Housing Deduction Form 2555

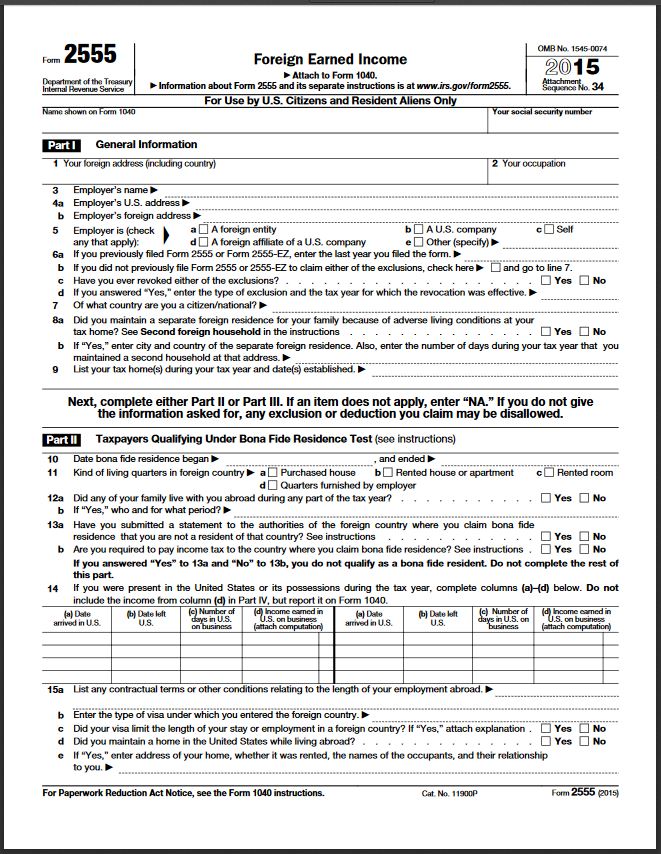

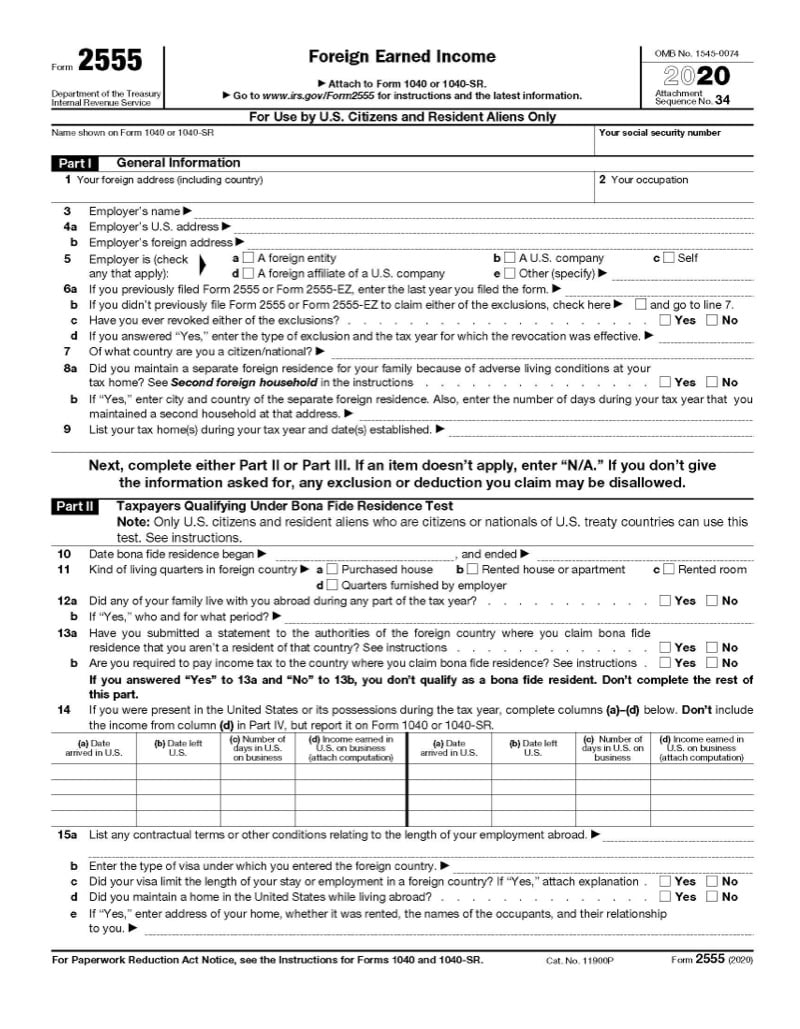

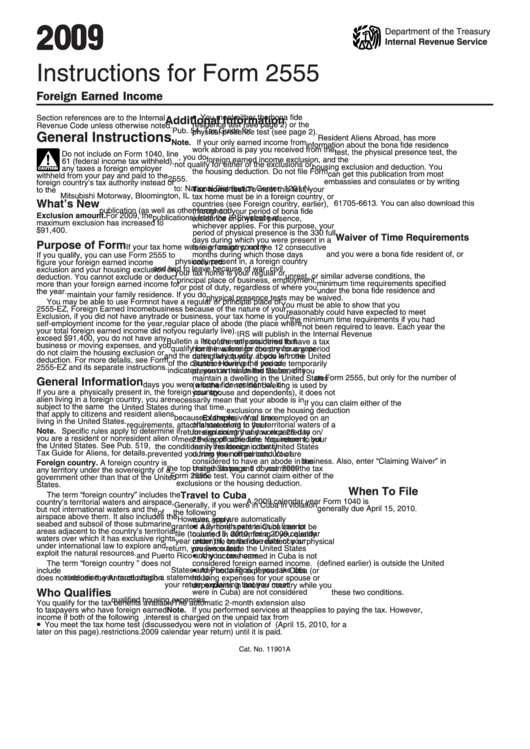

Housing Deduction Form 2555 - You can exclude up to the limit on housing expense of the city you lived. 5 = optimize prior year unused foreign tax credit. You cannot exclude or deduct more than your. You cannot exclude or deduct more than the. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned. Web the foreign earned income exclusion and the foreign housing exclusion or deduction are claimed using form 2555, which should be attached to the taxpayer’s form 1040. Get ready for tax season deadlines by completing any required tax forms today. Web you will only be able to claim these allowances by filling out and including form 2555 with your federal tax return. Please refer to the instructions for form 2555 and chapter 4 of. If you choose to claim the foreign earned.

The exclusion is available only for wages or self. One cannot exclude or deduct more than the amount of foreign. Web you will only be able to claim these allowances by filling out and including form 2555 with your federal tax return. If you choose to claim the foreign earned. You cannot exclude or deduct more than the. The housing deduction is figured in part ix. Get ready for tax season deadlines by completing any required tax forms today. If you are married and you and your spouse each qualifies under one of the tests, see. Go to www.irs.gov/form2555 for instructions and the. Complete, edit or print tax forms instantly.

Web in addition, the taxpayer may exclude housing expenses in excess of 16% of this maximum ($52.60 per day in 2023) but with limits. 4 = foreign tax credit. Web use form 2555 to compute foreign earned income exclusion and housing exclusion/deduction. 3 = foreign earned income and housing exclusion. You cannot exclude or deduct more than the. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned. Have you ever revoked either of the exclusions? Go to www.irs.gov/form2555 for instructions and the. The housing deduction is figured in part ix.

Foreign Earned Exclusion Form 2555 Verni Tax Law

Have you ever revoked either of the exclusions? 3 = foreign earned income and housing exclusion. The simplified form 2555 ez cannot be. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web if you qualify, you can use form 2555 to figure your foreign earned income.

Tax Deduction Form For Donations Form Resume Examples XA5yWX1kpZ

Web navigate to page six of the irs instructions for form 2555, and locate the city you lived in. Get ready for tax season deadlines by completing any required tax forms today. The housing deduction is figured in part ix. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web.

Housing Allowance For Pastors Fill Online, Printable, Fillable, Blank

You can exclude up to the limit on housing expense of the city you lived. The housing deduction is figured in part ix. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned. Web the foreign housing exclusion or.

Foreign Housing Deductions & Exclusions US Expats Tax Form 2555

Complete, edit or print tax forms instantly. If you are married and you and your spouse each qualifies under one of the tests, see. 3 = foreign earned income and housing exclusion. You can exclude up to the limit on housing expense of the city you lived. Web you will only be able to claim these allowances by filling out.

Form 2555EZ Foreign Earned Exclusion (2014) Free Download

Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned. The housing deduction is figured in part ix. 4 = foreign tax credit. The simplified form 2555 ez cannot be. The exclusion is available only for wages or self.

Form 2555 Claiming Foreign Earned Exclusion Jackson Hewitt

You cannot exclude or deduct more than the. If you qualify, you can use form. Please refer to the instructions for form 2555 and chapter 4 of. 5 = optimize prior year unused foreign tax credit. One cannot exclude or deduct more than the amount of foreign.

Instructions For Form 2555 Foreign Earned Internal Revenue

If you choose to claim the foreign earned. Get ready for tax season deadlines by completing any required tax forms today. The simplified form 2555 ez cannot be. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Please refer to the instructions for form 2555 and chapter.

Deduction from of housing property (Section 24)

Web use form 2555 to compute foreign earned income exclusion and housing exclusion/deduction. You cannot exclude or deduct more than your. Complete, edit or print tax forms instantly. Web navigate to page six of the irs instructions for form 2555, and locate the city you lived in. Web information about form 2555, foreign earned income, including recent updates, related forms,.

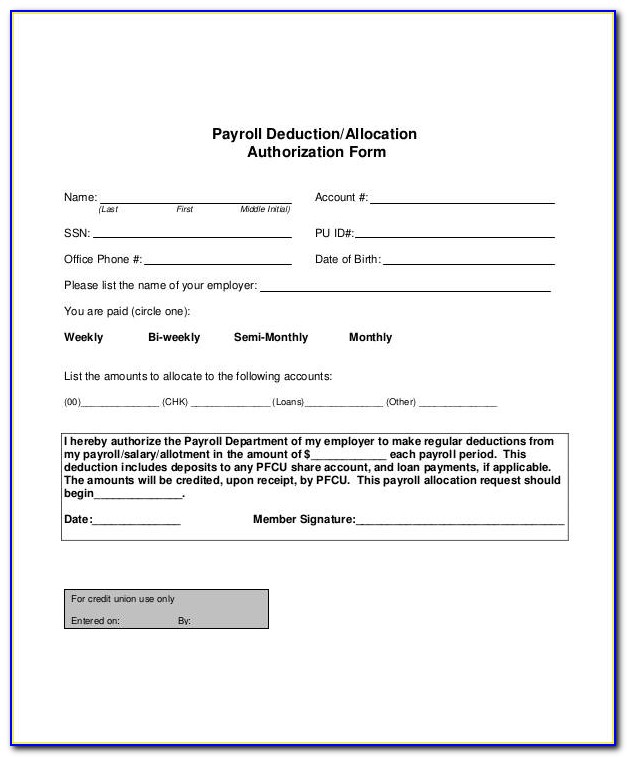

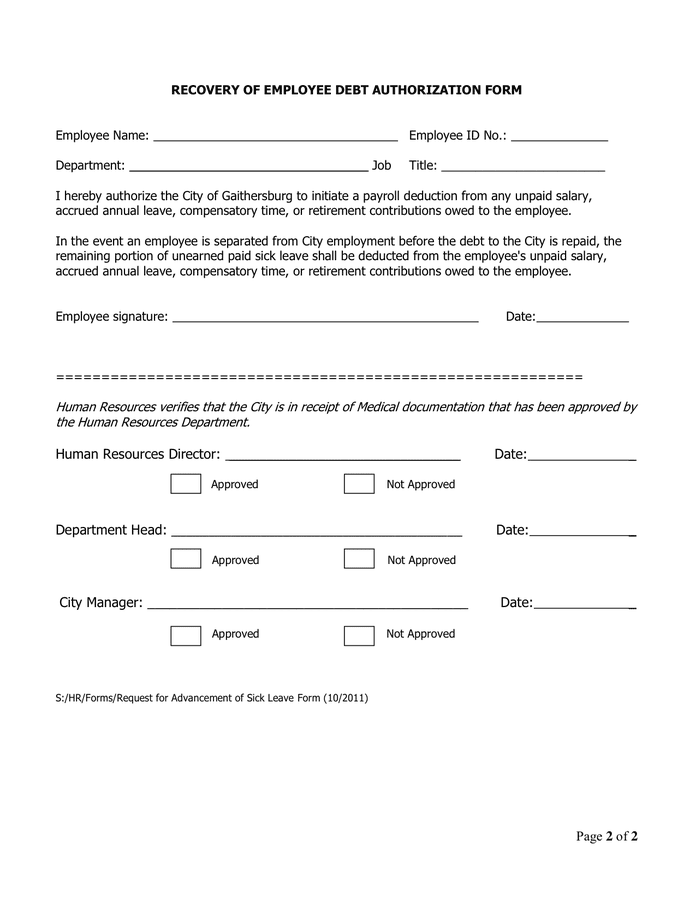

Payroll deduction authorization form in Word and Pdf formats page 2 of 2

One cannot exclude or deduct more than the amount of foreign. If you are married and you and your spouse each qualifies under one of the tests, see. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned. The.

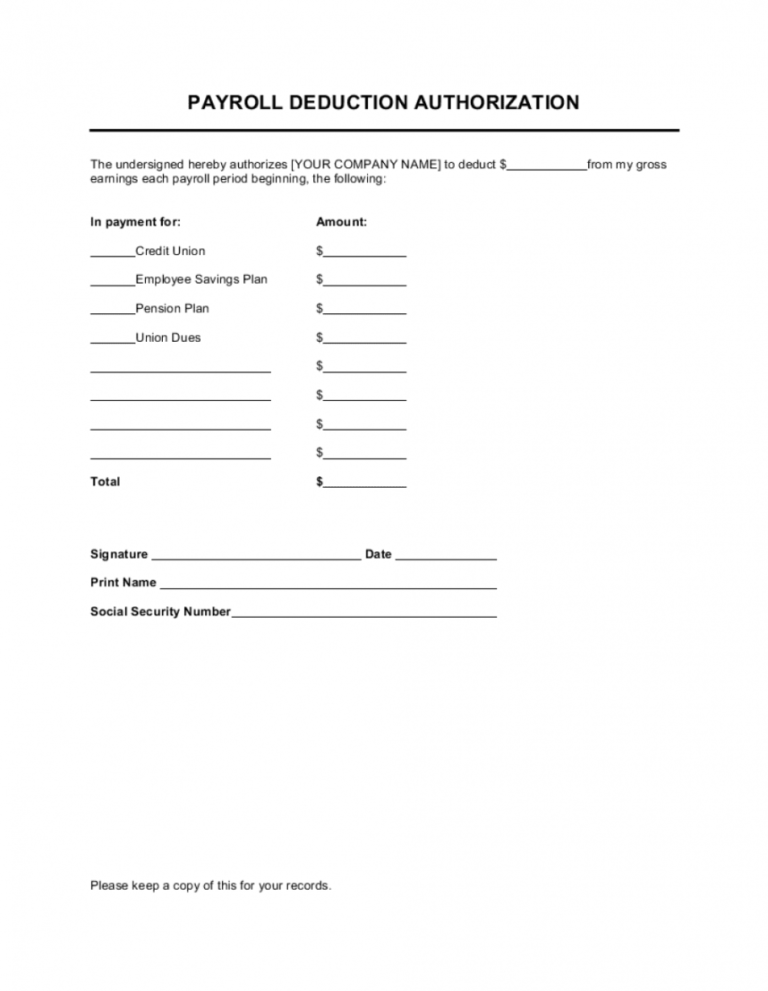

Sample Payroll Deduction Authorization Template Businessinabox

Web the foreign earned income exclusion and the foreign housing exclusion or deduction are claimed using form 2555, which should be attached to the taxpayer’s form 1040. Complete, edit or print tax forms instantly. Please refer to the instructions for form 2555 and chapter 4 of. If you are married and you and your spouse each qualifies under one of.

One Cannot Exclude Or Deduct More Than The Amount Of Foreign.

Get ready for tax season deadlines by completing any required tax forms today. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. The exclusion is available only for wages or self. The housing deduction is figured in part ix.

4 = Foreign Tax Credit.

If you qualify, you can use form. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned. You cannot exclude or deduct more than your. 3 = foreign earned income and housing exclusion.

Web The Foreign Earned Income Exclusion And The Foreign Housing Exclusion Or Deduction Are Claimed Using Form 2555, Which Should Be Attached To The Taxpayer’s Form 1040.

Web use form 2555 to compute foreign earned income exclusion and housing exclusion/deduction. You can exclude up to the limit on housing expense of the city you lived. Web you will only be able to claim these allowances by filling out and including form 2555 with your federal tax return. The simplified form 2555 ez cannot be.

Web Navigate To Page Six Of The Irs Instructions For Form 2555, And Locate The City You Lived In.

If you are married and you and your spouse each qualifies under one of the tests, see. If you choose to claim the foreign earned. Go to www.irs.gov/form2555 for instructions and the. Web in addition, the taxpayer may exclude housing expenses in excess of 16% of this maximum ($52.60 per day in 2023) but with limits.