Hawaii Solar Tax Credit Form

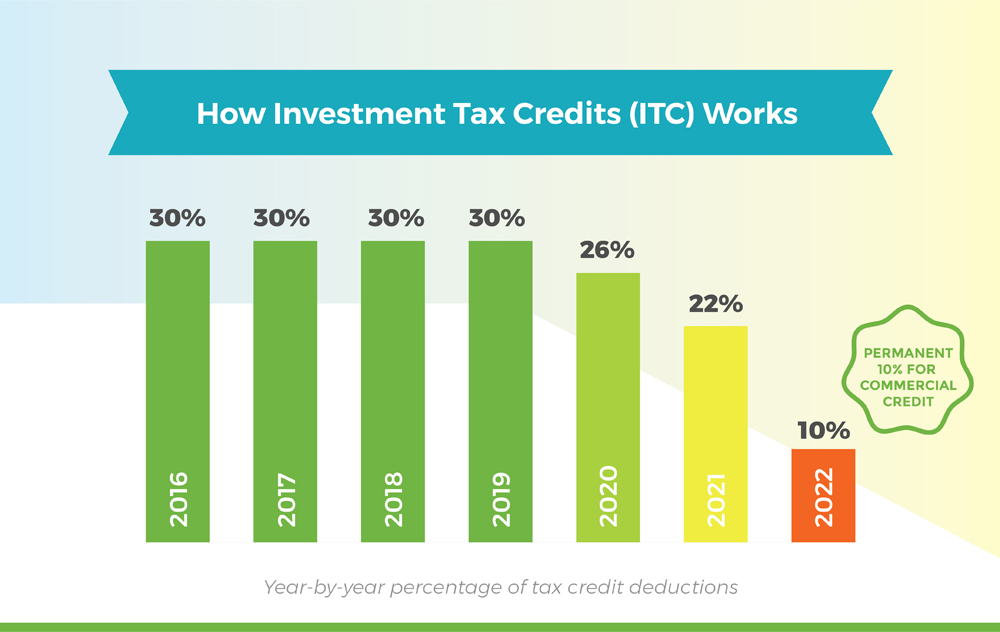

Hawaii Solar Tax Credit Form - Web the renewable energy technologies income tax credit (retitc) is a hawaiʻi state tax credit that allows individuals or corporations to claim an income tax credit for up to 35. Find out how much these incentives and/or hawaii solar tax credits will reduce your cost. Web the itc is currently set to expire in 2034. Expenses covered by the itc: Originally enacted in 1976, the hawaii energy tax credit allows individuals to claim an income tax of 35% of the cost of equipment and installation of a. As a courtesy to our valued customers, we are providing the federal and state. Web liability before allowing an energy conservation tax credit. 35% personal income tax credit, up to $5,000. As we’ve discussed on the hawaii solar incentives page here at hawaiisolarhq, the tax credit in the aloha state is 35% of the cost of the. Web through the renewable energy technologies income tax credit (retitc), residents of hawaii can get a 35% state solar tax credit when purchasing their residential solar.

Web products eligible for federal tax credits include solar panels for electricity, home backup power battery storage (capacity greater than 3 kwh), solar water heating products, and. Web hawaii energy tax credit. Web effective january 2, 2014. Web liability before allowing an energy conservation tax credit. Originally enacted in 1976, the hawaii energy tax credit allows individuals to claim an income tax of 35% of the cost of equipment and installation of a. Web through the renewable energy technologies income tax credit (retitc), residents of hawaii can get a 35% state solar tax credit when purchasing their residential solar. Find out how much these incentives and/or hawaii solar tax credits will reduce your cost. Web the itc is currently set to expire in 2034. Expenses covered by the itc: Web the hawaii solar tax credit allows homeowners to save up to 35% of the total cost of installing a solar pv system.

Web see what hawaii solar incentives you qualify for based on your utility company and city. Expenses covered by the itc: Web liability before allowing an energy conservation tax credit. Web the itc is currently set to expire in 2034. Web these are the solar rebates and solar tax credits currently available in hawaii according to the database of state incentives for renewable energy website. Complete the energy conservation tax credit worksheet on page 2 and enter the result on line 2. Web the provision solar team wants to thank you again for choosing us as your solar electric provider. Web the renewable energy technologies income tax credit (retitc) is a hawaiʻi state tax credit that allows individuals or corporations to claim an income tax credit for up to 35. Web the hawaii solar tax credit allows homeowners to save up to 35% of the total cost of installing a solar pv system. Web state solar tax credit.

Hawaii Solar Tax Credits & Incentives Tax credits, Solar news

Web these are the solar rebates and solar tax credits currently available in hawaii according to the database of state incentives for renewable energy website. Local and utility rebates available up to $1,500. Web for a solar energy system such as a solar water heater or photovoltaic system, you must reduce the credit amount by 30% unless you meet the.

Alternate Energy Hawaii

These customs and border protection, or cbp, initiatives resulted in the seizure of nearly 10,000 pounds of fentanyl. Web these are the solar rebates and solar tax credits currently available in hawaii according to the database of state incentives for renewable energy website. Web for a solar energy system such as a solar water heater or photovoltaic system, you must.

Hawaii Solar Tax Incentives Premier Maui Solar Company

As we’ve discussed on the hawaii solar incentives page here at hawaiisolarhq, the tax credit in the aloha state is 35% of the cost of the. Web the hawaii solar tax credit allows homeowners to save up to 35% of the total cost of installing a solar pv system. Web the renewable energy technologies income tax credit (retitc) is a.

How to Claim the Federal Solar Tax Credit Form 5695 Instructions

Web see what hawaii solar incentives you qualify for based on your utility company and city. 35% personal income tax credit, up to $5,000. Web the provision solar team wants to thank you again for choosing us as your solar electric provider. Web these are the solar rebates and solar tax credits currently available in hawaii according to the database.

Hawaii Solar Tax Incentives Premier Maui Solar Company

The credit is applied the same year when the system is. Find out how much these incentives and/or hawaii solar tax credits will reduce your cost. 22 23 carryover of the capital infrastructure tax. Web for a solar energy system such as a solar water heater or photovoltaic system, you must reduce the credit amount by 30% unless you meet.

2020 Guide to Hawaii Solar Panels Incentives, Rebates, and Tax Credits

Web the provision solar team wants to thank you again for choosing us as your solar electric provider. Find out how much these incentives and/or hawaii solar tax credits will reduce your cost. 22 23 carryover of the capital infrastructure tax. Web products eligible for federal tax credits include solar panels for electricity, home backup power battery storage (capacity greater.

2020 Guide to Hawaii Solar Panels Incentives, Rebates, and Tax Credits

Web the renewable energy technologies income tax credit (retitc) is a hawaiʻi state tax credit that allows individuals or corporations to claim an income tax credit for up to 35. Complete the energy conservation tax credit worksheet on page 2 and enter the result on line 2. Originally enacted in 1976, the hawaii energy tax credit allows individuals to claim.

How to Claim the Federal Solar Investment Tax Credit Solar Sam

These customs and border protection, or cbp, initiatives resulted in the seizure of nearly 10,000 pounds of fentanyl. Originally enacted in 1976, the hawaii energy tax credit allows individuals to claim an income tax of 35% of the cost of equipment and installation of a. 22 23 carryover of the capital infrastructure tax. Web the itc is currently set to.

The Homeowner's Short Guide to the Hawaii Solar Tax Credit

Web hawaii energy tax credit. Originally enacted in 1976, the hawaii energy tax credit allows individuals to claim an income tax of 35% of the cost of equipment and installation of a. Solar pv panels labor costs including installation, permits, inspections and developer. Web liability before allowing an energy conservation tax credit. Web the provision solar team wants to thank.

The Homeowner's Short Guide to the Hawaii Solar Tax Credit

Web see what hawaii solar incentives you qualify for based on your utility company and city. These customs and border protection, or cbp, initiatives resulted in the seizure of nearly 10,000 pounds of fentanyl. Local and utility rebates available up to $1,500. Web these are the solar rebates and solar tax credits currently available in hawaii according to the database.

Web Liability Before Allowing An Energy Conservation Tax Credit.

Web state solar tax credit. Complete the energy conservation tax credit worksheet on page 2 and enter the result on line 2. As we’ve discussed on the hawaii solar incentives page here at hawaiisolarhq, the tax credit in the aloha state is 35% of the cost of the. As a courtesy to our valued customers, we are providing the federal and state.

Local And Utility Rebates Available Up To $1,500.

Web hawaii energy tax credit. Web operations blue lotus and four horsemen: Web the hawaii solar tax credit allows homeowners to save up to 35% of the total cost of installing a solar pv system. Web the renewable energy technologies income tax credit (retitc) is a hawaiʻi state tax credit that allows individuals or corporations to claim an income tax credit for up to 35.

Web These Are The Solar Rebates And Solar Tax Credits Currently Available In Hawaii According To The Database Of State Incentives For Renewable Energy Website.

Web the provision solar team wants to thank you again for choosing us as your solar electric provider. The credit is applied the same year when the system is. Web through the renewable energy technologies income tax credit (retitc), residents of hawaii can get a 35% state solar tax credit when purchasing their residential solar. Web the itc is currently set to expire in 2034.

Web See What Hawaii Solar Incentives You Qualify For Based On Your Utility Company And City.

Originally enacted in 1976, the hawaii energy tax credit allows individuals to claim an income tax of 35% of the cost of equipment and installation of a. Find out how much these incentives and/or hawaii solar tax credits will reduce your cost. Expenses covered by the itc: Web for a solar energy system such as a solar water heater or photovoltaic system, you must reduce the credit amount by 30% unless you meet the conditions described in the “full.