How Are Owner Draws Taxed S Corp

How Are Owner Draws Taxed S Corp - What is the owner’s draw tax rate? Because of this, you’ll want to prepare before filing your taxes. Web an owner’s draw is simply a distribution of profits from the s corporation to its owners. When it comes to opting for a salary from your business you tend to give yourself a wage depending on your position in the company. February 23, 2021 04:06 pm. All about the owners draw and distributions. Web the owners of the s corp pay income taxes based on their distributive share of ownership, and these taxes are reported on their individual form 1040. Is an owner’s draw considered income? How much should you pay yourself? Web updated june 24, 2020:

Web in its most simple terms, an owner’s draw is a way for owners to with draw (get it?) money from their business for their own personal use. Web how does an owner's draw get taxed? What is the owner’s draw tax rate? To qualify for s corporation status, the corporation must meet the following requirements: Any net profit that’s not used to pay owner salaries or taken out in a draw is taxed at the corporate tax rate, which is usually lower than the personal income tax rate. Web owners of some llcs, partnerships and sole proprietorships can take an owner’s draw. All about the owners draw and distributions. Is an owner’s draw considered income? The company typically makes the distribution in cash, and it is not subject to payroll taxes (such as social security and medicare). Can you deduct an owner’s draw?

An owner’s draw can also be. General overview of s corporation distributions. May be individuals, certain trusts, and estates and. How to pay yourself as a business owner by business type. How much should a sole proprietor set aside for taxes? Web are owner’s draws taxable? For this article, we will be focusing on owner investment drawings. Web the owners of the s corp pay income taxes based on their distributive share of ownership, and these taxes are reported on their individual form 1040. Owner’s draws are subject to federal, state, and local income taxes. Web how are owner’s draws taxed?

A Guide to How SCorp Distributions are Taxed 2023

The right choice depends largely on how you contribute to the company and the. How does a salary differ from an owner’s draw? When it comes to opting for a salary from your business you tend to give yourself a wage depending on your position in the company. Can you deduct an owner’s draw? Web in an s corp, the.

owner draw quickbooks scorp Anton Mintz

Is an owner’s draw considered income? Any net profit that’s not used to pay owner salaries or taken out in a draw is taxed at the corporate tax rate, which is usually lower than the personal income tax rate. Web the owners of the s corp pay income taxes based on their distributive share of ownership, and these taxes are.

Owner's Draws What they are and how they impact the value of a business

I'll ensure your owner withdrawals are correctly recorded in quickbooks. Business owners or shareholders can pay themselves in various ways, but the two most common ways are. In most cases, the taxes on an owner’s draw are not due from the business, but instead the income is reported on the owner's personal tax return. To qualify for s corporation status,.

SCorporations Everything You Need to Know TL;DR Accounting

In most cases, the taxes on an owner’s draw are not due from the business, but instead the income is reported on the owner's personal tax return. For example, if the profits of the s corp are $100,000 and there are four shareholders, each with a 1/4 share, each shareholder would pay taxes on $25,000 in profits. S corp shareholder.

What Is An S Corp? IncSight

The entity pays a 21% corporate income tax on a net income of $79,000 ($100,000 taxable income = $21,000 corporate income tax). Faqs about paying yourself as a business owner. Bill lee and the 113th general assembly give businesses a $1.9 billion franchise tax break, they're allowing large farms to benefit from a projected $2 million measure that. How much.

owner's drawing account definition and Business Accounting

There are a couple of ways to be compensated as an owner of a business. The specific tax implications for an owner's draw depend on the amount received, the business structure, and any state tax rules that may apply. The right choice depends largely on how you contribute to the company and the. It is vital to note that an.

Owners Draw

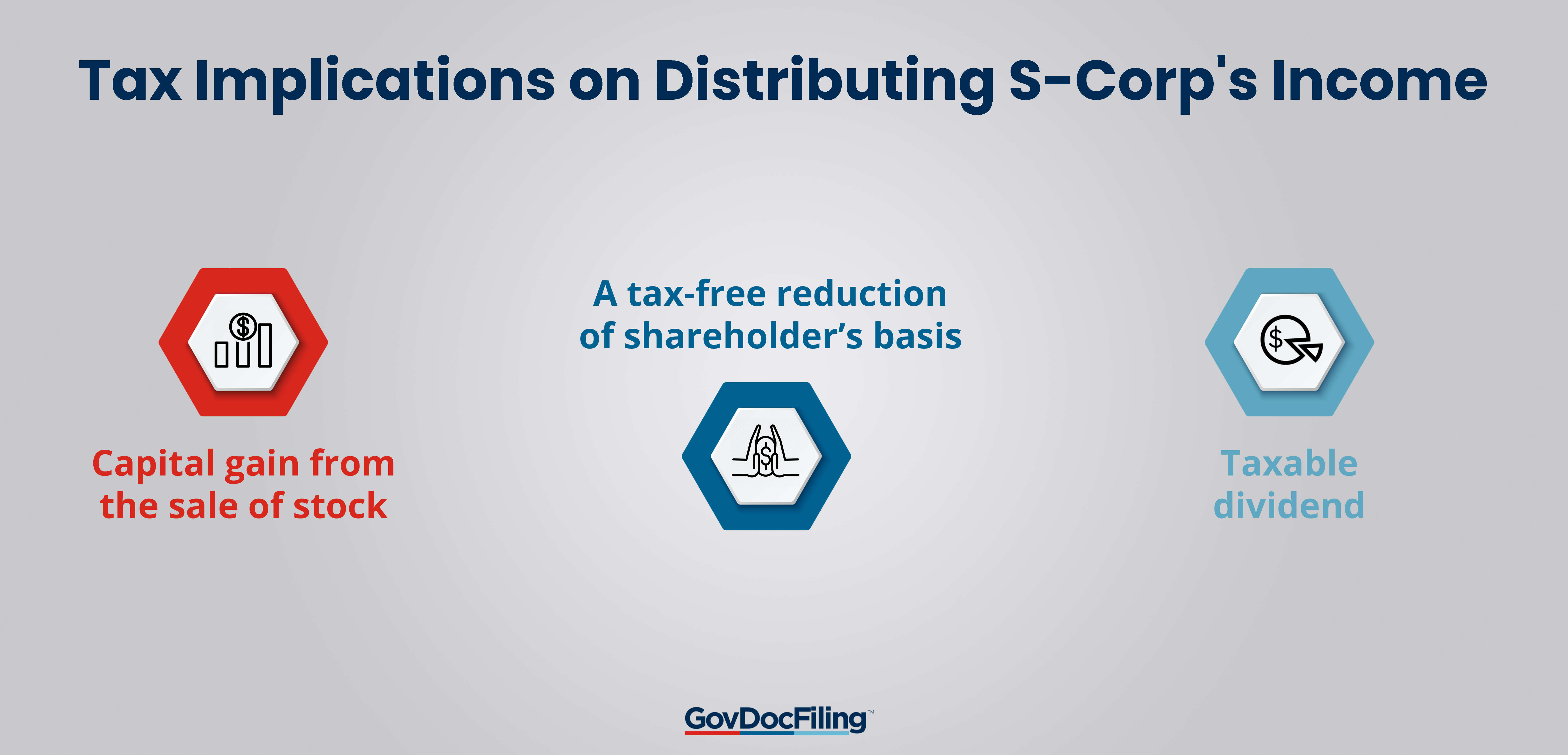

May be individuals, certain trusts, and estates and. Any net profit that’s not used to pay owner salaries or taken out in a draw is taxed at the corporate tax rate, which is usually lower than the personal income tax rate. Technically, it’s a distribution from your equity account, leading to a reduction of your total share in the company..

A Guide to How SCorp Distributions are Taxed 2024

How much should you pay yourself? How to pay yourself as a business owner by business type. You qualify for the 20% deduction only if your total taxable income for the year is less than $157,500 (single) or $315,000 (married, filing jointly). A draw lowers the owner's equity in the business. An owner of a c corporation may not.

LLC Taxed as an S Corporation An Option You May Not Know You Have

Owner’s draws are subject to federal, state, and local income taxes. Can you deduct an owner’s draw? S corp shareholder distributions are the earnings by s corporations that are paid out or passed through as dividends to shareholders and only taxed at the shareholder level. Web how does an owner's draw get taxed? How do business owners pay themselves?

General Overview Of S Corporation Distributions.

Web in its most simple terms, an owner’s draw is a way for owners to with draw (get it?) money from their business for their own personal use. How to pay yourself as a business owner by business type. Web since an s corp is structured as a corporation, there is no owner’s draw, only shareholder distributions. The entity pays a 21% corporate income tax on a net income of $79,000 ($100,000 taxable income = $21,000 corporate income tax).

Technically, It’s A Distribution From Your Equity Account, Leading To A Reduction Of Your Total Share In The Company.

To qualify for s corporation status, the corporation must meet the following requirements: Owner’s draws are subject to federal, state, and local income taxes. You qualify for the 20% deduction only if your total taxable income for the year is less than $157,500 (single) or $315,000 (married, filing jointly). For example, if the profits of the s corp are $100,000 and there are four shareholders, each with a 1/4 share, each shareholder would pay taxes on $25,000 in profits.

Tax Implications And Regulations Differ Based On The Business Structure Chosen.

But a shareholder distribution is not meant to replace the owner’s draw. The company typically makes the distribution in cash, and it is not subject to payroll taxes (such as social security and medicare). Owner’s draws allow business owners to withdraw funds for personal use across various business structures. How much should you pay yourself?

In Most Cases, The Taxes On An Owner’s Draw Are Not Due From The Business, But Instead The Income Is Reported On The Owner's Personal Tax Return.

An owner of a sole proprietorship, partnership, llc, or s corporation may take an owner's draw; Web an owner’s draw is simply a distribution of profits from the s corporation to its owners. Web the most common way to take an owner’s draw is by writing a check that transfers cash from your business account to your personal account. Bill lee and the 113th general assembly give businesses a $1.9 billion franchise tax break, they're allowing large farms to benefit from a projected $2 million measure that.