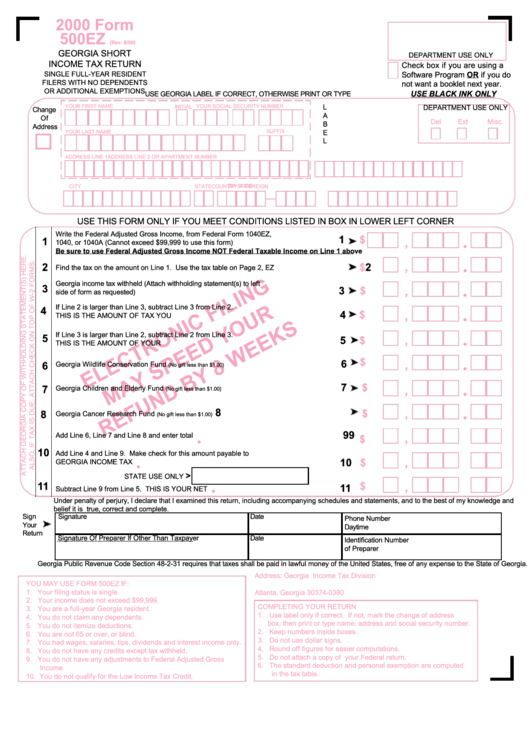

Form 500ez Short Tax Return 2000 printable pdf download

Ad fill, sign, email ga 500 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Please use the link below to. Get everything done in minutes. Form 500 requires you to list multiple forms of income, such as wages, interest, or alimony.

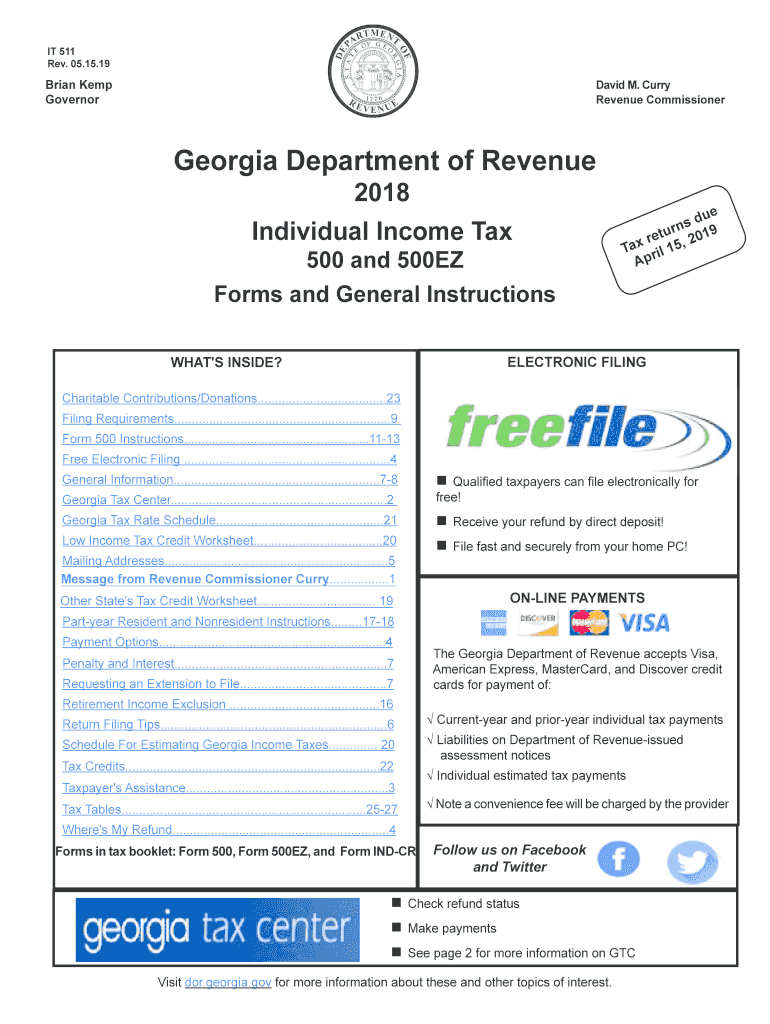

State Tax Form 500ez kkload

Web the following tips can help you fill out printable georgia tax form 500 quickly and easily: Web paying your estimated tax electronically is the fastest method. Your social security number gross income is less than your you must. Web ga tax withheld georgia form500 individual income tax return georgia department of revenue 2020 14a. Web georgia form 500x (rev.

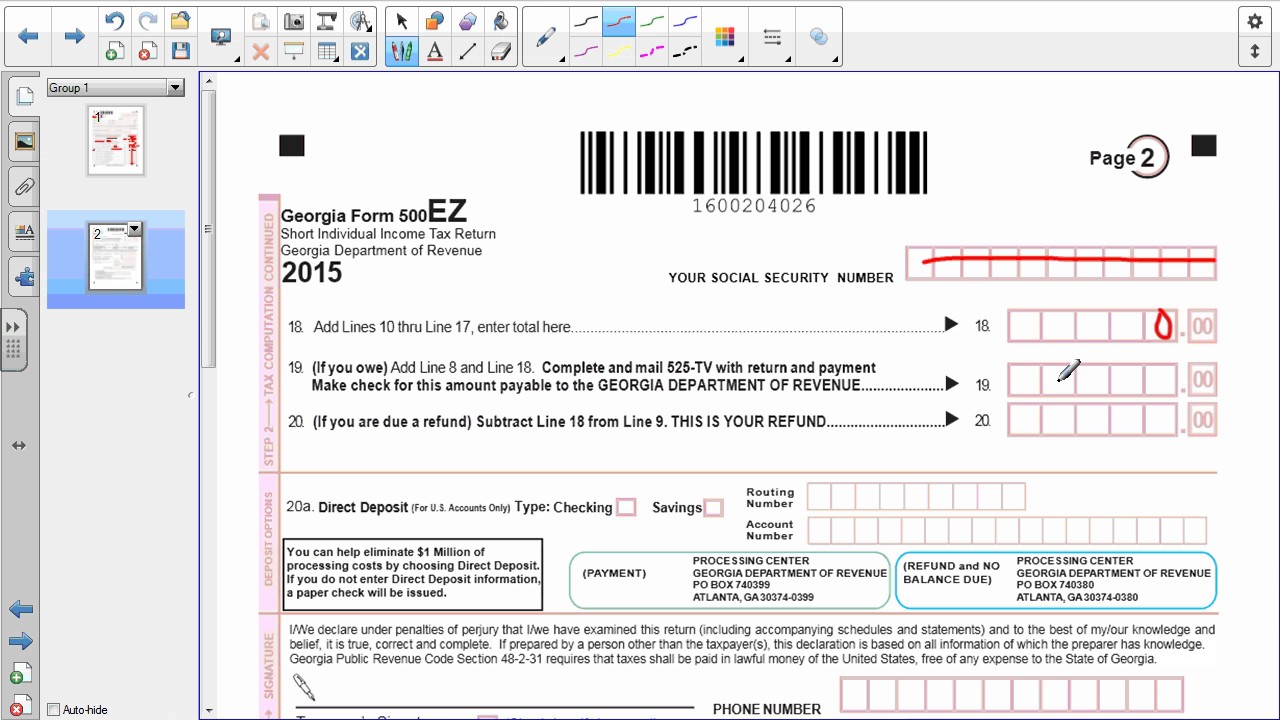

State of tax Form YouTube

Web georgia form500 individual income tax return georgia department of revenue 2022 your social security number 7b. Form 500 requires you to list multiple forms of income, such as wages, interest, or alimony. Web form 500 is the general income tax return form for all georgia residents. Web form 500 georgia — individual income tax return download this form print.

Fillable Form 501x Amended Fiduciary Tax Return 2015

Select “this year's tax forms”. Web complete, save and print the form online using your browser. Web paying your estimated tax electronically is the fastest method. Complete, edit or print tax forms instantly. Web georgia individual income tax is based on your federal adjusted gross income (your income before taxes), adjustments that are required by georgia law, and your filing.

2019 Form GA DoR 500NOL Fill Online, Printable, Fillable, Blank

Web paying your estimated tax electronically is the fastest method. Ad fill, sign, email ga 500 & more fillable forms, register and subscribe now! Web the following tips can help you fill out printable georgia tax form 500 quickly and easily: Web 500 individual income tax return what's new? Get everything done in minutes.

Form 500 EZ Individual Tax Return Fill Out and Sign

Web form 500 georgia — individual income tax return download this form print this form it appears you don't have a pdf plugin for this browser. 06/20/19) individual income tax return. Enter the number from line 6c. Ad download or email ga form 500 & more fillable forms, register and subscribe now! Complete, save and print the form online using.

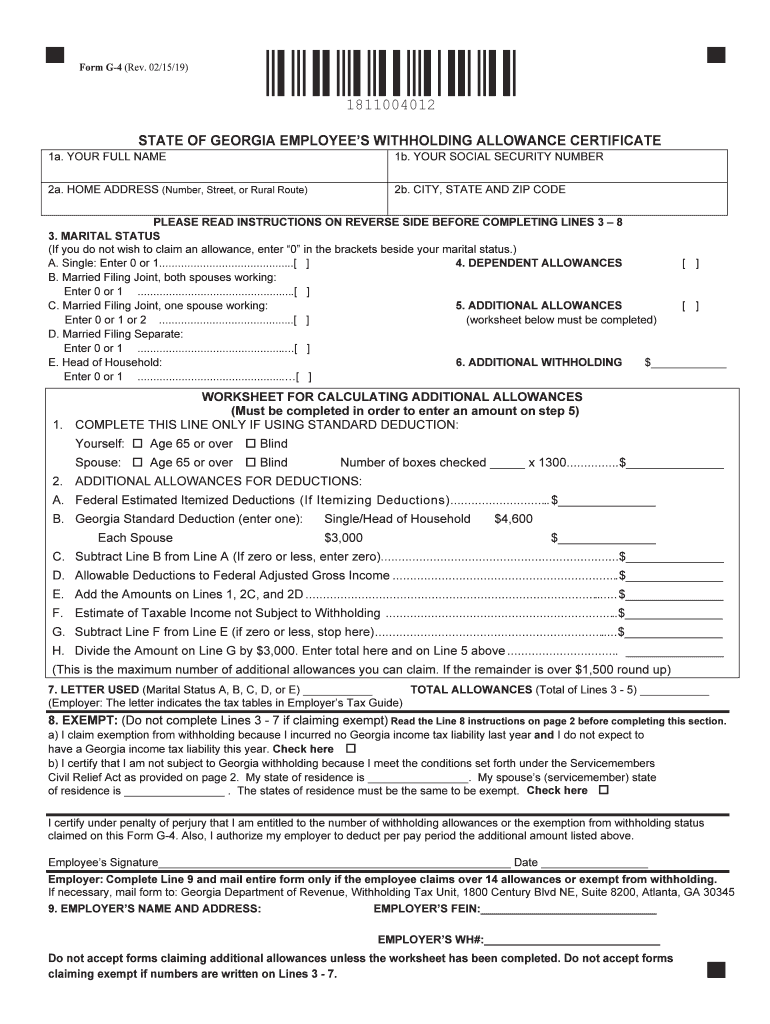

Withholding Form 2021 2022 W4 Form

Ad fill, sign, email ga 500 & more fillable forms, register and subscribe now! Web paying your estimated tax electronically is the fastest method. Get everything done in minutes. Web ga tax withheld georgia form500 individual income tax return georgia department of revenue 2020 14a. Please use the link below to.

State Tax Form 500ez bestkup

Web georgia individual income tax is based on your federal adjusted gross income (your income before taxes), adjustments that are required by georgia law, and your filing. Form 500 requires you to list multiple forms of income, such as wages, interest, or alimony. Ad fill, sign, email ga 500 & more fillable forms, register and subscribe now! Please use the.

form 500 Fill out & sign online DocHub

Web form 500 is the general income tax return form for all georgia residents. Ad fill, sign, email ga 500 & more fillable forms, register and subscribe now! Web form 500 georgia — individual income tax return download this form print this form it appears you don't have a pdf plugin for this browser. Web paying your estimated tax electronically.

Web The Following Tips Can Help You Fill Out Printable Georgia Tax Form 500 Quickly And Easily:

Complete, save and print the form online using your browser. Web georgia form 500 (rev. Web georgia form500 individual income tax return georgia department of revenue 2022 your social security number 7b. Web 500 individual income tax return what's new?

Web Form 500 Georgia — Individual Income Tax Return Download This Form Print This Form It Appears You Don't Have A Pdf Plugin For This Browser.

06/20/20) individual income tax return georgia department of revenue 2020(approved web vers ion) pag e1 fiscal yearbeginning rfission)cal. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. 06/20/19) individual income tax return. Web georgia individual income tax is based on your federal adjusted gross income (your income before taxes), adjustments that are required by georgia law, and your filing.

Web Print Blank Form > Georgia Department Of Revenue Zoom In;

Get ready for tax season deadlines by completing any required tax forms today. 06/20/19) amended individual income tax return georgia department of revenue use this form for the 2019 tax year only. Web complete, save and print the form online using your browser. Web georgia form 500x (rev.

Web Paying Your Estimated Tax Electronically Is The Fastest Method.

Web form 500 is the general income tax return form for all georgia residents. Get everything done in minutes. Web ga tax withheld georgia form500 individual income tax return georgia department of revenue 2020 14a. If you do not already have a.